The gold miners just finished reporting their latest quarterly results, revealing how they are actually faring fundamentally. Those proved somewhat mixed for the largest gold miners dominating the leading gold-stock benchmark. While production stayed stable, mining costs are still climbing although their ascent is moderating. Plenty of gold miners are forecasting growing output driving lower costs as 2023 marches on.

The GDX VanEck Gold Miners ETF remains this sector’s dominant benchmark. Birthed way back in May 2006, GDX has parlayed its first-mover advantage into an insurmountable lead. Its $13.5b of net assets mid-week dwarfed the next-largest 1x-long major-gold-miners ETF by fully 30x! GDX is undisputedly the trading vehicle of choice in this sector, with the world’s biggest gold miners commanding most of its weightings.

Gold-stock tiers are defined by miners’ annual production rates in ounces of gold. Small juniors have little sub-300k outputs, medium mid-tiers run 300k to 1,000k, large majors yield over 1,000k, and huge super-majors operate at vast scales exceeding 2,000k. Translated into quarterly terms, those thresholds shake out under 75k, 75k to 250k, 250k+, and 500k+. The latter two larger categories account for 4/7ths of GDX.

The major gold miners as measured by GDX have struggled over this past month, selling off 8.7% as of mid-week. But that followed a strong 63.9% upleg over 6.5 months into mid-April, which left this sector really overbought. So a correction is healthy, rebalancing sentiment and technicals to prepare the way for the next surge higher. Good buying opportunities are nearing as gold stocks slump into their summer doldrums.

The gold stocks are ultimately leveraged plays on gold, with GDX tending to amplify material gold moves by 2x to 3x. Between late September to mid-April, this latest GDX upleg leveraged gold’s driving one by 2.5x. Since then, GDX’s selloff has amplified gold’s own by 3.1x. So major gold stocks’ behavior over the past half-year has been normal. Their latest quarterlies help illuminate where they are likely heading next.

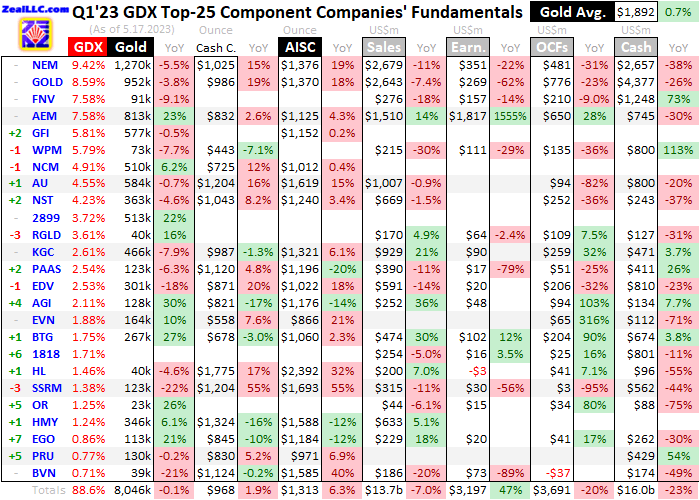

For 28 quarters in a row now, I’ve painstakingly analyzed the latest operational and financial results from GDX’s 25-largest component stocks. Mostly super-majors, majors, and larger mid-tiers, they dominate this ETF at 88.6% of its total weighting! While digging through quarterlies is a ton of work, understanding the gold miners’ latest fundamentals really cuts through the obscuring sentiment fogs shrouding this sector.

This table summarizes the operational and financial highlights from the GDX top 25 during Q1’23. These gold miners’ stock symbols aren’t all US listings, and are preceded by their rankings changes within GDX over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q1’22. Those symbols are followed by their current GDX weightings.

Next comes these gold miners’ Q1’23 production in ounces, along with their year-over-year changes from the comparable Q1’22. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After are the costs of wresting that gold from the bowels of the earth in per-ounce terms, both cash costs and all-in sustaining costs. The latter help illuminate miners’ profitability.

That’s followed by a bunch of hard accounting data reported to securities regulators, quarterly revenues, earnings, operating cash flows, and resulting cash treasuries. Blank data fields mean companies hadn’t disclosed that particular data as of the middle of this week. The annual changes aren’t included if they would be misleading, like comparing negative numbers or data shifting from positive to negative or vice-versa.

The big gold miners’ Q1’23 proved solid, but still somewhat disappointing. Most super-majors and majors dominating GDX continued failing to grow their production, a perpetual problem at the large scales they operate. Lower output naturally drove higher costs, overshadowing better results from the smaller mid-tiers we’ve long specialized in. The world’s biggest gold miners continue to hobble their sector’s performance.

