NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 48th year in the gold business

August 2021

“Despite everything that could be imagined, said, written, done, as huge events happened, it is a fact that there is still today no currency that can compare, either by a direct or an indirect relationship, real or imagined, with gold.”

Charles DeGaulle (1965)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– The key to financial wisdom

The key to financial wisdom

To fully understand markets, understand gold. It is the key to financial wisdom. By learning of its role as a financial asset, one will discover universal truths about the value of money, and hence, the underlying value of all assets. It does not do much good, for example, to make a small fortune in the stock market, only to see it dwindle (or disappear overnight) in an inflationary storm or an implosion in financial markets.

The central tenet to the wisdom of gold lies in its status as the most liquid and widely owned asset that is not simultaneously someone else’s liability. Former Federal Reserve Chairman Alan Greenspan once remarked: “No one refuses gold as payment to discharge an obligation. Credit instruments and fiat currency depend on the creditworthiness of a counter-party. Gold, along with silver, is one of the only currencies that has an intrinsic value. It has always been that way. No one questions its value, and it has always been a valuable commodity, first coined in Asia Minor in 600 BC.”

In 2001, James Grant wrote an essay aptly titled “For Real Money.” It is a study of gold’s role in the financial marketplace. Though two decades old, that essay still resonates today. In it, he said that a new bull market for gold was already underway. Few believed him, but he turned out to be right. At the time, the metal was trading in the $280 range. Over the ensuing twenty-year period, it would rise to a little over $1800 per ounce today for a total return of 567%, or just over 10% per year compounded. (Gold reached a record high in August 2020 at $2067 per ounce.) He summed up the need for gold as follows:

“There are many differences between physics and economics, but the greatest of these is that particles aren’t people. Participating in a monetary system, clever people will exploit the rules in such a way as eventually to bring the system down. The system in place subsidizes and encourages risk-taking and borrowing. Accordingly, leveraged financial structures and colossal debts abound. The gold standard failed by reason of its structure (perceived as rigid). The pure paper standard is failing on account of its lack of structure. Anticipating the end of the dominance of the paper dollar, we have cast around for an alternative. The answer we keep coming up with is the one you already know.”

Two years later, as gold began to nudge higher, Grant would lay out a similar argument under the title “Value Hedge” – another study emphasizing the need for gold in the private investment portfolio:

“The salient feature of the millennial economy is not, as claimed by Greenspan, its complexity, but rather the determination of the Federal Reserve to forestall bad things through money printing. The rich old speculator Bernard M. Baruch forehandedly bought gold and gold shares after the 1929 Crash. Years later, a suspicious Treasury Secretary asked him why. Because, Baruch replied, he was ‘commencing to have doubts about the currency.’ Many are beginning to doubt the strength of the dollar today, as well they might. Following Baruch’s example, they should lay in some gold as a hedge.”

Grant has refined the message a bit over the years. “Gold,” he said back in May, “is not exactly an inflation hedge, but it is an investment in ‘monetary disorder,’ which is what we have. If I am right, there will be a world that will want tangible monetary stability because it loses confidence in central banks. When the cycles turn, people will want gold and silver. When people consider the shortcomings of the Fed, they will turn to gold.” Lay in a hedge. Financial wisdom need not be hard-won.

____________________________________________________________________________________

If you would like to read the two essays from the early 200os referenced above, USAGOLD reprinted both with Mr. Grant’s kind permission back in 2004 as part of our Gold Classics Series. Here is the link. A subscription to Grant’s Interest Rate Observer, his monthly newsletter, is highly recommended.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The six keys to successful gold ownership

This eye-opening, in-depth introduction to precious metals ownership will help you avoid many of the pitfalls that befall first-time investors. Find out who invests in gold, what role gold plays in serious investors’ portfolios, and the when, where, why, and how of adding precious metals to your holdings. To end right, it is critical that you start right, and the six keys to successful gold ownership will point you in the right direction.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––————–

Central banks are buying the dip in gold prices

A Bloomberg report in July on burgeoning official sector gold demand received scant attention among gold analysts. What makes it a matter of better than casual interest, though, is that the central banks appear to be buying the dip in prices this year – a preference that, if it continues, could carry longer-term implications for gold market fundamentals. Most notably, Brazil – the world’s ninth-largest economy – announced purchasing a hefty 41.8 tonnes of the metal last week. Similarly, Poland has made plans to add 100-tonnes of the metal to its coffers “over the course of a few years.”

