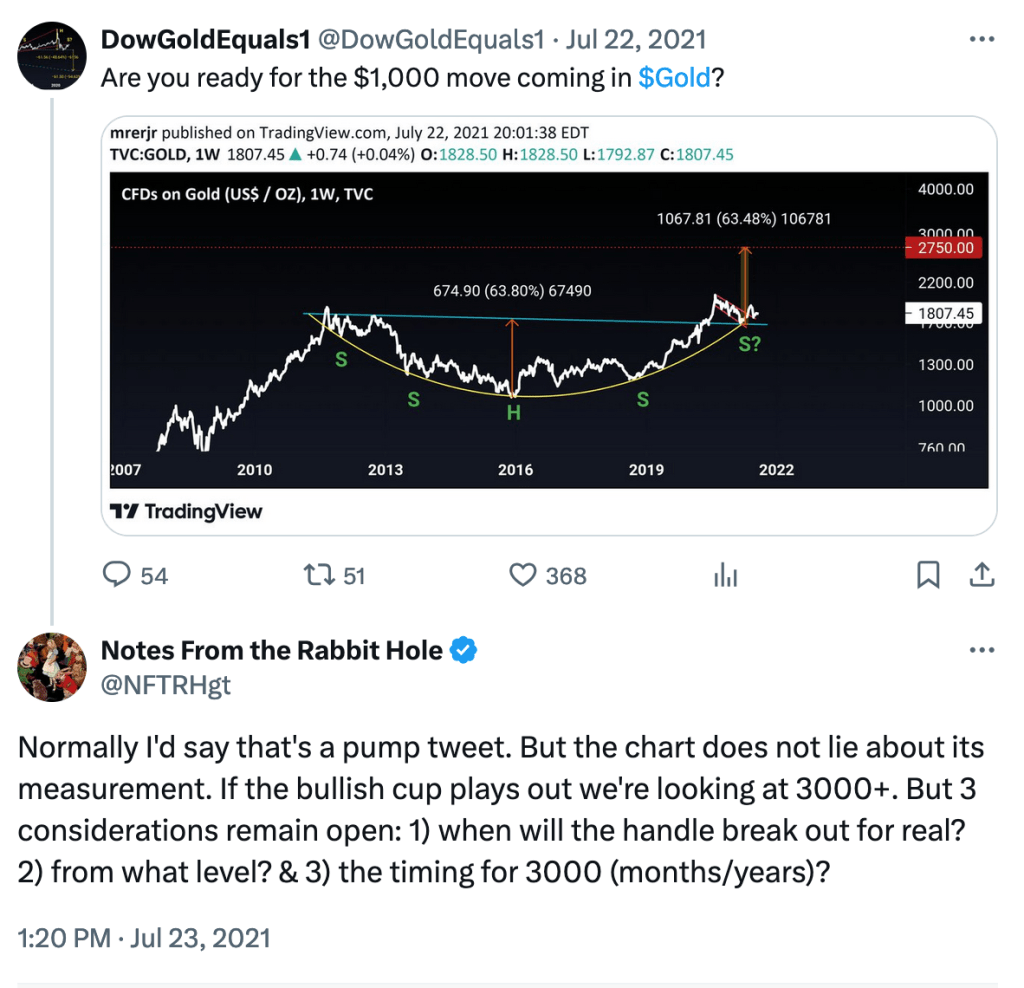

Just to be clear that the source writing to you now (your friendly blogger and letter writer) is not among the come-lately momo “me too!” crowd, here is a historical fact:

I found this on X, as for some reason someone just ‘liked’ it yesterday and it showed up in my notifications. So it’s an opportunity to highlight a 3+ year old call that will be right if gold tacks on another mere 12% to “3000+”.

As to the considerations I noted at the time (2021):

1) The handle actually got sloppy and morphed into a bullish pattern, which we targeted to 2450, long-since in the books. 2) The handle hit the low 1600s as its lows, during the post-Cup grind. 3) The answer was years, but now we are within months, if not weeks.

