Could restoring a depleted stash of critical minerals help to bolster security of supply, while also assisting in the energy transition?

US recognition of the importance of critical minerals goes back over 100 years.

In World War I, severe material shortages (tungsten, tin, chromite, optical grade glass, and manila fiber for ropes) played havoc with production schedules and caused lengthy delays in implementing programs. This led to development of the Harbord List — a list of 42 materials deemed critical to the military.

National Defense Stockpile

By 1940, small amounts of chromite, manganese, rubber and tin were procured under the Strategic Materials Act. The purchases certainly weren’t enough and all throughout the war effort these and numerous other materials had to be imported in large quantities.

After World War II, the United States created the National Defense Stockpile (NDS) to acquire and store critical strategic materials for national defense purposes. The Defense Logistics Agency Strategic Materials (DLA Strategic Materials) oversees operations of the NDS and their primary mission is to “protect the nation against a dangerous and costly dependence upon foreign sources of supply for critical materials in times of national emergency.”

In 1984, US Marine Corps Major R.A. Hagerman wrote: “Since World War ll, the United States has become increasingly dependent on foreign sources for almost all non-fuel minerals. The availability of these minerals has an extremely important impact on American industry and, in turn, on US defense capabilities. Without just a few critical minerals, such as cobalt, manganese, chromium and platinum, it would be virtually impossible to produce many defense products such as jet engines, missile components, electronic components, iron, steel, etc. This places the U.S. in a vulnerable position with a direct threat to our defense production capability if the supply of strategic minerals is disrupted by foreign powers.”

Despite this, in 1992 Congress directed that the bulk of the strategic and critical materials the US had accumulated in the National Defense Stockpile be sold.

The primary purpose of the National Defense Stockpile was to decrease the risk of dependence on foreign or single suppliers of strategic and critical materials used in defense, essential civilian, and essential industrial applications.

While much of the rest of the world was scrambling to tie up control of strategic minerals, America deliberately hamstrung itself.

Things began to change under former President Trump, and it had to — at the time the US was 100% reliant on imports of 13 critical minerals.

In 2017 Trump signed an executive order to encourage the exploration and development of new US sources of these metals.

In December 2017, the U.S. Geological Survey released its Professional Paper 1802 titled “Critical Mineral Resources of the United States— Economic and Environmental Geology and Prospects for Future Supply”.

The report represented the US government’s most comprehensive assessment of the nation’s mineral resource profile and potential, serving to inform federal mineral policy. The report lists 23 metals and minerals that are critical to “the national economy and national security of the United States.”

In 2018, the US Government’s Critical Minerals List was published.

In 2021, President Joe Biden signed an executive order (EO) aimed at strengthening critical US supply chains:

“The United States needs resilient, diverse, and secure supply chains to ensure our economic prosperity and national security. Pandemics and other biological threats, cyber-attacks, climate shocks and extreme weather events, terrorist attacks, geopolitical and economic competition, and other conditions can reduce critical manufacturing capacity and the availability and integrity of critical goods, products, and services.”

The EO identifies three technology sectors as critical supply chains:

- Advanced semiconductors

- High-capacity batteries, including electric vehicle (EV) batteries

- Pharmaceuticals

The EO also identifies “critical minerals and other… strategic materials” as a fourth supply chain, essential to technology manufacturing and the defense industrial base.

New light was cast on the National Defense Stockpile when China decided last year to restrict the export of gallium and germanium — which could have affected production of everything from military satellites to missiles and night-vision goggles.

While a crisis was averted when exports resumed, the incident once again highlighted US dependence on foreign, in this case Chinese suppliers, and it was noted that years of budget cuts had shrunk the National Defense Stockpile to historic lows.

The stockpile was valued at just $912 million in March, 2023, compared to an inflation-adjusted peak of $42 billion at the start of the Cold War in the 1950s, a 2021 Heritage Foundation report found.

