The Precious Metals remain weak, which looks likes it will continue through at least part of December. There is technical weakness in the gold chart, as well as silver to a lesser degree. On Friday, a shortened trading day, the banks smacked the gold price on a day of light volume, but the mining stocks finished flat to marginally higher. While this is a good sign (as the mining stocks often lead the metals), we need to see a continuation of this type of price action for several days on strong volume.

There bargain in the mining sector everywhere; the real question is, where are the best values? Yes, there are some exceptional values in the junior space, but this has expanded to producers from all categories. Even Barrick Gold, the second-largest gold producer globally, is trading with an implied gold price of $1,600-$1,625/oz. But some other senior producers are trading with implied gold prices in the $1,500's. On average, many of the junior and mid-tier producers are trading with implied gold prices of $300/oz. below current prices. For the most part, excluding senior producers, gold producers are trading with an implied gold price of $1,550/oz. +/- $25/oz. If you buy right and sit tight, you will be handsomely rewarded in the not too distant future. Alternatively, waiting until the metals and mining stocks have bottomed is a low-risk strategy even though you will likely be buying at higher prices. Regardless, either way will work out very well.

This week at Goldseeker.com, we've finished two more reports, both of which are on companies we believe have tremendous upside. Please try our 30-day risk-free trial or simply sign up for our free email list.

This week was quiet, which makes sense as companies often defer releasing positive news when the metals and mining stocks are in a down-trend.

$AXU, $AR.TO, $BRC.V, $CGC.V, $GBR.V, $OR, $OD, $NAK, $NEE.V, $SKE.TO, $VZLA.V, $WDO.TO

Alexco Resources: Announced the commissioning of the Keno Hill District Mill commencing as scheduled, with initial production of concentrates underway. The initial ore source for Mill commissioning is the Bellekeno underground mine, where drilling, blasting, and extraction of ore from long-hole stopes continues.

Argonaut Gold: announced that it had discovered four new, high-grade zones below or adjacent to the planned open pit at its 100% owned Magino property in Ontario, Canada: the Scotland Zone, the #42 Zone, the Sandy Zone and the South Zone, which sit between 350 and 700 meters southwest of the previously identified Elbow Zone. Highlights include:

- 7m @ 14 g/t Au

- 8.0m @ 9.3 g/t Au

- 9.0m @ 5.4 g/t Au

- 7.0m @ 4.2 g/t Au

- 4.4m @ 14.1 g/t Au

The Magino project has the making of a long-lived, long-cost project of scale. There is still significant exploration and production upside and will be a company maker for Argonaut once built.

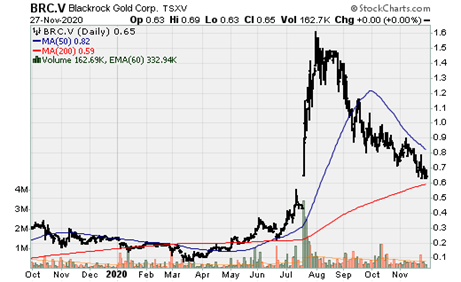

Blackrock Gold: Reported multiple high-grade gold & silver intercepts and discovers a new vein zone at the Victor Target at Tonopah West. Highlights include:

- At the Victor Target, a high-grade, multi-vein gold and silver zone has been drill-defined within an area 210 by 150 meters and remains open to the west and down-dip;

- Drillhole TW20-020C encountered 19 g/t gold and 1,634 g/t silver (3,534 g/t AgEq) over 0.9 meters near its target destination; however, it was abandoned at historic mine workings.

- Drillhole TW20-031C cut 2.9 meters grading 1081 g/t AgEq; this intercept potentially represents a new vein system to the north of the Victor Target. This intercept connects with drill hole TW20-021C, which hit 3.0 meters of 785 g/t AgEq. The two drill holes are separated horizontally by190 meters;

- 24,000 meters in 48 drill holes completed to date. Assays for 24 drill holes have been released, delivering 22 significant and high-grade intercepts ranging from 1 to 29 meters in thickness, with grades from 300 to 4,643 g/t AgEq. Sixteen intercepts have assayed at +500 g/t AgEq, with seven assayed at +1,000 g/t AgEq.

