Strengths

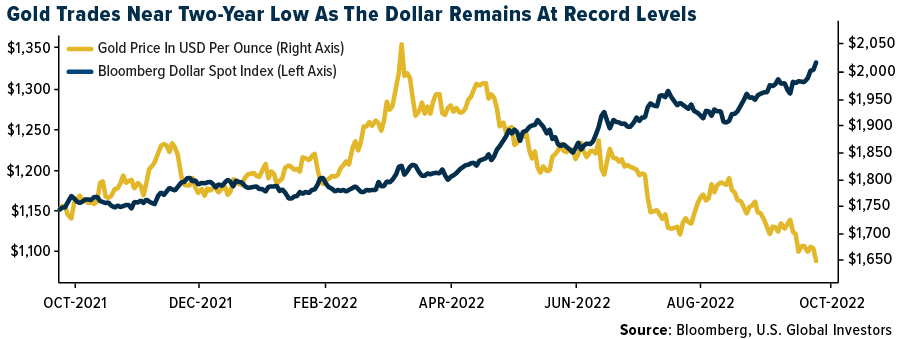

- The best performing precious metal for the week was gold, but still off 1.92%. Gold caught a break on Wednesday when the Bank of Japan intervened in the foreign exchange markets overnight to try and halt the slide in the yen against the dollar. Strength in the U.S. dollar is affecting world trade flows as the dollar is approaching trading levels not seen in the last 20 years. The rapid change has stressed balance sheets.

- Revival Gold reported new drill results for the Beartrack-Arnett Gold Project in Idaho. One of most significant intercepts was 3.49 grams per tonne (g/t) over 115.4 meters, which included 10.12 g/t gold over 11.4 meters. This hole was a 150-meter step out from a previous intercept of 4.34 g/t over 110.6 meters, which included 12.00 g/t gold over 13.7 meters. The continuity of the higher-grade subsection within the larger intercept raises the potential for better improved economics for the project.

- Iamgold Corporation is tracking toward the upper end of its 2022 production guidance of 570-640,000 ounces. The company noted it could have increased production guidance in the second quarter, but due to potential geopolitical risks in Burkina Faso, it remained conservative. Previously reported cost guidance is TCC of $1,100-$1,150 per ounce and AISC of $1,650-$1,690 per ounce.

Weaknesses

- The worst performing precious metal for the week was platinum, falling 4.95%, likely on anticipated weaker auto sales in the near future with an apparent recession playing out. Gold headed for a second weekly decline, reports Bloomberg, after a slew of central banks raised interest rates to cool inflation. Bullion slipped even lower on Friday, as the U.S. dollar climbed to a record.

- CFO Daniella Dimitrov has left Iamgold Corp., and Vice President of Finance Maarten Theunissen has been appointed interim CFO. Management changes add uncertainty, in addition to Cote development issues and liquidity concerns.

- Newmont’s dividend remains a focus point, and it is reasonable to expect upcoming changes, including a net reduction. Management emphasized balance sheet flexibility was the company's priority, and Newmont was in the process of evaluating key variables that affect its capital allocation. These include: 1) reserve pricing for gold, which could be increased from the current $1,200 per ounce by $100-$200 per ounce, and may impact the company’s current base dividend rate, and 2) industry inflation, which remains a factor into 2023, but is viewed as moderating into 2024. When evaluating the dividend, Newmont discussed 3.0% as being a notable threshold for some investors. It is unclear how the base dividend will change, a net reduction in the overall dividend as reasonable to expect at current gold prices.

Opportunities

- Newmont’s near-term capital profile includes high existing spending for the Tanami II and Ahafo North projects, which are guided to provide growth in 2026—the advancement of Yanacocha Sulfides would have exaggerated both near-term spending over 2022-25, and growth in 2026, ultimately increasing near-term cash flow risk. Project deferral reduces Newmont's near-term capital risk profile, enabling the company to smooth its free cash flow (FCF) outlook and potentially sustain the existing dividend at current gold prices of $1,700 per ounce, while capital return sustainability risks could persist at lower gold pricing.

- According to UBS, platinum has diverse end uses; 85%-90% of palladium demand is for automotive catalysts. Since April, there has been a 36% recovery in ICE passenger vehicle sales in key end markets as the pent-up demand created by the order backlog was unwound after the easing of the chip shortage. During the year, UBS has constantly revised its primary platinum supply forecasts lower due to Russia's invasion of Ukraine, disappointing operational updates and the recent two-month delay to the Amplats' Polokwane smelter rebuild.

- Coeur Mining has announced that it has entered into a definitive agreement with AngloGold Ashanti to sell its Crown and Sterling holdings for closing cash consideration of $150 million and deferred cash consideration of $50 million to be paid upon Crown Sterling, attaining a total resource of at least 3.5 million gold ounces.

Threats

- UBS calculates that platinum margins are still close to record levels on a dollar per ounce basis and continues to forecast a gradual normalization in margins back to mid-cycle levels. However, in a falling platinum basket price, coupled with an elevated inflationary environment, there could be a quicker-than-expected normalization in sector margins. While a steepening cost curve could provide some support to prices, the basket price could trade closer to the 50th percentile in a severe cyclical downturn.

- AngloGold Ashanti acknowledged that mergers and acquisitions (M&A) activity is generally difficult to complete, and the best way for the company to add value is through organic growth opportunities. This is underpinned by the recent acquisition of Coeur Mining's Nevada assets in the Beatty district.

- Gold sales in India may suffer this year as inflationary pressures and an erratic monsoon could hurt farmers’ incomes, reducing their ability to buy the precious metal. The livelihood of millions of farmers in the country depends on the annual monsoon, and uneven rains this year could hurt incomes in the farm sector, the biggest buyer of gold in India. An increase in the import tax in July also reduced appetite for the precious metal in the second-biggest consumer.