According to a recent Bloomberg story, Officials have rushed around the globe to negotiate deals with key allies, while behind the scenes US diplomats are cajoling Western miners to expand investment in the copper and cobalt-rich Democratic Republic of Congo, where China dominates production. The Biden administration also intends to team-up with the European Union to bolster efforts to gain some control over global supplies, while it funnels billions of dollars into projects to create a domestic mining and refining raw material supply chain.

Moreover, industry executives are urging Washington to develop a more nimble stockpiling program, similar to China’s National Food and Strategic Reserves Administration, also known as the State Reserve Bureau. Unlike the US, Beijing regularly purchases materials within the SRB when prices are low, such as $270 million worth of cobalt last year.

In December, Congress passed a new National Defense Authorization Act, giving the Defense Logistics Agency (DLA) freedom to make purchases without congressional approval previously needed. It also promises a billion dollars a year in future funding.

But the stockpile must still receive annual approval for appropriations and renewal of the DLA’s funding is not guaranteed. After a new crop of lawmakers is installed in January, 2025, who knows what could happen.

Bloomberg quotes an expert who says the National Defense Stockpile should function more like the Strategic Petroleum Reserve, of which the Biden administration sold off nearly half last year, to limit rising oil prices following Russia’s invasion of Ukraine.

“It’s easier to increase the stockpiling than it is to get projects online that can take years or even decades,” said Gregory Wischer, principal at Dei Gratia Minerals, a Washington DC-based consulting firm.

“Stockpiling,” he adds, “will be a very powerful tool to support an energy transition in the United States.”

Cobalt and the DRC

Cobalt was one of the first metals sold from the NDS in the 1990s. While the new National Defense Authorization Act allows the DLA to strike supply deals with domestic refineries, and several companies are working to build refineries in the North America, market volatility has made fundraising difficult.

Also, the only domestic US cobalt mine has been shuttered for more than a year due to low prices.

Even though EV sales have slowed, demand for cobalt, used in electric vehicle battery cathodes, is expected to double by 2030.

The need for cobalt is thus pushing US government officials to the DRC, where 70% of the metal is mined — much of it illegally, and under deplorable conditions including the use of child labor.

The DRC just turned the screws on cobalt supply

According to Bloomberg, after receiving $1 billion from Congress in 2021, to avoid a funding crisis that would have seen the NDS reach a breaking point by 2025, officials traveled to South America, Africa and Southeast Asia, trying to build diplomatic relations with countries rich in critical minerals.

(As we know, the Biden administration prefers to leave “dirty” mining and mineral processing to foreign countries, and instead invest in cleaner, more upstream activities like battery EV manufacturing.)

Efforts to secure cobalt supplies have so far focused on the Congo. The problem is that many Western companies have left the country after what Bloomberg describes as a slew of problems—from asset seizures to billion-dollar corruption cases—cemented Congo’s reputation as one of the world’s most risky mining jurisdictions.

For example, Freeport-McMoRan sold its majority stake in the Tenke Fungurume cobalt-copper mine to China’s CMOC Group in 2016.

Now, the story goes on to say, US officials have been deployed to convince people that times have changed. (Yeah, right — Rick)

This includes Helaina Matza, who oversees Biden’s infrastructure investment program, visiting several mining projects in Congo in October, 2023; and encouraging financing for copper and cobalt assets in the region.

Washington has also agreed to help finance parts of the $2.3 billion project to rebuild and expand the Lobito railway corridor, the copper belt in Zambia and Congo, to Angola’s Atlantic Coast, Bloomberg states.

Funny how the Biden administration is seeking security of cobalt supply in a country that consistently ranks poorly on the UN Human Development Index (HDI), which represent an annual assessment of measures of progress in human well-being. Countries at the bottom of the list suffer from inadequate incomes, limited schooling opportunities and low life expectancy rates due to preventable diseases such as malaria and AIDS.

In a previous article, we wrote that life expectancy in the Democratic Republic of Congo is less than 48 years, one of five children will die before age five, and almost 60% of the country’s 71 million people live on less than $1.25 per day.

The DRC is also racked by political violence in eastern Congo, where clashes between the DRC’s army and Rwanda’s Tutsi-led rebels have killed many people and displaced hundreds of thousands.

