The gold miners’ stocks have suffered an extended correction in recent months, leaving them deeply out of favor. Yet their underlying fundamentals remain incredibly strong, thanks to continuing high prevailing gold prices. These companies’ recently-released Q4’20 results revealed they are thriving, generating massive revenues, earnings, and operating cash flows. Thus their stock prices need to mean revert way higher.

The leading and dominant gold-stock benchmark and trading vehicle today is the GDX VanEck Vectors Gold Miners ETF. Launched way back in May 2006, GDX’s first-mover advantage has grown into an insurmountable lead. With $14.2b of net assets this week, GDX commands a staggering 32.0x more capital than its next-biggest 1x-long major-gold-miners-ETF competitor! GDX is really the only game in town.

Yet this sector’s challenging price action of late has cast GDX and the major gold miners it contains off traders’ radars. This gold-stock bull’s last upleg proved mighty, with GDX skyrocketing 134.1% higher in just 4.8 months! In early August it peaked with gold, the gold stocks’ overwhelmingly-dominant primary driver. Then GDX rolled over into a necessary and healthy correction to rebalance sentiment and technicals.

That looked to bottom in late November at a 24.9% loss over 3.6 months, paving the way for this sector’s next upleg. Indeed GDX surged 15.2% higher during the next 1.3 months, decisively breaking out above multiple major resistance zones in early January. But then the markets threw a low-probability curveball, and gold stocks started slumping again. GDX ground lower until its original correction low failed in late February.

The major gold stocks plunged into early March, their leading ETF extending its correction to 30.5% over 6.8 months. That slaughtered any remaining bullish psychology, unleashing universal bearishness. This small contrarian sector was left forsaken again, an ideal spawning ground for this bull’s next major upleg. It is likely underway, with GDX already rebounding 10.7% higher at best. So fundamentals really matter today.

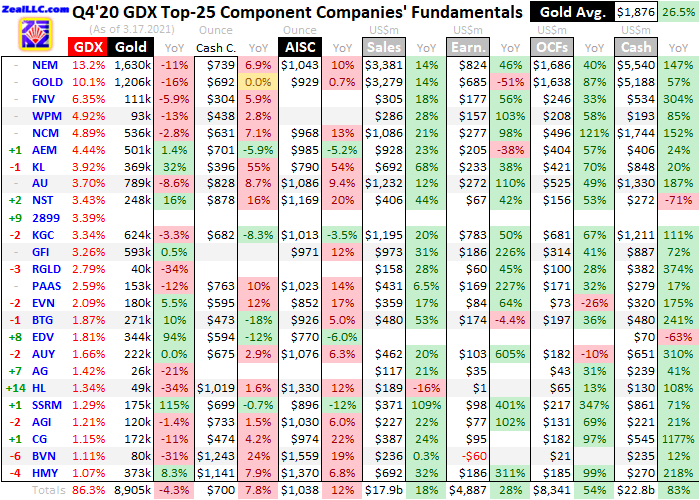

For 19 quarters in a row now, I’ve painstakingly analyzed the major gold miners’ latest quarterly results right after they are reported. While GDX contained a crazy 51 component stocks this week, I’m limiting my analysis to its top 25 holdings. These are the world’s biggest and best gold miners, which command a dominant 86.3% of GDX’s total weighting. The lion’s share of capital chasing gold stocks ends up in them.

Unfortunately Q4 results closing out calendar years arrive much later than normal quarterlies. Since the annual reports containing Q4 numbers are bigger, more complex, and must be audited by independent CPAs, securities regulators grant extended filing deadlines. Those are 60 days after year-ends in the US, and a ridiculous 90 days in Canada where most of the world’s gold stocks trade! So Q4 analysis runs later.

Even at this Wednesday’s essay data cutoff 76 days after year-end, one key Canadian GDX component hadn’t yet reported its Q4 results. The major gold miners trade in the US, Australia, South Africa, China, and Canada, making amassing this data somewhat challenging. There are different financial-reporting requirements around the globe, and even within the same country miners report different data in different ways.

