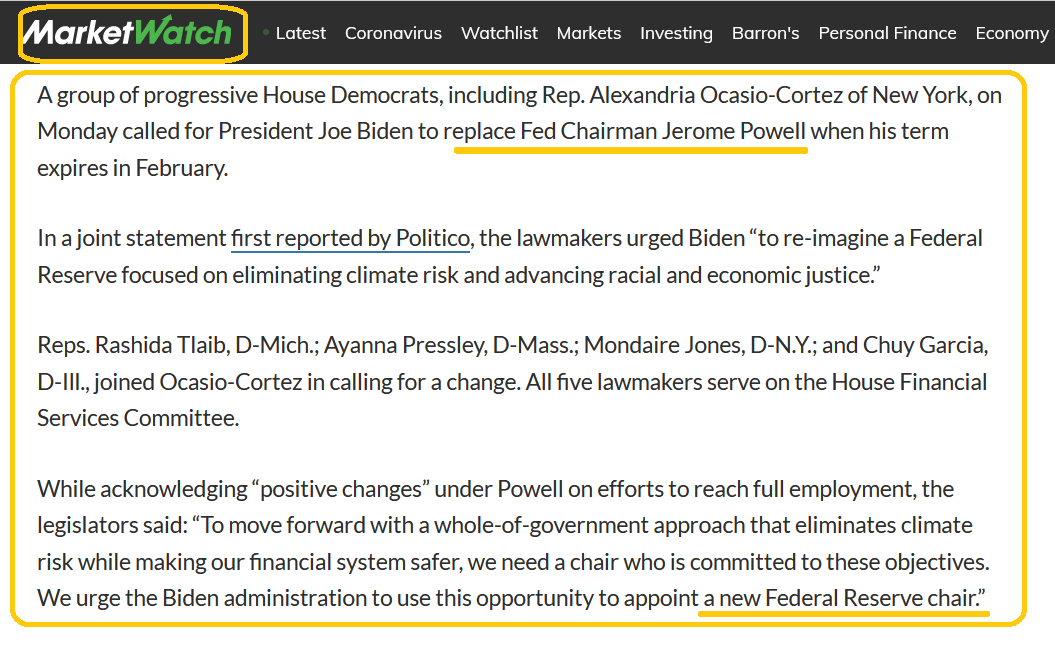

- Why is Jay Powell so adamant that inflation is temporary?

- If the Fed acknowledges that higher inflation is ingrained, it must raise rates and kill its QE welfare programs for stock, bond, and real estate investors. That’s the last thing the Fed wants to do.

- Jay won’t be announcing any QE welfare for Hurricane Ida victims. There won’t be any QE for medicine for the elderly, nor for overloaded ICU units. Tiny businesses ruined by lockdowns get no printed fiat from Jay.

The 2021-2025 timeframe is a potential war cycle. A war between Main Street America and its elite is possible and arguably likely, given the outrageous actions of the Fed.

The 2021-2025 timeframe is a potential war cycle. A war between Main Street America and its elite is possible and arguably likely, given the outrageous actions of the Fed.  Click to enlarge this US stock market chart. The market is incredibly overvalued, with many PE ratios essentially rising towards Pluto!

Click to enlarge this US stock market chart. The market is incredibly overvalued, with many PE ratios essentially rising towards Pluto!- Jay and the rest of the Fed do not care how unaffordable home prices are, how overvalued the stock market is, or how much government debt has been enabled by QE. All the Fed appears to care about is keeping the party going. The big question for investors:

- Will the Fed continue to promote this disgusting welfare for the elite that is paid for with the blood of Main Street?