On Tuesday, it was reported that Prime Minister Jean-Michel Sama Lukonde resigned, and the government was dissolved, after France said earlier in the day it was “very concerned” about the situation in the eastern part of DRC and called on Rwanda to cease its support for the M23 rebel group, which has recently stepped up its offensive.

Government incentives in Canada

With an abundance of battery metals and cheap hydroelectric power, particularly in Quebec and British Columbia, Canada is uniquely positioned to become an EV leader, from the mining and processing of metal ores, all the way up to the manufacture and assembly of electric vehicles.

The Liberal government has said it is planning on spending CAD$400 million to build 50,000 electric vehicle charging stations, on top of half a billion Canadian dollars for charging infrastructure through the Canada Investment Bank and $1.7 billion to extend an incentive program for EV purchasers.

According to the president of the Canadian Vehicle Manufacturers Association, Canada will need 4 million charging stations by 2050, 80 times higher than the 50,000 currently targeted.

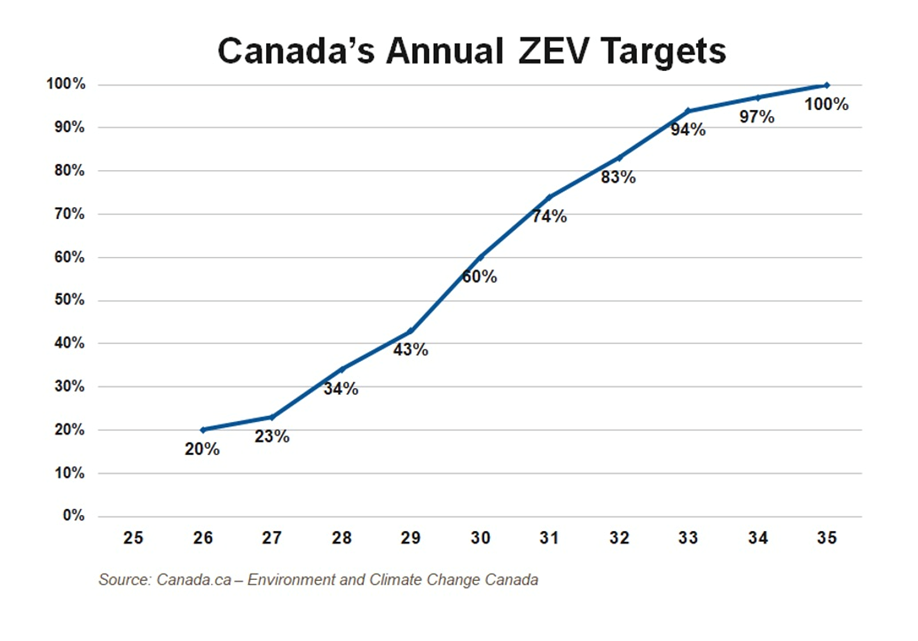

The large spending package is part of the government’s plan to require that 20% of new light-vehicle sales in Canada be zero-emissions by 2026. After 2026, the government’s mandate will require that at least 60% of sales are zero-emission by 2030 and 100% by 2035. The stated goal is to phase out gasoline-powered cars by 2040.

Swedish battery producer Northvolt and German car manufacturer Volkswagen are both receiving billions in Canadian federal and provincial funding to build battery factories in Canada.

The country plans to boost its energy security by improving its permitting processes, thus lowering the time it takes to develop new critical mineral mines by nearly a decade.

Ottawa is focused on six minerals needed to make electric vehicles and wind turbines: lithium, graphite, nickel, cobalt, copper, and rare earth elements.

Energy Minister Jonathan Wilkinson told Reuters on Tuesday that the government is looking at cutting regulatory and permitting processes from 12-15 years down to five.

To cover the cost of these changes, Ottawa is putting in place investment tax credits, and funds are being made available for mining infrastructure like transmission lines and roads.

British Columbia, meanwhile, has taken the first step in developing a strategy to mine critical minerals in the western-most province.

