To keep it simple: Nope! Not this time anyway. That is, however, what you hear from the wistful market makers who want to see last week’s CPI release as proof inflation was “transitory.” Let me disabuse you of that fantasy entirely.

Inflation took a breather. It didn’t fall. It climbed, but not as much as each month’s climb had been before.

It’s reasonable to think, if you are a mere surface scratcher, that the subtle decline in inflation’s rate of rise might mean inflation is already tiring. It’s also easy to think that inflation is putting in a top if you like to think that things are going to go the way you want them to go in order to keep yourself happy. However, a deeper look will completely dispel that notion because the forces that are causing inflation are nowhere near letting go of us.

First, the CPI numbers

Core CPI, which is the number you will see the Fed using all the time, versus the broader headline number, actually rose quite a bit at 0.33% added to tracked prices in just one month. To put that in perspective, if monthly inflation actually did stabilize at that level, it would still add about two more percentage points to the 2021 annual inflation rate by the end of the year (when compound each month) above the high number we already have in annualized inflation. So, the decrease in the rate of rise wasn’t much of a rest.

Energy leaped up 1.7% in just one month, and food prices jumped 0.7% over the month.

According to BofA – and judging by the market’s delighted kneejerk response – this month revealed significant cooling in transitory inflation. First on the goods shortages theme: used car prices edged up 0.2% mom, even though new cars were much stronger at 1.7% mom.

Due to the rapid rise in used-car prices in earlier months (up 41% for the year so far with new cars only up 6% for the year so far), some joked that we are seeing

an example of carbitrage, where “people buy new cars then flip them for profit as used cars.”

Medical care costs and owner-equivalent rent (the Bureau of Lying Statistics’ mischievous way of distorting the true cost of homeownership) each rose 0.3% month-on-month. Price increases in those categories tend to hang around once they rise.

While we added more inflation to a year that will already come in hot by year’s end, even if we added nothing for the remainder of the year, many price categories came in calmer than in previous months where each month has, up to now, been worse than the prior month. Thus, the sigh or reprieve in some quarters.

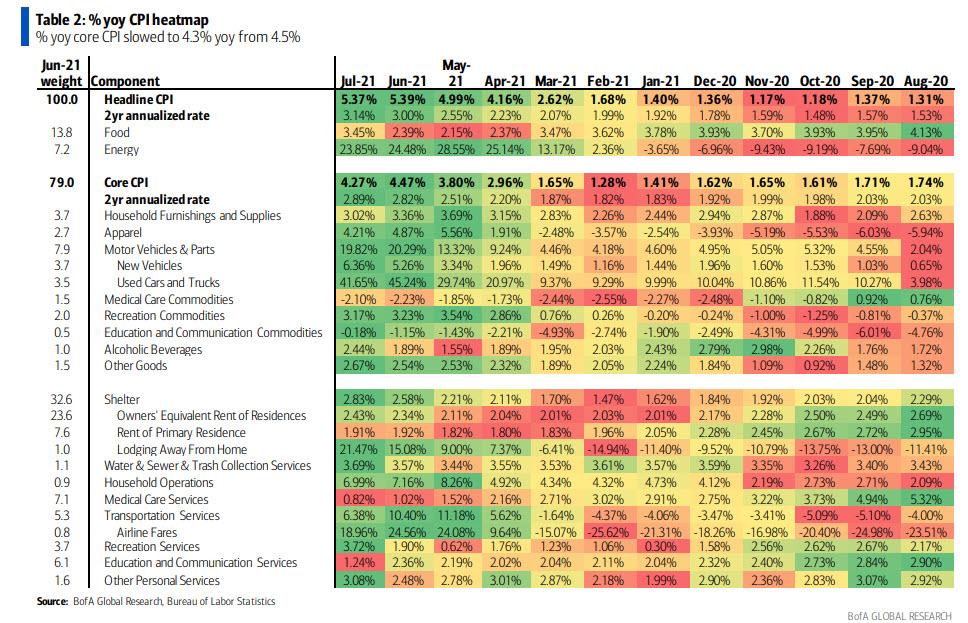

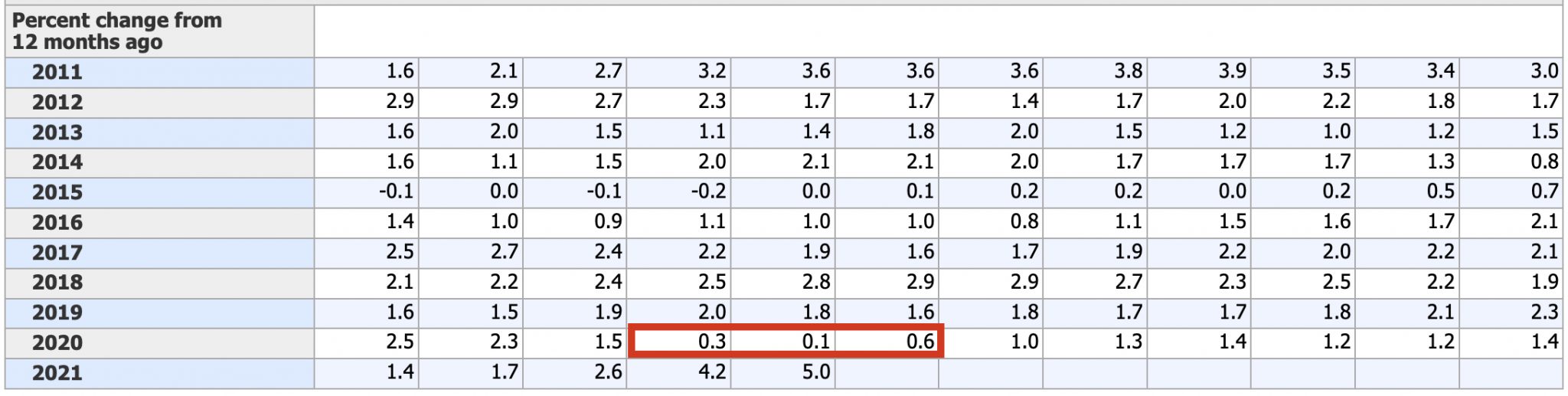

Another way of looking at this is with the following “heat map” for year-on-year cost-of-living increases, where (perversely in my way of seeing things) green equals hotter inflation and red equals cooler inflation:

As you can see, the overall year-on-year inflation dipped a minuscule amount this month (from 5.39% to 5.37%), but the number of categories that are green (perversely signifying hotter inflation) in July are greater than any other month on the chart, including June! So, more things are rising now, but in aggregate they added up to a tiny bit less total year-on-year inflation. That means inflation is broadening.