Some annual reports are well-laid-out and easy to parse, while others seem intentionally opaque requiring lots of digging and calculations to tease out comparable data. Australia and South Africa require half-year reporting instead of quarterly, although their gold miners usually give supplemental quarterly updates. But in cases where half-year data was all that was available, it is split in half to approximate Q4’20 results.

This table summarizes the operational and financial highlights from the GDX top 25 in Q4’20. These elite gold miners’ symbols are listed, some of which are from their primary foreign stock exchanges. That is preceded by their ranking changes in terms of GDX weightings from Q4’19. Then their current weightings as of this week follow those stock symbols. This ETF essentially weights gold stocks by market capitalizations.

So relative ranking changes help illuminate outperformers and underperformers over this past year. That data is followed by each miner’s Q4’20 gold production in ounces, and its year-over-year change from Q4’19’s results. Then comes cash costs per ounce and all-in sustaining costs per ounce along with their YoY changes, revealing how much it costs these gold miners to wrest their metal from the bowels of the earth.

Next quarterly revenues, GAAP earnings, operating cash flows generated, and cash on hand are listed along with their YoY changes. Blank data fields mean companies hadn’t reported that particular data as of the middle of this week. Blank percentage fields indicate those changes would be either misleading or not meaningful, like comparing two negative numbers or data shifting from positive to negative and vice versa.

Despite gold’s correction running through Q4’20 which drove gold stocks’ selloff, last quarter still enjoyed the second-highest average gold prices ever witnessed at $1,876. So the major gold miners dominating GDX put up blockbuster results then. In many cases these proved the best on record, with miners’ gold output rebounding in Q4 after governments’ COVID-19-lockdown orders hammered Q2 and early-Q3 production.

GDX’s component rankings stayed fairly static over this past year, with only one gold miner Hecla Mining newly rising into the top 25. Chinese gold miner Zijin Mining with that numerical symbol shot higher, as did Canada’s Endeavour Mining and First Majestic Silver. While I’ve looked every quarter for years, Zijin rarely updates the English version of its website. Even its Chinese financials don’t reveal gold production!

After prevailing gold prices which miners are at the mercy of, their output levels are the most-important driver of their long-term success. Investors and speculators prize production growth above all else, since it boosts revenues, earnings, and operating-cash-flow generation. Generally the more gold that miners can bring to market, the faster they can keep growing by expanding, constructing, or buying more gold mines.

This powerful virtuous circle makes production the lifeblood of the gold-mining industry. And output for the GDX top 25 was a mixed bag last quarter. Overall these elite gold miners produced 8,905k ounces of gold in Q4’20, which slumped 4.3% year-over-year from the GDX top 25 in Q4’19. That’s certainly not optimal, so we need to drill down on it for more context. The World Gold Council is the best place to start.

After every quarter, the WGC’s analysts publish outstanding Gold Demand Trends reports. These have the best-available data on global gold supply and demand. Interestingly in Q4’20 overall gold mined worldwide also fell 2.9% YoY to 28,817k ounces. So the GDX major gold miners’ weaker production is mirroring the industry trend. The good news is that has rebounded strongly from Q2’s lockdown-spawned nadir.

With national economies and their gold mines opened back up, the GDX top 25’s total production soared a massive 17.9% from Q2’20 levels! According to the comprehensive WGC data, that quarter suffered the lowest global gold mined since Q1’14. So the major gold miners’ recovery from the government-imposed mine shutdowns is going strong. And the GDX top 25’s output is skewed low by the pair of super-majors.

Newmont and Barrick Gold are in a league of their own, producing a colossal 1,630k and 1,206k ounces of gold in Q4’20. Their extreme outputs drive massive market capitalizations dwarfing all the other major gold miners, granting NEM and GOLD a huge 23.3% combined weighting in GDX. But operating at such outlying enormous baseline scales, these two largest gold miners have long struggled with depleting production.

