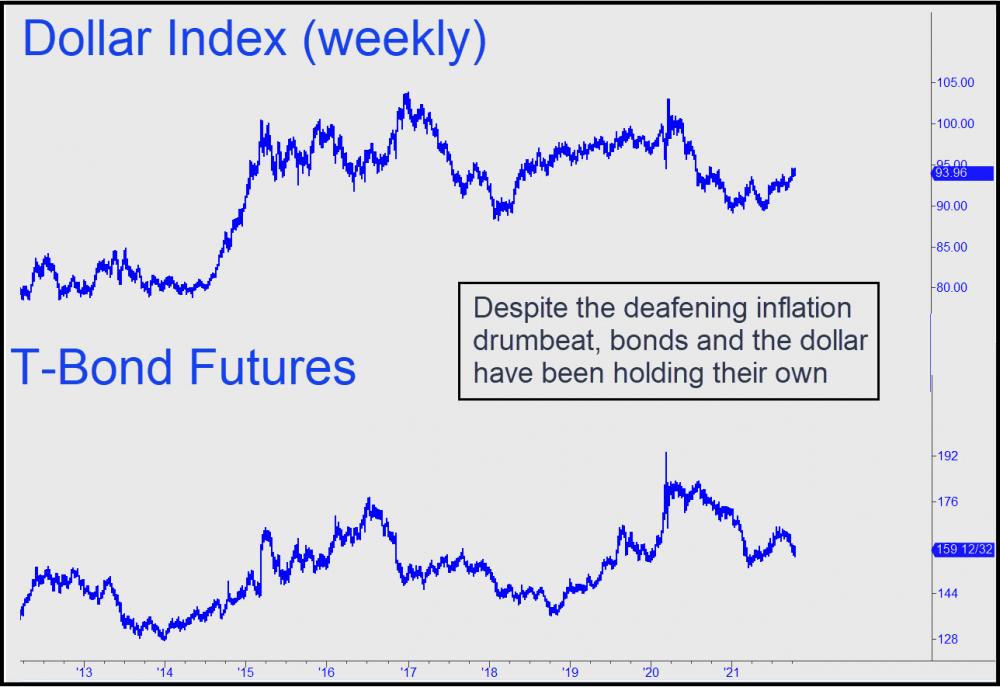

Inflation fears are at a generational peak, pushing our stubbornly unfearful Fed chairman against a wall. He may yet prove right in saying inflation will be transitory, but for reasons that should comfort no one. In the meantime, the U.S. dollar seems resistant to the nervous chatter while Treasury bonds, although struggling for altitude, continue to hold their own. Both are near the middle of their respective trading ranges for the last five years, presumably waiting for more persuasive evidence that the inflation we've seen to date is about to go out of control. An obvious reason this has yet to occur is that wages have barely budged relative to the soaring cost of groceries and consumer goods. But how high can inflation go, one might ask, when the broad middle class can no longer afford stuff? Answer: Only so far. The wealthy will not have much of a counter-effect, either, since the trillions they've banked from the bull market will get plowed back into financial assets and real estate, not CPI items.

Meanwhile, the theory that raising the minimum wage creates inflation has been tested and refuted by a pandemic-strained job market. What it does most clearly is destroy jobs. McDonald's may have rolled over on paying burger flippers $15 an hour -- what choice did they have? -- but they have minimized their pain by revamping the restaurants so that as few as three or four employees can run an outlet, including the drive-through. For customers, this means it now takes ten minutes to order a burger using a kiosk, compared to 90 seconds when there was someone behind the counter taking orders. Virtually all labor-intensive businesses continue to find new ways to operate with fewer employees, and many of them, including banks, are on the verge of operating without a human interface. Lay off enough tellers and food-service people, and it eventually will kill inflation.

Deflation Will Bring 'Relief'

For now, though, supply-chain problems and the resulting shortages are helping to push up prices and will likely be with us for a very long while. Before the pandemic hit, global delivery systems were operating with the precision of a Swiss watch. Smash it with a hammer, which is what the lockdowns have accomplished, and it will never be the same. But if you are looking for total relief from inflation, there is one thing you can count on for certain: a bear market. When it finally comes, triggering a deflationary collapse that massive credit stimulus has held off for decaades, expectations of inflation will vanish overnight. The dollar will break out, yields on Treasurys will fall toward zero, and gold will enjoy safe-haven status for the first time since the 1970s. For more on this, click here to access the interview I did last week with Howe Street's Jim Goddard; and here for an earlier one with Max Keiser.