This was another week full of production results from gold and silver producers. This is far and away the most companies I’ve ever seen reporting quarterly production numbers instead of waiting until earnings. Again, this is likely because investors who know production numbers ahead of earnings could lead to buying earlier, pushing up stock prices. Other than some companies making construction decisions, reporting exploration results, there wasn’t much news outside of the release of production numbers as well as little economic development taking place. This is likely to remain the case until the election are over.

Visit GoldSeeker.com & Sign-Up for The Free Email List and Receive Free Reports on a Wide Range of Topics including valuation, company news, among other content.

$AR.TO, $BTG, $DSV.V, $EGO, $EQX $AG, $FSM, $GORO, $GCM.TO, $JAG.TO, $KNT.V, $KL, $LUG.TO, $NGD, $NRG.V, $OR, $PG.TO, $SVM, $ELEF.TO, $VGCX.TO, $WDO.TO

Argonaut Gold: Announced that the Board of Directors has approved the construction of the Company’s 100% owned Magino gold project in Ontario, Canada. Argonaut received a fixed bid pricing proposal for a significant portion of the initial capital requirement for the Magino project and that it has secured debt financing of up to $175m by way of a $50m bought deal offering of senior unsecured convertible debentures and the extension and expansion of its existing revolving credit facility up to 125m. At quarter end, the company had cash balance of $178m. It has also received $30m from the Sale of Ana Paula (which I don’t believe they received adequate compensation nor think it was wise to divest the high-grade, low-cost development project). Further, the company is expected to generate operating cash flow of $142m through 2020 (using a $1,600/oz. gold price). In short, the company is adequately financed for the mine build which is estimated to require capital investment of $360-$380m. Magino is a game-changer for the company, not only regarding a significant increase in production and free cash flow but its cost of capital improve by having a flagship asset in Canada.

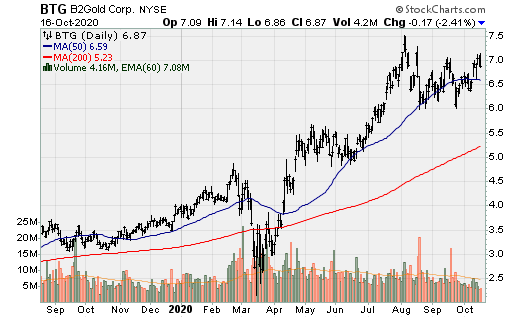

B2Gold: Another great outperformance by the company, setting records for quarterly production, revenue and in all likelihood, cash flow generation. Q3 production totaled 248.73k oz. Au from its operating mines (and 263.8k oz. Au including attributable production from Calibre Mining, of which it holds a 34% interest). Revenue totaled $487m for the quarter, a 57% increase over Q3 2019. The company also announced a 100% increase in its quarterly dividend to $0.04/share. During the quarter, the company also successfully commissioned the Fekola mill expansion to 7.5mtpa, a 25% increase but it has the potential to run above that throughput rate, with an internal analysis underway to determine the optimum rate. B2Gold is now debt free (except for mining equipment loans and leases totaling roughly $50m). Subsequent to quarter end, Calibre repaid the $10m owed to B2Gold as part of the acquisition of its Nicaraguan assets as well as a $5.5m working capital adjustment.

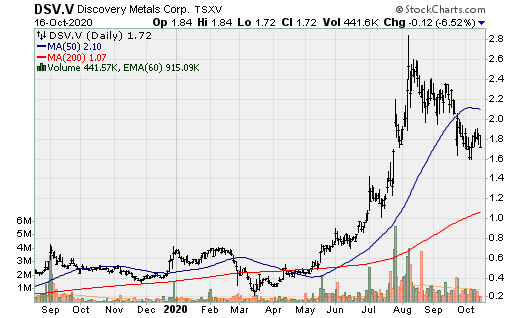

Discovery Metals: The company reported more high-grade intercepts at its flagship Cordero project and extended the strike length of the Todos Santos vein (which now has a minimum strike length of 1.5km’s). Highlights include:

- 3.4m @ 412 g/t Ag, 0.42 g/t Au, 8% Pb and 10% Zn

- 2.0m @ 532 g/t Ag, 0.38 g/t Au, 6.30% Pb and 9.2% Zn

- 3.30m @ 152 g/t Ag, 0.71% g/t Au, 2.20% Pb and 6.9% Zn

- 1m @ 433 g/t Ag, 0.23 g/t Au, 9.30% Pb and 22.90% Zn

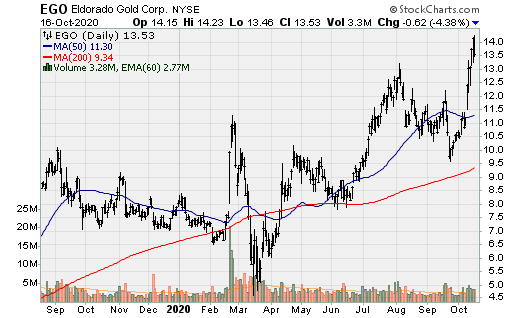

El-Dorado Gold: Produced 136.7k oz. Au during the quarter and this was a 35% increase over the comparable period in 2019. This was driven by higher output at Kisladag (+66%), Lamaque (+23%), and Olympias (+75%).

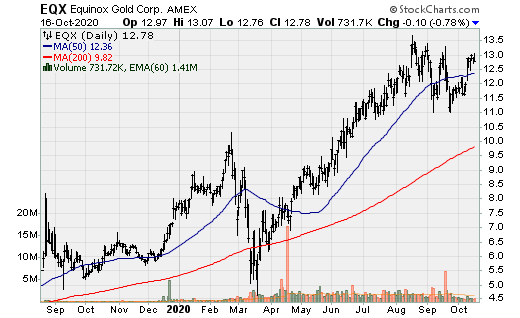

Equinox Gold: The company announced it achieved its first gold pour from its Castle Mountain mine, which will become a cornerstone asset for the company once Phase II is complete. The illegal blockade at Los Filos continues, which is sure to impact both Q2 and Q3 production. However, the beauty of having someone like Ross Beaty and Equinox’s excellent management team is that they have dealt with these types of things many times in the past.

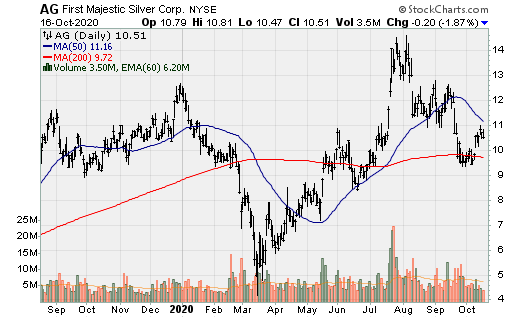

First Majestic Silver: Announced Q3 production results which totaled 3.2m oz. Ag and 23.77k oz. Au. It is worth noting that La Encantada produced 978k oz. Ag, the second highest quarterly production since 2014. It is also worth noting that San Dimas produced 1.68m oz. Ag, the highest quarterly silver production since it acquired the asset in May 2018. The company has several growth projects including bringing La Parilla and San Martin back on-line in the not too distance future and possibly La Guitarra. It also has the Ermitano project at Santa Elena. Aside from the tax overhand, $AG remains a must-own company for those wanting significant leverage to the silver price.

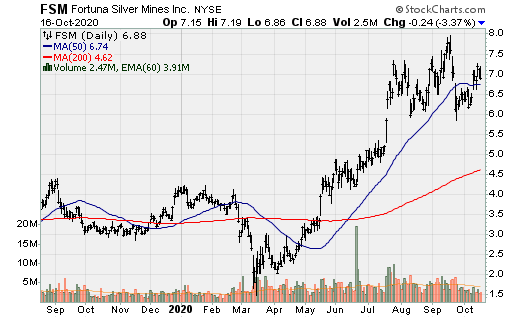

Fortuna Silver: Q3 production totaled 2.1m oz. Ag and 12.8k oz. Au, bringing YTD production to 5.2m oz. Ag and 30k oz. Au. Q3 silver production increased 10% over Q3 2019 and gold production increased 12% over the same time period. After many delays and capital cost over-runs, Fortuna placed 675k tons of ore on the leach pad at Lindero, which will see production in Q4 and continue to ramp-up thereafter. After a weak Q1, San Jose had a strong showing in Q3, producing 1.918m oz. Ag and 11.43k oz. Au.