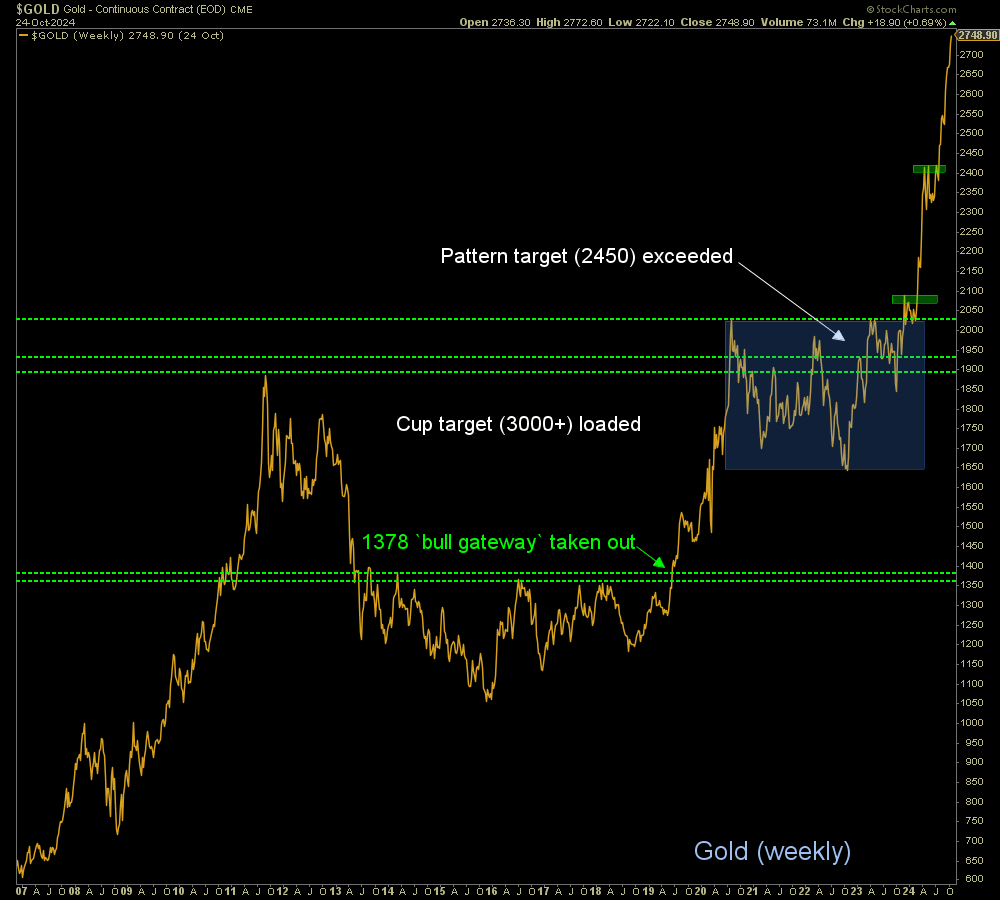

Here is a visual as of market close on October 24. It’s as if the gold price is on a mission, isn’t it? Load target and acquire target…