Regardless, because the headline number took a tiny dip, the stock market seemed to breathe a little sigh of relief that maybe, just maybe, the Fed might not feel forced to tighten sooner, rather than later.

Time to call the “base effect” for the baloney that I already called it

There is one critical problem for supposing the ever-so-slight calm in inflation mean anything. The Fed’s own argument of the “base effect” now works against it. Remember the argument I’ve criticized over the past months, wherein the Fed said high inflation was mostly just a baseline effect in year-over-year numbers because we were supposedly comparing against months a year ago where we had seen deflation?

Did I tell you that argument would prove to be nothing once we crawled past those supposed dip months from a year ago during the lockdowns, which the Fed said were distorting our year-on-year inflation numbers to make them look worse than they really were? Well, here we are, we’re passing out of the dip in last year’s inflation that supposedly was the main reason year-on-year inflation looked so horrible, and, yet, July looks every bit as horrible as June with a headline number that is only 0.02 points lower than the last of the dip months. I guess that 0.02% was the total contribution of the base effect, since July is the month we put the comparison to the dip months behind us.

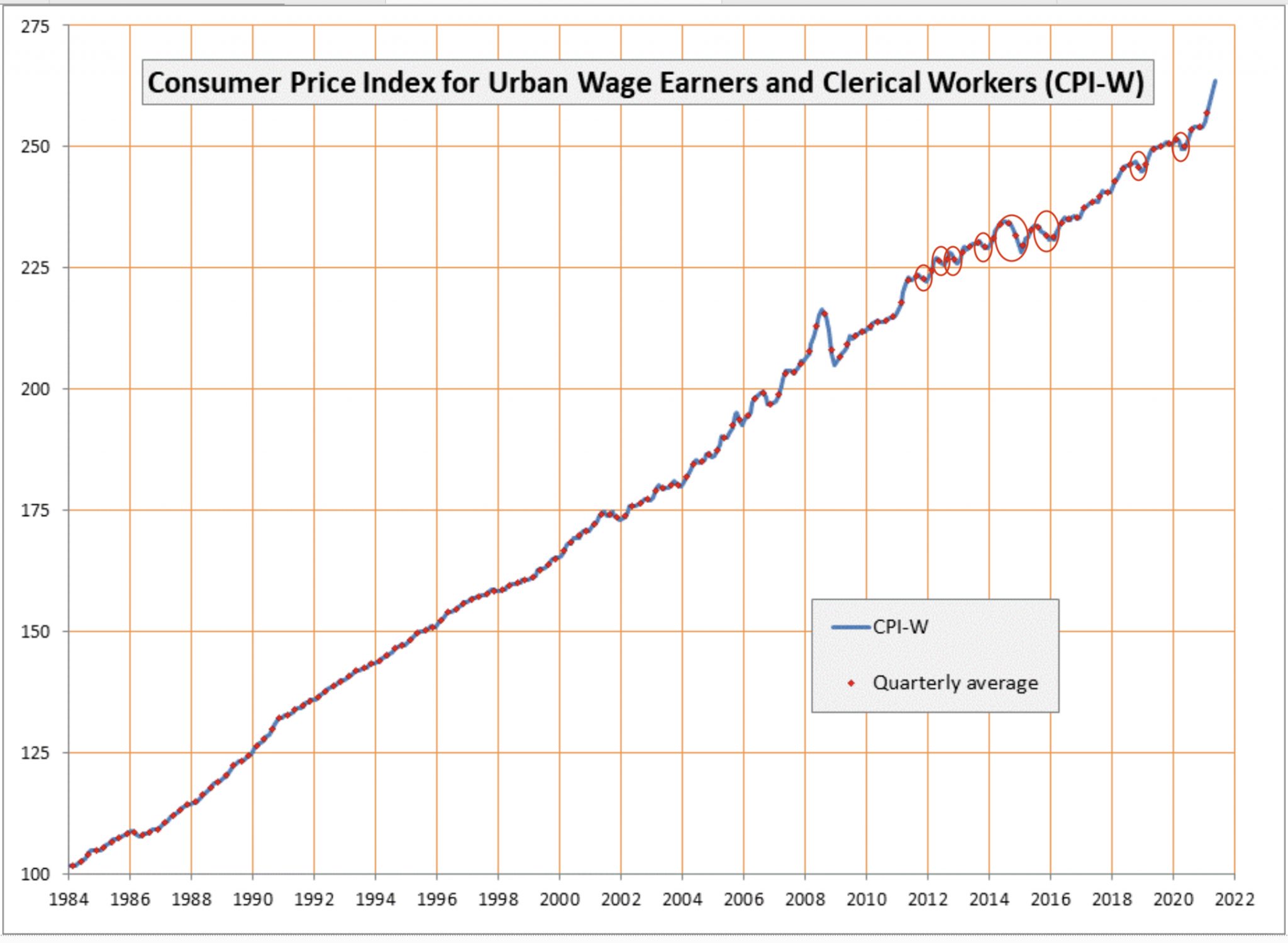

In one of my Patron Posts at the start of summer, I laid out a full argument for why the “base effect” based on the “dip” was meaningless. This baseline argument was used by the Fed and all who parrot whatever the Fed says, to support the argument that all of this inflation was transitory. Therefore, I showed how the mysterious dip in the prior year’s inflation, which was being used as an argument against current inflation, looked like this in a chart I presented: (Strain to see it. It’s the tiny circle to the far right.)

For those experiencing inflation in big cities, anyway, the previous year’s dip was entirely insignificant. As I wrote back in that June Patron Post,

As you can see by the numerous circles I placed on the graph after the big crash of 2008-2009, there have been many dips … since the Great Recession, some of them two or three times as large as the one in 2020, and NO ONE claimed the next year’s CPI percentage increase didn’t fully count because there had been a dip the year before!

This is the first time we are repeatedly hearing that rationale because 1) the Fed doesn’t want us to worry that inflation is as bad as it is right now, so it’s reaching for an argument it has never used; 2) the Fed did want us to believe it was coming close to its 2.0% increase each year in all previous years, which is why it never used this argument for all the dips along the way prior to now; and 3) no one else really wants to believe inflation is as bad as it is either. I call that “denial.”