A couple years ago soon after both companies announced mega-mergers, I wrote an essay analyzing their usually-shrinking outputs. That vexing and apparently-insurmountable problem along with NEM’s and GOLD’s giant market caps guarantees their stock prices will always lag smaller fundamentally-superior mid-tier and junior miners. Excluding these super-majors, the rest of the GDX top 25 look much better.

Their collective gold production actually edged up 0.5% YoY in Q4’20 to 6,069k ounces! So generally the major gold miners of GDX are faring better than this industry as a whole. Interestingly the GDX top 25’s silver production surged 11.5% YoY to 27,961k ounces last quarter. But that resulted from a changing component mix, with major silver miners First Majestic Silver and Hecla Mining newly climbing into these ranks.

In gold mining, output levels and unit costs are usually inversely proportional. The more gold mined, the more ounces to spread this industry’s big fixed costs across. Those are generally determined when mines are being planned, then don’t change much. Quarter after quarter, individual mines require about the same levels of infrastructure, equipment, and employees to feed their fixed-capacity mills with ores to process.

Those fixed costs staying roughly steady regardless of prevailing gold prices is what gives gold miners’ earnings big leverage to the yellow metal. With overall GDX-top-25 gold output lower last quarter, these gold miners’ unit costs should’ve risen proportionally. But with average gold prices rocketing up 26.5% YoY in Q4’20, 4%-ish higher costs wouldn’t have significantly impaired profits growth at major gold miners.

Cash costs are the classic measure of gold-mining costs, including all cash expenses necessary to mine each ounce of gold. But they are misleading as a true cost measure, excluding the big capital needed to explore for gold deposits and build mines. So cash costs are best viewed as survivability acid-test levels for the major gold miners. They illuminate the minimum gold prices necessary to keep the mines running.

In Q4’20, the average cash costs reported by these GDX-top-25 gold miners climbed 7.8% YoY to $700 per ounce. That was on the high side of the 19-quarter range since I started this research thread, which ran from $594 to $725. And that $700 was skewed excessively-high by three outliers reporting extreme cash costs last quarter. They were Hecla Mining, Peru’s Buenaventura, and South Africa’s Harmony Gold.

Hecla blamed COVID-19 for its higher costs, citing ramping back up to full production in one mine after lockdowns and temporary suspensions at others. Buenaventura has long struggled with declining output caused by endless operational problems. And Harmony’s old and very-deep gold mines are increasingly expensive to run. Excluding these outliers, the rest of the GDX top 25 averaged excellent $627 cash costs.

All-in sustaining costs are far superior than cash costs, and were introduced by the World Gold Council in June 2013. They add on to cash costs everything else that is necessary to maintain and replenish gold-mining operations at current output tempos. AISCs give a much-better understanding of what it really costs to maintain gold mines as ongoing concerns, and reveal the major gold miners’ true operating profitability.

The GDX top 25’s headline average AISCs looked even worse than cash costs, surging 12.2% YoY to $1,038 per ounce in Q4’20. While still far below prevailing gold prices and thus super-profitable, that was a new high over the last 19 quarters. But again this was skewed high by that same trio of struggling gold miners, with HL, BVN, and HMY reporting outlying extreme AISCs of $1,330, $1,559, and $1,370 last quarter!

Their problems certainly don’t reflect this industry as a whole, so excluding them the rest of these major gold miners in the GDX top 25 averaged much-better $971 all-in sustaining costs. That’s still higher than they were pre-pandemic, as the GDX top 25 averaged $903 in the four quarters ending Q1’20. But gold prices were much lower than too, averaging $1,461. Long-term gold-price trends affect miners’ strategies.

