This week spot gold closed the week at $1,769.13, down $8.07 per ounce, or 0.45%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 4.99%. The S&P/TSX Venture Index came in up 2.65%. The U.S. Trade-Weighted Dollar rose 0.49%.

- The best performing precious metal for the week was palladium, up 2.85%. Palladium surged above $3,000 an ounce for the first time ever as the global shortage for the precious metal deepens on strong demand from automakers. Palladium is up over 20% so far this year, building on five straight annual gains, according to Bloomberg data. Gold production is forecast to grow 6% in 2021, according to S&P. Gold production had fallen to a six year low in 2020 due to pandemic lockdowns.

- The World Gold Council (WGC) says China’s demand for gold bars and coins will remain robust and investor interest is likely to be positive in 2021. China, the world’s top consumer of bullion, saw jewelry demand rise 212% year-over-year in the first quarter to 191.1 tons, the highest amount since 2015. Chinese gold ETFs saw inflows of 11.5 tons in the first quarter, contrasting with the global trend of outflows.

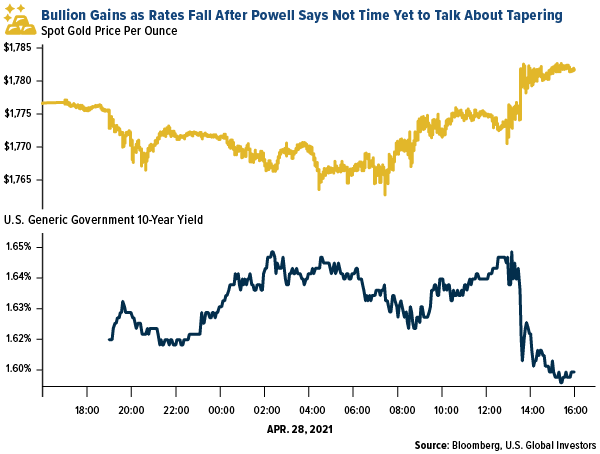

- Gold rose on Wednesday after Fed Chair Jerome Powell said it is “not time yet” to start conversations about slowing the pace of purchases by the central bank, reports Bloomberg. Bullion is up from a nine-month low hit in March as bond rates and the U.S. dollar weaken.

Weaknesses

- The worst performing precious metal for the week was platinum, down 2.31%, perhaps on investors jumping into sister metal palladium. Auto production cuts, some as much at 50%, on the worldwide computer chip supply chain shortage could weaken platinum demand near-term. After staging a comeback in April, gold saw a weekly loss for the first week in four as bond yields and the dollar firmed up.

- The worsening COVID-19 pandemic in India could hamper its gold demand recovery. WGC reported consumer demand rose 37% in the first quarter but could fall again as the total number of cases rises past 18 million. Many states have reimposed restrictions and shut non-essential businesses such as jewelry shops.

- Newmont, the world’s largest gold producer, reported first quarter production 6% below consensus, which resulted in earnings and cash flow being below expectations. Earnings per share were 74 cents, below the 80-cent estimate for the first quarter.

Opportunities

- Gold Fields plans to set carbon emission reduction and workforce diversity targets by the end of 2021 and aims to become net zero carbon by 2050. Russian producer Polymetal seeks to cut greenhouse emission intensity per ounce of gold equivalent by 30% by 2023. The company announced on Thursday that it will run 100% on renewable power and has already agreed to get 90% of its needs from hydropower. Miners that cater toward more ESG-conscious investors could attract more capital.

- Fortuna Silver Mines is acquiring Roxgold. Fortuna shareholders will own 64% of the combined company. The price offered is a 42% premium to the pre-announcement price but is at 0.88x of NAV. The company aims to have a low-cost platform for gold and silver in the world’s fastest growing metals producing regions. Again, we see another acquisition proposed in the gold space because the target’s share price is too low for the value that can be identified within its holdings. The current synergy is just the surface of the value within Roxgold in the future. Other mining companies in West Africa should consider what their logistical synergies could bring to the table.

- Gold companies with exposure to copper are set to benefit from surging prices for the red metal, especially during periods of weak bullion prices. Newmont, the world’s largest gold producer, is boosting its exposure to copper through “mega projects.” CEO Tom Palmer said copper will account for 15 to 20% of the miner’s total output by the end of the decade. Despite the negativity surrounding bullion, Palmer said in a Bloomberg TV interview that gold prices are at “healthy levels.”

Threats

- ETFs sold 755,476 troy ounces of gold on Wednesday, the biggest one-day decrease since 2016, to bring net sales for 2021 to 8.43 million ounces, according to Bloomberg data. Total gold held by ETFs is down 7.6% so far this year, a continued trend that shows investors are moving on from the yellow metal.

- Diamond Foundry received a $200 million investment by Fidelity to fund a lab-grown diamond startup. The goal is to compete with gemstone miners like DeBeers. The immediate goal is to quadruple production at its Washington state factory to 5 million carats per year by 2022.

- Russian miners may face U.S. sanctions, according to former U.S. Government officials and S&P. Sanctions have already been placed on Russia for meddling in the 2020 election, gathering troops on the Ukraine border, sending warships to the Black Sea and having a global cyber espionage campaign. Russia represents 45% of global palladium production and 14% of global platinum production.