NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 47th year in the gold business

SEPTEMBER 2020

“Stay with silver and gold and pray for the good of the nation.” – Richard Russell

“Those who plan, invest and execute long-term win,’ says long-time market analyst R.E. McMaster in A Layman’s Guide to Golden Guidelines for Wise Money Management. “Win-win decisions, looking to the long term with short-term work and sacrifice, are historically the tickets to success in all areas of life – short-term sacrifice for long-term benefits, deferred gratification rather than instant gratification. This is the difference between wealth and poverty, between class and trash. Those who make primarily fear-based, ego-based, selfish, win-lose, lose-lose, emotional and/or short-term decisions as their primary mode of operation in life nearly always end up miserable, often as losers in a comprehensive sense in life. Such people are walking tornadoes to be avoided.” [The Law of Long-Term Time Preference]

Successful investors have a philosophy, usually carefully cultivated, that they rely upon in their investment decisions no matter what happens in the markets in the short-run. Too, successful investors, as R.E. McMaster points out above, are rarely shaken by short-term events and, rarer still, guilty of short-term thinking. USAGOLD has always nurtured the belief that gold should not be purchased principally as a speculative investment, but more as an asset accumulated for long-term asset preservation in the form of coins and bullion. That, in fact, is a viewpoint it shares with the bulk of its clientele. Thus, when we have a sell-off like what occurred this past month, experienced gold investors usually view such events as buying opportunities and part of a normal, healthy market process.

Along these lines, Financial Sense‘s Jim Puplava, a forty-year market veteran who has seen his share of twists and turns in the financial markets, offers some valuable perspective. “I have found throughout my long investment career,” he says, “that an investor needs to make very few investment decisions in their lifetime. The key is to identify a long-term trend as it begins to emerge, invest in that trend, ride it until it ends and another trend replaces it. As an example, U.S. stocks in the 50s and 60s, commodities in the 70s, Japanese stocks in the 80s, tech stocks in the 90s, commodities in 2000s, and tech and paper assets in the 2010s. The next trend that is emerging will favor things or hard assets. This is what the gold markets are telegraphing now. This trend will be inflationary driven by resource shortages and a tsunami of money printing.”

Warren Buffett’s timing on gold

‘Getting out of the paper money business and into the hard money business’

Gold has gone from roughly $1500 in March to nearly $2000 as this newsletter is published – a fairly significant move to the upside in a few short months. We also note with interest that Warren Buffett recently shed a portion of his bank stock position and rolled that capital into Barrick gold mining stock. Buffett, it is well known, built his fortune on value investing – identifying investments with solid fundamentals, being early in the game, and sticking with those choices for the long run. As a result, his foray into the gold market is likely to have a major psychological impact on Wall Street investors in general. Electrum Fund’s Thomas Kaplan – the billionaire investor in gold and gold mining companies – called Buffett’s latest moves a “huge detoxifier for gold.”

“Like Banquo’s ghost in Shakespeare’s Macbeth,” says market analyst James Ricards in a commentary posted recently at the Daily Reckoning website, “gold keeps showing up as an uninvited guest at the dinner table to haunt the central bankers. Economists may have abandoned gold, but investors have not. And perhaps the most famous investor of all is now betting on gold. … Banks create money by making loans and adding the loan proceeds to borrower accounts through a few accounting entries. The banks create paper money. But, gold miners create money by digging up gold, processing it and selling it to refiners. In other words, the gold miners create hard money. Buffett is signaling a loss of confidence in the dollar. He’s getting out of the paper money business and into the hard money business. Economists call this a ‘liquidity preference.’ I call it a sign of the times. If Buffett is moving into hard money in the form of gold, maybe you should too.”

Ohio pension fund buys gold

At a 5% diversification pension funds would pump $1.12 trillion into the gold market

From last month’s News & Views:

“First institutions and funds came over to gold’s corner, then central banks. Now, one of the more important stories in the gold investment arena is the developing interest among a whole new grouping of professional investors – pension funds, private equity, insurance companies, and sovereign wealth funds. “It’s a bit like what happened to big tech,” says highly respected economist Mohammed El-Erian. “People like [gold] because it’s defensive. People like it because it’s a reflation trade. People like it because it’s inflation protection. What we are starting to see with the narrative about gold is starting to be like the narrative about big tech. It gives you everything.” These groups bring considerable purchasing power and market savvy to the table. One immediate result might be more buying interest on price dips. Another might be a better blend of investment psychology and objectives that could have a settling effect on the market overall.”

