So, the bad news keeps rolling in for the stock market, even on a good stock day when the Dow soared 575 points because we caught an inflation beat that nudged down. This time it was in the PCE report. Last time it was in CPI. The CPI number didn’t look anywhere near as helpful once you looked beneath the surface, and I suspect this one won’t with the same kind of Deeper Dive. So, I’ll be covering that this weekend. Right now, I want to focus on what happened in the economy this week and in stocks as related news continue to pour in today.

On the basic economic front, the Chicago Purchase Manager’s Index, a major report that covers the upper midwest, came in all-out horrible. Zero Hedge referred to it as “craters to depression levels.” I wouldn’t go quite that far, but it’s close. Let’s say it cratered to our two latests and deepest recession levels.

That looked like this:

Deep to darkest deep in recession territory. Almost as low as the Great Recession got during its worst months and almost as low as the Covidcrash during the month when most of the world was forced to close shop. This recession hasn’t even officially started yet, yet this major set of metrics keeps falling down a very steep set of stairs.

(In the numbers below, “50” is where recessionary economic decline begins.)

After unexpectedly slumping last month to 37.9, the Chicago PMI index cratered even more unexpectedly in May, when it defied hopes of a rebound to 41.5, and instead tumbled even more, sliding to a cycle low of 35.4 which was not only below the lowest estimate, but was staggeringly low.

Indeed, if what purchase managers are seeing looks almost on par with two historically very deep recessions (though the last one was brief because it was created artificially and turned back on via the same legal mechanisms used to shut the world off), then how are we not already in recession?

Remember that former Fed Chair Ben Burn-the-banky infamously said in the summer of 2008 that there wasn’t a recession anywhere in site, and then the National Bureau of Economic Research (the NBER, which officially declares US recessions) came along a few months later and said we had actually already been in one for half a year when Gentle Ben made that proud proclamation of Fed economic success, and then it turned out to be the greatest recession since the Great Depression!

Zero Hedge kicks it up a notch:

… which seems to suggest that at least according to Chicago-based purchasing managers, the economy is in a depression.

It wasn’t just that everything measured in the Chicago region fell, it was that many things fell at a faster rate than in all the previous months when the Chicago PMI had already been falling. The decline is steep and deep.

So there was that …

Software enthusiasm gets its soft head caved in

…and there was this:

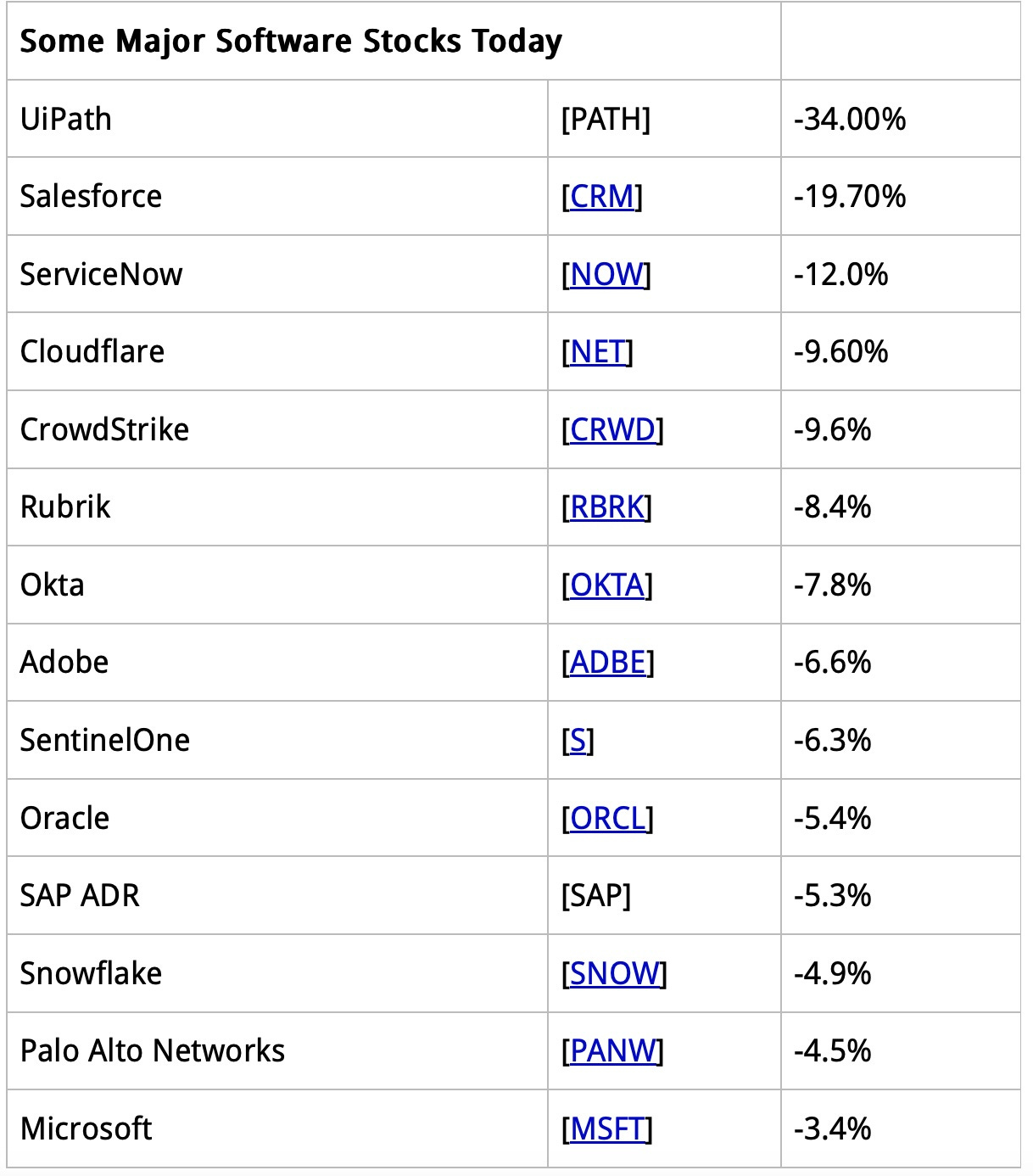

Software stocks got massacred this week to such extent that BofA predicted today that tech may be the next pain trade for stocks. Of course tech had been, by and in large, the only positive area in stocks due to anything connected with AI riding high on the frenzy of AI love. However AI seems to have gotten a case of strep sewer breath this week because suddenly no one wants to kiss it.

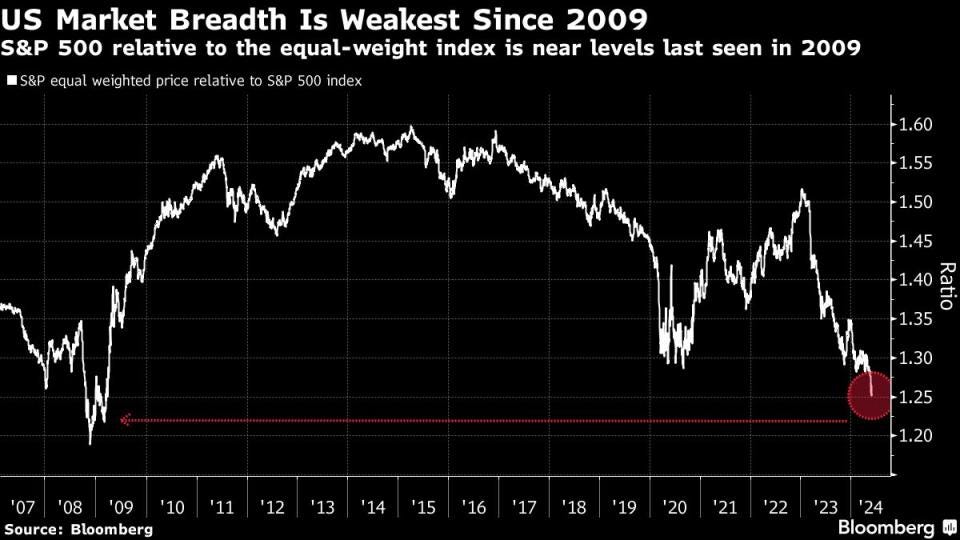

Market breadth during this tumultuous week utterly collapsed:

… also looking nearly as bad as it did during the deep belly of the Great Recession back when there was “no recession anywhere in sight.”

Investors betting that technology behemoths will continue to fuel the rally in equities could be in for a rough ride when other sectors start to catch up, according to strategists at Bank of America Corp….

Other potential sore points on the horizon include a drop in US equities and a widening in investment-grade bond spreads, Galou said by email.

In fact, software stocks generally got clobbered this week. It wasn’t just Salesforce, as I reported on yesterday: UiPath, another AI driven business software platform, plunged 34%. Other software companies followed in the downdraft.

The “consensual hallucination” about AI, as economist Wolf Richter is calling it, called in sick this last week. The cave-in at UiPath caused a big shakeup in corporate leadership. Apparently, the company still has to be run by humans, and they are not performing well or are behaving badly.

According to Richter,

the whole thing is corporate hogwash to cover up chaos.

The opening round of softheaded software chaos looks like this:

So, when you have narrow breadth throughout the market, and the big leaders start doing that, how can that be good?

Bonds go bonk

Bonds are not really bonkers because they finally returned to what they should have been doing since last October, but they are bonking stocks on the head. While bond yields got some reprieve today due to that whiff of PCE inflation hope I’ll be digging into this weekend with paid subscribers, they have really gouged stocks all over the world this week,

Global bond investors are coming to terms with the likelihood that interest rates are going to stay high for the foreseeable future.

