Strengths

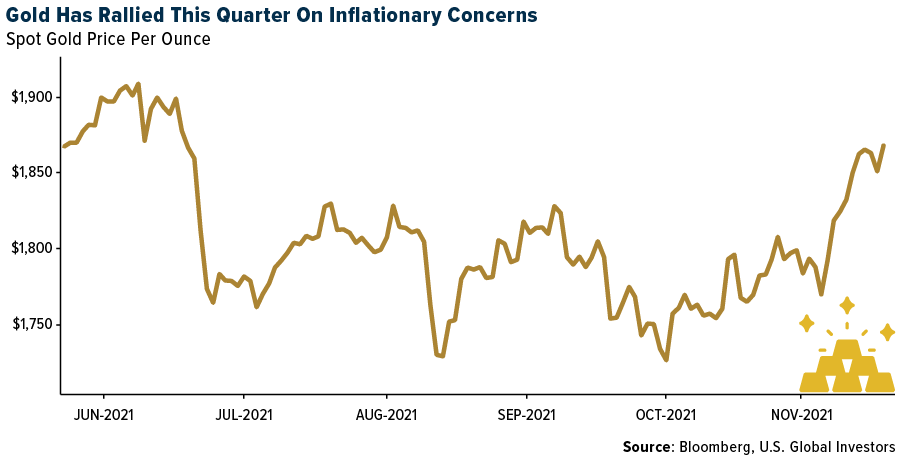

- The best performing precious metal for the week was spot gold, but still down 1.03%. Gold climbed to the highest since June as the dollar weakened ahead of a slate of speeches by Federal Reserve officials and economic data. Bullion is up more than 4% this month, set for its best since May, having broken through key technical barriers after U.S. consumer prices rose the fastest since 1990. The data has sparked growing pressure on the Fed to speed up the pace of monetary tightening amid fears it could lose control of inflation.

- K92 Mining reported third quarter earnings, with cash costs ($596/ounce) significantly below consensus. Although K92 revised 2021 production guidance (production 96-102 thousand ounces) to account for Covid-19 challenges that predominantly impacted the first half of the year, consensus already accounted for such disruptions and is therefore, in line with expectations.

- Regression analysis, using 10-year U.S. real rates, the Bloomberg Dollar Spot index and ETF holdings going back to 2005, has an enviable record in tracing gold prices. Measured monthly over the past decade, the predicted and actual prices have a correlation of 0.7. On Tuesday, gold was $25 below where this model said it should be. In fact, since the U.S. inflation reading on Aug. 11, the metal has outperformed its derived fair value by $148. This suggests sentiment has turned for gold.

Weaknesses

- The worst performing precious metal for the week was platinum, down 4.76%, despite hedge funds staking the largest net-long position in 6-months. Spot gold has climbed since late September, while holdings in bullion-backed exchange-traded funds fell 1.8%. That’s unusual, as flows in this sector are among the biggest drivers of prices. Since the invention of gold ETFs in 2003, holdings have moved in the same direction as price in every year, bar one. This year, they’re close to notching a second divergence. Spot gold has trimmed the year’s losses that at one point tallied more than 10% to just under 2%. Meanwhile ETF holdings plunged 283 tons, or 8.5%.

- Pure Gold reported third quarter sales and earnings with diluted EPS lower than consensus (actual -$0.04 versus consensus -$0.02) largely due to lower revenues generated on the back of lower gold ounces sold versus produced. There were 10% lower gold ounces sold (8.4 thousand ounces) than gold produced (9.2 thousand ounces) while operating costs remained largely in line with consensus.

- Americas Gold & Silver reported earnings per share (EPS) of $(0.13), missing consensus of $(0.09) due to higher construction and maintenance (C&M) and operating costs (primarily at Relief Canyon prior to suspension of operations) as well as higher deprecation.

Opportunities

- On the back of the financing, Arizona Metals has approximately C$56MM in cash ready to allocate to the drill bit. Drilling thus far in 2021 has been threefold: i) increased confidence in the historic 5.8-million-ton Exxon resource, ii) discovering a Zn-Au zone directly adjacent to the historic Exxon resource, and iii) added tonnage at depth. With the new funds, AMC has a fourth rig on order, and is ultimately looking to scale drilling up to six rigs to increase cadence.

- Wheaton Precious Metals will purchase 50% of silver production from Blackwater until 18 million ounces have been delivered, after which the stream will reduce to 33% of silver production over the life of mine. The stream includes a partial buyback option whereby Artemis may purchase up to 33% of the stream by January 1, 2025, or the achievement of commercial production at Blackwater. There is a cash consideration of $141 million payable to Artemis in tranches during the initial construction phase of the project. Wheaton will make payments equivalent to 18% of the spot silver price until their investment has been recovered after which the Wheaton would pay 22% of the spot silver price over the life of mine. Artemis intends to use proceeds from the silver stream to fund construction and development of the Blackwater project.

- Mineros S.A. listed it common shares on the Toronto Stock Exchange in a small $20 million raise. Up till now, their shares were only listed for trading in Colombia where no other mining companies have listed shares, hence it came to the market at a significant valuation discount relative to its peers. For a quarter-million-ounce gold producer that had a strong history of dividends, currently yielding 6.80% and has double-digit returns on invested capital should spark some interest now that it’s a more liquid opportunity.

Threats

- With third quarter earnings now complete for gold producers, a common theme in the results was a discussion on cost inflation. Fuel continues to be the area most cited along with rising pressures on consumables/reagents, with FX headwinds particularly for those with Canadian operations. As well, supply chain logistics continue to be a challenge particularly in Latin America and Africa, where shortages in container shipping capacity and port congestion have impacted sales volumes and procurement. Lastly, larger producers have noted the potential to partly mitigate rising cost impacts via global purchasing strategies and leveraging order consolidation in negotiating/renewing supplier contracts.

- Barclays Plc, Société Générale SA, Scotiabank, and London Gold Market Fixing Ltd. will pay a combined $50 million to end antitrust litigation over an alleged scheme to rig the gold “fix,” a key pricing benchmark, according to a federal court filing in Manhattan. The traders leading the lawsuit sought preliminary approval for the agreement from Judge Valerie E. Caproni, who’s overseeing the multidistrict case. She has tentatively signed off on a $62 million settlement with Deutsche Bank AG and a $42 million deal with HSBC Holdings Plc.

- Gold closed the week on negative note with Fed Vice Chairman Richard Clarida along with Fed Governor Christopher Waller both echoing comments that the Fed needs to look closely at the date leading up to the December’s policy meeting. There is a push to quicken the pace of reducing asset purchases and raise interest rates to quell inflation.