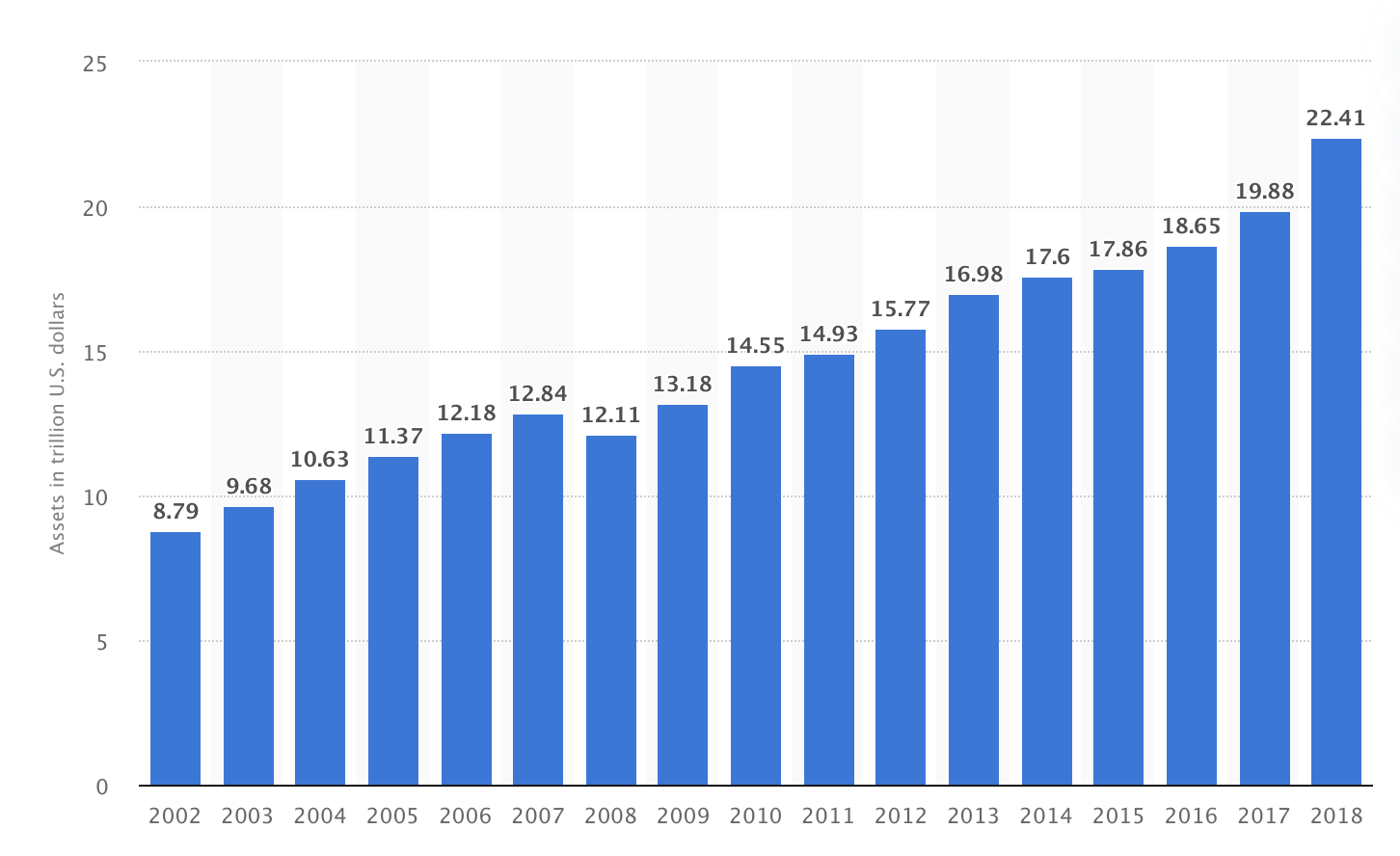

Pension fund total assets

(United States, 2002-2018)

Chart courtesy of Statista.com • • • Click to enlarge

Along comes the Ohio Police and Fire Pension Fund (OP&F) to announce in late August that it will allocate 5% of its nearly $16 billion investment portfolio to gold as a “strong diversifier” and “effective hedge against inflation.” A 5% allocation to gold, if achieved, would amount to roughly $800 million at $2,000 per ounce – about 400,000 troy ounces or 12.5 metric tonnes. Even though that commitment amounts to a formidable boost for the annual demand table, OP&F is just a small slice of the $22.4 trillion U.S. pension fund universe.

If by some stretch of the financial imagination, U.S.-based pension funds were to allocate 5% to gold across the boards, over $1.12 trillion would suddenly enter the gold market – the equivalent of almost 17,500 metric tonnes at current prices and an amount equal to half central banks’ total gold reserves. That is not a likely outcome but we throw the number out there just to offer an idea of pension funds’ purchasing power. Globally, pension funds have roughly $35 trillion under management. If only 1% were allocated, it would translate to almost 5,5oo tonnes – still a significant number. Mike McGlone, Bloomberg’s chief commodities analyst, reports in a recent commodity outlook that gold ETFs absorbed 20% of mine production in 2019 and that they are on pace to absorb 30% in 2020. “Starting from zero in 2004,” he says, “gold ETFs are a relatively nascent investment vehicle with plenty of room for maturation.” Taking into account the latent purchasing power just in pension funds – not to speak of what could be generated if private equity, insurance companies, and sovereign wealth funds were included in the mix – it is not difficult to understand what might have motivated Warren Buffett’s interest in the gold sector.

