First to Gold, then the economic mold (its detritus, all told).

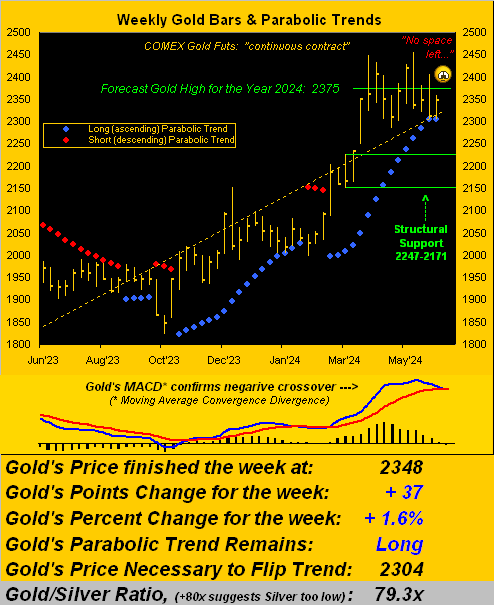

As herein anticipated a week ago: Gold’s weekly MACD (moving average convergence divergence) has now confirmed crossing to negative, despite price’s +1.6% up week in settling yesterday (Friday) at 2348. We shan’t rehash all the math behind like instances as detailed per the prior missive, other than to reiterate price probably produces a down run from ’round here toward the center of the 2247-2171 structural support zone as below shown, notably with no space left for another parabolic Long trend blue dot, (barring Gold leaping from this spot):

‘Course the above analysis is purely a nearer-term technical read which has historically led to lower price levels. From a broader-term fundamental perspective –certainly so given inflation having just abruptly stopped — the Federal Reserve absolutely must cut its Funds Rate come 31 July, right? A Gold positive, to be sure. And in turn that puts to bed our year-to-date musings for a Fed hike, right? “Curiouser and curiouser!” cried Alice.

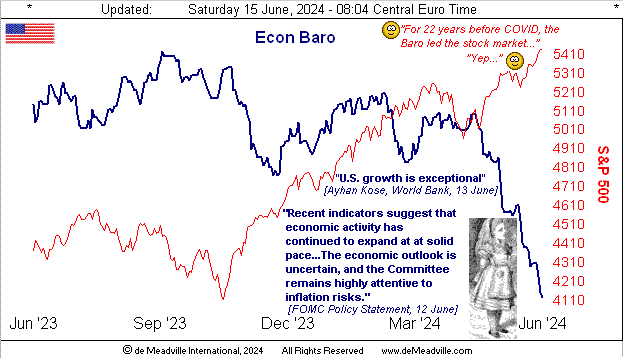

Toward economic mold (including more on the sudden absence of inflation), initially we’ve these two sentences from The Federal Open Market Committee’s Policy Statement of 12 June 2024:

- First paragraph, opening sentence –> “Recent indicators suggest that economic activity has continued to expand at a solid pace.

- Second paragraph, closing sentence –> “The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.”

So is the Fed sensing an economic inflection point?

But wait, there’s more: hat-tip Dow Jones Newswires from the ever-ebullient Ayahn Kose (who is the World Bank’s Deputy Chief Economist as everyone knows) came his 13 June prose –> “U.S. growth is exceptional”.

Your having thus absorbed all that parroted wisdom from on high, here’s the Economic Barometer, borne of the math beneath it all. Indeed, ![]() “Go ask Alice…”

“Go ask Alice…”![]() –[Slick/Jefferson Airplane, ’67]:

–[Slick/Jefferson Airplane, ’67]:

And yes, also go ahead and quote one John Patrick McEnroe: “You canNOT be SERious!!” For 29 April-to-date is the worst plunge for such time frame in the Econ Baro’s 26-year history!

