- For investors who are following the Corona action, please click here now. The delta variant of Corona is a concern, and it’s possible that more severe variants emerge over the coming year.

- I’ve detailed 2021-2025 as a possible war cycle period. If the economy were to be locked down again, it’s easy to envision US republicans and democrats who hate each other… engaging what could become outright civil war.

- Tensions are high and there are numerous events and processes at play that could trigger more violence. Clearly, gold is the most important asset to own in these murky and disturbing times.

- Please click here now. I’ve suggested that US GDP growth may be peaking. There are lots of houses for sale, but the fiat-obsessed Fed has driven prices up so much that only high earners and investment funds can afford to buy them without taking on a ridiculous amount of debt.

- The stock market is at risk in the medium term. That’s why I currently advocate a shorter-term buy and sell approach to handling that market. As risks intensify, reducing the time that capital is exposed to those risks is the best way to manage the situation.

- Please click here now. Double-click to enlarge this stock market buy and sell signals chart. Using a solid moving average series (10,100 for the QQQ ETF), investors can take part in the outrageous upside action created by QE and government handouts…

- While getting out of the market (or shorting it) before the entire house of fiat cards collapses.

- To view one of the world’s most important charts for gold stock investors,

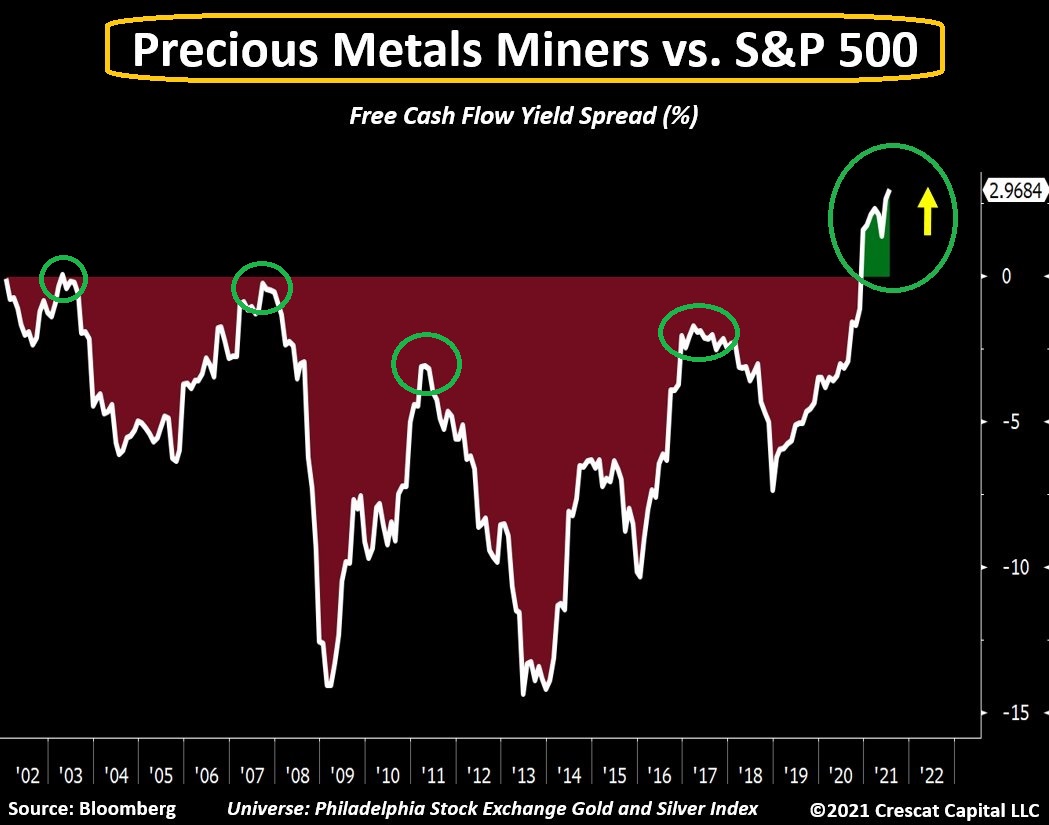

Click to enlarge this operational efficiency comparison chart. Note the green circles that I annotated; the free cash flow yield of the miners is now well above all the previous highs…

Click to enlarge this operational efficiency comparison chart. Note the green circles that I annotated; the free cash flow yield of the miners is now well above all the previous highs… - Yet their stock price action makes it look like they are losing a lot of money and gold is sub $1000!

- Please click here now. Double-click to enlarge this key gold stocks versus Dow price chart. Patience is a virtue, and mining stock investors need to have it.

- The .007 number is the line in the sand for gold stocks versus the Dow; a breakout above there likely is followed by a long period of outperformance by the miners against all other assets.

- Investors are understandably frustrated with the enormous disconnect between the fabulous mining stock fundamentals and the price. Is there a solution that can help investors?

- Well, I’m a strong believer in the KISS (keep it simple, superstar) principle. To apply it to mining stock investment, please click here now. Double-click to enlarge this “follow the support and resistance rules” weekly gold chart.

- Gold stocks (and silver stocks) outperform gold bullion and the stock market quite dramatically when there are significant rallies in bullion.

- It’s important for investors to monitor the big picture for key sea changes, like the imminent failure of QE, war, persistent inflation, etc.

- Big picture monitoring is important, but the simplest way to make money with gold stocks is to buy them only at major support for bullion. This allows investors to have money at risk for shorter periods of time, with higher odds of booking great profits.

- The next big support zones for gold are at $1966 and $1566. Buying the miners on a reaction to $1566 is a simple procedure.

- Buying them at $1966 requires gold bullion to first rise well above $1966.

- The buying would occur on a reaction back to $1966 from those higher prices.

- Previous opportunities over the past 12 months included the late November $1778 buy zone 2020 and the March $1671 area this year.

- Please click here now. Double-click to enlarge this bitcoin chart. It doesn’t matter what the asset is; buying major support (like bitcoin $30,000) and selling into significant resistance (bitcoin $40,000) is the method of making money in the market that carries the least actual risk and the most potential reward…and that’s what investing is all about!

- Please click here now. Double-click to enlarge this exciting GOAU ETF chart. The action is exciting, for those who follow the gold bullion support and resistance rules.

- I believe that America’s major fiat markets (stock, bonds, and real estate) have devolved into socialist soup kitchens. Anger amongst gold bugs is understandable and blue collar America doesn’t appear to realize the extent to which they’ve really been scammed.

- I also believe that gold bugs deserve much better mining stock performance than cash flow and cash flow yield alone has given them. Moving to a short-term approach for the stock market and buying the miners with an iron hand at major gold bullion support… this approach will see gold bugs survive and prosper!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates