Strengths

- The best performing precious metal for the week was silver, up 6.58%. Silver ETFs saw inflows last week for the first time in almost six months as short interest retreated from 10-year highs. The outflow of physical silver from vaults also continued in September with levels reaching record lows and down 26% since highs in June 2021. Global ETF holdings of 750 million ounces remain almost 30% off from 2020 highs, but well above pre-pandemic levels around 600 million ounces.

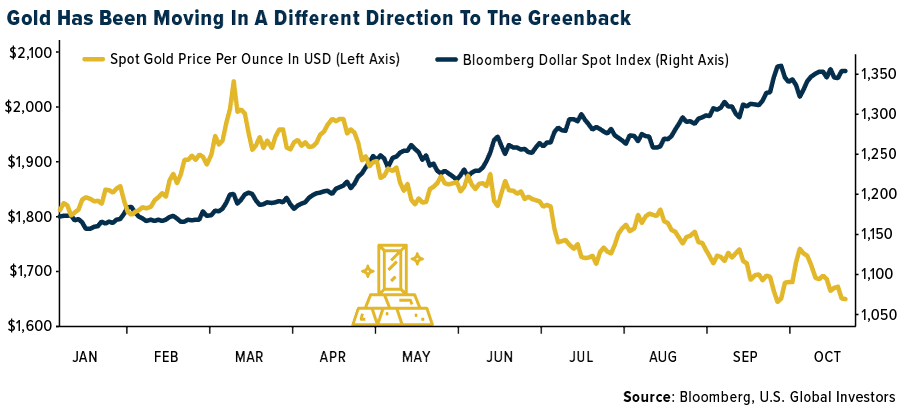

- Gold advanced on weakness in Treasuries and the dollar, as rising fears of a global economic slowdown boost the precious metal’s haven status. The gain comes after bullion last week traded near the lowest level since the end of September, dropping 3% amid expectations of more aggressive rate hikes by the Federal Reserve. On Friday, the BOJ defended its currency, which was off as much as 1%, to push the value of the yen higher by 2%. Consequently, gold rallied more than 1.5% on Friday.

- According to Stifel, IAMGOLD (IMG) announced entering into an agreement with Zijin Mining to sell IMG’s interest in Rosebel Gold Mines for $360 million cash and the transfer of $41 million in liabilities. Stifel believes IMG is getting a reasonable price for an asset that requires significant reinvestment, and it is negative net free cash flow for IMG now. Importantly, this is a material step toward reducing the funding gap to complete Côté.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 0.65%. Wesdome Gold Mines’ production of 22,883 ounces missed consensus of 29,400 ounces as maintenance work at Eagle River and Kiena impacted throughputs during the quarter. Wesdome is targeting the lower end of its 120,000-140,000-ounce guidance in 2022.

- At midweek, gold held a three-week low, reports Bloomberg, as speculation the Federal Reserve will keep aggressively tightening monetary policy and trigger a recession had investors again seeking shelter in the U.S. dollar. Renewed strength in the greenback has now seen bullion tumble more than 20% since a March peak, the article continues.

- Mandalay Resources reported third quarter production of 27,000-30,000 ounces gold which was below consensus of 33,000-37,000 ounces gold. The company has attributed the production miss to lower grades and Covid-related absenteeism. As a result, Mandalay has adjusted its annual production guidance down from 118,000-130,000 ounces gold to 106,000-115,000 ounces gold.

Opportunities

- The London Bullion Market Association gathered in Lisbon for its annual conference. Members from the world’s top bullion traders, refiners and miners always have an annual gold price forecast for one year forward. Despite gold being down about 20% since March, consensus forecast is for gold to trade around 10% higher in one year. The surprise standout was silver which is predicted to boom 50%, as reported by Bloomberg.

- Barrick Gold Corp. President and Chief Executive Mark Bristow says the process of completing the final agreements and legal steps that would enable the development of the Reko Diq project is making steady progress. Once the transaction is complete, Reko Diq, one of the largest undeveloped copper-gold deposits in the world, will be owned 50% by Barrick, 25% by Balochistan province, and 25% by major Pakistani state-owned enterprises.

- B2Gold reported consolidated gold production of 215,000 ounces, 39,000 ounces lower than the consensus of 254,000 ounces. Results were below forecasts at each operation, where Fekola was impacted by the rainy season, Otjikoto's underground ramp-up was delayed, and Masbate processed greater sulfide material. Despite lower third quarter output, the company reiterated full-year corporate production guidance, implying output of 330,000 ounces in the fourth quarter, a considerable 53% improvement quarter-over-quarter.

Threats

- As a result of lower realized commodity prices and potential operational challenges experienced at the asset or a delay in access to higher grades, earrings may be at risk. As margins narrow, royalties/streamers and companies with less exposure to operating and capital cost escalation, such as AEM, could do well.

- St Barbara (SBM) had a weak first quarter, with Gwalia labor issues forcing an 8% gold downgrade to fiscal year 2023 guidance. First quarter gold of 63.7 missed consensus by 9% on Gwalia labor issues and a major storm event at Atlantic. AISC was 13% above consensus at an elevated A$2,490 per ounce. SBM has lowered its fiscal year 2023gh Gwalia mine tonnage expectations to 950,000 tons from 1.1 million tons, with site gold guidance falling 14%.

- Worldwide diesel fuel is in short supply and that is pushing up costs for miners across the globe. Open-pit miners with lots of ore and waste haulage will be impacted the most as few miners, outside of Alamos Gold, have hedged their fuel risks.