Consumers and workers across the United States and globe regularly complain about the rising cost of living, and wages that don’t—and haven’t—keep pace with inflation.

They blame billionaires for income inequality, corporations for price-gouging and politicians for refusing to increase the minimum wage. Some of their arguments and criticisms are valid.

Stuart Englert's Substack is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

But what most people—minus the majority of precious metal stackers—don’t know or understand is that the primary and underlying cause of rising prices is perpetual expansion of the currency through excessive credit creation.

While supply and demand dynamics can and do contribute to higher costs of goods and services, they’re only a part of the equation in a financial and monetary system without a foundational and stabilizing anchor that limits credit and currency creation.

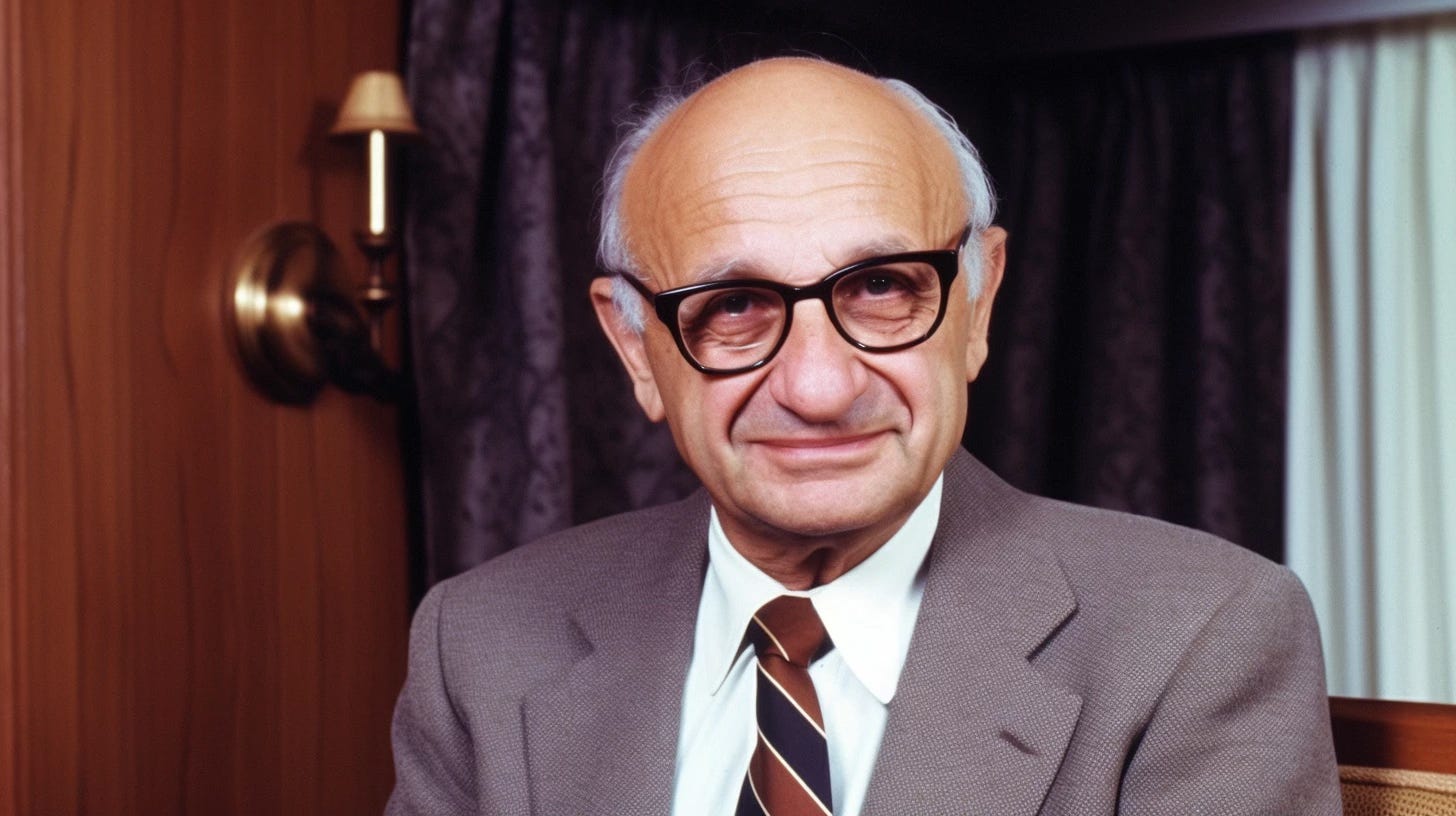

Nobel Prize-winning economist Milton Friedman simplified the obscure and perplexing reality. “Inflation is always and everywhere a monetary phenomenon,” he said during a 1963 lecture titled “Inflation: Causes and Consequences” in India.

In other words, prices are destined to rise whenever the issuance of credit and currency exceeds the availability and production of goods and services. Stated another way, inflation results when currency creation outpaces—and consumer demand chases—too few of the things that people desire and purchase.

While Friedman wasn’t a fan of the classical gold standard, he well understood the inflationary defects and destabilizing effects of government-controlled fiat currency when its creation exceeds real economic growth.

Fiat currency, for those that don’t know, is government-decreed money not redeemable for a physical commodity such as gold or silver. The unbacked, debt-based currency’s value is derived by government edict, and public and investor confidence that the mandated medium of exchange possesses value, which can be lost when its purchasing power incessantly or rapidly declines.

Precious Metals Restricted Excessive Borrowing & Spending

For much of human civilization, gold and silver acted as a monetary pillar, limiting credit expansion and growth of paper currency. That’s because extracting precious metals from the earth is labor-intensive, processing and refining them into coins and bars is time-consuming and costly, and gold and silver are produced in limited quantities.

Since financial institutions and moneylenders were inclined to issue more banknotes and credit than they had redeemable metal in their vaults, commodity-backed currencies weren’t infallible or perfect. Nonetheless, the finite quantity of gold and silver placed constraints on excessive borrowing and spending of government-issued and mandated money.

Even with their shortcomings, paper currencies backed by gold or silver imposed a level of accountability and honesty. The monetary metals helped expose fraud by central banks and lending institutions that issued credit and currency beyond their bullion holdings, and revealed financial malfeasance of profligate politicians whose spending exceeded incoming tax revenue.

Bankers and politicians gradually removed gold and silver from the financial and monetary system in the 19th and 20th century to spur economic growth and further increase the size of government. The move allowed lenders to issue more credit, earn greater profits and fuel the debt-based economy. Governments, meanwhile, could borrow greater sums and finance larger deficits to fund wars and social programs in efforts to exert power and control over other nations and their own citizenry.

Because the quantity of paper and digital currencies is virtually unlimited, their value as mediums of exchange was inextricably undermined when they no longer were backed by, or redeemable for, the monetary metals.

By eliminating precious metals as circulating legal tender and currency backing, the promoters and pushers of paper banknotes—including Federal Reserve Notes—ensured their loss of purchasing power and higher prices of most everything. Make no mistake, inflation is baked into the fiat cake.

The Inflation Fight Is Futile with Fiat

During periods of spiraling prices, central bankers and politicians purport to fight inflation by raising interest rates to slow lending, and curb public borrowing and spending. The claim is a ruse since banks and governments are responsible for creating inflation in the first place, and the debt-based monetary system they established and administer requires perpetual credit and currency expansion to survive.

The self-perpetuating system is similar to a Ponzi scheme that requires an ever-larger number of investors to prevent collapse.

Those who manage the nation’s money know price deflation is a depressionary death knell for fiat currencies. Therefore, the intent is not to eliminate monetary and price inflation, but merely to manage and limit its rate of growth.

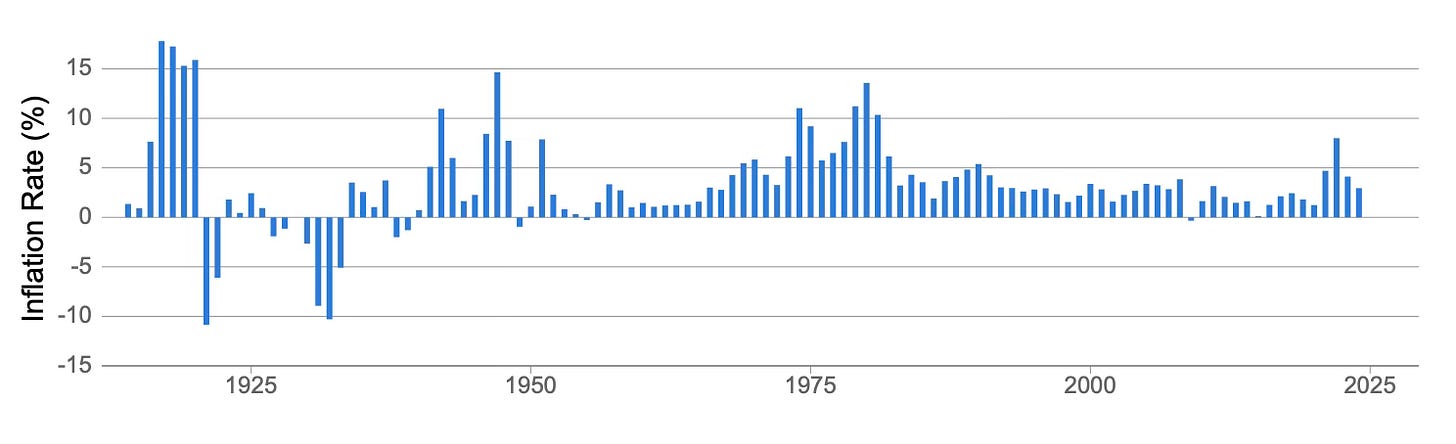

The Federal Reserve claims to target a 2 percent annual inflation rate, though the official rate since the central bank’s creation in 1913 has averaged more than 3 percent a year.

If a currency depreciates by 3 percent a year, it will lose 95 percent of its purchasing power in 100 years. So, over a lifetime, an average wage earner’s savings in depreciating U.S. dollars or other fiat currencies won’t be sufficient to sustain his or her lifestyle in retirement unless he or she earns a comparable interest rate or return on investment.

Savvy savers safeguard a portion of their nest egg by acquiring precious metals, which unlike fiat currencies retain value over time despite clandestine efforts by Western banks and governments to suppress gold and silver prices as documented by the Gold Anti-Trust Action Committee (GATA) over the last three decades.

Moreover, official inflation estimates calculated by the Bureau of Labor Statistics through its Consumer Price Index (CPI) understate the rising cost of living to conceal the extent of currency devaluation. The index doesn’t take into account all household expenses and outlays, including financing charges, income and property taxes, and investments such as bonds, stocks and new home purchases.

Because of these exclusions and numerous revisions in CPI methodology over the years, some economic analysts, including John Williams at ShadowStats and David Ranson of HCWE & Co., conclude consumer inflation is considerably higher, even two to four times the rate reported by the U.S. government.

Providing a Trustworthy Alternative to Depreciating Dollars

Since fiat currency is an inherently unreliable store of value, fated to debasement and loss of purchasing power, sound money proponents propose returning the nation’s currency to its constitutional roots by adhering to the highest law of the land.

Article 1, Section 10, Clause 1 of the U.S. Constitution states “No state shall . . . make any Thing but gold and silver coin a tender in payment of debts.”

In a digital age with the majority of financial transactions completed electronically, it’s unlikely consumers will carry around silver and gold coins in their pockets and purses to purchase gasoline and groceries in the future, much less heavy bars and coinage sufficient to buy cars and homes. Unless, of course, the electrical grid is down for an extended period or civilization degenerates into a post-apocalyptic Mad Max scenario.

New mechanisms and methods have been—and are being—devised to exchanges gold and silver, be they a gold-infused currency such as Goldbacks or tokenized silver such as Kinesis’ KAG.

Citizens for Sound Money (C4SM) and the Sound Money Defense League (SMDF) are working to restore gold and silver as the nation’s foundational currency at the state level. By removing sales and capital gains taxes from precious metals, and getting state legislatures to reaffirm gold and silver as transactable money, they hope to provide all Americans with a trustworthy and viable alternative to depreciating dollars.

While sound money advocates have different opinions about the best way to move forward and achieve their goals, most agree digital or tokenized gold and silver must be redeemable for physical metal. Otherwise, technological advances in the monetary realm will only lead to another inflationary and unsound currency, and a new form of financial tyranny for everyone, including consumers, savers and wage earners.

© 2025 Stuart Englert. All rights reserved.