This was a very volatile week for precious metals and related mining equities. On Monday, gold sold off $100/oz. on the rumor, there might be a successful vaccine for CV19. But this won’t impact gold as the bull market commenced well before the outbreak of CV19. Even if it does work, the vaccine is far from preventing CV19 as it is improbable someone would voluntarily be a guinea pig without knowing the side effects both short and long-term. There are also significant distribution issues. Even in the best-case scenario, the economy will remain at least partially shut down for the foreseeable future. It is still very likely multiple rounds of additional fiscal stimulus will be administered.

We cover most of the company's in this issue at Gold Seeker. We have published company reports for multiple companies mentioned herein. To view the in-depth analysis and valuation, sign up for your free 30-day trial @ Goldseeker.com or sign up for our free email list.

$USAS, $CXB.TO, $EQX, $FSM, $GCM.TO, $GBR.V, $MMX, $HL, $OR, $ROXG.TO, $SSRM, $TGZ.TO, $VGCX.TO, $WPM

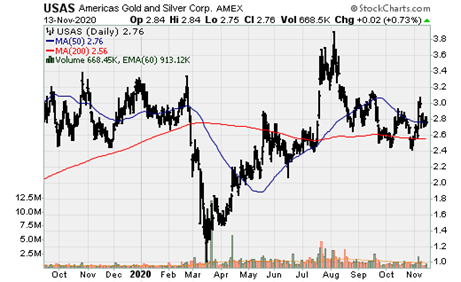

America’s Gold and Silver: Q3 and Q4 are transitional quarters for the company, with its flagship asset, Relief Canyon, on track to achieve commercial production in Q4. The Galena complex recapitalization plan is coming together with an increase in M&I and Inferred resources of 36% and 100% to 37.3m oz. Ag and 78.6m oz. Ag, which is based on just 33% of Phase I planned drilling. The advancement of these two assets is setting up for a strong 2021, assuming Relief Canyon can achieve feasibility levels of production and costs while operations at Galena should be robust and improve every year over the next several years.

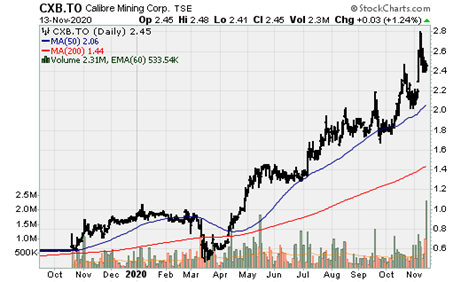

Calibre Mining: One of our favorite junior producers continues to release excellent news flow. Following an excellent quarter, the company published Infill and near-mind drill results. Highlights include:

- 3.9m @ 13.73 g/t Au (Panteon Underground)

- 6.8m @ 28.41 g/t Au (Panteon Underground)

- 4m @ 62.6 g/t Au (Panteon Underground)

- 8.6m @ 4.86 g/t Au (Panteon Underground)

- 12.2m @ 16.97 g/t Au (Limon South Open Pit)

- 1.2m @ 20.7 g/t Au (Limon South Open Pit)

- 2.9m @ 10.3 g/t Au (Limon Central Open Pit)

- 23.6m @ 11.89 g/t Au (Limon Central Open Pit)

- 12.9m @ 5.09 g/t Au (Limon North Open Pit ~ Tigra/Chapparal)

- 10.1m @ 5.28 g/t Au (Limon North Open Pit ~ Tigra/Chapparal)

- 5.6m @ 8.8 g/t Au (Jabali West Underground)

- 7.6m @ 6.3 g/t Au (Jabali West Underground)

- 3.7m @ 8.19 g/t Au (Panteon Underground)

- 14.3m @ 2.34 g/t Au (Rosario Gold Prospect ~ Libertad)

- 5.1m @ 7.96 g/t Au (Rosario Gold Prospect ~ Libertad)

- 1.5m @ 17.26 g/t Au (Nancite Gold Prospect ~ Libertad)

Equinox Gold: The company delivered record results across the board despite Los Filos ramping up in the first two months of the quarter with no production in September. I’ve talked to the company a couple of times recently, and they are meeting with the local community responsible for the illegal mine blockade, and progress is being made. The company made it clear it was looking for a long-term solution, so this won't happen again in the future. I did get the feeling that Equinox believes this will be resolved either this quarter or Q1 2021 at the latest.

The company announced it had started construction at Santa Luz, which has a short buildout period of 8-11 months and is expected to reach production in Q3/Q4 2021. This will add 100k oz. Au p.a. of low-cost production as well as a likely underground component in the future. Like Aurizona, a PEA for Santa Luz has been published. Equinox is also ramping up production at Castle Mountain Phase I, advancing the Aurizona U/G to PFS in Q2 2021, and actively looking for acquisitions that make sense.

Regarding Q3 operational and financial results, the company sold 128k oz. Au, generating $90m and $76m in operating and free cash flow. Due in part to the Los Filos suspension, cash costs, and AISC of $866/oz. and $1,035/oz. The company remains extremely well-funded with $311m in cash and $543m in total debt; however, $254m of that are in the money convertible notes, which will undoubtedly be converted to common stock.

Fortuna Silver: The company saw a big increase in operating and free cash flow due to higher silver prices in Q3. Lindero achieved its first gold pour in October and is on track to achieve commercial production in Q1 2021. Fortuna produced 2.13m oz. Ag ad 12.8k oz. Au in Q3, a significant increase over Q2 as its mines were fully ramped up after the Q2 suspension of mining at San Jose. On sales of $83.4m, the company generated operating and free cash flow of $45.5m and $30.1m. Fortuna remains very liquid if Lindero is delayed yet again, as it has been countless times over the past 3+ years, with Fortuna having $140m in available liquidity + on-going cash flow generation. Lindero is unlikely to be delayed again as it has achieved initial production in Q4, barring any mandated suspension of mining activities.

Gran Colombia: Q3 production totaled 58.45k oz. Au as operations normalized, a 21% increase over Q2. The company wasn't forced to suspend mining operations, but the CV-19 national quarantine adversely impacted them. The company generated record revenue, operating and free cash flow during the quarter, which has allowed it to increase its dividend from $0.015/share per quarter to the same amount paid monthly (3% dividend yield on an annualized basis, amongst the highest in the industry).

Cash costs and AISC remained elevated at $796/oz. (vs. $684/oz. in Q3 2019) and $1,122/oz. (vs. $951/oz. in Q3 2019). Operating and free cash flow was $67.7m (vs. $30.6m in Q3 2019) and $53.4m (vs. $19.6m in Q3 2019). The company's balance sheet continues to strengthen with cash of $138.2m (inclusive of $43m in Caldas Gold, of which $34.7m represents the net proceeds of Caldas Gold's special warrant financing), so the company's actual cash position stands at $103.50m. The principle amount of gold notes outstanding (which was a bad idea as the gold price has increased drastically) stands at $35.5m. Fitch upgraded the company from B to a B+.

Great Bear Resources: Reported the first gold recovery test results from its 100% owned flagship Dixie Project. Hinge zone high-grade gold samples with an average grade of 13 g/t Au recovered between 95.4-97.2% of the head grade gold from conventional cyanide 48-hour bottle roll leach tests. This was largely expected as free gold dominates the hinge zone and all zones at Dixie. Great Bear will periodically release recovery results from representative samples originating from all gold zones over the coming months. The company will also begin gravity circuit recovery tests in 2021.

Hecla Mining: The company posted a solid quarter from an operational and financial point of view, although costs at Casa Berardi were extremely elevated ($1,855/oz.) due to longer than planned downtime of major mill maintenance activities, along with lower grade ore because of a delay in the availability of higher-grade underground stopes from ground condition issues. These will no longer be an issue in Q4, and the company should see materially higher cash flow.

Silver and gold production totaled 3.5m oz. and 41.17k oz. Hecla generated operating and free cash flow of $73.4m and $49.7m. The company ended the quarter with $98.7m in cash and $348.7m of total liquidity. Hecla also increased its dividend by 50% and approved the payment of the first silver-linked dividend. Greens Creek continued its outperformance, and the ramp-up at Lucky Friday is ahead of schedule. Production will cease at San Sebastian at year-end. The resulting drop In silver production will be partially and eventually completed negated and more as Lucky Friday ramps up production from over 3m oz. Ag in 2021 to upwards of 5m oz. Ag in 2025.