“The Best Arguments Against ‘Persistent Inflation’ Have it Wrong“

As I showed in that article, the so-called dip months in 2020 — which were not so much a deflationary dip as just three months without much inflationary lift — were April through June:

Now, July, 2020, was a little low compared to other months, too, but it wasn’t in the low months mentioned in the Fed’s “base effect” argument.” Notice, too, that the entire year 2015 was a “dip” if you compare it to the 2020 “dip” months (and it was a real dip, as in disinflationary some months, not just a slow in the rate of rise); yet, you never heard the Fed pull out the baseline argument to say inflation really wasn’t as high in 2016 as CPI indicated (because that was when the Fed was trying to hit 2% inflation and couldn’t get it up).

Likewise, you don’t hear the Fed mentioning the end of the base effect now that we see only the most minuscule dip in July year-on-year numbers as the “base effect” rolls off. So, to all of the baloney we were Fed up on, I will repeat now what I wrote in that Patron Post:

What I see as significant when I look at that graph above is not the almost invisible dip in early 2020, but the incredibly sharp rise ever since. Note that the only other time inflation rose as steeply as it has been rising in the past twelve months for as long as it has been rising during those COVID months was immediately before our global crash into the highly deflationary Great Recession. So, this kind of inflation may be “transitory” in the sense that it it will quickly transit us into a major deflationary crash, but that is precisely what I’ve been claiming — not that inflation will keep rising like this for years to come, but that it will rise until it breaks us.

In all things economic, there is rarely a straight line to anything, especially over a number of years. All upward trends have their dips and all downward trends have their blips; and the 2020 dip looks insignificant compared to other blips along the trail that we never talked about at all. So, can we stop talking about the nonsensical baseline affect that we have never talked about before?

By the end of the year July’s slight downward nod as we left the “base effect” behind will look like nothing more than a wiggle on the upward trend, since that is all the difference we can see now between base-effect months and other months.

Will July’s calm really mark the end of the inflationary storm?

One other little problem for the relaxed view that thinks inflation if fading, besides the roll-off of the “base effect,” is that the price categories that saw a lower rise this month than last are still rising, having already doubled or tripled annualized inflation in six months.

However, a much bigger problem is that many of the softer prices in last week’s CPI print were in goods or services that do tend to be transitory, while some goods or services that tend to be persistent rose at a faster rate. To see what is still coming in inflation we need to look at what is happening in categories where price changes are definitely more persistent, as I have done in number of Patron Posts along the way and will now do in this article for everyone.

Housing inflation

To start out with, I’ll note that owner housing costs — as guessed at by the BLS via surveys that ask how much a homeowner thinks they can rent their house for — have barely increased to 2.43% year on year! We all know that number is absurd as is the data point that shows rents are up only 1.91% from a year ago. As I said in a recent article covering this inflationary factor, housing price increases that have already happened have not even begun to factor into the CPI data due to forbearance rules as well and due to how CPI calculates the housing category in ways that significantly delay the reported increase. So, there is a lot of actual inflation to play through that has already happened in the real world but doesn’t show up yet in BLS stats.

You see, higher prices for houses have to first become higher rental prices from landlords to renters (due to landlords paying more to buy the houses and paying more in property taxes) before they can become higher prices for houses under the BLS’s “Owners Equivalent Rent of Residences” category, which is based purely on that B(L)S survey of what owners think their houses would rent for. After all, how can an owner guess what his new house would rent for (as if owners even pay attention to rental rates) when the year-long rise in new house prices has not even impacted rents yet due to forbearance rules keeping most rents locked in place?

So, this area of CPI will take months and months, as I wrote in July, to reflect the price increases that already happened in the real world. Yet, look at what just happened in real-world housing prices, regardless of what CPI errantly shows:

Home Prices Soar At The Fastest Pace On Record As Affordability Hits All Time Low

…Today the NAR [National Association of Realtors] reaffirmed that US home prices are rising at the fastest pace on record, with the median price of an existing single-family home soaring 22.9% in the second quarter from a year earlier to an all-time high of $357,900….

The result was an increase in existing home prices in all but one of 183 measured markets during the second quarter of 2021….

U.S. housing has never been more unaffordable.…

Just how unaffordable is housing? Well, among first-time buyers, the mortgage payment on a 10% down payment loan jumped to 25% of income (21.2% one year ago)….

Oh and for those hoping to escape the hyperinflation in the housing market by renting, sorry – you are out of luck: rents are also soaring at the fastest pace on record!

CPI has a lot of catching up to do just to reflect what has already happened. That is inflation in the bag that just hasn’t been reported yet. Of course, the BLS will reduce its highly inaccurate survey number down the road with adjustments to minimize the truth as much as possible; but there will still be truth seepage that makes its way into the BLS numbers over the months ahead because, if the B(L)S numbers don’t somewhat rise with the truth, the numbers will become unbelievable to all (as they should already be).

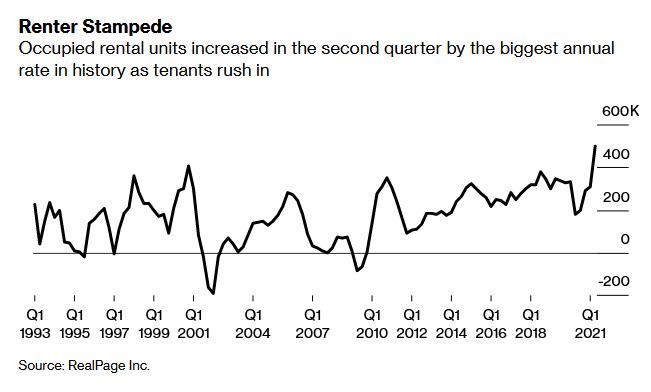

Meanwhile, rising home prices and scarce availability of homes for sale are pushing more and more people into becoming renters (now surpassing previous record levels):

The largest surge in rent in months is coming from people who are newly entering the rental market (whose rates are not, therefore, frozen by forbearance) even as they barely show up in CPI … so far. Wait until forbearance ends (if the government ever allows a free market in rents again) to see what happens to rents once the following kinds or restraint are finally lifted:

It’s hard to raise rents on existing renters with such frightening restraints firmly in place against landlords. If you raise rents, your renters won’t pay them, and you can’t get your renters out if they just stop paying altogether. So, there is tremendous inflation already in the pipeline there, waiting to emerge as soon as the government plug is pulled.