Production growth trumps everything else as the primary mission for gold miners. Higher outputs boost operating cash flows which help fund mine expansions, builds, and purchases, fueling virtuous circles of growth. Mining more gold also boosts profitability, lowering unit costs by spreading big fixed operational expenses across more ounces. But most of GDX’s biggest gold miners continued suffering shrinking output.

That includes mighty Newmont, Barrick Gold, Gold Fields, Anglogold Ashanti, Northern Star Resources, Kinross Gold, and Endeavour Mining. These giants collectively produced 4,513k ounces of gold in Q1’23, almost 4/7ths of the GDX-top-25 total. Yet their aggregate output still dropped a rather-sharp 5.1% year-over-year! Super-major Agnico Eagle Mines bucked that shrinkage trend, but only because of a merger.

AEM’s hefty 23.0% YoY production growth looks impressive, but that was solely driven by its acquisition of Kirkland Lake Gold which closed a third of the way into Q1’22. Buying out other gold miners certainly boosts output, but that growth is temporary only lasting four quarters after mergers. After that production resumes contracting as large gold miners struggle to overcome depletion at their vast operational scales.

I’ve long argued gold-mining mega-mergers are bad for this sector. Acquiring shareholders suffer big dilution during these expensive acquisitions, which only temporarily mask depletion. These deals also ultimately destroy value in this sector. Great highly-profitable gold mines that really attract investors into smaller gold stocks are relegated to immateriality when forced into and buried in major miners’ extensive stables.

Smaller mid-tier gold miners are fundamentally superior since they can often grow their production more consistently operating at lower scales. Alamos Gold, B2Gold, and Eldorado Gold collectively enjoyed outstanding 26.5% YoY output growth to 508k ounces in Q1’23! And investors have rewarded them with much-better stock-price performances. We added newsletter trades in all three of these mid-tiers last July.

As of mid-week, GDX was up about 30% since then. Yet our unrealized gains in AGI, BTG, and EGO in our popular weekly newsletter over that same span averaged 63%! And that’s after gold stocks’ selloff during this past month. The super-majors and majors failing to grow their production yet still dominating GDX are truly deadweight for gold-stock performance. Thankfully the GDXJ gold-stock ETF excises most of them.

Next week I’m analyzing the Q1’23 results from the GDXJ mid-tier gold stocks which should prove much better. Back to GDX for now, overall its 25 biggest components saw their total production edge down just 0.1% YoY to 8,046k ounces. That sounds solid, but it’s still actually relatively weak. The best-available fundamental data for global gold supply and demand is published quarterly by the World Gold Council.

Its latest excellent Gold Demand Trends report covering Q1’23 showed total global mined supply actually grew 1.5% YoY last quarter to 27,521k ounces. So the major gold miners of GDX are lagging their peers even with flat output. But interestingly the top 25 GDX gold miners generally see improving production in this year’s remaining quarters. Both top super-majors Newmont and Barrick reiterated that in their Q1 reports.

NEM advised “We expect to deliver approximately 55 percent of our full year gold production guidance in the second half of the year.” GOLD declared “Pueblo Viejo and Nevada Gold Mines ramp up to drive a stronger second half in line with guidance.” Plenty of others joined in, like Anglogold Ashanti saying “Production is expected to be second half weighted, with unit costs expected to decline into the second half of 2023.”

Output rising throughout calendar years is actually normal for gold miners. That latest WGC GDT reports quarterly global gold-mining output going back to early 2010. On average in Q1s, Q2s, Q3s, and Q4s since then, world mine production has swung -8.7%, +4.7%, +6.9%, and +0.3% sequentially quarter-on-quarter. Q1s like this latest one actually see the weakest gold production of the year, falling sharply.

Q1’23’s world gold output indeed plunged 10.4% sequentially from Q4’22. The GDX top 25 did better than that, suffering a smaller 7.8% QoQ production decline. After Q1s’ plunge, gold output tends to jump dramatically in Q2s and Q3s. So the major gold miners’ assertions that their output will improve in 2023 are very likely to prove true. Q1s like this latest one are usually weak production-wise for several reasons.

Like most of the world’s land masses, most gold mines are found in the northern hemisphere. Winter weather peaking in Q1s adversely impacts operations, ranging from bitter cold up north to heavy seasonal rains down south. Both reduce efficiencies of necessary chemical reactions in heap leaching commonly used to dissolve gold from ores. Q1s are also when mine managers get new maintenance and upgrade budgets.

