- Years ago, when I predicted a “virus cycle carpet bombing” of America for 2019-2021, I warned that it could look like a “peanut play” compared to the 2021-2025 war cycle that would follow.

- Americans are gleefully tossing their virus masks into the garbage can, just when they should consider buying hazmat suits and building bomb shelters. Alas, such is the irony of life.

- Unlike the disgusting regime change wars instigated by American government “Gmen” in the past, as this war cycle intensifies, significant blood is likely to be spilled… on American soil.

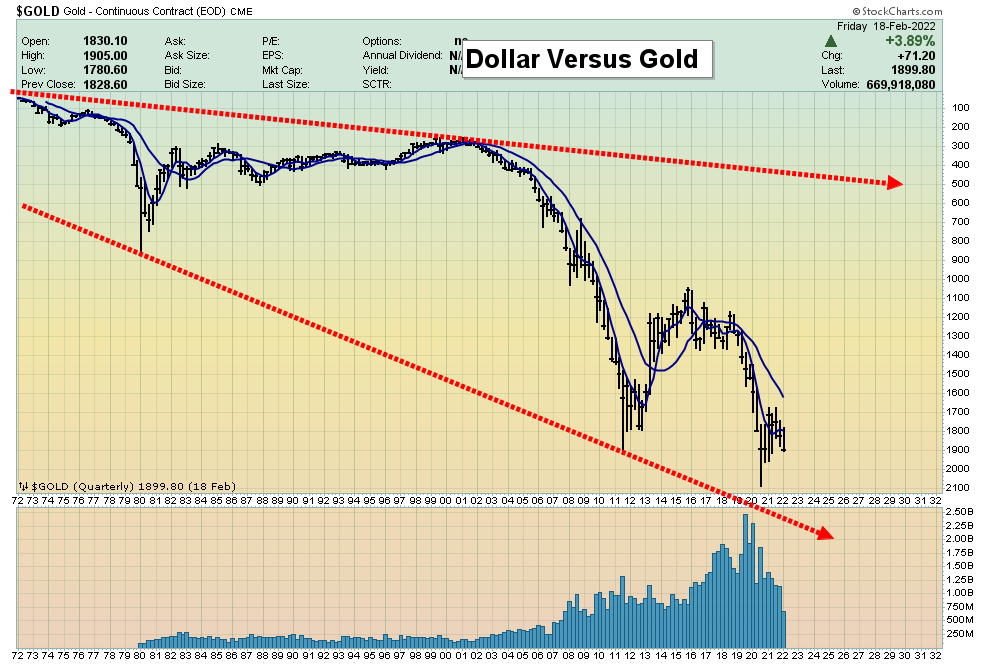

Gold is the money of champions, and fiat appears to be the money of… chumps.

Gold is the money of champions, and fiat appears to be the money of… chumps. - It should be obvious that fiat-oriented freedom isn’t real freedom. It’s fake, because it’s government-oriented. Having said that, please click here now. Double-click to enlarge. This isn’t a “top call”. It’s a call to get richer!

- Investors have significant profits on gold stocks bought at my buy zone of late September/Early October, and the time is here for conservative investors to book some of their gains.

- For a closer look at the $1900 sell zone, please click here now. Double-click to enlarge. $1900 is significant resistance and while a lot of bullish factors are in play, from a tactical viewpoint, it’s a profit booking zone for mining stock investors.

- Please click here now. I don’t have the same view that UBS analyst Joni Teves has, but anything is possible in markets, and her $1600 target is roughly the same as my $1577-$1450 buy zone.

- The difference between her outlook and mine is that I want investors prepared to buy $1577-$1450 if it happens.

- In terms of prediction though, the odds favour a push towards $2089 more than a dip to her $1600 target price.

- Please click here now. In the short term, upwards pressure on commodities is likely to continue, but bond yields could fall as the stock market enters a panic stage.

- Please click here now. Double-click to enlarge this disturbing Nasdaq ETF chart.

- For a big picture view of the US stock market, please click here now. Double-click to enlarge this Dow chart. The bottom line: I’ve issued some major buy and sell signals over the past 40 years, and this sell signal is the biggest of them all.

- It’s essentially a sell signal for the entire American empire.

- The US central bank uses inflation calculations that are out of touch with the “boots on the ground” pricing pain experienced by the average citizen.

- That’s one reason why Fed chair Jay hasn’t announced an interim (between meetings) rate hike. Here’s another:

- The Fed likely hoped that inflation would fade so it could continue its QE and zero interest rate welfare programs for the government, and for the stock and real estate market “oligarchs”.

- That hasn’t happened. Instead, the war cycle has intensified, and war is one of history’s greatest catalysts for inflation!

- Please click here now. Double-click to enlarge this spectacular GSG-NYSE commodity fund chart. A powerful inverse H&S pattern is in play.

- If gold stock investors are booking partial profits on some of their mining stock positions here, broad-based commodity funds (as well as gold bullion itself) are a good place to allocate some of the proceeds.

- Please click here now. Double-click to enlarge this triple-leveraged bond fund chart.

- I do short-term trades for this bond fund as well as triple-leveraged GDXU and GDXD for gold stocks at my swing trade newsletter. Regular pricing is $289 for 3 months. I have a gold bug special this week of $249 for 4 months. Traders can get the alerts by email or text to phone. Send me an email if you want the swing trade special. Thanks!

- Next, please click here now. Double-click to enlarge this enticing GDX chart. A breakout from a massive drifting wedge pattern is in play but…

- A Friday close over $35 is required to “lock it in”. Conservative investors should also wait for a Friday gold price close of $1915 before getting too excited, but there’s no question that the tide is turning… and favours the bulls!

Thanks!

Cheers

St