Producer price increases

Throughout the latter half of 2020, I wrote that inflation being seen on the production side of the economy would eventually make its way through to the consumer side (CPI). So, I regularly tracked the Producer Price Index (PPI), particularly for my patrons. The increases there took well over half a year to become reflected in prices passed along to consumers because producers had a lot of inventory they could still sell at a profit without raising prices because they had made the inventory when their own prices for materials and parts were lower. Because most producers have now burned through their inventory, producer price increases experienced now will pass through to CPI much more quickly than before.

As with housing, today’s producer price increases have yet to be reflected in consumer price increases. So, CPI will certainly be adding them in as those increased costs get priced along in a world where there is little to no inventory left to act as a buffer.

After soaring to a record high 7.3% YoY in June, PPI was expected (like Core CPI) to moderate modestly in July to ‘just’ +7.2% YoY. They were wildly wrong as July’s PPI soared to a new record +7.8% YoY (up 1.0% MoM)…

And that looks like this:

Just when it looked like inflation on the producer’s cost side might be starting to round off, it leaped up again. And this, of course, is not just how inflation moves along to the consumer but is how inflation can potentially damage the stock market (even without causing a Fed taper) by squeezing profit margins, something some individual investors still pay attention to when they buy individual stocks. To avoid that potential peril, producers will increasingly pass along these costs as they no longer have the inventory to buffer their increased expenses, which are due to all the supply-chain troubles we will be coming to. If they cannot pass the increases along because consumers can’t absorb more inflation, producers will run in the red, and that will damage their stocks. So, either PPI raises CPI more, or the rise in PPI starts to tear at the market’s underbelly by taking profits down to nothing or even into losses. So, either way, inflation will do its damage.

It’s true for services, too:

The index for final demand services rose 1.1 percent in July, the largest one-month increase since data were first calculated in December 2009.

And, if you think those product shortages you’re likely seeing on the shelves now will be going away soon (shortages are a major driver of higher prices), look what manufacturers are looking at as they set their production calendars:

The Empire State Manufacturing Survey shows business conditions have crashed toward the zero bound by more than half (from 43 to 18.3).

As ZH put it,

massively missing expectations of a drop to 28.5.

It’s the biggest plunge ever with the exception of what happened when we fell into the COVIDcrisis lockdowns, and part of the plunge in business conditions was due to the serious rise in prices that producers are facing. Prices are up, even as demand is falling. Sound like stagflation to you?

Facing that, you’d be more inclined to slow production than increase it. Thus, business activity has taken a big hit, while economic surprises have been running increasingly to the negative side for months. There is not a lot of “transitory” news coming in.

In yet another sign inflation might not be transitory, over 85% of manufacturers reported increasing prices in July in the most recent manufacturing ISM report…. CPI has already come in hotter than expected every month this year.

Inflation, I’ve said since last year, would be the big story to watch.

A big part of those rising costs is rising labor costs, and it’s hard to roll those back once you’ve put them in place, even if the labor pool grows after all the unemployment supplements end in September — IF they end, given they’ve been rolled along at the last minute several times now. I think they will end because the government is reaching its limit on finding willingness in congress to extend them.

The weakest link in the supply chains — shipping

One of the Fed’s biggest excuses for claiming inflation would be transitory was that most of it was based on COVID-related supply chain problems that would supposedly go away as the recovery took hold. I laid out earlier in the year in regular posts and Patron Posts the many reasons why those supply-chain problems would not be going away anytime soon (and did not even get into the possibility that COVID, itself, might not be going away soon). Now we can readily see that many of those supply-chain bottlenecks the Fed referred to are actually worse as we start to close out the summer than they were when the Fed made that delusional claim.

Shipping is feeling the pinch, and that is one of the other big cost increases manufacturers are facing.

Anecdotally, I experienced the shipping logjam just this past weekend in a way that felt almost apocalyptic. Having dinner at a friend’s house that overlooks a bay, I saw two large container ships anchored. One, was empty, judging by his high waterline, and the other full. “So what?” you might say. This is a bay in which I have never seen container ships anchored, and where I lived and played for years. Its little port has no facilities for loading and unloading such ships. That meant the container ships were parked there waiting to get moorage most likely in Seattle, some one-hundred miles away. That’s a long backup!

I asked my friend about it, and she said she’s never seen this before either until recent weeks where it has become the new norm.

There is nothing the Fed can do about the nation’s backed-up ports, nor the government. The shipping problem is global. Ships, for example, are backed up because large Chinese ports have closed for business due to COVID lockdowns.

Shipping will need to start to make contingency plans if cases of Covid-19 continue to escalate in China, the world’s most important nation for shipping movements…. The delta variant has broken through the country’s virus defences, which are some of the strictest in the world, and reached nearly half of China’s 32 provinces in just two weeks….

When a Covid-19 outbreak was detected at Yantian Port in late May, operations at the key southern Chinese export hub were slashed by 70% for most of June. Similar disruptions are on the cards in the coming weeks, while shipyards are also likely to see their delivery schedules come under pressure if any wider lockdown measures are taken….

“Cargo owners, already stressed beyond sanity from devastatingly high freight rates and absurd surcharges, and with no way to secure neither equipment nor space, would suddenly see their procurement costs sky-rocket in addition to their back-breaking logistics costs,” Murphy predicted….

Many ports in the country are also requiring vessels to quarantine for 14-28 days if they previously berthed in India or performed a crew change within 14 days of arriving in China.

It’s no wonder that shipping rates from China have punched a hole through the sky:

Having already scaled all time highs, the acceleration in Delta-variant COVID-19 outbreaks in several counties has added to the upward price pressure by slowing global container turnaround rates.

The Fed is powerless to do anything about that. Did no one see the likelihood of more Coronavirus shutdowns when they were talking about inflation being transitory? Is the Fed also going to manhandle the typhoons that are sidetracking shipping routes this year? Can they change the impact on inflation of the summer weather?

“These factors have turned global container shipping into a highly disrupted, under-supplied seller’s market, in which shipping companies can charge four to ten times the normal price to move cargoes,” said Philip Damas, Managing Director at maritime consultancy firm Drewry. “We have not seen this in shipping for more than 30 years,” he said, adding he expected the “extreme rates” to last until Chinese New Year in 2022.

So, I sat on a lazy summer’s eve and watched ships caught in the economic doldrums of our COVID world — parked and waiting to move, but their only movement was their slow turn like weather vanes on their anchor lines to point their bows toward the winds that blew against them.