Credit Suisse’s global equity analyst Andrew Garthwaite takes note of the trend in a recent report reviewed at ZeroHedge and offers a glimpse of the rationale behind the purchases. “Gold is a hedge against extreme financial deleveraging,” he says. “The level of government debt, deficit, and corporate debt is extreme. We continue to believe that if the TIPS yield gets much above zero, that would start to cause the markets to worry about a debt trap and that in turn could lead to a major risk-off trade. This could then prompt a Fed response driving down real yields (and debasing money).… We think this will also cause central banks to buy more gold (as currencies are being debased). Central banks account for 12% of gold demand. If all central banks had a minimum of 10% in gold, then gold demand would increase 1.6x, on our calculations.”

Stagflation is ‘a legitimate risk’ that would be painful for U.S. markets

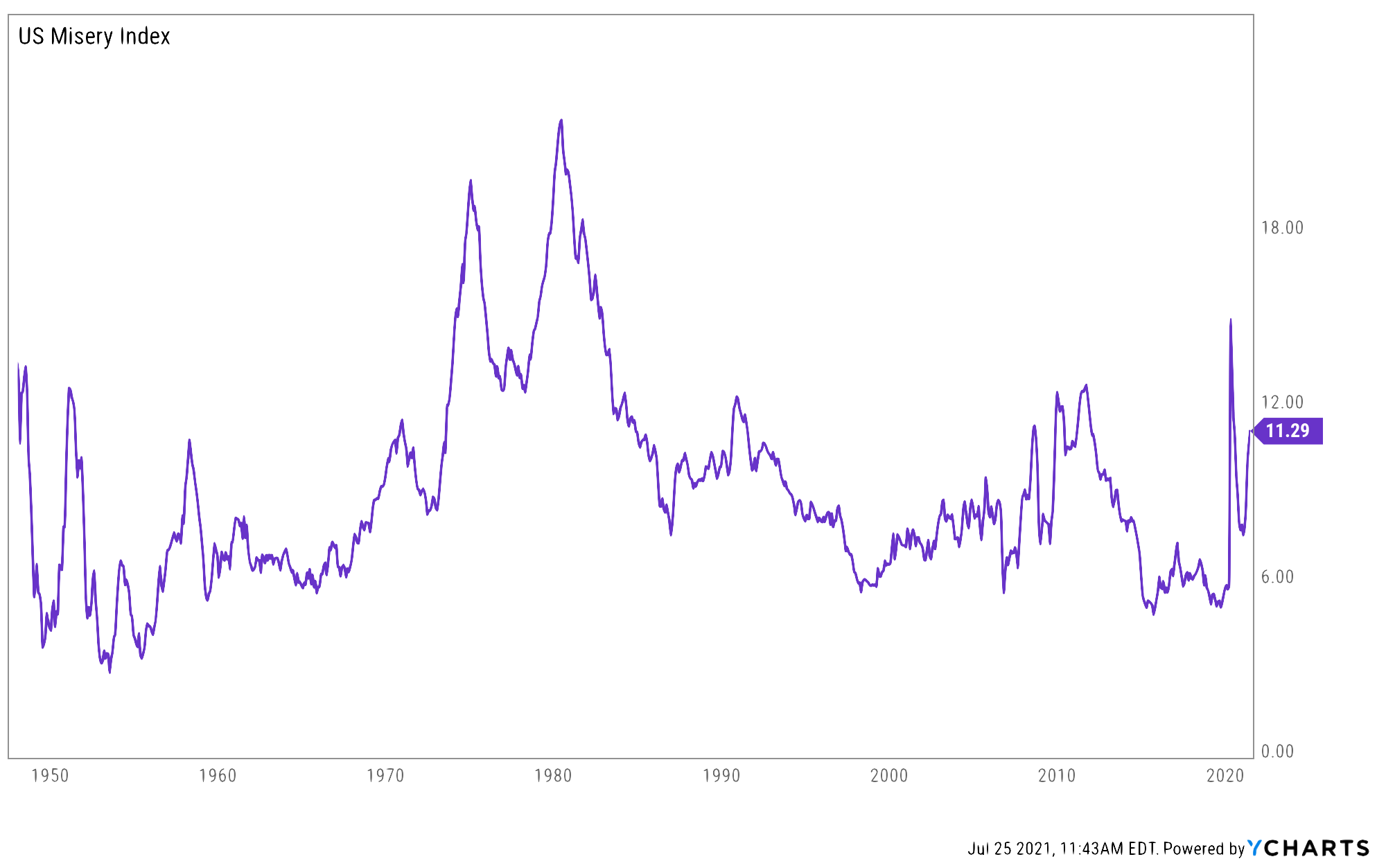

Alan Greenspan was among the first to warn that the economy could be headed for a round of stagflation like the 1970s, and that was back in late 2018, early 2019. Stagflation is the combination of high inflation and high unemployment, i.e., what Ronald Reagan called the Misery Index. At its height in 1980, the Misery Index reached 22%. As of the most recent government reports, it stands at 11.29%, according to YCharts, and is now climbing again. “Stagflation,” says Quadratic Capital Management’s Nancy Davis in a MarketWatch article, “is absolutely the biggest risk for every investor.… Imagine how scary it would be for the market if we had stocks and bonds selling off together … a major problem because central banks can’t really come to the rescue and cut interest rates.” Gold and silver were top performers during the stagflationary 1970s.

US Misery Index data by YCharts

Druckenmiller: ‘This is the biggest bubble I’ve seen in my career

Criticism of the Biden free-wheeling economic agenda is commonplace among Wall Street financiers. Still, we thought Duquesne Capital’s Stanley Druckenmiller, a highly respected commentator and money manager got to the heart of the matter during an interview with MSNBC recently. By passing the $3.5 trillion infrastructure bill, he thinks the government will throw fuel on the inflationary fire that could consume both Wall Street (in the form of a burst financial bubble) and Main Street (in the form of runaway inflation.) “If I was Darth Vader and I wanted to destroy the US economy, I would do aggressive spending in the middle of an already hot economy. You usually get a bubble out of that, and you get inflation of that. Frankly, we now have both. This is the biggest bubble I’ve seen in my career. … What are we going to get out of this? You’re going to get a sugar high, the higher inflation, then an economic bust.”