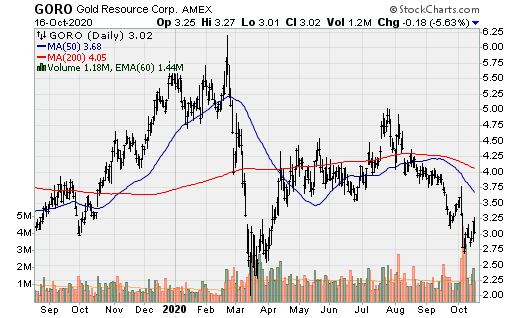

Gold Resource Corp: Reported record Nevada gold production results in Q3, which contributed to consolidated production of 12,575 gold ounces, 333,761 silver ounces and significant base metals. Nevada gold production increased by 51% as the production ramp up phase continues. Q3 production from the Company’s Nevada Mining Unit (NMU) totaled 7,847 gold ounces, a 51% increase over the prior quarter. Q3 was the first full quarter that the Company was able to regularly access portions of the deposits higher-grade Pearl zone, while also mining the deposit’s lower grade Isabella zone. The Pearl zone is estimated to contain 80% of the gold ounces at the Isabella Pearl deposit with an estimated average gold grade of 4.0 g/t. Gold Resource Corporation remains on track with ramp up into the fourth quarter, positioning the Company to achieve its annual production target of 40,000 gold ounces in 2021. Q3 production from the Company’s Oaxaca Mining Unit (OMU) totaled 4.73k oz. Au, 324.6k oz. Ag, 428 tons Cu, 2.16k tons Pb and 5.54 tons Zn.

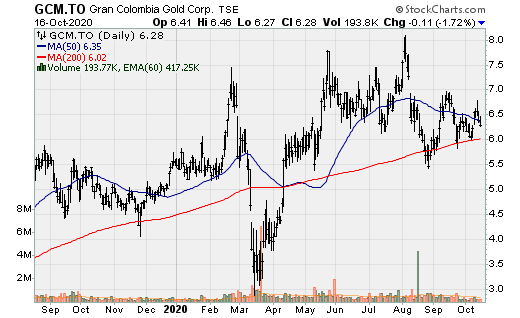

Gran Colombia: The company produced 58.54k oz. Au in Q3, a 4% increase over Q3 2019 and a 21% increase over Q2 2020. YTD production now stands at 162.93k oz. Au. This was lower relative to the first 9 months of 2019 (174.75k oz. Au) as a result of operations being adversely impacted by CV19.

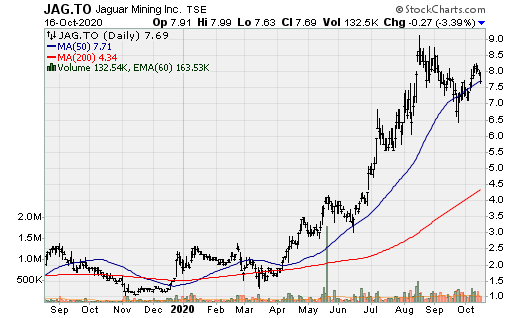

Jaguar Mining: Jaguar continues to makes progress towards its goal of sustainable production of 25k oz. Au per quarter, producing 24.093 oz. Au in Q3 2020, a 25% increase over the comparable period in 2019. The Turmalina mine saw its highest production in three years. Pilar gold production set a new record and saw 25% production growth over the comparable period in 2019. Jaguar’s cash position increased $9m during the quarter but that company also paid a $4.4m dividend, purchased $500k worth of common stock and paid down $0.6m of bank debt, so we can assume it otherwise generated cash flow around $14.5m.

