Gold and silver continue to trade sideways, though silver continues to act stronger the gold. However, this isn't being reflected in some silver producers but is in others. The mining index XAU-to-gold ratio continues to trade at very depressed levels relative to the past two decades; however, this doesn't paint an entirely accurate picture. It doesn't account for dilution, of which there has been a fair amount. Earnings season has started and will last through mid-March. With the passing of the next massive stimulus bill nearing, initiating or adding to existing positions will prove smart. At the same time, it is also a good idea to keep a cash position in the case of another market crash similar to 2008/2020 given how leveraged the system is.

$AEM, $ARTG.V, $DPM.TO, $EQX, $GBR.V, $IRV, $KGC, $MGG.V, $NFG.V, $ODV.V, $SAND, $WDO.TO, $WPM, $AUY

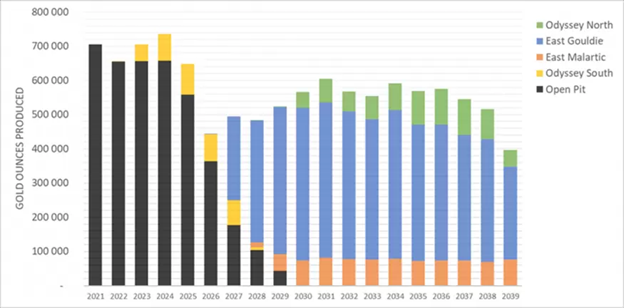

Agnico-Eagle Mines: Reported Q4 and full-year 2020 results. Agnico set a record in Q4 for the highest quarterly production of 501.4k oz. Au @ AISC of $985/oz. Full-year 2020 production totaled 1.736m oz. Au @ AISC of $1,051/oz., the mid-point of guidance. 2021 and 2022 production guidance Is 2.05-2.1m oz. Au and 2.125m oz. Au in 2023. 2021 cost guidance is AISC of $950-$1,000/oz. Reserves increased 12% to 24.1m oz. Production growth over the next three years will be sourced from Kittila, Meliadine, Amaruq underground (2022), and the Odyssey project (2023). Agnico's balance sheet continues to strengthen with cash and equivalents of $406.5m.

Artemis Gold: The company announced it had submitted an application to the B.C. government to undertake an early works construction program regarding its Blackwater Gold project. The Program is designed to focus on clearing key infrastructure areas, including haul roads, the stage 1 tailing storage facility, and camp areas. Construction of the mine access road and plant-site bulk earthworks will be fast-tracked to facilitate early mobilization of the engineering, procurement, and construction contractor to the site upon receipt of major works permits. The company expects to receive approvals in late Q2. Artemis will commence full construction activities in roughly one year.

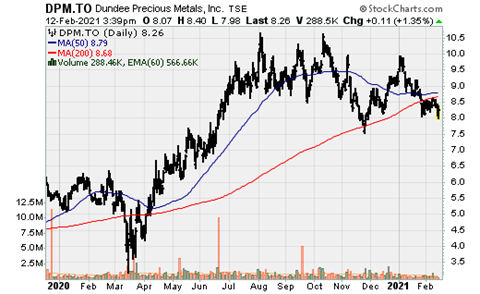

Dundee Precious Metals: Reported Q4 and 2020 full-year results. Dundee reported record gold production of 298.3k oz. and copper production of 35.6m lbs. All-in sustaining costs were $654/oz, and the company generated $197m in operating cash flow. The company also increased its quarterly dividend 50% to $0.03/share. Dundee is in strong financial shape with $150m in cash, an investment portfolio worth over $100m, and no debt. Gold production in 2021 is expected to be 271-317k oz., 240-280k oz. in 2022, and 265-310k oz. in 2023. 2021 cost guidance has decreased to $625-$690/oz., $730-$810/oz. in 2022 and $630-$710/oz. in 2023.

Equinox Gold: The company 2021 production and cost guidance. 2021 will be a year of heavy capital investment and higher costs but will fall considerably in 2022 and the years ahead. Equinox has guided for production of 600-665k oz. Au @ AISC of $1,190-$1,275/oz.

- Los Filos: Guadalupe and other open-pit stripping ($23m), Bermejal and Los Filos underground development ($57m), fleet rebuilds, and equipment ($38m). A good chunk of this is going toward multiple expansion projects. When the FS study is published regarding the 8ktpd CIL plant, the company will update projected spending. AISC in 2021: $1,330-$1,390. Costs are expected to fall to $850-$950/oz. in 2022/23.