At the AME Roundup 2024 conference, BC Premier David Eby said “The world needs a stable, free, democratic, high-standard producer of the metals and minerals needed to battle climate change. That gives B.C. a generational opportunity to seize, one where we can be prosperous and protect the planet for our kids at the same time.”

Key initiatives include: establishing a new BC Minerals Project Advancement Office to expedite critical mineral projects and maximize federal funding opportunities; creating a BC critical minerals atlas; and starting a new BC Energy and Mines Digital Trust project that ensures high ESG standards and invites mining companies to be more transparent about where and how their products are made.

While BC’s mining sector welcomed the strategy, some said the initial phase does not go far enough when it comes to making the province competitive with other mining jurisdictions.

“To unlock BC’s critical minerals potential, the province needs competitive fiscal and regulatory policies to attract and retain investment in our sector,” said Mining Association of British Columbia (MABC) President and CEO Michael Goehring. “BC’s mines and smelters operate in a high-cost environment due to complex resource geology and challenging geography.”

An economic impact analysis prepared by the Mining Association of British Columbia, and quoted by Mining News North, estimates that 14 critical minerals projects and two mine extensions could generate nearly CAD$800 billion in wages, taxes and other economic benefits over a little more than two decades.

One area of alignment between the BC government and mining industry is exploring the potential for extracting critical minerals from mine tailings.

A new Geoscience B.C. program, also introduced at Roundup, supports a province-wide study to identify concentrations of these minerals in mine tailings and waste rock, that could be economically extracted.

By-product critical minerals include tellurium found in gold deposits, rhenium and cobalt with copper, and gallium and germanium with zinc.

Source: Mining Association of British Columbia

Source: Mining Association of British Columbia

Challenges

Canada’s ambitious EV targets, and those of other countries, including the United States, the EU and China, are admirable, but the reality is that meeting them will require more critical minerals than are currently in the production pipeline, states a recent article authored by Chantelle Schieven, head of research at Toronto-based Capitalight Research.

To meet international EV adoption targets, the world will need 50 new lithium mines, 60 new nickel mines and 17 new cobalt mines by 2030, according to the International Energy Agency (IEA). Cathode materials, anode materials and battery cells will also require additional raw material, adding up to about 388 new mines, it says.

Schieven goes on to say that unrest in Mexico, Peru and China has led to strikes and temporary mine closures, but the main supply constraint for critical minerals is the need for more mine production and new infrastructure for refining minerals.

Compounding the problem is the recent decline in battery metals prices. This is further delaying mining projects due to lack of capital. She says If prices don’t recover, it will deepen shortages of materials in the coming years, putting the brakes on governments’ ambitious agendas to decarbonize their economies.

To avoid this from happening, Schieven says Ottawa could improve the chances of developing successful domestic supplies by making all steps of mine study, metallurgy, and materials testing in battery and vehicles eligible for flow-through tax credits until 2030…

To date, government incentives outlined in The Canadian Critical Minerals Strategy appear to help manufacturers (i.e. funding for processing plants and auto manufacturers) more than miners…

The plans announced to date are a start, but more action is needed on already outlined plans, such as reducing red tape between federal, provincial and local governments, and increasing incentives (and longer time horizons) for investors.

A junior resource company’s place in the food chain is to acquire projects, make discoveries and hopefully advance them to the point when a larger mining company takes it over. Discoveries won’t be made if juniors aren’t out in the bush looking at rocks.

Juniors are extremely important to major mining companies because they are the firms finding the deposits that will become the next mines. In this way, juniors help the majors to replace the ore that they are constantly depleting in their operating mines.

One source points out that senior miners have been allocating a relatively small portion of their revenues to exploration spending, with most expenditures invested in developing existing mines and measures to reduce operating costs.

If the seniors aren’t exploring, it falls to the juniors to do it. But junior mining financing has pretty much dried up; global exploration budgets in 2021 were half of what they were in 2012. Since it can take up to 20 years to go from discovery to mining you can see we are squarely behind the eight ball in our efforts.