From the US and Germany to Australia and Japan, the past two weeks have been punishing for investors who have clung to hopes for rolling rate cuts this year from the world’s biggest central banks. The reality is, inflation has yet to be fully tamed, and that’s put central banks on guard and left bondholders with losses.

And that future was “foreseeable” because it has been foreseen and spelled out here each step of the way since last summer, saying we’d get here. Investors had to roll their rate-cut hopes with their impact on stock pricing along month after month and are still rolling.

Global government debt lost about 1.3% since May 16 — around the time when many yields were at their lows of the month, according to a Bloomberg Index. The sector is down about 5% so far this year, erasing all of the gains from late last year, when optimism over the prospect of imminent worldwide rate cuts was at its peak.

The selloff deepened Friday after euro area inflation quickened more than expected in May, driving the 10-year German yield to the highest level in over six months….

“This was supposed to be the year of the bond, and it’s proven not to be,” said Ian Pollick, global head of FICC strategy at Canadian Imperial Bank of Commerce. “We are in higher-for-longer right now. So bond markets are trying to recalibrate.”

That is what happens when you live outside of reality, believing in fantasies about inflation, ignoring months of rising inflation, and clinging to things whispered by Fed Chair Jerome Powell that the Fed never actually said in its policy statements or minutes.

Once pricing in almost seven quarter-point Fed rate reductions in 2024, US swaps traders are now barely betting on one reduction, and officials are keeping alive the potential further rate hikes.

Markets largely chose to ignore the rate-hike talk, while I chose to start the rate-hike talk on GoldSeek Radio before you heard a word from the Fed on that because it was what inflation dictated, while the Fed itself was living on second-hand dreams that its sticky inflation would now prove transitory. (You can listen to this week’s GoldSeek Radio Nugget here where I talk about gold, central-bank moves, housing’s delayed impact on inflation and new MBS troubles breaking out as they did in 2008.)

Much of the pressure has emanated from the US, where weak Treasury auctions in recent days have fanned concerns over investor demand at a time when the US is selling more bonds than ever.

That’s not going away. That’s something I and others have been reading from our radar screens for months, explaining that it was just a mathematical fact that a high supply of Treasury bonds was coming and that would create a big problem for the Fed and Treasury as the Treasury was losing international buyers.

Auctions of two-, five- and seven-year Treasury notes all drew higher-than-anticipated yields, a sign interest in buying the securities fell short of expectations.

Inflation’s return to rising has been global. Rising inflation was reported for Europe, Australia and Japan today. In Europe, unemployment also remains at an all-time low, just as in the US, giving central banks no apparent reason to shift back into easing.

“The key thing, let’s be clear, is going to be inflation,” he said. “If these wage numbers don’t come down and service inflation doesn’t come down in the months ahead, this might be the first [ECB] rate cut for a while before we get anything else coming through. And I think that’s going to be even more important for the Fed.”

Inflation has always been the key thing in these editorials. Of course, endless rolling back of rate cuts keeps the needed rate-hike scenario in play, and that is where massive recalibration in stocks would likely take place if that were to happen:

“The risk – the thing that will finally break the market – is that the Fed opens the door to interest rate hikes,” Trindade said. “That is not our central scenario, but investors must have it at the back of their minds.”

“Higher for longer” is getting dangerous

Higher for Longer Rates Mean No Escape From the Debt Squeeze

Companies going bust, mounting credit card debt, higher mortgage bills.

The highest interest rates in years are taking a toll from the US to Australia, creating cracks in economies despite low unemployment and booming stock markets. Even where consumer spending looks solid, it’s often being funded by borrowing, from credit cards to “Buy Now Pay Later” services.

It’s all part of the new normal, a world where the floor for rates is much higher and where corporate, household and government borrowers have to accept that this backdrop is sticking around for longer.

As consumers and businesses and stock and bond investors all wake up from their delusions to face this reality (consumers and businesses perhaps not being so delusional as the investor crowd), you’re going to see some rapid gearing down for recession. Chicago PMI and this week’s earlier Dallas survey say that gearing down is already well underway. It’s a stealth recession—one made of stagflation—that won’t likely be declared until it is deeply entrenched due to the reporting agencies being the incumbent government that wants to get re-elected and due to no one understanding that tight labor in the present times means weak labor.

So, this recession will fly in under the radar and won’t be declared unless and until it becomes so obvious that the declaration can no longer be avoided or denied. The wake-up calls are coming in now:

Bank of Montreal shares plunged on loan-loss concerns, prompting analysts at Scotiabank to respond that “the ‘higher-for-longer’ rate scenario is a reality.” It “appears to be impacting credit performance” more than analysts or management expected, they said.