Silver could be setting up for a repeat of 2020’s explosive rally

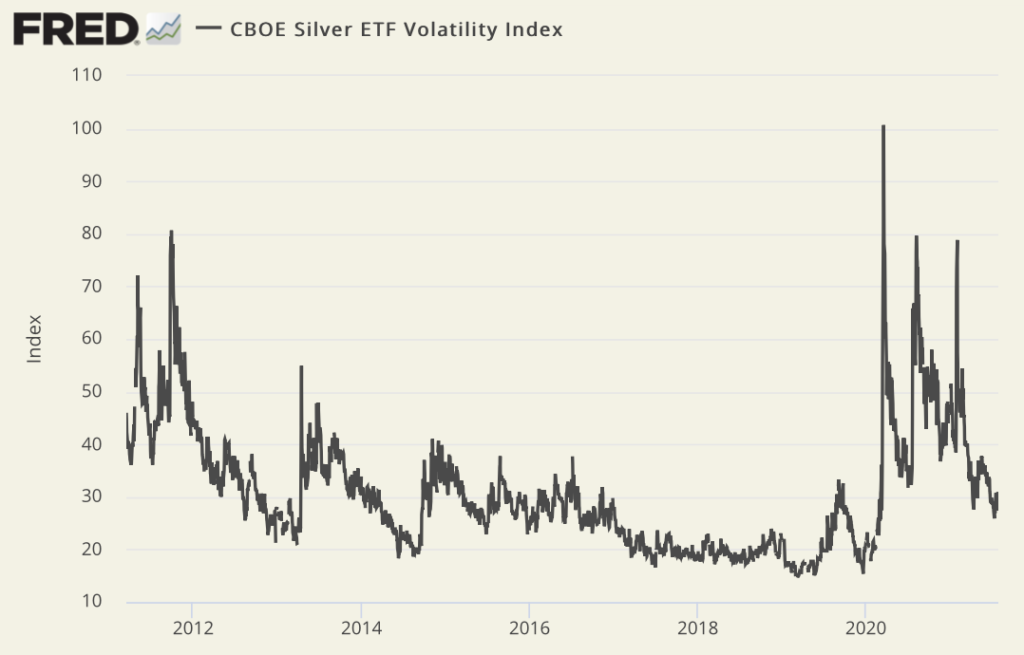

Silver’s performance over the past month offers a reminder of the metal’s volatility. Commodity analyst Andrew Hecht, whose experience in the silver market stretches back to the 1970s as a trader with Salomon Brothers, is well aware of the metal’s long history of radical ups and downs. “Silver volatility,” he writes in a recent Seeking Alpha article, “can be explosive. Meanwhile, the price action can also be coma-like, lulling market participants into a false sense of security for long periods. Silver’s history is full of false technical breakouts and breakdowns…Silver is a unique metal as it is part industrial, part investment asset. It experiences long periods of coma-like price action. Still, when it moves, as the price did not 2020, few commodities compare to the precious metal when it comes to percentage moves.” Hecht reminds readers of silver’s performance in 2020 when “bearish price action gave way to an explosive rally.” (Silver went from the $12 level in March to $29 by early August.) He goes on to say that “[t]he recent price dynamics could be setting up for a repeat performance given the rising level of inflation across all markets.”

Silver Volatility Index

Sources: St. Louis Federal Reserve [FRED], Chicago Board Options Exchange

Will the Biden administration stick with Powell or go progressive with Brainard?

“A ‘hands-off’ policy,” writes former Alliance Bernstein chief economist Joseph Conrad in an analysis posted at ZeroHedge, “is a short-term friend to finance until it isn’t, whereas a ‘hands-on’ is a long-term friend as it attempts to limit the scale of the inflation cycle. Greenspan’s “hands-on” policy worked, and early results indicate Powell’s “hands-off” isn’t. How long will it take before investors realize Powell will eventually need to follow Greenspan’s plan?” Such thinking will figure largely within the Biden administration as it contemplates who will chair the Fed come February of next year. The White House will be heavily in favor of the “hands-off” approach and will worry about Powell, a Republican, changing course if/when he is reappointed.

Lael Brainard, often touted as the most likely alternative, favors the progressive agenda embraced by the Biden White House. We find ourselves among the minority who believe Lael Brainard stands a strong chance of displacing Jerome Powell when decision time arrives next year. Why would the Biden administration pass up the opportunity to install an individual with unwavering progressive credentials as head of the Federal Reserve? Particularly in light of the fractious culture alive and well in the nation’s capital.

Quantitative easing is a dangerous addiction

“The Economic Affairs Committee,” reads the notice posted recently at the United Kingdom Parliament’s website, “publishes its report ‘Quantitative easing: a dangerous addiction?’, which urges the Bank of England to explain in more detail why it believes rising inflation will be a short-term phenomenon, and why continuing with its quantitative easing programme until the end of 2021 is the right course of action.”