Capital expenditures in mining fell from approximately $260 billion in 2012 to $130 billion in 2020 (corresponding to 15% and 8% of industry revenues, respectively), McKinsey & Company found.

Miners themselves have also tightened their purse strings. In 2022, the 40 largest mining companies invested a total $75 billion, equivalent to only a quarter of EBITDA (earnings before interest, taxes, depreciation and amortization). The world’s largest miner, BHP, invested $8.8 billion last year, less than half what it spent in 2013.

According to The Economist, one reason mining companies have become so stingy is to win back the confidence of investors who were hurt badly when the mining boom of the 2000s and 2010s went bust.

Instead of splashing the cash on new projects, companies are expanding or selectively acquiring existing sites. They are also returning profits to shareholders, in the form of dividends and stock buybacks.

The Economist notes that miners and their cautious investors aren’t the only reason for the lack of activity. The rising cost of labor and equipment has squeezed returns, miners are expected to do more to minimize environmental impacts, and permitting remains a lengthy process — often delaying projects and adding uncertainty.

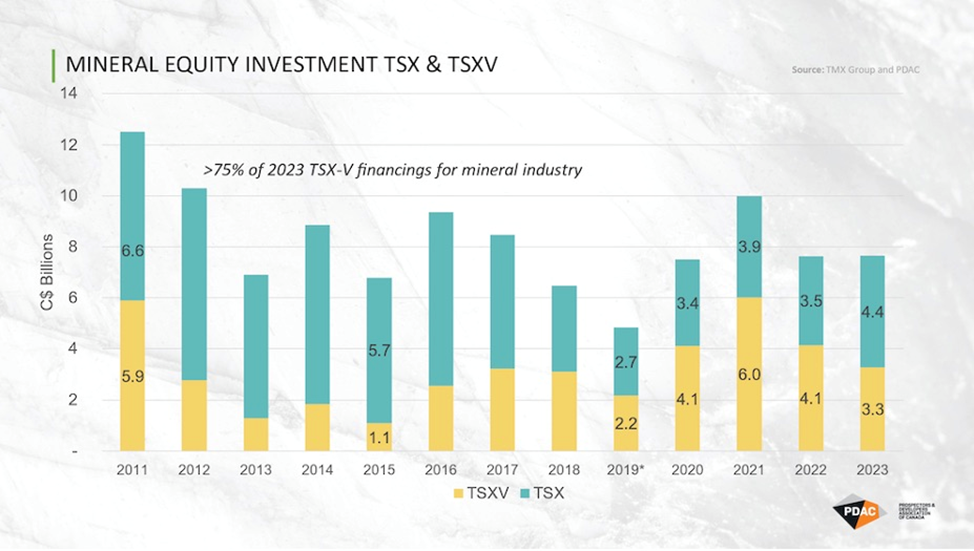

Last year for the first time in a decade, there wasn’t a single financing about $125 million on the TSX Venture Exchange, according to data from the Prospectors and Developers Association of Canada (PDAC). Deals at the $200M level were previously common.

Moreover, Total financing on the TSX Venture has fallen for three years running, with the exchange falling far behind the main board in equity raised for the first time since 2017. Last year, the gap between the two grew to C$1.1 billion.