After enough years of gold climbing on balance, gold-mine managers start planning on higher prevailing gold prices being sustainable. So their mine expansions and new mine builds start shifting towards lower ore grades. Naturally the lower the ratios of payable gold to waste rock in ores, the more expensive it is to produce each ounce of gold. Better economics for gold mining over time gradually lead to higher unit costs.

The major gold miners’ average all-in sustaining costs can also be subtracted from average gold prices for a great proxy of industry earnings trends. Gold again averaged $1,876 last quarter, its second-highest on record. And the GDX top 25’s headline AISCs including that outlying triad averaged $1,038 per ounce in Q4’20. That implies the major gold miners were earning about $838 per ounce, which is utterly stellar!

That makes for the second-highest unit profits ever seen, after Q3’20’s $884 per ounce. Last quarter’s $838 achieved by the major gold miners blasted 50.3% higher year-over-year! Prudent investors and speculators should be scrambling to deploy capital in stocks with earnings growth of that magnitude. And amazingly such stock-market-besting profits surges haven’t even been unusual for this abandoned sector.

Running into Q4’20, the last six quarters have seen GDX-top-25 earnings by this metric skyrocket 53.5%, 57.8%, 55.5%, 66.2%, 49.7%, and 50.3% YoY! That averages out to incredible 55.5% YoY profits growth over this longer-term span. After putting up phenomenal sustained numbers like these, traders should be rushing into this sector. Every investor and speculator should have a material allocation to gold-mining stocks.

The major gold miners’ super-strong fundamentals last quarter were confirmed in their hard accounting results reported to national securities regulators. These are conservative, based on Generally Accepted Accounting Principles in the US or their equivalents in other countries. The GDX top 25 knocked the ball out of the park financially last quarter, which their battered stock prices today certainly aren’t reflecting yet.

These elite gold miners reported a combined $17.9b in revenues in Q4’20, which surged 18.3% YoY. That roughly jibes with 26.5%-higher quarterly average gold prices combined with 4.3%-lower gold output. These sales are the highest by far the GDX top 25 have ever collectively reported in the 19 quarters I’ve been expanding this research thread. In Q3’20 their total revenues only ran $13.9b on lower gold output.

The GDX top 25’s hard GAAP earnings were excellent too, blasting 27.7% higher YoY to $4.9b. While that was only the second-highest on record after Q3’19’s $5.3b, that earlier peak reflected huge one-off non-cash gains. Accounting rules require many paper gains and losses to be flushed through income statements in quarters they happen. And gold miners have seen a lot of those in recent years on gold volatility.

The biggest non-cash gains this sector has reported lately are reversals of impairment charges. When prevailing gold prices trend lower for enough years, the gold miners have to write down the values of their mines and gold deposits to reflect the deteriorating economics that lower gold prices bring. But later after gold reverses and climbs on balance again for enough years, those impairment charges can be unwound.

Excluding the bigger ones I saw on the GDX-top-25 companies’ Q4’20 income statements, their adjusted earnings last quarter were closer to $4.1b. But in the comparable year-earlier quarter of Q4’19, the GDX top 25’s income statements were riddled with impairment reversals and even a few new impairments. If those are adjusted out accordingly, these major gold miners only earned about $1.5b in that year-ago quarter.

That means the GDX top 25’s adjusted profits growth is much closer to 165% YoY than that 28% masked by all the big non-cash charges and unwinds! If anything, that quarterly average-gold-prices-less-average-AISCs proxy for sector earnings is really understated. Odds are there are no other sectors in the entire stock markets enjoyed earnings growth anywhere close to the gold miners. That will eventually attract big capital.

Fat profits combined with weak stock prices naturally mean low valuations evident through conventional trailing-twelve-month price-to-earnings ratios. The GDX top 25 averaged P/Es of 29.7x this week, which was the lowest by far in my 19 quarters of this research. And that is skewed high by First Majestic’s outlying 155.7x. Without that, the rest of the GDX top 25 gold miners earning money averaged even-lower 23.4x P/Es.

Four of those companies are so dirt-cheap they have single-digit P/Es, while another six are trading in the teens! These super-low valuations by broader stock-market standards will help attract in institutional investors, who check for expensiveness in their screens. The major gold miners have never looked better fundamentally than they did in Q4’20, and sooner or later their stock prices must reflect this underlying reality.

Last quarter’s high prevailing gold prices also enabled the GDX-top-25 gold miners to generate fantastic cash flows from operations. These totaled a stellar $8.3b last quarter, the highest ever witnessed. That even bested Q3’20’s $7.8b, before much of gold’s latest correction. The big cash flows the gold miners are spinning off will be largely used to expand their operations, upping their growth trajectories and stock prices.

Those torrents of cash earned in Q4’20 piled up in the major gold miners’ treasuries. The GDX top 25 ended last quarter with a massive record $22.8b of cash and equivalents! That is going to burn holes in their pockets, virtually guaranteeing a sizable wave of acquisitions is coming. The larger gold miners unable to grow their outputs organically have little choice but to buy entire companies in the stock markets.

The main beneficiaries of this are shareholders of smaller fundamentally-superior gold miners, which we’ve long traded in our newsletters. Like fish in a food chain, the bigger miners grow by gobbling up the smaller ones. Merger-and-acquisition activity has an additional sector benefit of getting gold miners back on more mainstream traders’ radars. The financial media takes notice of and reports on larger gold-stock deals.

With incredibly-strong fundamentals like these, investors and speculators should be stampeding back into undervalued gold miners. But they really aren’t yet, because most are momentum traders lacking the fortitude to fight the herd and buy low while sectors are out of favor. Yet as gold’s coming bull-market upleg powers higher and gold stocks amplify its gains like usual, this sector will increasingly attract new buying.

Gold stocks’ track record for multiplying wealth is unparalleled! Today’s middle-aged gold-stock bull has already seen four uplegs, which averaged huge 99.2% absolute GDX gains over 7.6 months! And the secular gold-stock bull before that had literally a dozen uplegs averaging 87.5% absolute gains over 7.8 months. So playing the contrarian to buy lower early in these before selling higher later on is fantastically lucrative.

The sweet spot for gold-stock appreciation potential during uplegs isn’t the large major miners dominating GDX. This ETF’s gains will be trounced by smaller fundamentally-superior mid-tier and junior gold and silver miners able to consistently grow their production. Uncovering them is the goal of our painstaking multi-decade research campaigns, so we can deploy capital in these outperformers during gold-stock uplegs.

At Zeal we walk the contrarian walk, buying low when few others are willing before later selling high when few others can. We overcome popular greed and fear by diligently studying market cycles. We trade on time-tested indicators derived from technical, sentimental, and fundamental research. That’s why all 1178 stock trades recommended in our newsletters since 2001 averaged hefty +24.0% annualized realized gains!

To multiply your wealth trading high-potential gold stocks, you need to stay informed about what’s going on in this sector. Staying subscribed to our popular and affordable weekly and monthly newsletters is a great way. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off sale! Early in a young gold-stock upleg is a great time to get deployed.

The bottom line is the major gold miners’ recently-reported Q4’20 results revealed their best quarter ever per multiple key fundamental benchmarks. Revenues, adjusted earnings, operating cash flows, and cash treasuries surged to record highs. Last quarter was this sector’s sixth in a row of strong mid-double-digit earnings growth, which has to be unparalleled in all the stock markets! Valuations collapsed to record lows.

Despite these incredibly-strong fundamentals, traders have largely abandoned this high-potential sector due to its recent extended correction. That’s a huge mistake. Today’s anomalously-low gold-stock prices driven by popular bearish sentiment will mean revert dramatically higher during gold’s coming next upleg. Contrarian investors and speculators who can fight the herd to buy low now stand to earn massive gains.

Adam Hamilton, CPA

March 19, 2021

Copyright 2000 - 2021 Zeal LLC (www.ZealLLC.com)