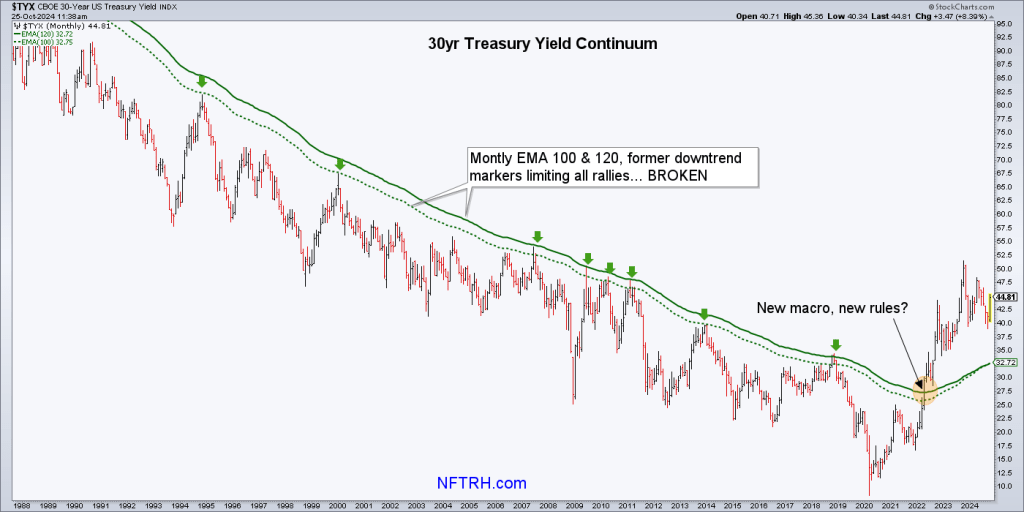

After target acquisition (assuming the plan remains on track) there are potential negatives out ahead. But we are changing the long-term macro and that means a new age for gold over the bubble beneficiaries of the last 20 years. Gold miners, all things being equal (like governments not commandeering mines, for example), will leverage gold’s standing in the macro. Once again, a stark picture of one indication that the long-term macro has changed…

One new macro rule? The disinflationary trends in bonds that supported the inflationary bubble making machinery for several decades have been ruptured. Ah, but that discussion is beyond the scope of this article. I have put it out there multitudes of times. Do a search of nftrh.com, and you’ll have it.

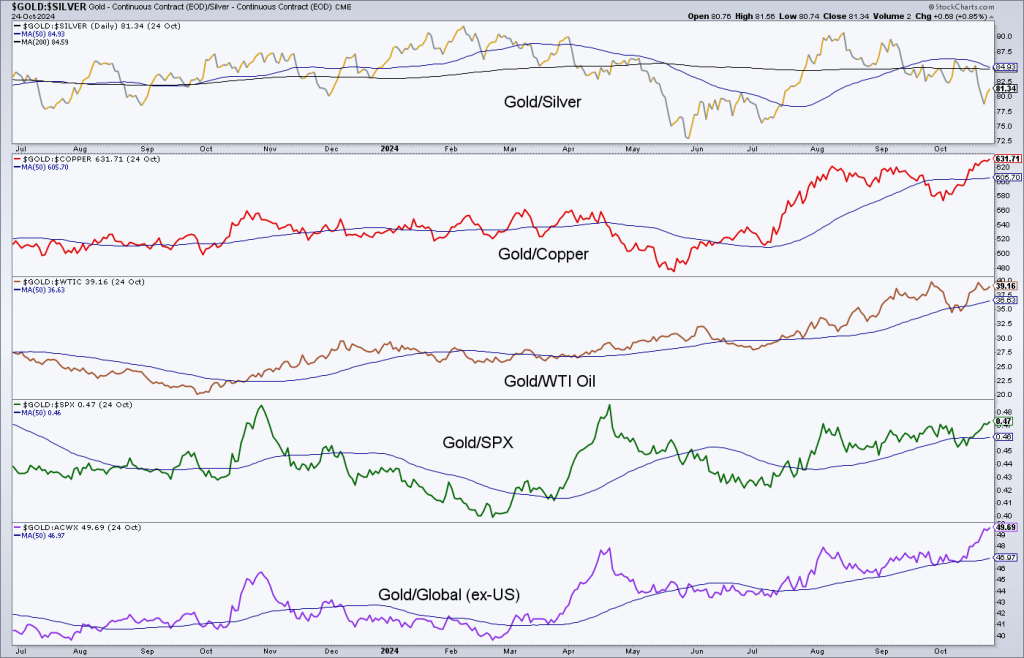

The “gold price” actually means little to me other than the value of my insurance is rising. As a speculator, gold’s relationships in the financial macro provide indications for gold mining stocks. That is where the action is.

