- The best performing precious metal for the week was platinum, up 0.56% on positive comments on price outlook by an industry leader. After dropping on Monday, gold climbed back on Tuesday as President-elect Joe Biden is set to unveil plans for a multi-trillion-dollar stimulus package. This could mean huge inflation, which is historically supportive for the yellow metal. Rhodium is on a tear already for the year. Prices now exceed $20,000 an ounce, according to Johnson Matthey Plc data. The precious metal used to clean toxic emissions is soaring on the bet that China will see a recovery in vehicle sales.

- Russia’s $583 billion reserves now consistent of more gold than U.S. dollars for the first time on record. Bloomberg notes gold made up 23% of Russia’s central bank holdings as of the end of June 2020 and the share of dollar assets fell to just 22%, which is down from over 40% in 2018. The move is part of the country’s goal to “de-dollarize” the economy amid U.S. sanctions and growing tensions. Gold is now the second-biggest component of reserves after the euro.

- The World Gold Council (WGC) predicts gold demand in India will rebound this year after more than halving to just 275.5 tons in 2020. The group estimates pent-up demand from delayed weddings and festivals will boost sales. Newmont, the world’s largest gold producer, announced a $1 billion share repurchase plan for a second year, reports Bloomberg. The miner raised its dividend by 60% to 40 cents a share less than three months ago on the heels of higher gold prices boosting returns.

Weaknesses

- The worst performing precious metal for the week was silver, down 2.57% on the fall in gold. Gold slid as much as 1.7% on Monday after suffering its worst three-day decline through Friday since August. “The metal is starting to look precarious,” said Rick Bensignor, president of Bensignor Investment Strategies in a Bloomberg interview, highlighting gold’s failure to move above $1,927 was a major technical miss. The rising U.S. dollar and higher Treasury yields threaten more trouble for the yellow metal.

- UBS Group sees gold weakening to $1,800 by year-end as the macroeconomic backdrop improves and the Federal Reserve signals it will taper its bond-buying program. Analysts including Giovanni Staunovo said low real rates and a weaker dollar should support gold’s recovery to around $1,950 in the first quarter. However, prices may come under pressure mid-year due to modest ETF inflows.

- Hecla Mining announced preliminary results for the fourth quarter and full-year 2020 that estimate gold production fell 23% year-over-year to 208,962 ounces. 2019 was Hecla’s highest gold production on record. The miner did say it expects an increase of 7% in silver ounces from the year prior.

Opportunities

- Peru’s new mining minister Jaime Galvez has vowed to streamline the consultation period prior to granting mining licenses as part of planned reforms to the country’s mining regulations. Peru currently has a $56 billion mining construction portfolio and could continue to grow amid new interest. Precious metals producers such as Rio Tinto, Barrick Gold, Fortuna Silver Mines and Gold Fields could be big beneficiaries. Oro X Mining, a gold explorer already developing projects in the country, now has an even more favorable environment.

- Gold production in Burkina Faso surged to a record 60.8 tons last year, according to the country’s Chamber of Mines, after recovering from a jihadist raid in 2019 that killed 39 employees of Semafo’s operation. Endeavour Mining bought Semafo in 2020 for $690 million in shares. Bloomberg reports Burkina Faso is now Africa’s fourth-biggest gold miner after Ghana, South Africa and Sudan.

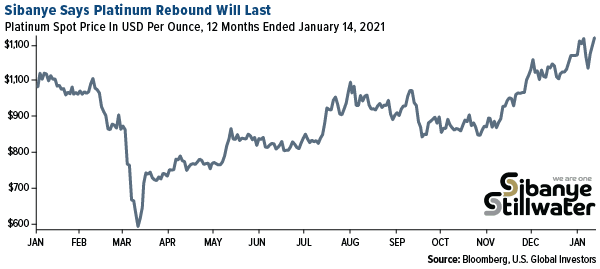

- Sibanye Stillwater, the world’s top platinum miner, said it expects the price of the precious metal to climb more than 80% over the next four to five years as the globally economy improves and supply shrinks. “Platinum has only just started to re-rate and it will continue,” CEO Neal Froneman said. “There is no reason why platinum will not eventually trade at $2,000 an ounce and probably even higher.” Bloomberg reports the metal has nearly doubled since its 18-year low in March due to supply disruptions and growing demand from China for use in pollution-control devices.

Threats

- U.S. retail sales disappointed, falling 0.7% in December after a drop of 1.4% in November. Economists were expecting a decrease of just 0.2%, reports Kitco. Gold fell immediately after the data was released to $1,841 an ounce. The U.S dollar was also higher on Friday morning, sending both bullion and silver lower. A strengthening dollar is a threat for precious metal and commodity prices.

- Chile’s state-owned Codelco, the world’s top copper producer, said it will up precautionary measures against the coronavirus at its mines amid a recent increase in infections. This is a cautious sign that other miners might need to take similar measures. Rising virus cases worldwide remains a threat to miners of all types who might face another round of lockdowns.

- Members of Arizona’s San Carlos Apache tribe filed a property lien on Thursday in an attempt to regain control over land the U.S government is set to give to Rio Tinto for its copper mine, reports Reuters. The tribal members say the government has illegally occupied the land for more than 160 years and does not have the right to give it to anyone.