To see the Econ Baro so plunge, one ought think the Fed — as it did under Chairman Greenspan pre-“911” both on 03 January 2001 and 18 April 2001 — make an emergency rate cut straightaway. For after all, along with this economic erosion, inflation within the one mere month of May just comprehensively went away! “Don’t delay, cut today!” Yet for some unforeseen reason, the Fed doesn’t see the Econ Baro; neither do CNBS, Bloomy nor Foxy. But in staying the “no inflation” proclamation:

- At the retail level, the Consumer Price Index showed no inflation (0.0%) for May, the 12-month CPI summation now +3.1% (and “core” +3.5%) … courtesy of The Bureau of Labor Statistics;

- At the wholesale level, the Producer Price Index showed deflation (-0.2%) for May, the 12-month PPI summation now +1.9% (and “core” +1.8%) … courtesy of The Bureau of Labor Statistics.

However, recall a week ago also courtesy of The Bureau of Labor Statistics: May’s unexpected upside explosion in Payrolls’ creation was accompanied by an inflationary doubling of the increased pace of Hourly earnings from +0.2% to +0.4%. So fortunately, there’s no inflation, (let alone stagflation), right?

“Well, it is an election year, mmb, and this is the Labor Dept…“

Avoiding any book-cooking notions there, Squire, (this being a financial treatise rather than one political), you know and we know and everyone from Bangor, Maine to Honolulu and right ’round the world knows that hardly has inflation slowed: “Been to the store lately?” Moreover, were Gold to react to inflation having suddenly vanished, price would be rate-cut-influenced moon-bound rather than (at least technically) indicative of moving down.

To be sure, ’tis said the Fed is typically “behind the curve”, indeed today in a state of squirm. For the Fed to opine (at best ‘twould seem) that “economic activity has continued to expand at a solid pace”, we’d say their analysis has (in Formula One lingo) “gone beyond the edge of adhesion and into the Armco!”

And as for the tumbling Econ Baro: ’twill be interesting to see just how negative for May the Conference Board’s Leading [i.e. “lagging”] Indicators shall be come next Friday (21 June). Economic mold, indeed.

Too, there’s earnings mold, our live price/earnings ratio for the S&P 500 settling the week at a historically unsupportable 41.4x. But until real fear hits, everything’s great, right? As is our wont to quip: marked-to-market, everybody’s a millionaire; marked-to-reality, nobody’s worth squat.

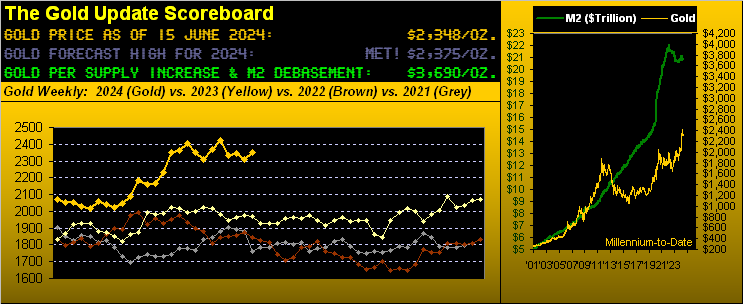

From such mold, back to firm Gold. Whilst price near-term may be a bit challenged, the broader picture remains most positive — perhaps technically too positive — but fundamentally there’s so much currency debasement ground to gain, (our opening Scoreboard valuation of 3690 versus Gold currently just 2348).