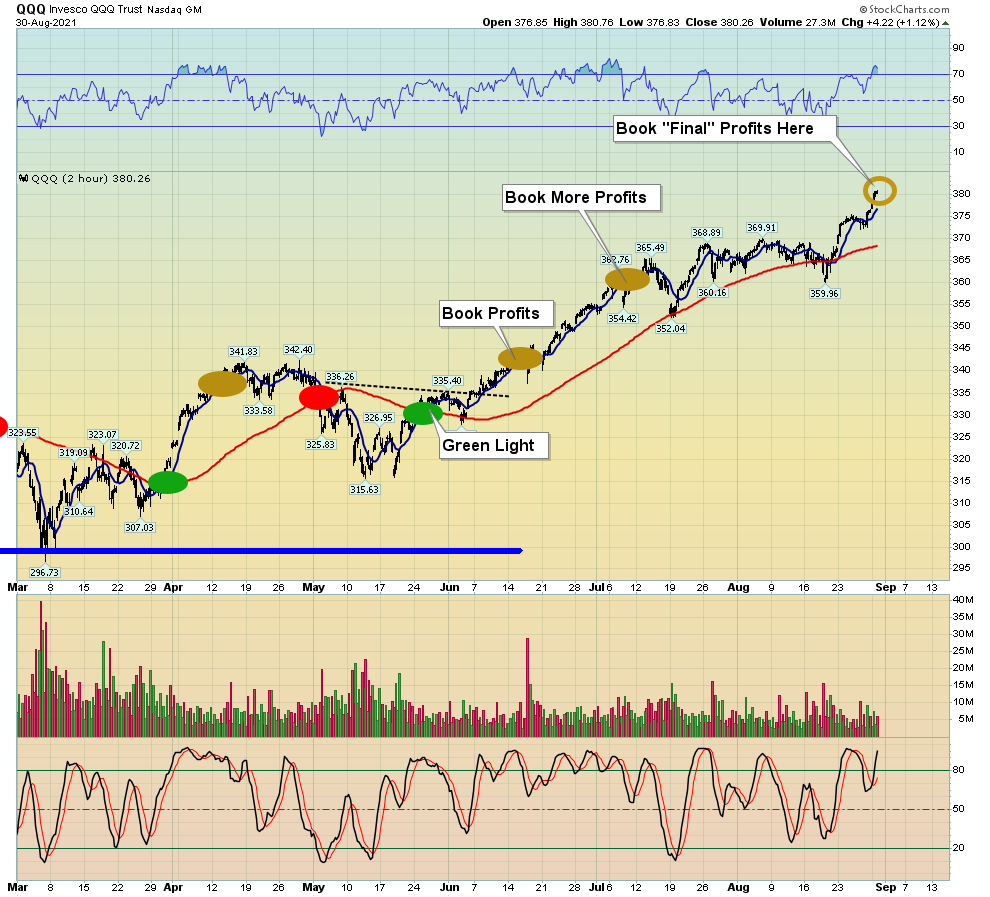

Click to enlarge this stock market tactics chart. Investors can use my key 10,100 moving average signals on the 2hour Nasdaq ETF chart to get them out of the market before a major Fed-related tumble occurs…

Click to enlarge this stock market tactics chart. Investors can use my key 10,100 moving average signals on the 2hour Nasdaq ETF chart to get them out of the market before a major Fed-related tumble occurs…- And to stay in when the market “impossibly” roars higher! The bottom line: The Fed’s actions have created a Zimbabwe-like stock market in America. Moving averages tend to be the most reliable tool to manage risk and enhance reward in this kind of situation.

- Savvy investors in Zimbabwe’s past hyperinflation crises bought the stock market and then put their winnings into gold bullion.

- The end of the American fiat empire likely requires similar tactics… if investors want to survive and prosper.

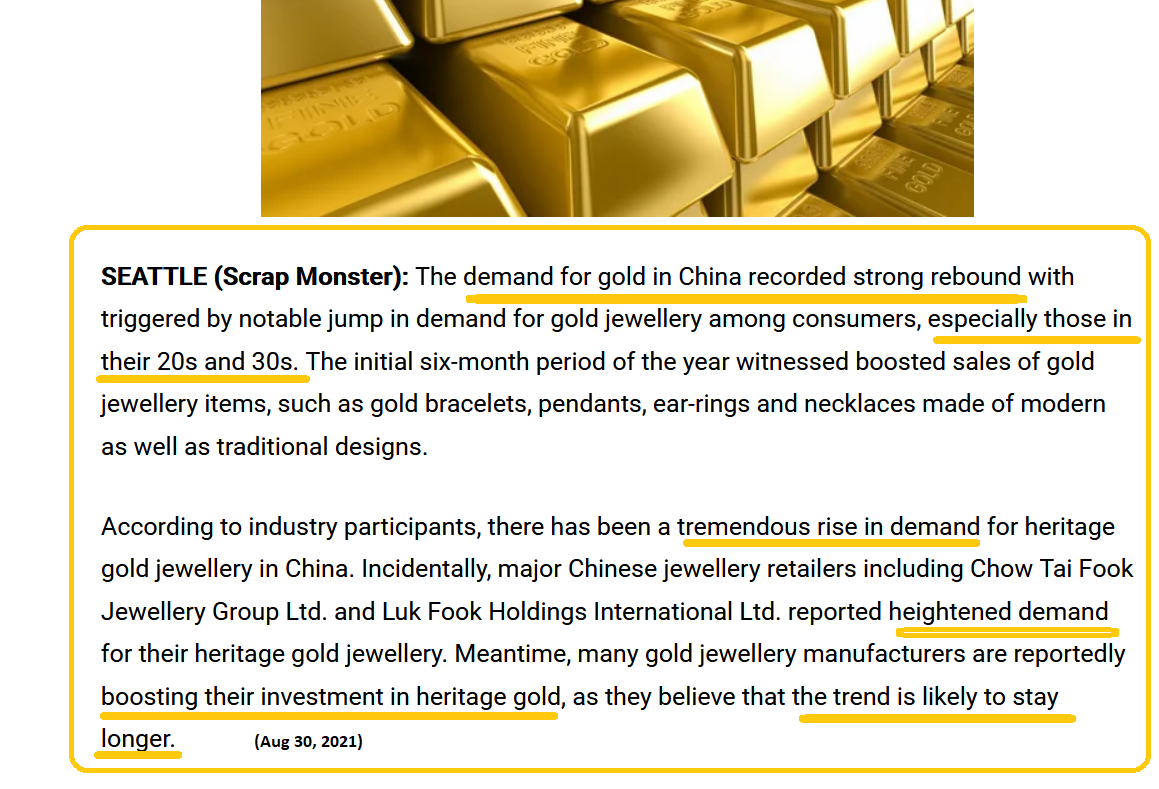

- Investors need to be bold, and own lots of gold! Global inflationary pressures are increasing even after some supply chain blockages have been cleared. Real rates are set to become more negative and Western money managers buy gold when this theme is strong.