Maverix Metals: Like most producing royalty and streaming company's, the company announced record Q3 results. Maverix sold a record 7.8k oz. AuEq during the quarter, generating $10.84m in operating cash flow. Maverix also announced the acquisition of 11 gold royalties from Newmont Mining for $75m and a potential future contingency payment of up to $15m and repaid $41m of the outstanding balance on the company's revolving credit facility. The Newmont portfolio acquisition added some nice royalties with near- and medium-term growth, including but not confined to:

- 2.0% NSR royalty on Camino Rojo (under construction; production expected in 2021)

- 1.0% NSR royalty on Cerro Blanco (construction to commence in 2021)

- 1.0-2.0% NSR on the Mother Lode Project (development stage)

- 1.0% NSR royalty on Imperial (development)

- 2.0% NSR royalty on Ana Paula (development)

Osisko Gold Royalties: The company generated $31.7m in operating cash flow on attributable AuEq production of 16.74k oz. Q4 attributable should be a bit higher as the Eagle mine continues ramping up production. But the real story is its 5yr growth profile, which is unrivaled amongst its peer group. There were several key developments in Q3/Q4 that will be instrumental in this growth. The company announced the transfer of mining assets and select equity interests via a reverse takeover and creating a North American gold development company, Osisko Gold Development. Osisko GR will own an 88% interest in the company and retain a 5% NSR on Cariboo/Bonanza Ledge II and a 15% precious metal stream on the San Antonio project. Bonanza ledge II will start production very early in Q1, and San Antonio is expected to reach production in Q3 2021. On an annualized basis, these two assets will increase attributable production by 11.25-12k oz. Au. Combined with a full year of production fully ramped up from the Eagle mine, these assets will increase attributable production by 19k oz. Au (and at least 13k oz. Au just in 2021). To put Osisko's 5-year organic growth profile into perspective, it has a CAGR of 17-18.50%. We at Gold Seeker just published a full company report. To view the in-depth analysis and valuation, sign up for your free 30-day trial @ Goldseeker.com.

Roxgold: Produced 33.56k oz. Au in Q3 @ 7.7 g/t Au, bringing YTD total to 98.75k oz. The company generated operations cash flow of $28.2m. Cash costs and AISC was $735/oz. and $1,095/oz. AISC was $104/oz higher due to CV19 and the timing of gold shipments. Yaramoko continued to operate with reduced personnel due to travel restrictions and other CV19 protocols. While throughput levels were maintained, mill feed was supplemented with lower-grade stockpiled ore of 3.1 g/t, which increased costs (+$49/oz.). The real story from now on is Seguela, one of its two development projects. Once in production (construction start in 2021/2022), this high-grade deposit will drastically increase production (>100%) and lower companywide AISC. Like many other West African producers, Roxgold is trading with a big discount to NAV.

SSR Mining: The company announced Q3 operational and financial results, the first following the transformational acquisition with Alacer Gold, though the full impact of its Copler mine won’t be realized until Q4. With operations now in 4 countries (Argentina, Canada, U.S., and Turkey), the company has several development projects, notably its massive Pitarrilla silver project in Mexico and its small albeit exceptionally high-return project in Peru, which would give it exposure to 6 different countries.

Q3 was essentially a transition quarter for the company, with Seabee ramping back up to capacity and a partial quarter contribution from what is now its most valuable asset, Copler.

In Q3, the company produced 89k oz. Au and 1.28m oz. Ag and sold 99.5k oz. Au and 1.19m oz. Ag or 106.9k oz. AuEq and 115k oz. AuEq. Cash costs and AISC (per AuEq oz.) were of $735/oz. and $1,034/oz. Net of the transaction costs associated with the Alacer merger, operating cash flow was $75m. This should see a significant increase in Q4 as Copler contributes a full quarter of low-cost production, production returns to normal at Seabee, and costs fall approx. $200/oz.