Needless to say, we were surprised by the direct reference to quantitative easing as an addiction since it is a malady we have referenced repeatedly at the USAGOLD website over the years. We see very little from American politicians on the dangers of quantitative easing, particularly its addictive qualities. Can you imagine a member of the U.S. Senate going public with a statement that the Federal Reserve has become addicted to quantitative easing? Even going further by stating the policy needs “significant scrutiny and accountability”?

A few days later, in a Bloomberg Opinion piece, former Bank of England Governor Mervyn King announced his support of the inquiry, saying that the answer to the dangerous addiction question is “yes.” King, the highly respected former governor of the Bank of England, believes quantitative easing should have been used as a temporary measure and that it should now be “dialed back” with authorities “helping investors to plan accordingly.” All of that is taken as sound advice. Much of the damage, though, has already been done as QE’s excesses filter through the economy – not the least inflation coupled with an unhealthy sense of moral hazard.

The next great monetary experiment

‘They began to sell their shares of stock and hoard in gold the enormous wealth they had acquired.’

According to Modern Monetary Theory, governments cannot go bankrupt because they can print money. But, at the same time, when money printing leads to inflation, it is the citizenry that is harmed. “By a continuing process of inflation,” wrote John Maynard Keynes in The Economic Consequences of Peace (1919), “governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method, they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but at confidence in the equity of the existing distribution of wealth.”

Daily Reckoning’s Brian Maher warns of the potential consequences of modern monetary theory. “This MMT sounds like a recipe for immense inflation, even hyperinflation,” he says. “You are spending all this money directly into the economy. It will drive consumer prices through the attic roof, you say. This is crackpot. A witch’s sabbath of inflation would surely result. Yes, but here the MMT crowd meets you head-on… They agree with you. They agree MMT could cause general inflation, possibly even a hyperinflation.” [Link to full article]

Modern Monetary Theory (MMT), we would add to Maher’s observation, is neither modern nor a theory. John Law, the Scottish financier, tried a version of it almost exactly 300 years ago (1717-18) in France.* He did so with the blessing of the French monarchy and with a rationale very similar to MMT’s proponents today. Simply put, MMT entails a federal government fiscal policy without spending limits coupled with the power to print whatever money is required to finance any deficits. In the end, Law’s theories (to his surprise if we are to believe the historical account) bankrupted the French people and the government, reduced the economy to ashes, and created such a distaste for paper scrip among the citizenry that it took 80 years for France to reintroduce paper money as a circulating medium.

