- Monday’s stock market meltdown did not hurt gold, but the miners and silver took a hit. The big question:

- Is this the start of a bear market in stocks or is it just a dip that should be bought?

- For some insight into the matter, please click here now. Double-click to enlarge. The US government and the Fed have become a ghoulish debt and money printing tag team. The tag team has created near-hyperinflation in the stock, bond, and real estate markets.

- Having said that, it likely takes another significant wave of inflation to pop the stock market bubble.

- As Bank America notes, more money is flowing into stock markets this year than in the past two decades!

- A major reaction in the August-October period is likely, and the final peak probably happens in 2022 or 2023.

- Please click here now. I sold about 30% of my US stock market holdings ahead of the meltdown, and moved another 30% to trading my short-term “traffic lights”. I suggested gold bugs with stock market exposure do the same thing.

- My traffic light signals should keep investors safe, and there will be some big gains on both the long and short side in the year ahead.

- More government debt and central bank money printing likely keeps the stock market boat afloat, but the winds of civil war are blowing, and that could sink the boat sooner than expected.

- Many republicans believe that forensic audits will prove they won the election, and the democrats lost. The anger could morph into significant violence, or civil war.

- Please click here now. Tension between democrats and republicans is intense, but in the big picture, the leaders of both parties continue to embrace the fiat “swamp thing”. Fiat money is the macabre enabler for America’s debt worship and money printing madness.

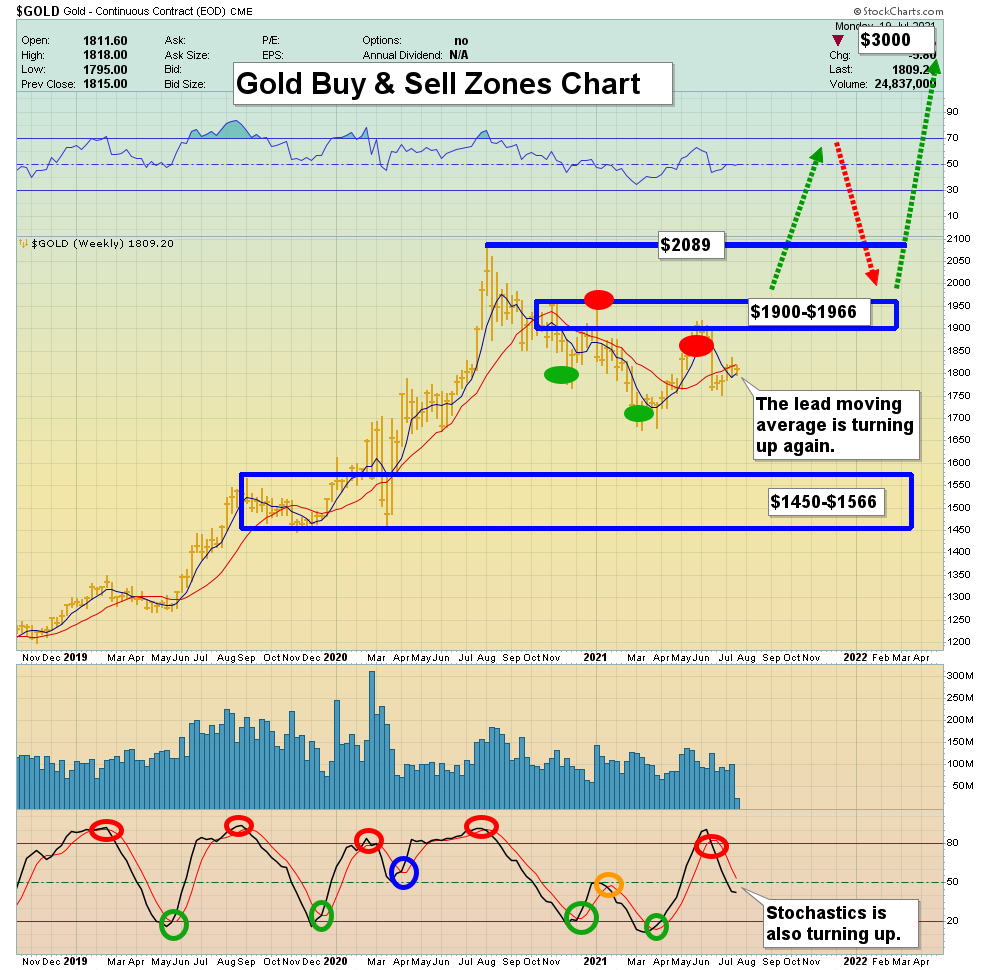

Click to enlarge this weekly gold chart. The price action is positive. Note the fresh upturns on the lead lines of the Stochastics oscillator and moving averages.

Click to enlarge this weekly gold chart. The price action is positive. Note the fresh upturns on the lead lines of the Stochastics oscillator and moving averages. - Indian jewellers have forecast a resurgence in demand will begin later in August and that seems likely. Also, Biden isn’t going to just hand over his presidency to Trump, regardless of what the audits suggest.

- Even if he did, Trump has shown no interest in replacing fiat with gold.

- America’s next decade is likely to be dominated by republican-democrat tension that turns violent… and inflation. Meantime, middle class incomes in China and India are growing faster than gold supply.

- Clearly, the big picture is that both the fear trade of the West and the love trade of the East are going to ensure that gold continues to crush fiat with ease.

- Having said that, I’ve cautioned silver and mining stock investors to have patience. The last big buying opportunity was in March at about $1671 for gold.

- More great buying opportunities will happen, but not until gold either trades above $1966 or near $1566. The good news: I’m projecting that $1966 is next!

- Please click here now. Double-click to enlarge this SIL silver stocks ETF. The action is disappointing, but not for those who follow the gold bullion support and resistance rules.

- Note the fabulous rallies from November 2020 and March of this year. Both occurred from significant gold support zones ($1776 and $1671).

- Rather than try to “call a bottom”, my suggestion for silver stock enthusiasts is to simply wait. Buy silver stocks when gold is at a price of about $1566 or $1966… and cheer that $1966 is next!

- Please click here now. Double-click to enlarge. GOAU tends to outperform GDX in a strong gold market but investors can outperform everything if they focus on the gold bullion support and resistance rules.

- It turns out that rules weren’t made to be broken, especially in the gold market! Note the nice rally for GOAU from gold $1776 and the huge one from $1671.

- If gold trades above $1966, that price area will become a big floor and turn miners into cash flow cows on steroids. It would become a major launchpad for the next great gold stock rally!

Thanks!

Cheers

St