The Copler mine produced 19.6k oz. Au for SSR Mining while full quarter production was 77k oz. Au. Cash costs and AISC was $609/oz. and $737/oz. Marigold produced 49.1k oz. Au with cash costs and AISC of $899/oz. and $1,243/oz. and has become a very high-cost mine for the company, at least in 2020. Seabee produced 20.25k oz. Au, a 37% decrease relative to the 2019 comparable period as the mine was ramping up production in July and August. This was further augmented by an 18% decrease in mill feed grade vs. Q3 2019. Cash cost and AISC were $538/oz. and $988/oz., 44%, and 38% increase vs. Q3 2019. Lastly, Puna produced 1.28m oz. Ag with cash costs and AISC of $9.33/oz. and $11.26/oz. Note: SSR acquired the remaining JV interest in Puna from Golden Arrow (GRG: TSXV, GARWF: OTC) at bargain-basement prices, so it would be wise to stay away from that company as it clearly destroyed significant shareholder value.

The company ended the quarter with $746m in cash and marketable securities and $405m in debt. If it should decide to pursue additional M&A, it won’t solely to use equity as the company could use its large cash position and ability to obtain a much larger revolver to minimize dilution. SSR has become a larger mid-tier producer.

Teranga Gold: The West African producer has successfully launched itself into mid-tier status as it started integrating and mining the Massawa mine. In 2021-2025, companywide production will average >500k oz. p.a. at attractive costs. Q3 production and financial results were solid as gold output increased 69% to 104.77k oz. Au and a 71% increase in operating cash flow to $75.6m and free cash flow generation of $37.2m. Cash costs and AISC was $736/oz. and $962/oz., which should fall in 2021.

Teranga and Endeavour Mining both confirmed they were in merger talks. A tie-up between these two companies would create a West-African focused power-house produce with production >1.5m oz. Au. There is no guarantee Endeavour will make a bid for Teranga. Still, it would create and unlock value for both sets of shareholders as Endeavour would be large enough to attract institutional investors and larger funds.

Victoria Gold: The company posted a disappointing quarter; however, it was unexpected as it ramps up to design capacity and achieves an annual run-rate of 210K+ oz. Au p.a., which will be achieved in late Q4, if not Q1 2021. Victoria produced 35k oz. Au and sold 32k oz. Au in Q3 with cash costs and AISC of $804/oz. and $1,315/oz. The stock was punished on the news to the tune of 10-11%. Looking a bit deeper into the quarter, it is clear why cash costs and AISC were elevated. This was a result of a strip ratio of more than 2x normal. Total ore mined was lower than forecast due to bottlenecks being resolved within the processing circuit. This allowed the mine to utilize available resources to advance waste stripping to ease future ore release requirements. There were several optimization activities in Q3, some of which were completed. Sustaining capital costs were also higher in Q3 (which explains the significant discrepancy between cash costs and AISC). Costs will come down in Q4, though feasibility levels won't be achieved until 2021. AISC in Q4 is likely to be $1,100/oz +/- $50/oz.

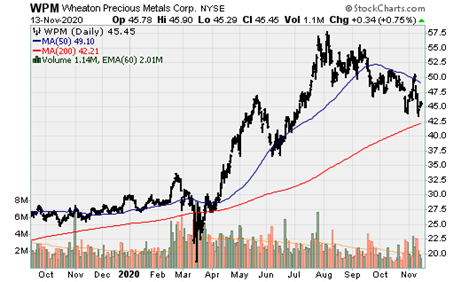

Wheaton Precious Metals; The largest royalty and streaming company by profitability (free cash flow), announced record revenue and cash flow in Q3 and the first 9 months of 2020. WPM generated over $228m in operating cash flow, a 60% increase vs. Q3 2019. Attributable AuEq production was 171.37k oz., a slight reduction relative to Q3 2019 due to the mining of lower-grade material at Salobo, and sales totaled 157.48k oz. Q4 should be more robust as Salobo gets back on track and silver produced but not yet delivered from Penasquito likely decreases.

Wheaton Precious has numerous growth assets over the next several years, including Keno Hill (production to start in late Q4), Voisey's Bay (stream begins at the start of 2021), Salobo III (expansion on track for completion in 1H 2022), Marmato (production will start in 2H 2023/1H 2024), Constancia (mining at Pampacancha likely to begin 1H 2021, increasing gold production by approx. 15-20k oz. Au). There is always a chance of construction commencing at Rosemont and/or Toroparu in 2021/2022. Lastly, on the Q3 conference call, the company said the project pipeline is full, which wasn't the case last quarter as conducting proper due diligence wasn't possible.