Excerpted from the October 2 edition of Notes From the Rabbit Hole, NFTRH 725:

Gold & Silver

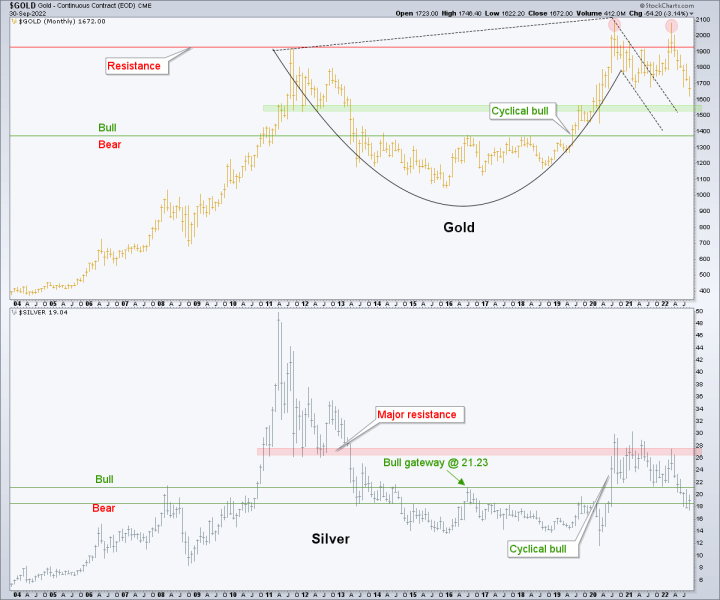

Gold and silver (monthly chart) continue in the cyclical bear that started in mid-2020. I had originally (and incorrectly) projected a Cup & Handle for gold that had to be revised to a double top when the 2022 high failed to gain blue sky. I’ve left the Cup drawn on the chart but that is no longer a handle of any sort. It’s a mess, actually.

The next technical target for gold is support in the 1500s per this Sept. 15th update [password protected]. Also note that the update included an extreme downside below 1300. While not overly likely (IMO), that would put a hard test on the bull market, which was indicated when gold took out the 1378 “bull gateway” (the bull/bear line shown below) in 2019.

As for silver, it continues to hold important long-term support at/around 18 after making a quick breakdown and reversal.

<end excerpt>

The precious metals complex is in a positive risk/reward situation, but that is different from a situation imminently ready to resume a bull market. It’s a process. A long and grinding one. Gold, silver and the miners have led the broad bear market by a country mile (the bear cycle is now in year 3) and the question remains whether or to what degree a final decline will manifest prior to bottoming.

That question could be answered by the answer to another question: Have enough inflation-centric bugs been exterminated (or at least cleaned out of the investor base) yet?

This excerpt was preceded in #725 by a couple of still-bearish macro indicators for gold to go along with Friday’s public article highlighting some developing positive ones. The excerpt was followed by a big picture technical view of HUI and review of the correction targets we are operating to.

Frankly, this report served to tamp my greed back down a bit and affirm my patience as well. I am often a different investor immediately after writing a weekend report than I was before it.

The rest of NFTRH 725 was very helpful to me personally, and that goes well beyond the precious metals. We are developing a thesis that would surprise a lot of 2022’s angst ridden broad market herds if it plays out.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.