As you can see, gold is trending up vs. cyclical and risk-on items for most of 2024. The exception being silver, which is not a problem to the gold stock investment case because silver will usually lead the precious metals complex during bull phases (ironically, it’s when the Gold/Silver ratio finds a low and turns up impulsively that the gold stock play could be indicated to be in trouble).

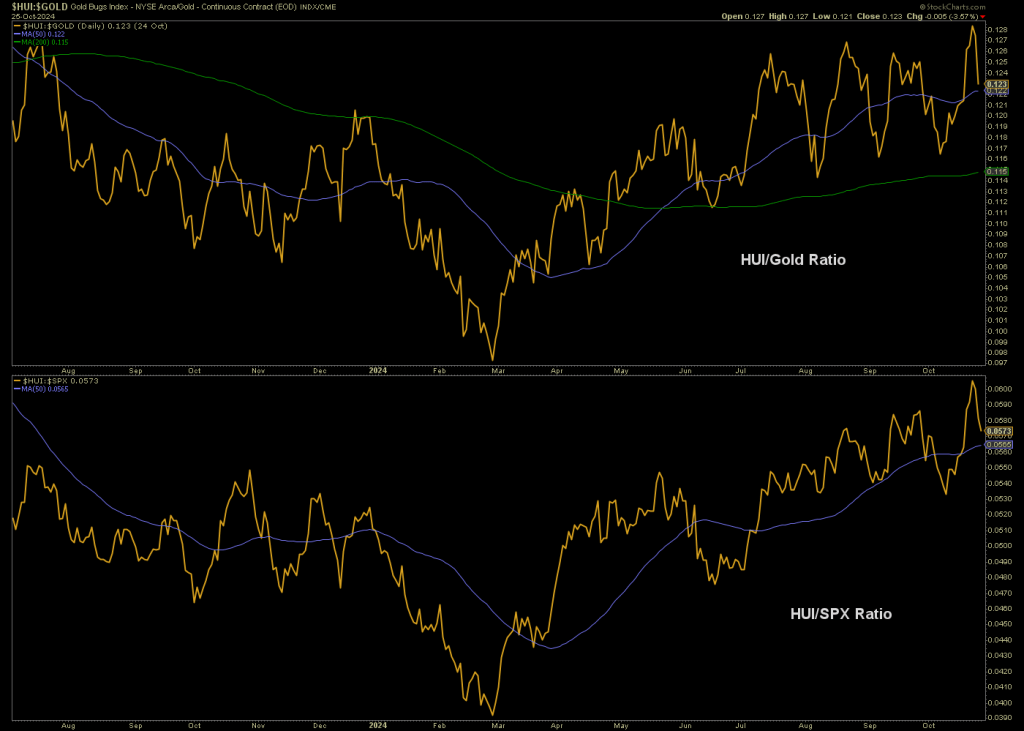

We should also consider how the miners are performing with the above indicators theoretically positive for the macro fundamental case. The HUI Gold Bugs index is doing just fine in relation to gold since March. That is an intact positive internal sector indication. Gold stocks are also on message while out-performing the vaunted US stock market bull over that same time period.

As gold eyeballs 3000+, this week’s correction in the gold stock sector is not indicated to be anything to worry about. Personally, I hedged it (per the NFTRH Trade Log), have covered half of that short (contemplating the remainder), and am not only surviving the dreaded <sarcasm alert> pullback, but am in the green. It doesn’t always work that well when hedging, but on this occasion it is. Now it is time to start planning for the next bull leg. We have our post-pullback upside targeting in place, and shorter and longer-term objectives.

On the biggest picture, however, for gold and the miners that will one day leverage its standing in the new macro, “It’s a bull market, you know”, as Edwin Lefèvre’s Old Turkey would say.