The shutdown at Ningbo-Zhoushan is raising fears that ports around the world will soon face the same kind of outbreaks and Covid restrictions that slowed the flows of everything from perishable food to electronics last year as the pandemic took hold.

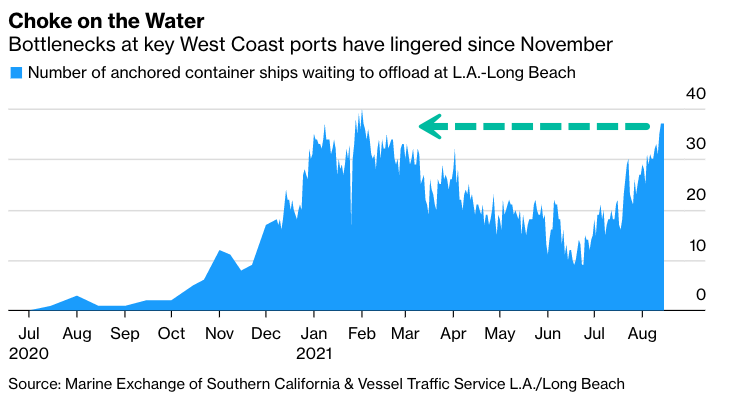

China now has three major ports that are either fully shut down due to COVID or partially shut. Talk about congestion from a bad cold! You can see in the following graph how US West Coast ports got backlogged back when China experienced its COVID lockdowns and then how it looked like that was going to be transitory as economies, including China, opened back up, and, finally, how all of that has fallen to pieces again now that the Delta variant is closing down Chinese ports again:

Readers may recall the collapse of the trans-pacific supply chains has been among the main reasons for soaring consumer goods prices. It’s also hardly a secret that the most vulnerable section of supply chains are West Coast ports where congestion remains off the charts. The transpacific trade routes have experienced significant port delays in China in recent weeks because COVID outbreaks are shutting down terminals…. Goldman Sachs has explicitly warned that “port closures or stricter control measures at ports could also put further upward pressure on shipping costs, which are already very high.“

Apparently, the supply-chain bottlenecks are not so transitory after all. Never underestimate the power of a tiny virus at stopping the world in its tracks.

Retail shortages popping up everywhere now

As a result of shipping and production problems, we’re finally seeing supply shortages reach major retail chains. Remember, I’ve claimed through the year that the real formula for consumer inflation is too much money chasing too few goods, so this is actually where you will see inflation start to heat up.

In another anecdotal snapshot, I went to Home Depot yesterday to buy a gallon of alcohol for cleaning grease from things I’m working on. Usually, their store has several rows of just alcohol on the shelf in a variety of sizes with boxes and boxes behind the displayed products. Today, none! That section of shelves was bare. Then, when I checked out at the register, the clerk loaded all my items back into the orange plastic bucket I had used as a carrying basket, and I said, “I wasn’t buying the bucket.” The clerk responded, “This is because we’re out of bags. You can use the bucket to get your items to your car.” I had to dump my items in the back of my car in a little pile and then return the bucket because America is actually running out of bags — both plastic and paper.

Once you start seeing empty shelves in major retailers with vast resources, you’ve entered a situation that can become catastrophic in a hurry. Suddenly, you will have people who can’t get basic necessities because of jammed-up shipping, lack of laborers in production and retail, COVID shutdowns around the world, and lack of resources to build things out of or parts to make them. We haven’t seen that until now because large corporate inventories were carrying us through as a buffer, but those inventories are mostly depleted now, and that means prices are likely to rise faster as people compete for the things they need. Do our government officials realize how quickly this could go from concerning to a panic?

You can’t get fat on inflated food.

A bag shortage a the local Home Depot is one thing, but shortages that cause high inflation are quite another when they start impacting both the price and availability of your food, which is where inflation showed up particularly strong in the last month, having just started to significantly impact food back in June.

Look no further than the big-box-store equivalent in the world of chicken — KFC — where food fights in the UK were taken to the police last week:

The entire restaurant industry is facing supply chain issues. Taco Bell, Starbucks, and McDonald’s have been some of the most recent fast-food companies to warn customers about limited menu items or shortages. The latest is everyone’s favorite, KFC, which has warned UK customers that some menu items “aren’t available or our packaging might look different.”

Yeah, the packaging may be back to chicken in a bucket, only it’ll be an orange Home Depot plastic bucket, apparently one of the few containers left available for packing things out!

According to The Independent, the shortage of menu items caused a large enough uproar that London’s Metropolitan Police was forced to publish a tweet about the “KFC Crisis.”

“Please do not contact us about the #KFCCrisis – it is not a police matter if your favourite eatery is not serving the menu that you desire.”

Ah, well, at least the austere conditions faced by all fast-food restaurants may press us all toward healthier diets, though you may soon be packing your groceries in plastic buckets and dumping them in your trunk, too, or bringing in your own cloth bag, which will supposedly save a few whales from choking on plastic.

We can handle the inconvenience in convenience stores and the slowdown in fast food, but what about when it impacts the staples in our diet?

The U.S. Department of Agriculture’s World Agricultural Supply and Demand Estimates (WASDE) report was released Thursday afternoon and pointed to declining grain supplies that sent grain futures prices higher and will keep food inflation in focus. A megadrought and back-to-back heat waves have plagued the corn belt and the U.S. West for much of the summer.

Of course, those staples go into a great many of our processed food products, such as cereals and breads, and anything that is sweetened with corn syrup. So, those price increases will work their way through nearly all foods, as will the shortages.

Bloomberg notes,

- DROUGHT BITES: U.S. corn and soybean yields fell below analyst expectations and the declines were largely centered in the drought-stricken northern Plains, where severe drought has withered crops.

- RUSSIA: So goes Russia’s harvest, so goes the wheat market. A large cut in the harvest means a lot less global wheat supplies and Russia’s wheat-export throne as the world’s top shipper is in doubt….

- WHEAT PEAK: Benchmark Chicago wheat prices hit the highest levels for a most-active contract since 2013….

- FOOD INFLATION: Of course, with grain and soybean prices elevated for months, the higher costs should start to filter through the supply chain

Yes, these are rising prices on the commodities market that haven’t even started to show up in store prices yet; but they certainly will. Of course, the biggest accelerant of high prices in food for all of us is speculators, who drive the price up in commodities markets mostly just for the sake of having the opportunity to gamble on food prices to the detriment of us all. That market should exist solely for producers, but it has long been just another gambling casino for people who have no intention of ever actually using the corn they are bidding up in price.