Caldas Gold: Announced C$85m subscription receipt offering and proposed change of board, management, and name. It commenced a private placement financing with a group of investors principally referred by Aris Gold Corporation that will result in changes to the management and the board of directors of the company and a change in the company's name to "Aris Gold Corporation." Once the financing is completed, Gran Colombia Gold is expected to become an approximately 45% shareholder of Caldas Gold. It will have the right to nominate two directors to the Caldas Gold Board after the Aris Transaction. Under the financing, the company has agreed to sell, on a non-brokered private placement basis, an aggregate of 37,777,778 subscription receipts of the company, at a price of CA$2.25 each, for aggregate gross proceeds to the Company of C$85 million. The financing is expected to close on or about November 27, 2020.

A highly experienced Board will lead the company with new nominees, including Ian Telfer as Chair, David Garofalo, Peter Marrone, Attie Roux, Daniela Cambone, and Neil Woodyer. Gran Colombia's nominees will be Serafino Iacono and Hernan Martinez. These are all competent leaders except for Daniela Cambone, which primarily did interviews with gold and silver experts, so most people are perplexed by this nomination. She is unlikely to contribute anything of value; however, the strong leadership from the rest of the board makes this immaterial. All on the BOD have numerous accomplishments except for that already mentioned.

- Ian Telfer: Founder of Goldcorp, Wheaton River, Terrane Minerals, and Wheaton Precious Metals. Inducted into the Canadian Hall of Fame In 2018.

- David Garofalo: Former CEO of Goldcorp (until its sale to Newmont), Former President & CEO of Hudbay Minerals, SVP, Finance, and CFO of Agnico Eagle.

- Peter Marrone: Chairman of Yamana Gold. Founded Yamana Gold in 2003.

- Daniela Cambone: No Relevant experience or achievements in Mining. Former Editor-in-Chief for Kitco News.

- Attie Roux: Former CEO of Endeavour Mining, Leagold, and Equinox Gold. A former head of metallurgy for Anglogold Ashanti.

- Neil Woodyer: Well known company builder CEO who created Endeavour Mining [soon to become a top-10 gold producer], Vice Chairman of Equinox, and former CEO of Leagold Mining and Endeavour Mining.

The management team will be led by Neil Woodyer, CEO, with the corporate head office based in Vancouver, BC. This group of incoming Board nominees, management, and Strategic Advisor is planning to personally participate in the Offering for an aggregate of CA$38 million.

Great Bear Resources: Reported results from its ongoing fully funded $21m exploration program at its flagship Dixie Project at LP fault. Highlights include:

- 38.4m @ 5.56 g/t Au

- 5.50m @ 21.92 g/t Au

- 8.85m @ 6.46 g/t Au

- 101.50m @ 4.69 g/t Au

- Including 5.25m @ 41.25 g/t Au

- 25.25m @ 5.6 g/t Au

- 53.5m @ 7.26 g/t Au

- 5.15m @ 20.63 g/t Au

Osisko Gold Royalties: The company and Osisko Development Corp. are pleased to announce the successful launch of Osisko Development – a premier gold development company in North America, to become the next mid-tier gold producer. The common shares of Osisko Development will begin trading on the TSX Venture Exchange on or about December 2, 2020, under the symbol "ODV."

On November 25, Osisko Royalties and Osisko Development completed their previously announced spin-out transaction, which resulted in, among other things, Osisko Royalties transferring specific mining properties, including the Cariboo Gold Project, and a portfolio of marketable securities (through the transfer of the entities that directly or indirectly own such mining properties and marketable securities) to Osisko Development Holdings Inc., following which Osisko Subco and 1269598 BC Ltd. were amalgamated by way of a triangular amalgamation under the Business Corporations Act (British Columbia) to form "Amalco." Upon the Amalgamation, Osisko exchanged its Osisko Subco shares for ODV Shares, which resulted in a "Reverse Take-Over" of Osisko Development.