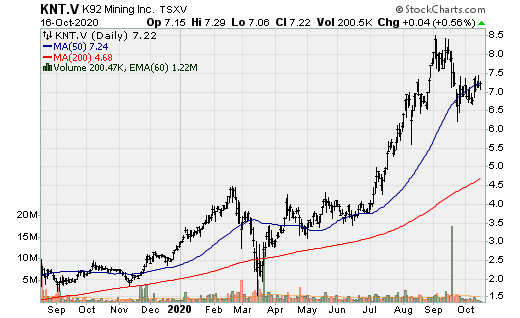

K92 Mining: The company continues to impress. Q3 production was 21.3k oz. Au, 7.1k oz. Ag, and 488k lbs. Cu for AuEq production of 22.26k oz. AuEq. K92 successfully completed commissioning of stage II process plant, doubling throughput capacity from 200ktpa to 400ktpa. The mill demonstrated capacity above the design of 1.1ktpd, including 5 days averaging 1.2ktpd. When the company undertakes the Phase III expansion and completes it, production will jump very significantly.

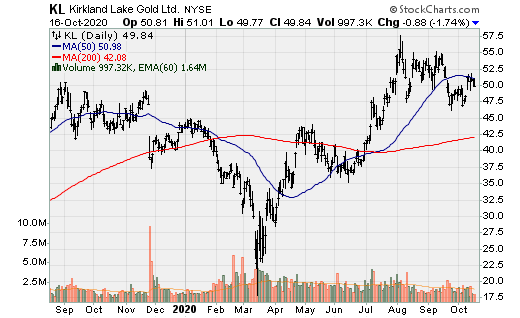

Kirkland Lake Gold: The company announced production results for the third quarter and first nine months of 2020. Q3 2020 production totaled 339,584 ounces, an increase of 91,184 ounces or 37% from 248,400 ounces for the third quarter of 2019. For YTD 2020, the Company produced 1,000,218 ounces, 305,345 ounces or 44% higher than the first nine months of 2019. While production was a bit lower than expected, it was a strong quarter nonetheless as seen through 58% increase in its cash position to $848m. Lower output can be attributed to Macassa as there was limited development earlier in the year, caused by CV19 protocols. Detour Lake production also fell a bit short. This was partially negated by another quarter of outperformance at Fosterville of 161.5k oz. Au (645k oz. annualized).

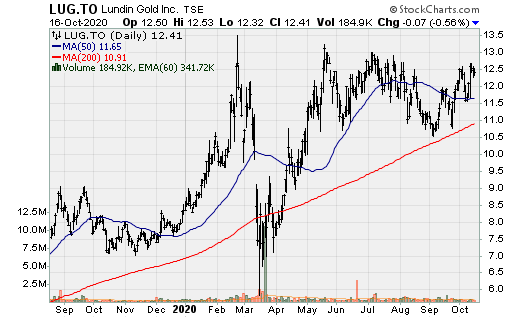

Lundin Gold: The company had a very robust Q3, production wise. Q3 was the first full quarter of operations where production totaled 94.25k oz. @ 10.4 g/t Au. This likely means Lundin generated very robust cash flow.

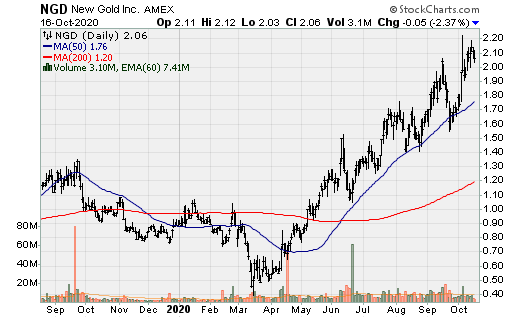

New Gold: There isn’t much to say here. We’ve watched New Gold sell-off quality assets like it was Michael Jackson and production continues to contract. Its Rainy River operations improved; however, it is unlikely it will achieve feasibility levels related to costs but maybe it will surprise. During the quarter, the company also sold an interest [now holding just a 54% interest] in its very low-cost New Afton mine and sold the massive Blackwater project [for less than it acquired it for], which should have been the future of the company. These follow the sale of the Mesquite mine [8-month before the gold price broke out of the heavy $1,350/oz. resistance level] to Equinox Gold for a song last year. Q3 production totaled 115k AuEq (79k oz. Au, 171k oz. Ag, and 18.2m lbs. Cu). This should serve as a good example for investors to avoid over-leveraged companies as it was essentially forced to sell many of its assets.