- Mesquite: Exploration ($9m), Brownie open-pit waste stripping ($30m), leach pad expansion ($10m), equipment ($8m). AISC in 2021: $1,275-$1,325/oz. vs $930-$975/oz. in future years.

- Castle Mountain Phase I: Leach pad expansion ($9m). AISC in 2021: $1,100-$1,150/oz. Costs are expected to fall to $975-$1,025/oz. in 2022/23, before Phase II, which will lower AISC to $790-$820/oz. (2024).

- Aurizona: Open-pit waste stripping ($27m), tailings dam lift ($15m), exploration and underground FS ($4m). AISC in 2021: $1,075-$1,125. Costs to fall to $875-935/oz. in 2022/2023.

- RDM: Major pit expansion ($35m) and tailings dam lift and equipment ($8m). AISC in 2021: $1,175-$1,225/oz. Costs in 2022/23 are expected to fall to $930-$1,010/oz.

Approximately 85% of 2021 production will come from assets that will see a temporary increase in costs and fall from 2022 onward. This guidance excludes the contribution attributable to the Mercedes Mine in Mexico, which will start when the Premier acquisition closes, expected by late March. With hefty capital investment nearly across the board amongst its assets, 2021 is a pivotal year for the company as production is expected to increase substantially through 2025: 900k oz. Au in 2022, 1m oz. in 2023, and 1.25-1.35m oz. in 2024/25. Furthermore, it has a strong balance sheet with a large portion of the outstanding debt being in the money convertible notes, $400m in cash on hand, and roughly $250m in equity investments (26% interest in Solaris Resources and a 30% interest in I-80 gold). Value of I-80 based on listing price per share (C$2.50-$3.00/share). Equinox also has $200m available under its revolving credit facility.

Great Bear Resources: Reported drill results from its ongoing 2021 exploration program at its Dixie Project. Great Bear published detailed individual assay data from shallow drill holes on one cross-section at three different scales. The company has observed similar excellent gold zone continuity at 25m spacing through tighter drilling, both along strike and vertically, as previously observed at 100-200m spacing. By year-end, the company plans to complete 100 drill sections similar to the one in this release, consisting of over 400m drill holes in total. All this drilling is within the same continuous gold zone along more than 4km's of strike length, which remains open to extension in all directions. Highlights from this release include:

- 18.15m @ 13.38 g/t Au

- 16.50m @ 4.90 g/t Au

- 57m @ 4.25 g/t Au

Irving Resources: Announced drill results completed at Nanko target (one of two vein targets) at the Omui mine site, part of the Omu Gold project in Japan. All drill holes in 2020 encountered high grade-silver intercepts. Highlights include:

- 2.39m @ 5.22 g/t Au and 103.6 g/t Ag

- 2.99m @ 4.34 g/t Au and 26.8 g/t Ag

- 2m @ 3.98 g/t Au and 26.1 g/t Ag

- 1.87m @ 8.88 g/t Au and 93.1 g/t Ag

- 6.50m @ 4.37 g/t Ay and 24.4 g/t Ag

The system is open in all directions. Based on CSMAT anomalies, the company believes that the Nanko veins will connect with the extensive vein system encountered at the Honpi target approx. 600m to the northwest. The 2021 drill campaign will begin following the quarantine period for the drillers, which arrived several days ago.

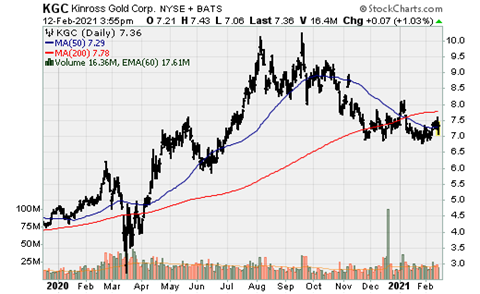

Kinross Gold: Reported Q4 2020 and full-year results and provided an update regarding its development projects pipeline. Q4 production totaled 624k AuEq oz. @ AISC of $1,013/oz. and full-year 2020 production totaled 2.366m AuEq oz @ AISC of $987/oz. The company generated operating cash flow of $527m in Q2 and 1.9b for the full year. Its three largest producing mines, Paracatu, Kupol, and Tasiast, accounted for 62% of production and were the lowest cost mines amongst its portfolio of operating assets. Tasiast delivered record production with further growth ahead as throughput is expected to increase to 21ktpd by year-end and eventually reach 24ktpd.

