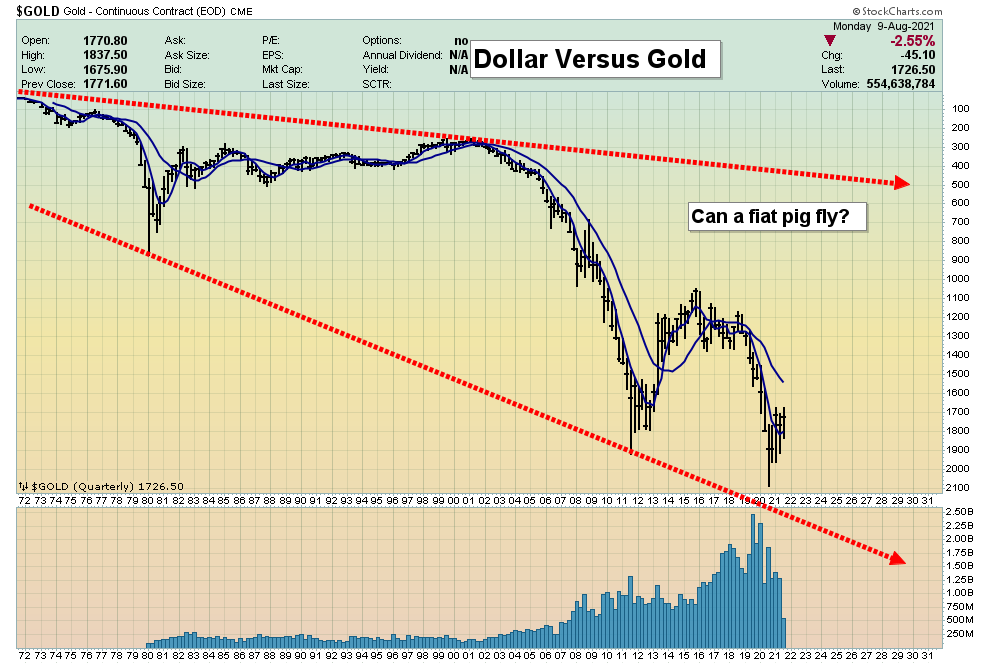

- To view what is arguably the most important chart in the world:

- The dip in the gold price over the past few days doesn’t change anything on this long-term chart. The bottom line is this: As money, gold is clearly superior to fiat.

- A lot of new investors to gold try to compare it to the stock market. That’s a mistake; gold is a currency, and it should be compared with other currencies.

- Please click here now. Double-click to enlarge. Bitcoin is also a currency. It’s superior to fiat… and inferior to gold.

- Subscribers to my crypto palace newsletter made 50% in just three weeks by taking action around my $30,000 major buy zone. They have even bigger profits in many of the alt coins.

- Bitcoin has outperformed gold and probably will continue to do so, but that doesn’t make it the ultimate currency that gold is.

- I regularly urge crypto investors to put most of their enormous profits into gold currency rather than into risky government fiat.

- What about gold stocks? Well, conspiracy buffs are concerned about naked shorting.

- That concern may be valid, but even in the 1980s and 90s, most gold stocks acted more like trading vehicles than something to buy and hold.

- Please click here now. Double-click to enlarge what I consider to be the second most important gold chart in the world.

- I’ve established key “gridline rules” for gold stock investors, and rule number one is to focus most buying on weekly chart support zones for gold bullion.

- I tweak that buying with the 14,5,5 Stochastics series oscillator and the 5,15 moving averages. There are currently no “green shoots” in play, but it’s only a matter of time before those shoots begin to sprout.

- Since gold reached major resistance in the $2000 area last summer, it’s traded at two major support zones ($1778 in November 2020 and $1671 in March 2021).

- Investors who bought miners there got fast profits of about 20%-30% in the intermediates and seniors, and more in the juniors.

- Time in the market is time that an investor’s money is exposed to potential reward, but it’s also time that their money exposed to substantial risk.

- If a mining stock investor can make 40%-60% (and more with juniors) a year by exposing their fiat or gold bullion capital to mining stock risk for just 3-4 months of a calendar year, does that make more sense than just a buy and hold approach to betting on inflation and America’s demise? I think so!

- Please click here now. There’s no question that inflation is going to be a major long-term problem for America (and the world), and so is the horrifying debt.

- The biggest problem is fiat itself. Fiat money is the enabler of debt, inflation, war, and the welfare state. In a nutshell, 99% of the problems that plague America (and most nations including China and India) can be traced back to… government fiat money.

- When debt, inflation, and other problems reach “flashpoints” as gold trades at major weekly chart support, investors have a strong wind at their backs.

- Please click here now. Double-click to enlarge this shocking long-term XAU gold stocks index chart. The XAU is currently trading where it was in 1984, almost 40 years ago!

- Long-term investors correctly believe the American empire is being destroyed by its fiat currency obsession, but if their buy and hold focus is the miners rather than gold bullion, most of them have not been financially rewarded and may have losses.

- On the other hand, investors who followed my gridline rules for the miners have performed incredibly well. They are ready for the next major opportunity I have outlined for them… at either $1566-$1450 or $2089-$1966.

- Please click here now. Double-click to enlarge this GDXJ “money train” chart. The money train is not at a gold bullion support zone “train station”. There’s no need for investors to board the train… yet!

- A stock market sell-off in September or October could see gold reach $1566. A debt ceiling fiasco could see a surge to $2089. These are the big fundamental events and the key numbers for gold. Investors are eager for action… and odds are high that the action is imminent!

Thanks!

Cheers

St