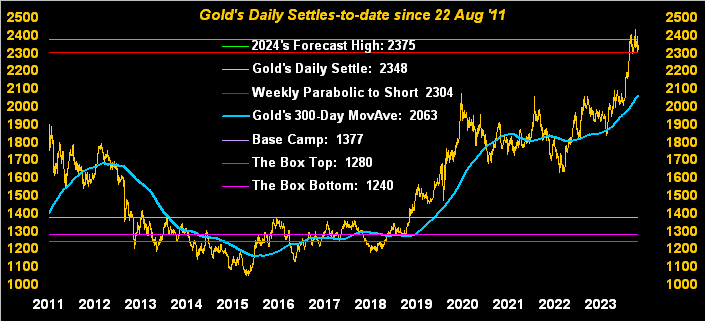

That noted, we go to Gold’s daily closes and 300-day moving average across the past 13 years, (the graphic still remindful of those tiresome 1200s-1400s during the prior decade). Therein, our green-line forecast high for this year (2375) has thus far held reasonably well, notwithstanding the brief, recent spike to 2454. And by this big picture, Gold’s sub-2000 days really do now appear permanently histoire, with an inevitable run to 3000+ in the balance ![]() “As time goes by…”

“As time goes by…”![]() –[Hupfeld ’31 … Wilson, Casablanca, ’42]:

–[Hupfeld ’31 … Wilson, Casablanca, ’42]:

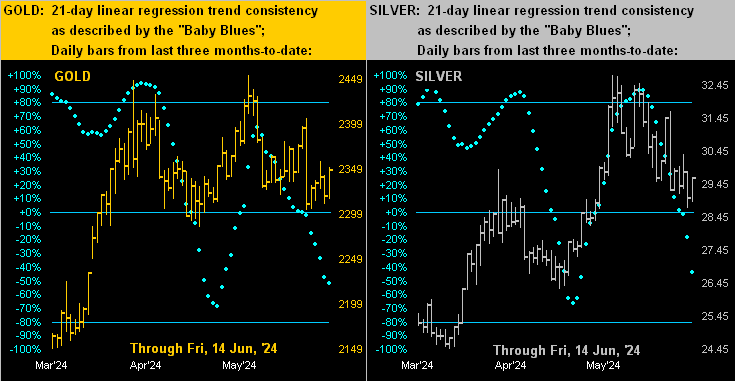

Drilling down into the precious metals, here next we’ve their daily bars from three months ago-to-date with Gold on the left and Silver on the right. Their respective baby blue dots of trend consistency trace nearly identical patterns, suggesting that Sister Silver is aligned with Gold, adorned in her precious metal pinstripes rather than her industrial metal jacket when aligned with Cousin Copper; however, should you peek at the website’s Copper and/or Market Trends pages, you’ll find the red metal’s “Baby Blues” are not that dissimilar from those of the white and yellow metals. Thus for the Metals Triumvirate, all three are at present in linear regression downtrends, our precious two in this view:

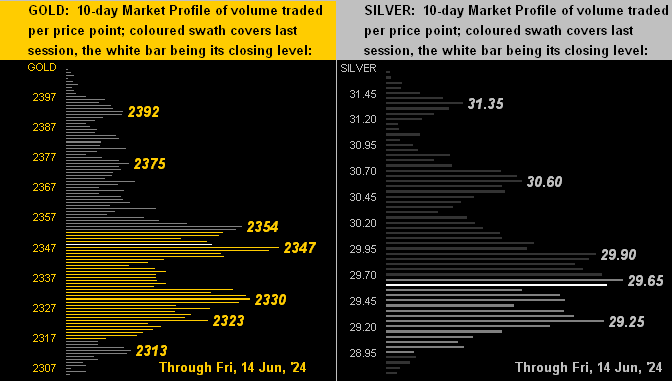

As to the 10-day Market Profiles, both Gold (below left) and Silver (below right) have positioned themselves above last week’s lows … but given the near-term negative trends, we’ll simply have to see how it goes:

To close, yes the Econ Baro looks terrible, again in its worst plummeting streak we’ve ever recorded. However, perhaps there’s happier news on the horizon: of the 14 metrics scheduled to hit the Baro in the new week, 10 by consensus are expected to have improved period-over-period. ‘Course, to be factored in as well shall be prior period revisions with which to weigh one’s decisions.

But when it comes to increasing one’s Gold buying program, as Bogey said, “Play it again, Sam!”

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

deMeadville. Copyright Ⓒ 2010 - 2024. All Rights Reserved