Management and Board Reconstitution (Osisko Royalties):

Effective upon closing of the RTO: Mr. Sandeep Singh became the President and Chief Executive Officer of Osisko Royalties, and a director on the Board of Directors of Osisko Royalties; and Mr. Sean Roosen was appointed as Executive Chair of the Board of Directors of Osisko Royalties and transitioned from his role as Chief Executive Officer of Osisko Royalties to Chief Executive Officer of Osisko Development.

Osisko Development:

Effective upon closing the RTO, the Board of Directors of Osisko Development was reconstituted to consist of Sean Roosen (Chair); Charles Page (Lead Director); John Burzynski, Joanne Ferstman; Michèle McCarthy; Duncan Middlemiss; and Éric Tremblay.

Effective upon closing of the RTO, management of Osisko Development was reconstituted to consists of Sean Roosen (Chair and Chief Executive Officer); Chris Lodder (President); Luc Lessard (Chief Operating Officer); Benoit Brunet (Chief Financial Officer, Vice President, Finance and Corporate Secretary); François Vézina (Vice President, Technical Services); Chris Pharness (Vice President, Sustainable Development); Maggie Layman (Vice President, Exploration); and a further technical team that will be transferred from Osisko Royalties to Osisko Development. In Mining, more than any other industry, investment in people is the key to success. Investing in Sean Roosen and Luc Lessard greatly increases the probability of investing success.

Northern Dynasty Minerals: The company received a negative federal record of decision on Alaska’s Pebble Project. If you’ve been keeping track of the company or the project over the last several years, this decision comes as no surprise and is the most likely outcome. The company received formal notification from the US Army Corps of Engineers that its application for permits under the Clean Water Act and other federal statutes has been denied. The lead federal regulator found Pebble's ‘compensatory mitigation plan' as submitted earlier this month to be ‘non-compliant', and that the project is ‘not in the public interest'.

Northern Vertex: The company reported record quarterly production, revenue, and earnings from mine operations. The company produced 14.67k oz. AuEq (including 13.08k oz. Au), generating $26.8m for Q3. Cash costs and AISC was $954/oz. and mine-site AISC of $1,317 ($1,365/oz. companywide AISC). This was due to a one-time cost’s ties to the construction of the powerline, exploration, and heap leach pad expansion totaling $292/oz. The company ended the quarter with $12.10m of cash on hand.

Skeena Resources: Reported additional diamond drill core results from the Phase I combined campaign of definition and exploration drilling at the Eskay Creek Project. The Phase II infill program focused on resource conversion for the PFS on open-pit constrained resources is ongoing, with eleven drill rigs currently active. Phase I infill drilling 21A zone highlights:

- 31.12m @ 5.44 g/t AuEq

- 18.32m @ 36.75 g/t AuEq

22 Zone highlights to date:

- 48.74m @ 8.52 g/t AuEq

- 29.60m @ 4.52 g/t AuEq

- 86.57m @ 4.00 g/t AuEq

Vizsla: The company provided the first results from the Aguita Zarca prospect on the Corden del Oro Vein at the Panuco Ag-Au Project. Drill highlights include:

- 18.15m @ 118 g/t Ag and 3.71 g/t Au

- 5.95m @ 243 g/t Ag and 10.49 g/t Au

Wesdome Gold: Announced Initial Development on the Kiena Deep A Zone That Confirms High-Grade Gold Mineralization and Recommissions Mill. The development will provide an opportunity to confirm the geologic interpretation of the deposit, test for spatial and grade continuity of the mineralized structures, validate key assumptions of the mineral resource estimate, and assess the rock quality characteristics. This information will assist the ongoing Prefeasibility Study (PFS), expected to be completed by H1 2021, determining the restart's timing.

The Kiena mill has now been restarted and is currently processing waste rock and low-grade mineralization in preparation to process the Kiena Deep A Zone development material later next month. The development material will come from two zones, namely the A and A1 Zones. At this time, it is expected to process the estimated 6,000 tons of the combined zones. The milling results will be used to reconcile gold production with development muck and chip samples and reconcile the production with grade estimated by three-dimensional block modeling and the forecast ounces of gold, thus validating key parameters of the resource estimate. The resource estimate is currently being updated and is planned to be released this December. This resource estimate will be based on the ongoing PFS, expected to be completed on schedule in H1 2021.