Kinross managed to increase its mineral reserves by 5.7m oz. net of 2020 depletion. The company's guidance is the same as 2020 at 2.4m oz. @ AISC of $1,025/oz. Production is expected to increase 20% to 2.9m AuEq oz in 2023 and produce an average of 2.5m AuEq oz. annually to 2029. The company provided the following update regarding its development projects;

- Tasiast 24k: Throughput expected to be 21ktpd by year-end and 24ktpd by mid-2023, increasing production.

- La Coipa (Restart): Pre-stripping started in early January, and first production is on pace for mid-2022. Kinross added 103k oz Au and 3.26m oz. Ag in reserves.

- Lobo-Marte: Feasibility study on track for completion in Q4.

- Fort Knox Gilmore: First gold ounces were produced from the new heap leach pad in January, and construction was completed on schedule and under budget.

With the increase in mineral reserves, Kinross extended the mine life at Kupol and Paracatu by one year to 2025 and 2032 and three years at Chirano to 2025.

Minaurum: Reported the final drill results from its Phase II drilling at its flagship project, Alamos Dorado. Drilling at the Europa-Guadalupe target outline a prospective southwest plunging silver shoot with the potential for additional high-grade mineralization to the north and south. Drilling at the Promontorio target, drilling returned high-grade mineralization more than 100m below historical workings. Highlights from this release include:

- 3.7m @ 528 g/t Ag, 0.8 g/t Au, 0.83% Cu, 2.43% Pb and 1.47% Zn. (Promontorio)

- 4.0m @ 161 g/t Ag, 0.5 g/t Au, 0.24% Cu, 2.15% Pb and 5.92% Zn. (Promontorio)

- 3.85m @ 342 g/t Ag, 0.76% Cu and 1.03% Zn. (Europa-Guadalupe)

- 3.25m @ 196 g/t Ag, 0.26% Cu, 0.35% Pb and 1.10% Zn. (Europa-Guadalupe)

- 4.45m @ 314 g/t Ag, 0.27% Cu, 0.19% Pb and 0.20% Zn. (San Jose)

- 2.15m @ 460 g/t Au, 0.15% Cu, 0.47% Pb and 0.85% Zn. (San Jose)

- 4.40m @ 210 g/t Ag, 0.59% Cu, 1.28% Pb and 1.30% Zn. (Travesia)

New Found Gold: One of Canada's most exciting exploration companies announced recently received assay results from drilling at the Keats zone at its Queensway project in Newfoundland. This is part of its large ongoing 200m diamond drill program. Highlights from this release include:

- 10.3m @ 25 g/t Au

- 5.8m @ 19.8 g/t Au

- 7.3m @ 19.3 g/t Au

- 13.8m @ 28.4 g/t Au

- 3.3m @ 20.6 g/t Au

- 32.3m @ 6.18 g/t Au

Mineralization at Keats is open in all directions. Drilling to date has outlined approx. 115m of strike length of thick, high-grade zone of gold. Drilling has outlined a near-surface, high-grade zone with significant size potential.

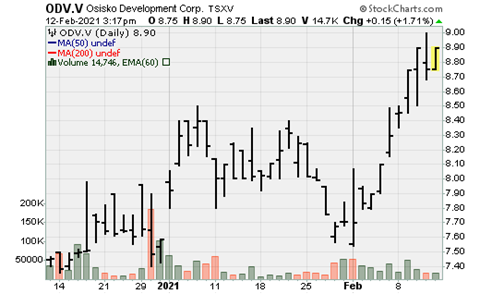

Osisko Development: Announced the expansion of Prospering discovery to 1.5km strike length. The system in open in all directions and highlights from this release include:

- 2.30m @ 6.81 g/t Au

- 1.7m @ 8.06 g/t Au

- 0.65m @ 25.30 g/t Au

- 0.50m @ 16.40 g/t Au

- 0.50m @ 14.20 g/t Au

- 9m @ 7.96 g/t Au

The Proserpine area is 6km along trend from the Cariboo deposits, and minimal drill testing has occurred along the trend to date. It is becoming increasingly clear the potential scale of the mineralized trend on the Cariboo mining camp is significant. The project currently has M&I resources of 3.2m oz. Au @ 4.6 g/t and Inferred resources of 2.7m oz. @ 3.9 g/t.