In The Story of the Greatest Nations (1900), Edward S Ellis and Charles F. Home tell of the public mania that engulfed the French people and led to ultimate financial ruin for thousands:

“The shrewder speculators* became alarmed. They began to sell their shares of stock and hoard in gold the enormous wealth they had acquired. This resulted in a demand on the government for metal in exchange for its paper, and soon the government had no metal to give. Then the crash came. Those who had the government paper could buy nothing with it. Those who held the Mississippi stock could scarce give it away. It was worthless. The government itself refused to accept its own paper for taxes. A few lucky speculators had made vast fortunes; but thousands of families, especially among the wealthier classes, were ruined.”

That snippet hints at the steps taken by those who survived Law’s version of modern monetary theory. For those to whom all of this has a distinct ring of familiarity, perhaps a judicious hedge makes some sense. Many analysts have argued that we do not have to wait for the formal launch of modern monetary theory. It is already here in the form of quantitative easing.

* Please see this link for a summary of Law’s Mississippi Company land scheme.IFLScience/James Felton/7-22-2021

Final Thought

Socialist mousetopia regresses to dystopia, apocalypse, and finally, extinction

In a piece written for IFL Science, James Felton offers a riveting account of what exactly happened in the Mousetopia of Universe 25. John B Calhoun, a medical doctor at the National Institute of Health, says Felton “set about creating a series of experiments [in 1973] that would essentially cater to every need of rodents, and then track the effect on the population over time.” It yielded some very unexpected results. Calhoun’s socialist utopia (or, in this case, mousetopia) evolved to a chaotic dystopia and finally an apocalypse, as the norms of mice behavior in the wild completely broke down in what can only be called social chaos. “Soon,” writes Felton, “the entire colony was extinct.” In the opening paragraph to the study, Dr. Calhoun says, “I shall largely speak of mice, but my thoughts are on man, on healing, on life and its evolution. Threatening life and evolution are the two deaths, death of the spirit and death of the body.”

In a piece written for IFL Science, James Felton offers a riveting account of what exactly happened in the Mousetopia of Universe 25. John B Calhoun, a medical doctor at the National Institute of Health, says Felton “set about creating a series of experiments [in 1973] that would essentially cater to every need of rodents, and then track the effect on the population over time.” It yielded some very unexpected results. Calhoun’s socialist utopia (or, in this case, mousetopia) evolved to a chaotic dystopia and finally an apocalypse, as the norms of mice behavior in the wild completely broke down in what can only be called social chaos. “Soon,” writes Felton, “the entire colony was extinct.” In the opening paragraph to the study, Dr. Calhoun says, “I shall largely speak of mice, but my thoughts are on man, on healing, on life and its evolution. Threatening life and evolution are the two deaths, death of the spirit and death of the body.”

It is difficult to read Felton’s account of what happened in Universe 25 without thinking about the still-developing response to the pandemic-related government support programs on all levels of our society, i.e., the distressing social, psychological, economic, and political upheaval it has induced. Calhoun, according to Felton, “believed that the mouse experiment may also apply to humans, and warned of a day where – god forbid – all our needs are met.” Moreover, Calhoun wrote, “For an animal so complex as man, there is no logical reason why a comparable sequence of events should not also lead to species extinction. If opportunities for role fulfillment fall far short of the demand by those capable of filling roles, and having expectancies to do so, only violence and disruption of social organization can follow.”

By all of this, we do not mean to suggest that contemporary society is headed for a dystopia – though some troubling signs are already present. On the other hand, it would be foolhardy to believe that there will not be modifications to the way our society operates, unintended consequences, and renegotiation (perhaps even radical alteration) of the standing social contract. The general effects on the economy – and ultimately financial markets – are likely to be ongoing with the ultimate results still to be determined. Returning to the theme of this month’s newsletter, the wise will prepare for the unexpected.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ORDER GOLD & SILVER ONLINE 24-7

Up-to-the-minute gold market news, opinion, and analysis as it happens.

If you appreciate NEWS & VIEWS, you might also take

an interest in our Daily Top Gold News and Opinion page.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.