You’ve got to give credit to Visa, Mastercard, Discover and Amex. They’ve managed to build one heck of a booming economy.

Despite surging price inflation, “resilient” American consumers have managed to keep spending money, driving “strong” economic growth – thanks to their credit cards.

But there's a problem. Americans are having an increasingly hard time keeping up with the bills.

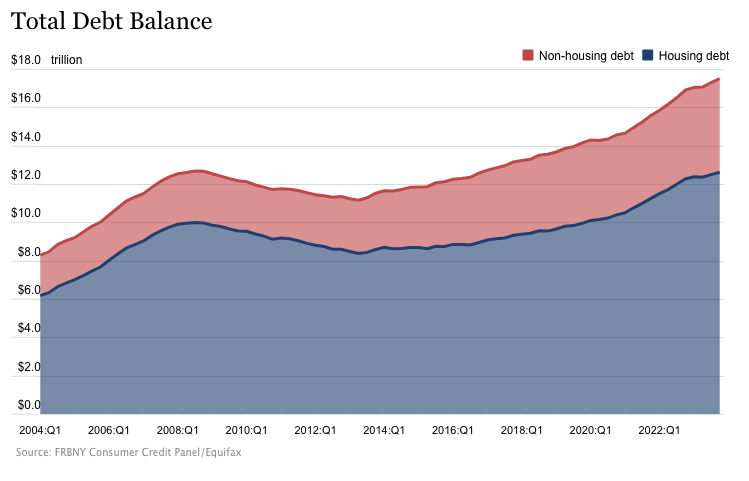

Household debt rose by another $212 billion in the fourth quarter of 2023, surging to a record $17.5 trillion, according to the latest data from the New York Fed.

Total household debt has increased by $3.4 trillion since the end of 2019.

Ballooning credit card balances led the way, increasing by 4.6 percent to $1.13 trillion.

On an annual basis, credit card balances rose by $143 billion.

The bigger problem is the double whammy of rising debt and rising interest rates. Average credit card interest rates eclipsed the previous record high of 17.87 percent months ago. The average annual percentage rate (APR) currently stands at 20.75 percent.

It’s clear that Americans have used credit cards to keep up with the bills as price inflation ate up their real earnings.

During the pandemic, consumers used stimulus money and generous unemployment benefits to pay down debt and bulk up savings.

Credit card balances stood at over $1 trillion when the pandemic began. They fell below that level in 2020, charting an 11.2 percent drop. There were small upticks in credit card balances in February and March of 2021 as the recovery began, but another round of stimulus checks rolled out in April driving another sharp drop in credit card debt. However, Americans started borrowing in earnest again in May 2021 and have added billions to their credit card balances month after month ever since.

Meanwhile, unable to leave their houses due to government lockdowns, but with money still flowing thanks to government stimulus Americans filled up their piggy banks. Aggregate savings peaked at $2.1 trillion in August 2021.

It didn’t take long for consumers stressed by inflation-driven price hikes to blow through that savings.

As of June, the San Francisco Fed estimated that aggregate savings had dropped to $190 billion. In other words, Americans ran through $1.9 trillion in savings in just two years.

"People have to deal with this somehow. After blowing through savings to buy essentials, they do what’s next: Find sources to borrow,” Villanova University finance professor John Sedunov told ABC News earlier this year.

On top of borrowing on credit cards, Americans are pulling equity from their homes to make ends meet. Balances on home equity lines of credit (HELOC) increased by $11 billion in Q4. It was the seventh consecutive quarterly increase since Q1 2022. According to the New York Fed, there is now $360 billion in outstanding HELOC loans.

- Americans haven’t just been borrowing using credit cards. Every debt category increased in the fourth quarter.

- Mortgage balances increased by $112 billion and stood at $12.25 trillion at the end of the year.

- Auto loan debt rose by $12 billion to $1.61 trillion in Q4 and stands at $1.61 trillion.

- Other consumer debt balances, including department store credit cards and other consumer loans, grew by $25 billion.

- Student loan balances were comparatively flat in Q4, rising by $2 billion.

In a single sentence, the economy is nowhere near as strong as the soft landing crowd thinks. Other than mortgages, this data is very recessionary. Consumers are struggling to maintain lifestyles and using credit cards to do so.

Rising Debt Is Putting Strain on American Consumers

The problem with financing economic growth with borrowing is that it’s expensive and credit cards have an inconvenient thing called a limit.

And Americans are clearly starting to feel the strain.

According to the New York Fed, delinquencies increased in every debt category during the fourth quarter.

Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.

Aggregate delinquency rates rose by 3.5 percent, with approximately 8.5 percent of credit card balances and 7.7 percent of auto loans transitioning into delinquency.

Serious delinquencies (more than 90 days past due) are the highest since 2011.

According to the Consumer Financial Protection Bureau, nearly one-tenth of credit card users find themselves in “persistent debt.” This means they rack up more interest and fees each year than they pay toward the principal.

"In the case of credit cards, it looks like things have reverted to a level that is worse than pre-pandemic," New York Fed analysts told reporters on a conference call.

Trouble in Paradise?

There are signs that Americans are reaching their limit.

Credit card borrowing suddenly fell off a cliff in December, according to the latest data from the New York Fed released by the Federal Reserve.

Revolving credit, primarily credit card debt, only rose by 1 percent in December, following on the heels of a massive 16.6 percent increase in November.

Non-revolving credit, including auto loans, student loans, and borrowing for other big-ticket items has been slowing for months, indicating Americans buried in debt are feeling the strain. In December, non-revolving credit rose by just 0.2 percent. On average, non-revolving debt has increased by 5 percent on an annual basis.

The plunge in non-revolving credit indicates consumers have cut back spending on big-ticket items. And now it appears they might be close to maxing out the credit cards.

If Americans can’t borrow anymore, how will the economy continue to “grow?”

The ugly truth is debt is creating an illusion of prosperity and economic growth.

There is a word for this.

Unsustainable.