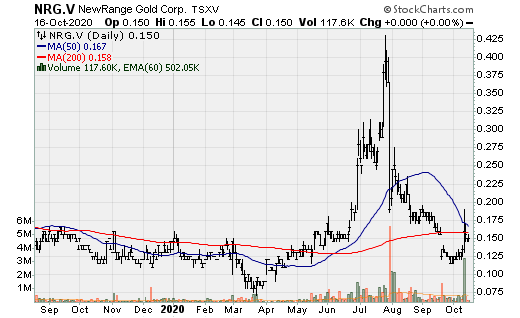

Newrange Gold Corp: the company announced hole P20-82 in the Merritt zone of the Pamlico project intersected near surface gold oxide mineralization of 9.15m @ 14.85 g/t Au, within a larger interval of 32m @ 4.74 g/t Au.

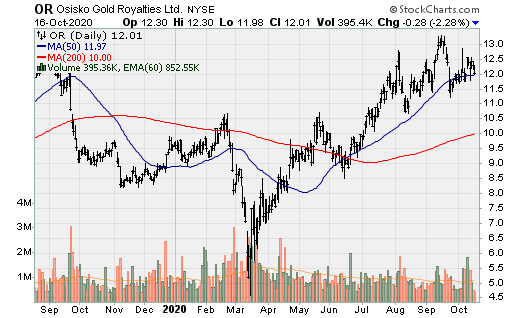

Osisko Gold Royalties: The company exercised its right to acquire a second 1% NSR (2% total) royalty on Sable Resources high-grade EL Fierro project in San Juan, Argentina in exchange for $5.5m. Osisko Gold Royalties over the last 12 months+ has many several high-return acquisitions or other value adding moves (such as a near-term spinning-off the Cariboo Project into Osisko Development, while retaining an 88% interest in the company, retaining a 5% NSR on Cariboo, and a 15% precious metals stream on the San Antonio gold-silver project), acquiring the remaining 15% of a portfolio is bought together with another company, which served to increase its royalty interests on number of mines, notably Lamaque and Island Gold. Both operations are undergoing expansion, with production from Island Gold to drastically increase once complete. It also increased its royalty interest in the large, high-grade Windfall project.

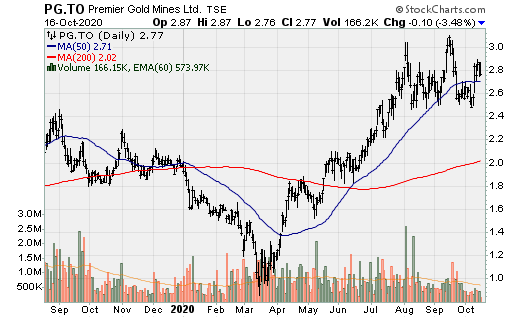

Premier Gold Mines: Q3 production was slightly in excess of 19k oz. Au. The Mercedes mine exceeded the new operating plan, producing 12.18k oz. Au, while South Arturo already exceeding the annual plan, producing almost 7.1k oz. Au. During the quarter there were very nice drill results from El Nino underground at South Arturo, including: 39.6m @ 17.11 g/t Au (including 21.3m @ 24.75 g/t Au), 100.6m @ 5.73 g/t Au. The operator, Barrick Gold, is in the final stages of completing a pre-feasibility study for South Arturo for the phase I and phase 3 open-pit projects, and are accessing the potential for an on-site heap leach facility.