In the East, investors don’t have a childish “I’ll only buy gold if the economy looks bad and rates decline!” mindset.

In the East, investors don’t have a childish “I’ll only buy gold if the economy looks bad and rates decline!” mindset. - Great economic news in the East is celebrated with powerful bursts of gold buying, and rightly so.

- It’s only a matter of time before the silly Western mindset of celebrating good economic times by dumping gold gets overwhelmed with the sanity of 3 billion citizens in the East.

click to enlarge this glorious gold chart. In the 1970s, US debt to GDP ratios were vastly lower than they are now.

click to enlarge this glorious gold chart. In the 1970s, US debt to GDP ratios were vastly lower than they are now. - The horrifying debt means that an inflation crisis now would be many times worse than in the 1970s.

- It appears that gold is poised to begin its rise from the right shoulder to and through the inverse H&S neckline.

- A “stagflationary meltdown” in the US stock market in 2022 is likely to coincide with an institution-powered “super surge” higher in gold, silver, and mining stocks!

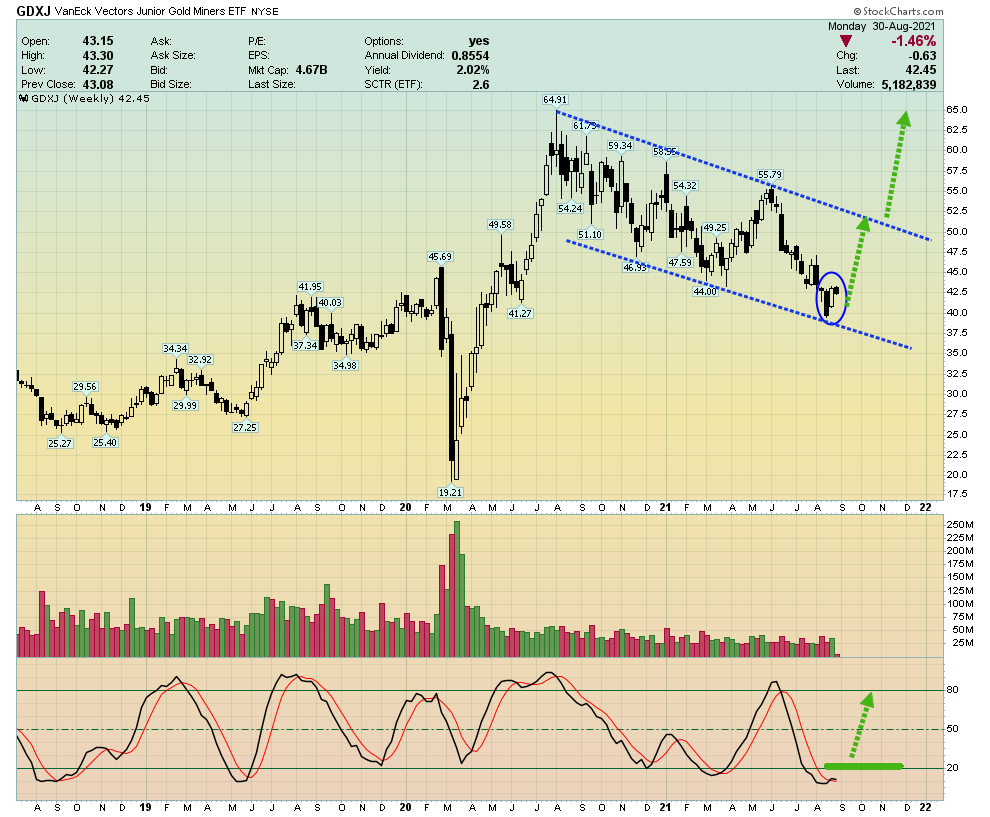

click to enlarge this GDXJ weekly chart. Note the 14,5,5 Stochastics oscillator at the bottom of the chart.

click to enlarge this GDXJ weekly chart. Note the 14,5,5 Stochastics oscillator at the bottom of the chart. - A move above the 20 area with a crossover buy signal would be very positive.

- Next,

click to enlarge this GDX daily chart. Over the past two decades, money managers have dabbled in the miners, but a “1970s on steroids” situation would bring a veritable tidal wave of institutional money flows.

click to enlarge this GDX daily chart. Over the past two decades, money managers have dabbled in the miners, but a “1970s on steroids” situation would bring a veritable tidal wave of institutional money flows. - Given the immense H&S action on my weekly gold bullion chart, investors should prepare themselves for a scenario where gold and silver mining stocks may be poised to begin not just any rally but…

- The greatest rally in the history of the miners!

Thanks!

Cheers

St