As Yellen slides from power, inflation keeps rising, thanks to Yellen & Co., and jobless claims burst higher in recent news, too. Stocks did not. They did not like the news.

We’ll get to it all.

Producer prices soar beyond expectations

The producer price index, which tracks wholesale prices, increased 0.4% last month. Economists polled by Dow Jones expected a 0.2% increase on a monthly basis.

Zero Hedge put it this way:

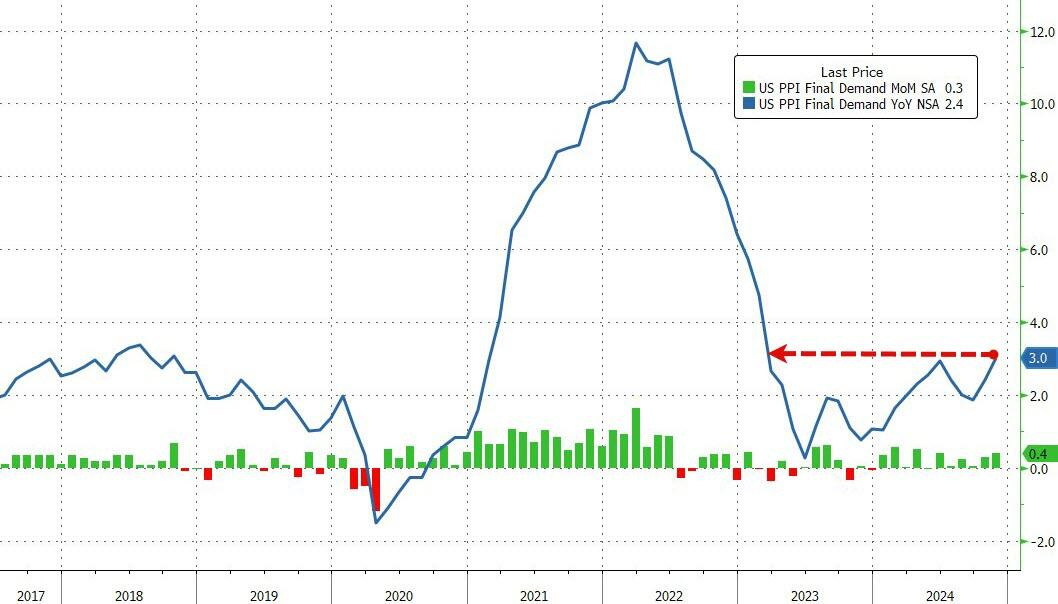

Producer Price Inflation Comes In 'Red Hot' In November

Following the prior day's reported re-ignition in consumer price inflation … this morning's producer prices were expected to accelerate further also to +2.6% YoY … But it didn't... Headline PPI surged … +3.0% — far above expectations and the highest since Feb 2023.

The MoM (double what was expected) was the biggest MoM jump since June. Now you can see a clear upward trend has been established in producer inflation, which we saw is already trickling into consumer inflation:

And this time the big driver was the one people seem to hate most—rising food costs (going up now at their fastest clip since November 2022). Chicken eggs jumped more than 50% because we keep killing so many of them due to bird flu and strange farm fires. All kinds of food items were up, and coffee prices are expected to become quite perky, too, due to crop failures.

And this time the big driver was the one people seem to hate most—rising food costs (going up now at their fastest clip since November 2022). Chicken eggs jumped more than 50% because we keep killing so many of them due to bird flu and strange farm fires. All kinds of food items were up, and coffee prices are expected to become quite perky, too, due to crop failures.

Service costs also accelerated rapidly while energy’s deflationary pressure is evaporating.

Meanwhile, here is what is happening in money supply, thanks to Fed softening but mostly government spending on loans pushed by Janet Yellen, shoving new money into the main economy:

That oughta help! The US deficit for the first two months of the fiscal year is the highest it’s ever been, pushing that new money into the economy like a high-speed train.

That oughta help! The US deficit for the first two months of the fiscal year is the highest it’s ever been, pushing that new money into the economy like a high-speed train.

According to the latest Treasury data released recently, in November - the second month of fiscal 2025 - the US spent a massive $584.2 billion, a 14% increase from the prior year, and a record for the month of November. For those who remember out [sic.] outrage from a month ago, will also remember that the latest deficit number follows what was also a record government outlay for the month of October.

If it makes you feel any better, Janet Yellen said she’s sorry recently:

“I am concerned about fiscal sustainability and I am sorry that we haven’t made more progress,” she said adding that “I believe that the deficit needs to be brought down especially now that we’re in an environment of higher interest rates.”

In other words, the deficit spending needs to be brought down on YOUR watch. (This was said to the new nominated Treasurer.) Biden and Yellen pumped it up as high as they possibly could on their watch, so Trump needs to bring it down on his. That has always been how every administration deals with the deficit—by assigning the problem to the next guy or next congress.

This is really funny for two reasons.

First, it was under Yellen's watch that the US experienced its biggest debt increase in history…. In other words, Yellen has personally presided over a gargantuan $15.2 trillion increase in US debt, or about 42% of all US debt ever issued! No one other government official can make even a remotely similar claim….

The last person allowed to seek accountability is Yellen, who is the one person in the US most directly complicit in making US fiscal sustainability a huge joke.

But, hey, she’s sorry, so that should help when the credit rating agencies start gearing up their downgrades. We can just show them the note that says she’s sorry.

The second reason why Yellen's words are a laughable grotesque, is that as we showed earlier, in its final days, the Biden administration - which is best known for spending trillions to buy votes in the US (and inexplicably, in the Ukraine) - has decided to go out with a bang, and at a time when government spending is hitting new record high month after month, even as US tax revenue has flatlined for the past five years...

The BANG! is that the government just approved a nearly trillion-dollar military budget. So, really, with lots bangs—big bangs.

Remember something else that was funny, too: It was Janet Yellen who said, when she was Fed head, that the Fed needed to get a handle on income disparity as she continued to pump all new money supply to the richest of bankers for years while publicly pondered why it was that the income of the rich was rising so much more rapidly than the middle class or the poor. Hmm. I wonder why that would have been.

Another big Yellen yuck from that our humorist pulled was when she said that quantitative tightening back in 2018 and 2019 would be as boring as watching paint dry, and then it blew red paint all over the Fed’s face, and the Fed had to slam on the brakes. To give a chaser to that dry humor, she also said, at that time, that we would not see another financial crisis in her lifetime … so problem solved, I guess.

Apparently, she was not expecting to live long after presiding over the worst wealth disparity in history. Probably was thinking a few angry poor folks that didn’t get trickled on would try to off her. Yet, she lived to see another financial crisis just a little over a year later when the government, with the Fed’s full assistance, created one out of COVID with lockdowns and the biggest corporate bailouts and individual stimulus checks in the history of this nation.

That grandma Yellen! She is so funny!

Never let a good crisis go to waste if you can blow it up into a bigger one like the current inflation!