A little drought and a little virus can bring a nation that thought it was invulnerable to its knees. We’re not there yet, but we’re moving rapidly in that direction, which is why I’ve been hounding the inflation beat in my reporting and analysis all year.

And the Fed can’t do anything about any of these pressures! They are simply the events that are happening. As Newsmax wrote a threw weeks ago,

[The] global supply chain … far from sorting out its problems, may be headed for more inflation-inducing trouble…. The new risks, threatening the twin ills of slowed growth and higher prices, mean the rosy future seen in June seems less assured…. It is, indeed, a long list of new problems that have arisen since June 16, when the Fed expressed confidence the pandemic was fading and that “progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy.” The rise of infections could, if it continues, weigh on the recovery, and would do so at a particularly tenuous moment.

For now, it doesn’t look as if the virus has decided to cooperate with the Fed’s agenda, which will leave the Fed trapped into tightening rapidly to curb inflation just as the economy is going down again and as the market is now constantly worried about inflation BECAUSE it will cause the Fed to tighten and end the party.

Any slowdown in the recovery or hiring, meanwhile, would occur amid the expiry of the federal spending and benefits that sustained personal incomes last year, a “fiscal cliff” already expected to slow annual economic growth from its current high-octane pace of around 7%…. The issue is being watched carefully at the White House as well, with both the core of Fed officials and the Biden administration saying they remain convinced current price increases are mostly the result of a complicated economic reopening and will ease on their own…. There may be new reason to doubt. A collision of events, including floods in Germany and China, are again clogging the flow of parts and materials around the world, prolonging the supply bottlenecks that Fed officials and the White House have counted on getting resolved to help ease price pressures.

The bottlenecks are not going away anytime soon, Folks, as I’ve been saying all year. The sources of problems causing them are too broad, and some are far outside of human control.

“Supply-side issues are clearly not going anywhere,” Citi economists wrote on Friday. “Costs from inputs and supplier wait times are likely to continue appearing in consumer inflation for months to come.”

This is a time for expecting the unexpected as new virus lockdowns scattered around the world, plus all the longterm damage I predicted from the global 2020 lockdowns (here, here, here and here), and strange weather patterns shake up the entire world. This isn’t just going to suddenly vanish and prove transitory. So, inflation will take down the stock market in due time as it and the shortages causing it rip the Fed’s and federal government’s recovery efforts to shreds. You cannot dump endless amounts of new money into supply shortages and not have high inflation.

Even …

The White House is shifting the way it talks about inflation, as polls show increasing voter concern and Republicans try to use rising prices to kill off President Joe Biden’s sweeping plans to spend trillions of dollars on social programs and infrastructure projects. Out: wonky words like “transitory” and complicated statistical explanations for price indicators. In: plain-language explanations from the president himself…. “My administration understands that if we were to ever experience unchecked inflation over the long term, that would pose real challenges to our economy. So while we’re confident that isn’t what we are seeing today, we’re going to remain vigilant about any response that is needed….” Worries are increasingly showing: consumer sentiment was weaker than all economists’ forecasts in early July as Americans factored in a higher cost of living. And the president’s own approval rating has been slipping, this month hitting its lowest in Gallup surveys since he took office.

The Fed and feds are starting to feel the pressure, and they’re going to feel it a lot more before this over. So, enjoy your Kentucky Fried Chicken while it is still available in buckets.

“I have no idea what the word transitory means,” said Jason Furman, an economics professor at Harvard and former chairman of the Council of Economic Advisers under President Barack Obama. “Inflation is currently running at a 9% annual rate. If it goes to 7%, does that mean it was transitory — because some of the nine went away? Does it need to go to 2 to be transitory?…” ¸Scott and other GOP lawmakers are also warning that Democrats’ plans for a $3.5 trillion social spending package will only pour “jet fuel” on inflation.

That’s right. Just because you can do it does not mean you can do it without the high cost or raging inflation … as so many other nations have found when they tried to use the money presses to print their way out of their troubles. Money doesn’t end supply shortages. It just empowers the inflation that supply shortages help create.