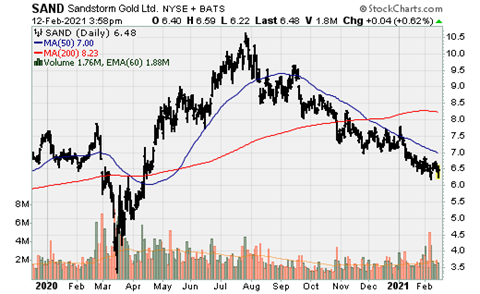

Sandstorm Gold: Released Q4 and full-year 2020 production and financial results. Q4 production totaled 15.8k AuEq oz. and the company generated record quarterly operating cash flow of $22.5m. For the full year 2020, attributable production totaled 52.17k AuEq oz. and the company generated record annual operating cash flow of $68.3m (FY 2019 - $60.7m). At quarter-end, Sandstorm had over $110m in cash and $60m in equity and debt investments. Sandstorm has ample capacity to complete more deals with total liquidity of almost $400m. Production in 2021 is forecast at 52-62k AuEq oz. Relief Canyon and Fruta Del-Norte will be the company’s primary growth drivers in 2021.

Wesdome Gold Mines: Published additional results from underground definition drilling and exploration at its Kiena Mine complex. In 2020, underground drilling was focused on definition drilling of the A zone, which upgraded a large portion of inferred resources to the indicated category. Drilling has returned to expansion drilling in the A zone, VC zone, and other targets within the mine area. Highlights from recent A zone drilling include:

- 5m @ 46.8 g/t Au (A2 zone).

- 15m @ 14.6 g/t Au (A1 zone).

- 6.0m @ 8.4 g/t Au (A2 zone)

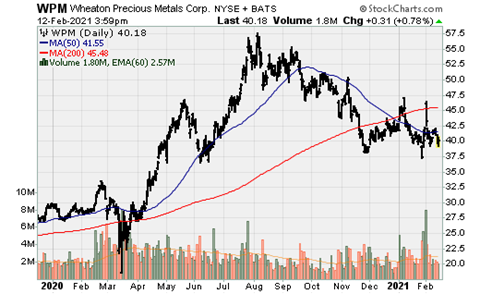

Wheaton Precious Metals: Reported attributable gold equivalent production of 672k oz. in 2020, consisting of 368k oz. Au, 22.9m oz. Ag and 22.18k oz. Pd. Wheaton has numerous assets that will fuel near-term organic growth and several assets that provide the company excellent optionality. 2021 guidance is for 370-400k oz. Au, 22.5-24m oz. Ag and 40-45k AuEq oz. from Pd and Co for total AuEq production of 720-780k oz. Gold production growth will be fueled by Salobo (from 2023). San Dimas and Constancia and silver production growth will be driven by Cozamin and Keno Hill, partially offset by a decrease at Penasquito due to expected mine sequencing. Wheaton also provided 5yr and 10yr average annual gold equivalent production of 810k oz. and 830k oz. This will likely prove conservative as the gold-to-silver ratio generally contracts as a bull market progress.

Wheaton's 10yr forecast includes Rosemont while its 5yr guidance doesn't. However, it is very likely one or multiple assets excluded from both projections do reach production. These could include Toroparu, Cotabambas, Kutcho, Navidad, and/or Pascua-Lama. Wheaton has a right of first refusal on the massive Metates project and Bear Creek's Corani project. Wheaton and Capstone also made it known they were in discussions for Wheaton to provide gold stream financing on the company's Santa Domingo project.

Yamana Gold: Reported Q4 and full-year 2020 results. Q4 production totaled 255k AuEq oz. and 901.15k AuEq oz. for the full year 2020 @ AISC of $1,076/oz. and $1,080/oz. Operating and free cash flow in Q4 was $207m and $61.7m. Yamana and Agnico released robust results for the Odyssey underground project at Canadian Malartic, approved by the BOD. This will be highly accretive for Yamana and Agnico and Osisko Gold Royalties as Canadian Malartic is its anchor asset. Furthermore, there remains significant exploration upside and optimization potential to increase annual production and increase the mine life well beyond 2039.