So they often schedule plant maintenance early in years, further slowing outputs. Sometimes they take advantage of winter weather impeding mining operations to expand throughputs. With much of that done and temperatures warming, gold mines often really hum in Q2s and Q3s. All of my gold-mine visits have been in summer months, and it’s always amazing seeing the beehives of activity with ore being moved.

Unit gold-mining costs are generally inversely proportional to gold-production levels. That’s because gold mines’ total operating costs are largely fixed during pre-construction planning stages, when designed throughputs are determined for plants processing gold-bearing ores. Their nameplate capacities don’t change quarter to quarter, requiring similar levels of infrastructure, equipment, and employees to keep running.

So the only real variable driving quarterly gold production is the ore grades fed into these plants. Those vary widely even within individual gold deposits. Richer ores yield more ounces to spread mining’s big fixed costs across, lowering unit costs and boosting profitability. But while fixed costs are the lion’s share of gold mining, there are also sizable variable costs. That’s where recent years’ raging inflation really hit.

Energy is the biggest category, both electricity to power ore-processing plants including mills and diesel fuel necessary to run fleets of excavators and dump trucks hauling raw ores to those facilities. Other smaller consumables range from explosives to blast ores free to chemical reagents necessary to process various ores to recover their gold. So higher variable costs continue to heavily impact the world’s gold miners.

In recent quarters they generally blamed rising costs on inflating prices. But Q1’23 saw lower output eclipse that. Newmont said higher costs were “impacted by lower production volumes and continued global cost pressures; costs expected to decrease throughout the year.” Barrick wrote higher costs were “mainly due to lower sales volumes, combined with higher input costs driven by energy and consumables prices”.

Cash costs are the classic measure of gold-mining costs, including all cash expenses necessary to mine each ounce of gold. But they are misleading as a true cost measure, excluding the big capital needed to explore for gold deposits and build mines. So cash costs are best viewed as survivability acid-test levels for the major gold miners. They illuminate the minimum gold prices necessary to keep the mines running.

These elite GDX-top-25 gold miners reported average cash costs of $968 per ounce in Q1’23, which only climbed 1.9% YoY. That’s impressive given far-higher inflation around the world! Yet $968 remains lofty, the second-highest cash costs on record just behind Q3’22’s $975. But excluding three extreme outliers skewing them high, they’d average a better $893. Those are Anglogold Ashanti, Hecla Mining, and Buenaventura.

While the latter has long been troubled, the former two see costs improving in 2023. AU’s Q1 results again declared “Production is expected to be second half weighted, with unit costs expected to decline into the second half of 2023.” HL said the same, “Expected gold production remains weighted towards the second half of 2023. Cash costs and AISC ... are also expected to trend lower in the second half of the year.”

All-in sustaining costs are far superior than cash costs, and were introduced by the World Gold Council in June 2013. They add on to cash costs everything else that is necessary to maintain and replenish gold-mining operations at current output tempos. AISCs give a much-better understanding of what it really costs to maintain gold mines as ongoing concerns, and reveal the major gold miners’ true operating profitability.

The GDX top 25’s AISCs looked similar last quarter, climbing 6.3% YoY to a very-high $1,313 per ounce. That was also the second highest ever after Q3’22’s ugly $1,391. But again they were skewed by those same three outliers. Excluding AU, HL, and BVN, the rest of these major gold miners averaged much-better AISCs of $1,210 per ounce in Q1’23. The former two are forecasting AISCs falling considerably in 2023.

Anglogold Ashanti sees full-year AISCs including Q1’s lofty level coming in 11.8% lower, while Hecla is guiding to a 15.8% drop. Many gold miners are expecting 2023 AISCs to average well under their Q1 levels driven by lower production. Newmont’s and Barrick’s AISCs shot up 19.0% and 17.7% YoY to a way-too-high $1,376 and $1,370. Yet they reaffirmed full-year outlooks averaging a much-better $1,200 and $1,210.

Last quarter’s really-high AISCs certainly cut into profit margins. A great proxy for how gold miners are faring as a sector subtracts average AISCs from quarterly-average gold prices to obtain implied unit profits. For the entire GDX top 25 including those three extreme outliers, that metric fell 10.1% YoY to $579 per ounce. That was still solid, the slowest decline since Q2’21 to the best unit profits seen in three quarters.