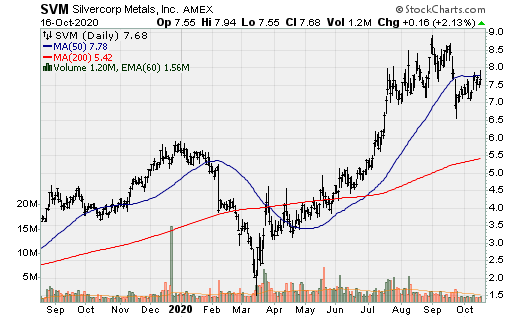

Silvercorp Metals: Reported production numbers for Q2 of its FY 2021 (ended September, 30). The company produced 1.7m oz. Ag, 1.1k oz. Au, 19.1m lbs. Pb, and 7.1m lbs. Zn. The company remains on track to produce 6.2-6.5m oz. Ag for its FY 2021. The company continues its successful exploration efforts at its Ying Mining Camp. Silvercorp would likely have a higher valuation if it acquired some growth assets and diversified out of China. While the valuation doesn’t look overly cheap, remember it has a significant interest in New Pacific Metals, which had created a lot of value for Silvercorp Metals.

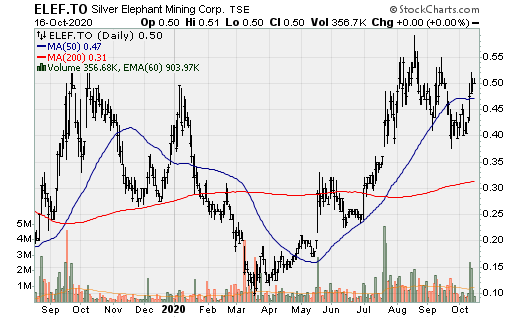

Silver Elephant: The company reported a mineral resource estimate for its Pulacayo Ag-Pb-Zn project in Bolivia. The resource consists of 106.7m oz. Ag, 1.38b lbs. Zn, 694m lbs. Pb (Indicated) and 13.1m oz. Ag, 123m lbs. Zn and 62m lbs. Pb (Inferred). The Paca deposit has a resource totaling 37m oz. Ag, 485m lbs. Zn, 43.7 Pb (Indicated) and 6m oz. Ag, 51.1m lbs. Zn and 43.7m lbs. Pb (Inferred). Along with New Pacific Metals, Silver Elephant is one of the first movers into this incredibly mineral rich country that is now encouraging foreign investment in the mining sector.

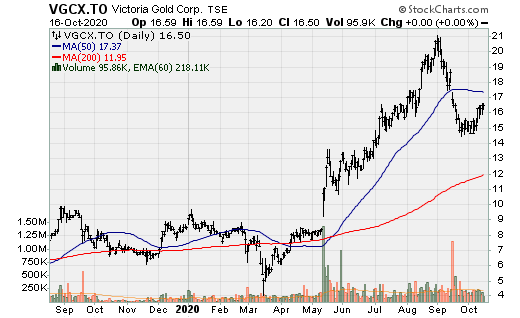

Victoria Gold: The newest Canadian mine to achieve commercial production produced 35.3k oz. Au, generating C$80m of revenue given the average realized gold price was $1,886/oz. Given the CV19 protocols, it is more difficult to ramp up throughout to design levels, but this was a big increase over Q2 and it should achieve full scale production (run-rate of 50-55k oz. Au per quarter in Q4 2020, if not Q1 2021).

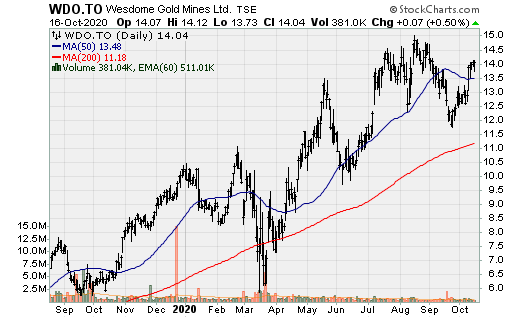

Wesdome: Q3 production totaled 20k oz. Au, bringing YTD production to 70.27k oz. This leaves the company well positioned to achieve is full year guidance of 90-100k oz. Au. The Eagle River mine accounted for 19.32k oz. of this, although it was a 33% decrease relative to the comparable period in 2019. This was lower due to annual planned mill maintenance in August, and the upgrade of the hoist control system impacting productivity. While companywide production was significantly lower relative to Q3 2019, this was largely negated by a 29% increase in the average realized gold price, assuming costs are similar. The company has an excellent high-grade development project in Kiena, with plenty of upside, the company is quite expensive, having a market capitalization of US$1.47B (C$1.92B).