Consumer sentiment sours

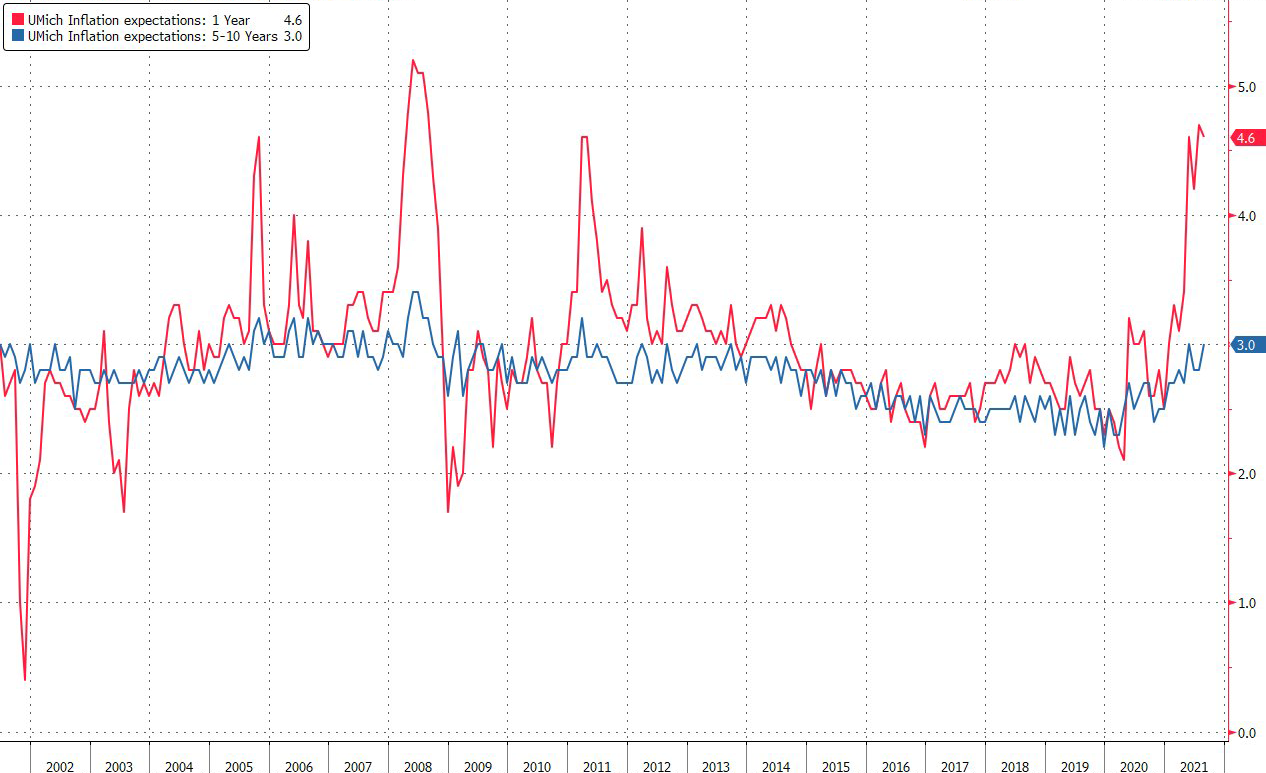

Of course, one of the biggest risks for persistent inflation is inflation’s self-reinforcing nature if it becomes a part of consumer expectations and business planning.

U.S. consumers’ dashed hopes for an end to the pandemic are at risk of morphing more broadly into higher inflation expectations over the next year. And that’s the biggest risk facing financial markets through mid-2022, according to Jefferies LLC economist Thomas Simons. “The longer the economy and society remain distorted or abnormal relative to what we expected pre-Covid, the longer and higher the inflation environment can persist….” Survey results released by the University of Michigan on Friday show consumers suffering a loss of confidence in early August that professional forecasters hadn’t expected — in what Jefferies describes as a rare, emotional knee-jerk reaction to COVID-19’s delta variant. Behind the unease is the sense that masks, social distancing, remote work from home, endless booster shots and the constant fear of becoming sick is turning into the new norm…. In a BofA Global Research note Friday, Ethan Harris says the Fed and investors “may be underestimating the underlying inflation pick-up,” by not paying enough attention to the right measures. And Jay Hatfield, CEO of Infrastructure Capital Advisors in New York, says the Fed has already “lost control on inflation….” the risk of inflation serving as the next catalyst for a dramatic adjustment in markets remains great. Not only is the central bank not able to ignore rising inflation expectations, according to Jefferies, it isn’t in a position to combat them with interest rate increases for possibly up to another year or more — given the need to taper its bond purchases first.

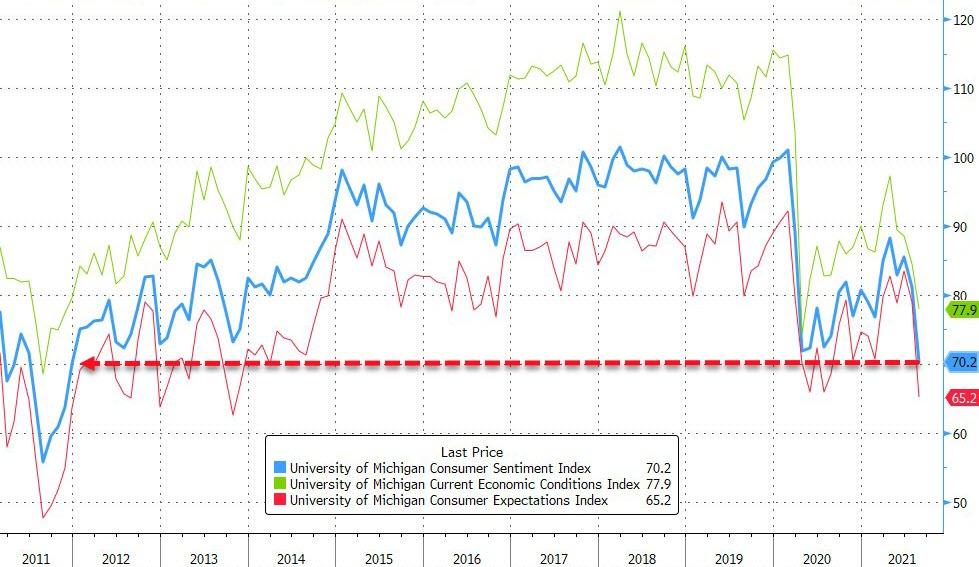

And that change in consumer sentiment looks like this:

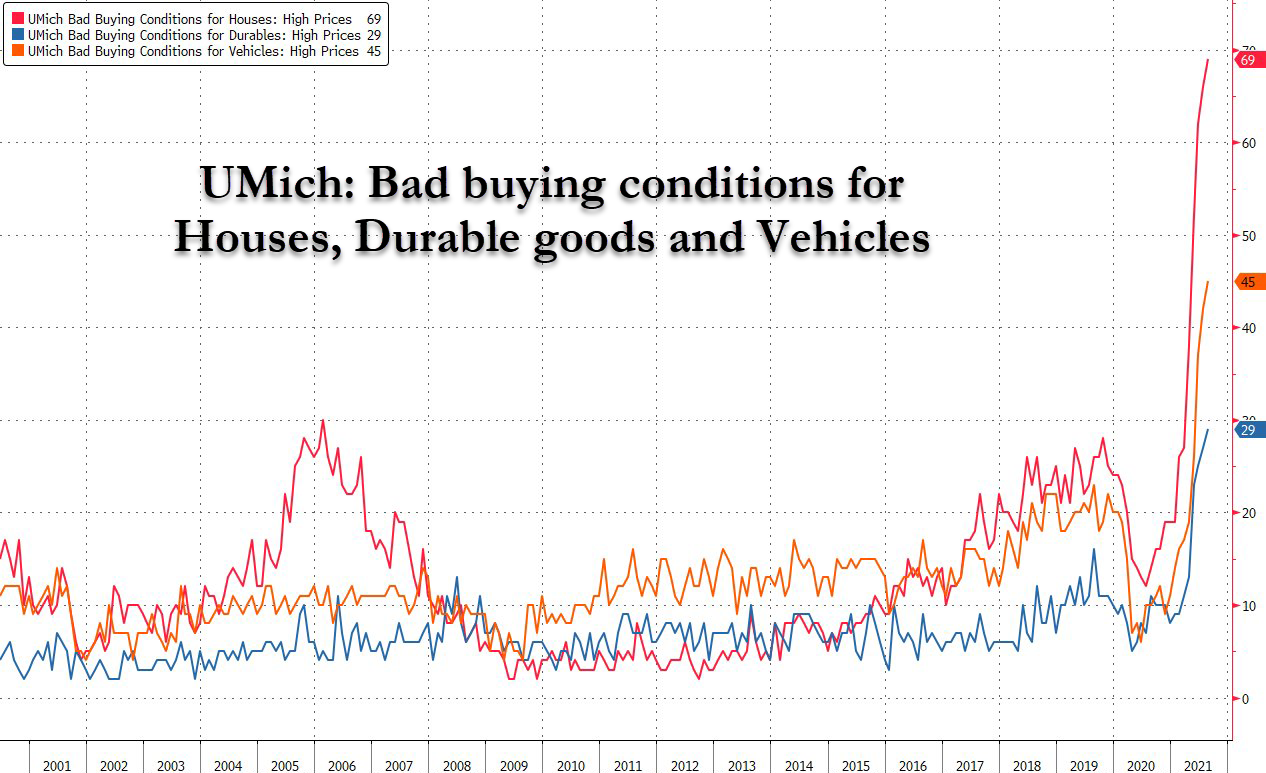

Consumer sentiment is already lower than its bottom during the 2020 COVID lockdowns and lower than it has been anytime since the tail end of the Great Recession. It has, in fact, taken among the top-ten fastest plunges in the past half century. And that cliff dive in consumer sentiment is largely focused on inflation:

The combination of shortages everywhere leading to high inflation is causing a perception of terrible buying conditions:

Thus, inflation now even has the attention of the spendaholics in government:

Of all people one might expect to finally blow the whistle on the Federal Reserve, a Democratic Senator may not have been at the top of the list of expectations. But that’s exactly what happened yesterday when U.S. Senator Joe Manchin (D-WV) put out a press release urging the Federal Reserve to “not overheat our economy”….

“I am increasingly alarmed that the Fed continues to inject record amounts of stimulus into our economy by continuing an emergency level of quantitative easing (QE) with asset purchases of $120 billion per month of Treasury securities and mortgage backed securities,” Manchin’s letter read…. “The record amount of stimulus in the economy has led to the most inflation momentum in 30 years, and our economy has not even fully reopened yet….” It concluded with Manchin urging Powell to reassess the FOMC’s stance: “I urge you and the other members of the Federal Open Market Committee to immediately reassess our nation’s stance of monetary policy and begin to taper your emergency stimulus response.

Even members of the spendy Left are starting to press the Fed to shift its polices toward taking down inflation, rather than fueling the economy and stock market. It’s going to rapidly become politically hard for the Fed to resist tapering its QE.

Yes, inflation has become the second-biggest story of the year, second only to COVID, itself. It is THE story I’ve said since last year, you should keep your eye on because it was likely to blow wide open. So, do I think the little pause in inflation’s rate of climb in July means anything? It’s just another wiggle in the road. The deeper causes of inflation that I’ve been tracking all along are actually more abundant and obvious and not going away anytime soon.

So, yes, I still believe inflation will plunge a sword through the heart of this stock market bull, either by causing the Fed to take away the market’s fuel in order to battle inflation or by inflation continuing higher if the Fed does not take away the fuel until inflation, itself, ravages the entire economy and the profitability of major companies. As consumer sentiment turns on its head due to extraneous events that are largely out of our control, so can market sentiment. Drop an asteroid on the world, and it will rip all sentiment to pieces.

This little virus, as I argued in an article the moment the virus hit US shores, was an asteroid that would impact the entire declining global economy.

The Fed is on a rocket ride to try to escape Earth’s gravity.

The Fed is on a rocket ride to try to escape Earth’s gravity.

It now seems like a long time since I wrote that article last spring:

The soup lines hadn’t formed yet. Jobs had not even noticeably started to dry up, but they weren’t as easy to find anymore. You had to be angry to quit without having a better job firmly in hand. Stocks were climbing furiously above an economy that had been slowly ebbing away since summer. Sales were down for months, so revenues were down for months, and profits were down. Funding in the world’s easiest credit market — interbank repos — was extremely tight — so tight the Fed had to come to the rescue every single day for months, and the problem was only getting worse.

Such were the times before COVID-19 struck the world in 2020 like an asteroid from some far reach of the solar system crumbling the walls that already sat on cracked foundations, burying in ash a partying world that hadn’t yet figured out it was already slowly dying from its own internal decay….

These are the last vestiges of indicators that came in before the crisis hit. They tell of twilight times slowly settling over a world soon to be struck with an exogenous event that no one saw coming….

It was into that decaying, sloppy, insensible world that the virus crashed with the impact of a large meteor that was pulled by earth’s gravity into its atmosphere, lighting space rock on fire and exploding on impact. The cracked foundations of civilization’s structures immediately crumbled, and its high towers toppled faster than its citizens ever thought possible. Crowded highways became nearly vacant. Those who had been coming and going about their business as if nothing could hurt them, ended their business activities overnight, and citizens isolated themselves by sheltering in their homes. Most of society waited on hold as numerous states and nations entered official lockdowns — waited to see how great the destruction from COVID-19 would be.

“Virus Impacts an Economy Already in Decline before the Crisis“

That article seems eerily prescient now. We were not a nation or a world with a strong economy, able to withstand the impact of a tiny virus. We were a nation and a world with a highly fractured economy, riddled with deep flaws and, including incredibly deep debt, even in the US, and we were experiencing continually falling GDP before the virus hit. The impact of the tiny virus is still reverberating through that fractured earth.

We delude ourselves into thinking we are invincible as surely as we delude ourselves into thinking the Fed can endlessly paper over our deep economic fault lines with new money. Reality has a way of breaking delusions, including market delusions by presenting events that are strong enough to tear our delusions down and that will be persistent enough to pound a little humbling truth about our own fragility into us. As I also wrote at the start of the virus, the Fed has lost the ability to save us. Its policies are far over the hill of diminishing returns.

Now, the federal government, which had to rush to join the Fed in order to stem the market’s hard crash in March of 2020, is also far down the path of diminishing returns where the more it pours stimulus into the economy, the more inflation will fight back. More on that in my next Patron Post.

(Note: I’m sorry this latest article has been long in coming. Extraneous life events have gotten in the way, but that should be clearing soon.)

Liked it? Take a second to support David Haggith on Patreon!