Without that trio of outliers, the major gold stocks’ implied profitability naturally looks way better. Q1’23’s $1,892 average gold price less that adjusted AISC of $1,210 yields $682 per ounce. That’s actually on the richer side, up over 5/8ths into the past 28 quarters’ trading range. So despite their challenges, the major gold miners dominating GDX are doing a lot better fundamentally than most traders give them credit for.

And gold miners’ earnings are likely to surge dramatically in this currently-underway Q2. Quarter-to-date so far, gold is averaging $2,007 which has powered up a big 6.1% sequentially from Q1! Even if gold’s healthy sentiment-rebalancing selloff persists, average prices this quarter will almost certainly remain well above Q1’s $1,892. Higher prevailing gold prices less lower AISCs on rising production yields fatter profits.

Moving on to hard accounting data reported to securities regulators under Generally Accepted Accounting Principles or other countries’ equivalents, the major gold miners’ Q1’23 was weaker. Their total revenues fell 7.0% YoY to $13,664m. That’s a steep drop given the GDX top 25’s total gold output only slipping 0.1% while average gold prices edged up 0.7%. So a couple other factors contributed to this discrepancy.

A sizable fraction of the major gold miners are also larger silver producers, and their total silver production plunged 24.7% YoY to 17,822k ozs last quarter. Part of that was driven by changing ranks of GDX-top-25 stocks. First Majestic Silver was included a year ago, but slipped out in Q1’23. Both its silver production and revenues were replaced by Australia’s Perseus Mining, which only reports the latter in half-year increments.

Bottom-line accounting profits looked great, with the GDX top 25 collectively earning $3,197m in Q1’23 which soared 47.4% YoY. But unfortunately that resulted from unusual items that various gold miners flush through quarterly net income occasionally. The big one was Agnico Eagle reporting an enormous $1,543m “Revaluation gain”! Gold miners almost never have the opportunity to write up mine carrying values.

AEM teamed up with Pan American Silver to buy out Yamana Gold. While PAAS got most of its assets, AEM was targeting AUY’s stake in the giant Canadian Malarctic gold mine in Quebec. That is expected to yield about 585k ounces of gold for AEM this year. Agnico Eagle had a 50% stake in that mine before buying the remaining 50% from Yamana, so it was able to revalue its original half to the price paid for the second!

Without that huge non-cash gain, the GDX top 25’s Q1’23 earnings fell to $1,654m. Similarly adjusting the comparable Q1’22’s to exclude the larger unusual non-cash items, last quarter’s actually fell 34.7% YoY. While not great, that’s more consistent with the lower revenues. GAAP earnings really ought to improve throughout 2023 if the gold miners’ forecasts for better outputs and lower costs indeed come to pass.

These elite gold miners’ operating cash flows generated fell a similar 20.5% YoY last quarter to $3,691m. There was great variability in individual gold miners’ OCFs, with some suffering big drops while others soared in big gains. Weaker cash flows combined with mine expansions, builds, and acquisitions also pushed the GDX top 25’s total cash hoards down 23.0% YoY to $16,020m. That’s still on the higher side historically.

So overall the major gold miners’ operational and financial results were somewhat mixed last quarter. Yet they still mined gold for way less than prevailing prices, driving solid earnings. And those are expected to really improve in coming quarters on expanding production driving down costs. Combine that with higher gold prices, and gold stocks’ recent selloff should soon lead to good buying opportunities in the summer doldrums.

Successful trading demands always staying informed on markets, to understand opportunities as they happen. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

Our holistic integrated contrarian approach has proven very successful, and you can reap the benefits for only $12 an issue. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential. Sign up for free e-mail notifications when we publish new content. Even better, subscribe today to our acclaimed newsletters and start growing smarter and richer!

The bottom line is the major gold miners are still faring fine operationally despite mixed quarterly results. Their collective production stayed stable even against the relentless depletion larger gold miners struggle with. And while mining costs climbed further, their rates of ascent continued to really moderate. Plenty of major gold miners are forecasting considerably-lower all-in sustaining costs in 2023 as production grows.

Thus coming quarters could see the first annual decline in gold-mining costs since mid-2018. Couple that with higher prevailing gold prices, and earnings could surge dramatically. The gold miners’ fundamentals continue to point to much-higher stock prices ahead, despite the selloff-induced bearish sentiment now plaguing this sector. So contrarians should be looking for buying opportunities in gold stocks’ seasonal trough.

Adam Hamilton, CPA

May 19, 2023

Copyright 2000 - 2023 Zeal LLC (www.ZealLLC.com)