Source: PDAC

Source: PDAC

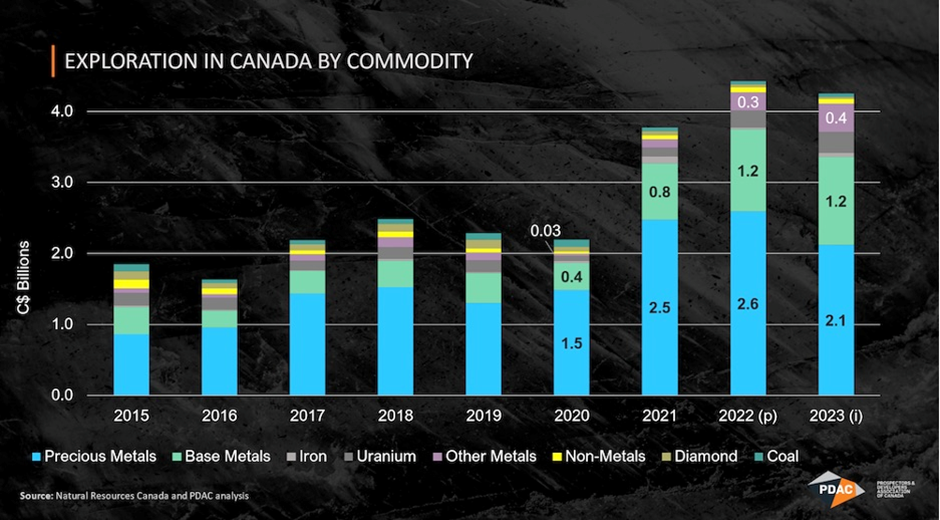

Positively for the energy transition, while precious metal exploration still draws the lion’s share of funding, with $2.1 billion raised last year, PDAC figures show capital for base and battery metals has roughly tripled since 2020 to nearly $2 billion, while funding for precious metal exploration shrunk by 19% last year. (Mining.com, Feb. 18, 2024)

Source: PDAC

Source: PDAC

Alisha Hiyate, editor-in-chief at The Northern Miner, notes the federal government has recently put in place policies and incentives that amount to end-to-end supports for mineral companies, from exploration through to project construction.

The packages are part of its Critical Minerals Strategy, introduced in late 2022, which commits C$3.8 billion in total spending.

But PDAC says the CAD$1.5 billion Critical Mineral Infrastructure Fund should remove the seven-year timeline and make it a perennial fund.

Also, PDAC wants to ensure that the Clean Technology Manufacturing input tax credit can be applied to polymetallic projects that may contain precious metals and critical minerals.

Finally, PDAC will be taking part in discussions about how to prevent short-sellers from targeting junior miners. In 2021, the organization called for an alternative uptick rule that would prevent short-selling in a stock that dropped more than 10% in one day, bringing Canada in line with US regulations.

“We’ve been asking for what we think are logical changes to regulations around short selling for several years,” Jeff Killeen, policy and program director for PDAC, said in an interview for the Mining.com article.

Conclusion

The global shift from a world run on fossil fuels, to one powered by renewable energies and electrification, means an even greater need for the minerals that go into these new technologies.

The World Bank projects the need for a 500 percent increase in graphite, cobalt, and lithium production by 2050. In 2022, one estimate claimed that approximately 700 million metric tons of copper would be needed over the next 22 years to reach sustainable economic growth targets—roughly the equivalent to what has been mined over the past 5,000 years of human history. Still other projections find that more than 300 new mines extracting critical minerals will be needed by the year 2030 to prevent a crippling supply shortage…

While 2023 was a challenge for many mineral commodities, mostly due to less demand from China, and the unsubstantiated threat of a recession, 2024 could see an improvement.

Macquarie Group’s analysis of January’s purchasing managers’ index (PMI) data shows that new global manufacturing orders rose 1.2% to 49.8. The Northern Miner’s Henry Lazenby recently wrote,

Contrary to expectations of a downturn due to policy tightening, US goods demand shows signs of re-acceleration, suggesting a potential soft landing or the end of an economic downturn.

He quotes Macquarie’s head of commodities strategy, Marcus Gavey, saying that now is an opportune time to invest in commodities, especially in cases where market positions are becoming increasingly bearish.

Jeff Currie, who spearheaded commodities research at Goldman Sachs for almost three decades, and correctly predicted the China-driven commodities boom of the 2000s, is bullish on the sector.

In an interview with Bloomberg Television, the veteran analyst said demand is at record levels, inventories are low and spare production capacity is largely exhausted.

“The set up for all of these markets is better than it was last year,” and if central banks proceed with interest rate cuts “you’re teeing yourself up for a fantastic 2024,” Currie said. “This is just classic ‘own commodities.’”

Richard (Rick) Mills