Strengths

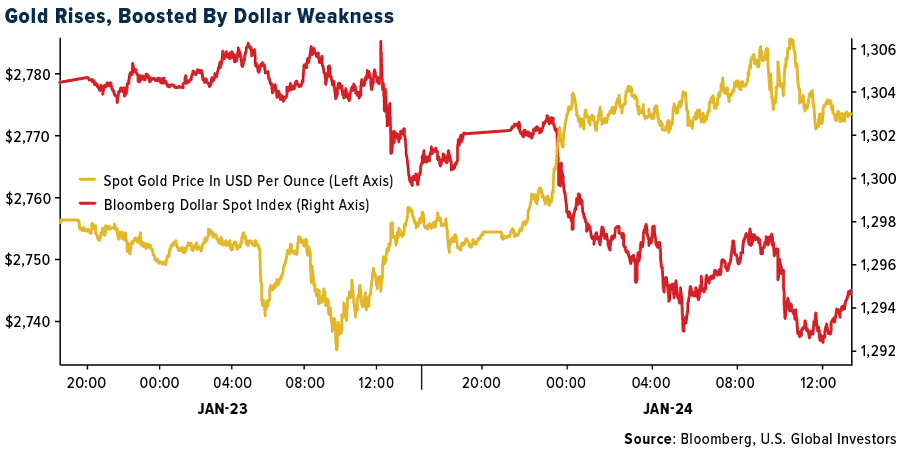

- The best performing precious metal for the past week was palladium, up 4.18%, which may have outperformed on certain incentives for EV growth being removed from with the incoming administration. Precious metals refiner Heraeus noted that “tariff concerns have proved contagious in the precious metals markets, as gold, silver, and platinum have all been affected.” On Friday, President Trump softened his stance on China tariffs—perhaps as a negotiation tactic. Nevertheless, the dollar weakened, and gold prices rose.

- K92’s production in 2025 is expected to be 160,000 to 185,000 ounces gold equivalent, increasing from the 2024 production of 149,515 ounces. Additionally, all-in sustaining costs (AISC) of $1,460-$1,560 per ounce gold are expected for 2025, according to Bloomberg.

- G Mining Ventures projects a strong 2025 performance, with the Tocantinzinho Gold Mine targeting annual production of 175,000 to 200,000 ounces of gold at competitive costs, supported by efficient operations and advanced technologies. Their strategic investments in exploration and development at Oko West and Gurupi position the company for long-term growth

Weaknesses

- The worst performing precious metal for the past week was silver, down 0.16%. Tax issues continue to dog certain jurisdictions—Mali being a recent example. Meanwhile, Rio Tinto has offered $295 million to the Mongolian government to settle a long-running tax dispute over the Oyu Tolgoi copper mine. This move could potentially clear the way for a merger with Glencore, as reported by Bloomberg.

- Hochschild Mining shares plunged 21% for the week. The mining company said the cost of producing gold and silver this year will be higher than previously guided, according to analysts and Bloomberg.

- B2Gold missed on earnings and followed up with a convertible senior unsecured note offering due 2030 in an aggregate principal amount of US$350 million. The Company intends to use the net proceeds from the offering to fund working capital requirements and for general corporate purposes. Additional capital had been expected and with the Mali shadow following the stock, it still has a negative return for the year versus some peers like Alamos Gold, with double digit gains.

Opportunities

- BMO Capital analyst Kevin O’Halloran has initiated coverage on Vizsla Silver with an outperform rating. Vizsla owns the Panuco property in Sinaloa, Mexico, which boasts an expected production profile of 15.2 million ounces per year of AgEq (silver equivalent), positioning it as one of the largest underground silver mines globally. The mine benefits from a relatively high average silver-equivalent grade of 350 grams per ton, with a front-loaded grade profile that supports a rapid expected payback period and boosts silver-equivalent production to 20.2 million ounces per year in the initial production years.

- Morgan Stanley strategists believe there are more investors looking to sell the dollar than expected and forecast a weaker U.S. currency by the end of the first quarter, despite the dollar’s current dominance. Potential catalysts for a dollar decline, including inflation data, Federal Reserve rate cuts, and trade policy developments.

- Saudi Arabia has already made some mining deals, including a 10% holding in Vale SA’s base metals unit and a pending deal for a stake in a copper and gold mining project in Pakistan and may even have an interest in Barrick Gold’s share of its 50% stake in Chile’s Zaldivar copper mine. Interestingly, foreign investors are more interested in accessing Saudi Arabia’s cash than investing in it. Despite touting $100 billion in local investment opportunities and $2.5 trillion in mineral resources, few major miners have committed to investing in Saudi Arabia, as reported by Bloomberg.

Threats

- Peru’s public safety crisis is worsening, eclipsing previous episodes, with the country’s Interior Minister and President blaming transnational criminal organizations for the chaos and violence. Peru is a major producer and exporting country of precious and base metals to world markets, and this could threaten supply chains. The government’s warning comes after months of protests and warnings from workers about a rise in extortion rackets, as reported by Bloomberg.

- Soaring precious metal prices are driving a gold rush in Brazil. Unfortunately, that surge in mining is being driven by illegal mining which is now dominated by drug gangs which usually use the cheapest gold extraction process available, being mercury. Brazil has tried to crack down on this activity, but the Amazon rainforest is so vast, such that operations continue.

- Bloomberg reported that Americans are now rolling over a larger share of their credit card debts despite high interest rates. Revolving card balances have accelerated to the highest level since 2012 and delinquency rates have risen, with 3.5% of card balances past due by 30 or more days. Pairing this data of an overstretched consumer with the recently released index of US consumer sentiment for January declined for the first time in 6-months, citing unemployment and potential tariffs’ impact on inflation.