[More below]

When ‘the process engages all the hidden forces

of economic law on the side of destruction’

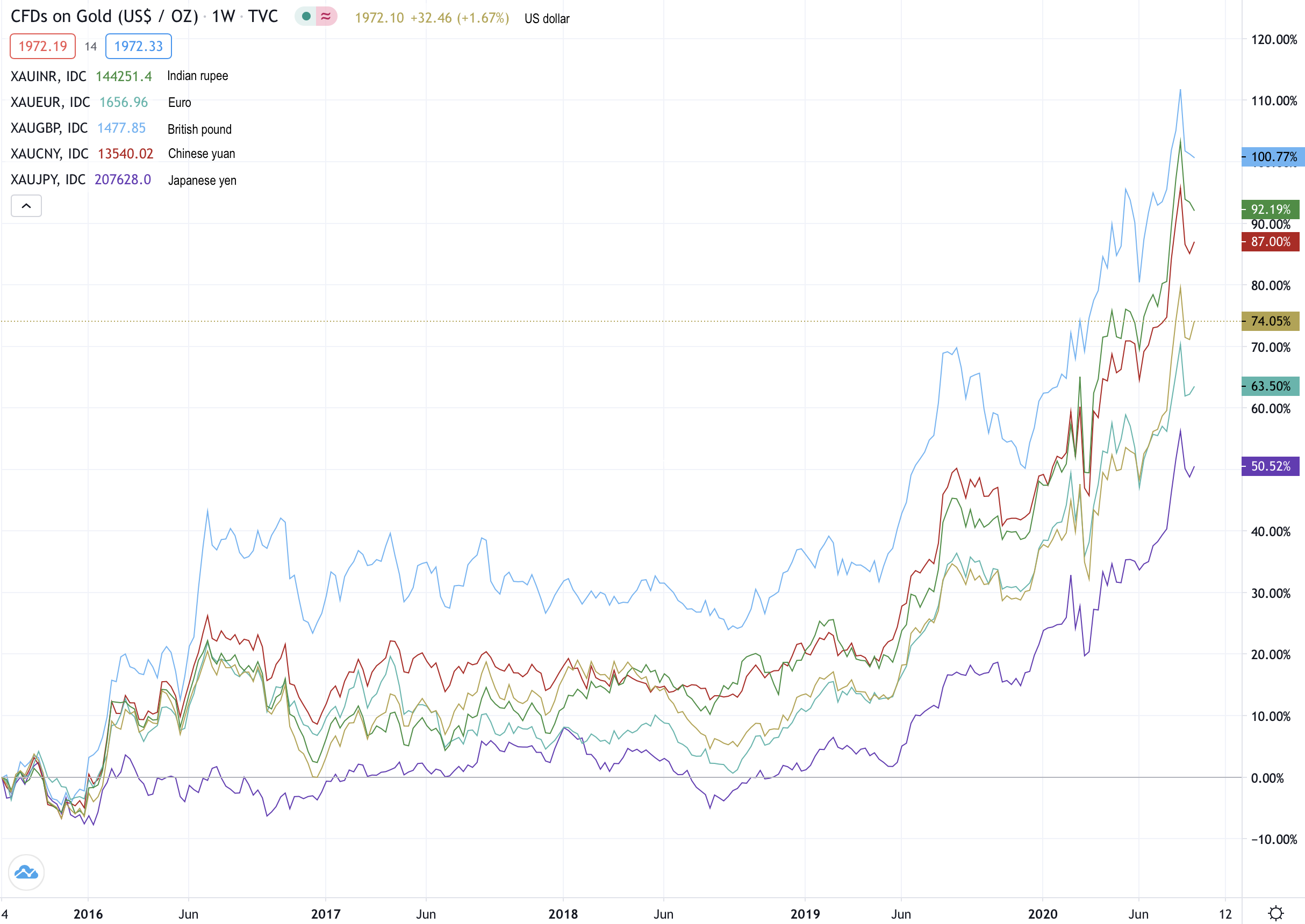

“Lenin was certainly right,” wrote John Maynard Keynes in The Consequences of Peace (1919), “there is no more positive, or subtler, no surer means of overturning the existing basis of society than to debauch the currency…The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million is able to diagnose.” Neither Keynes nor Lenin, however, would have envisioned the degree of currency debasement occurring globally the result of the pandemic. Too, though Keynes was right about currency debasement, he missed the mark on the public’s ability to identify the problem. Apparently, a good many not only understand the problem but how best to take refuge. Explosive growth in gold demand on a global basis has been the result – as shown in the chart on gold’s performance against the world’s top currencies. Over the past five years (as of the end of August), gold has risen sharply in six of the world’s top currencies – Indian rupee (+92.19%); Chinese yuan (+87.0%); U.S. dollar (+74.05%); British pound (+100.77%); European euro (+63.5%), and Japanese yen (+50.52%).

Gold price in key currencies

2018 to present

(Indian rupee, Chinese yuan, U.S. dollar, British pound, European euro, Japanese yen)

Chart courtesy of TradingView.com • • • Click to enlarge

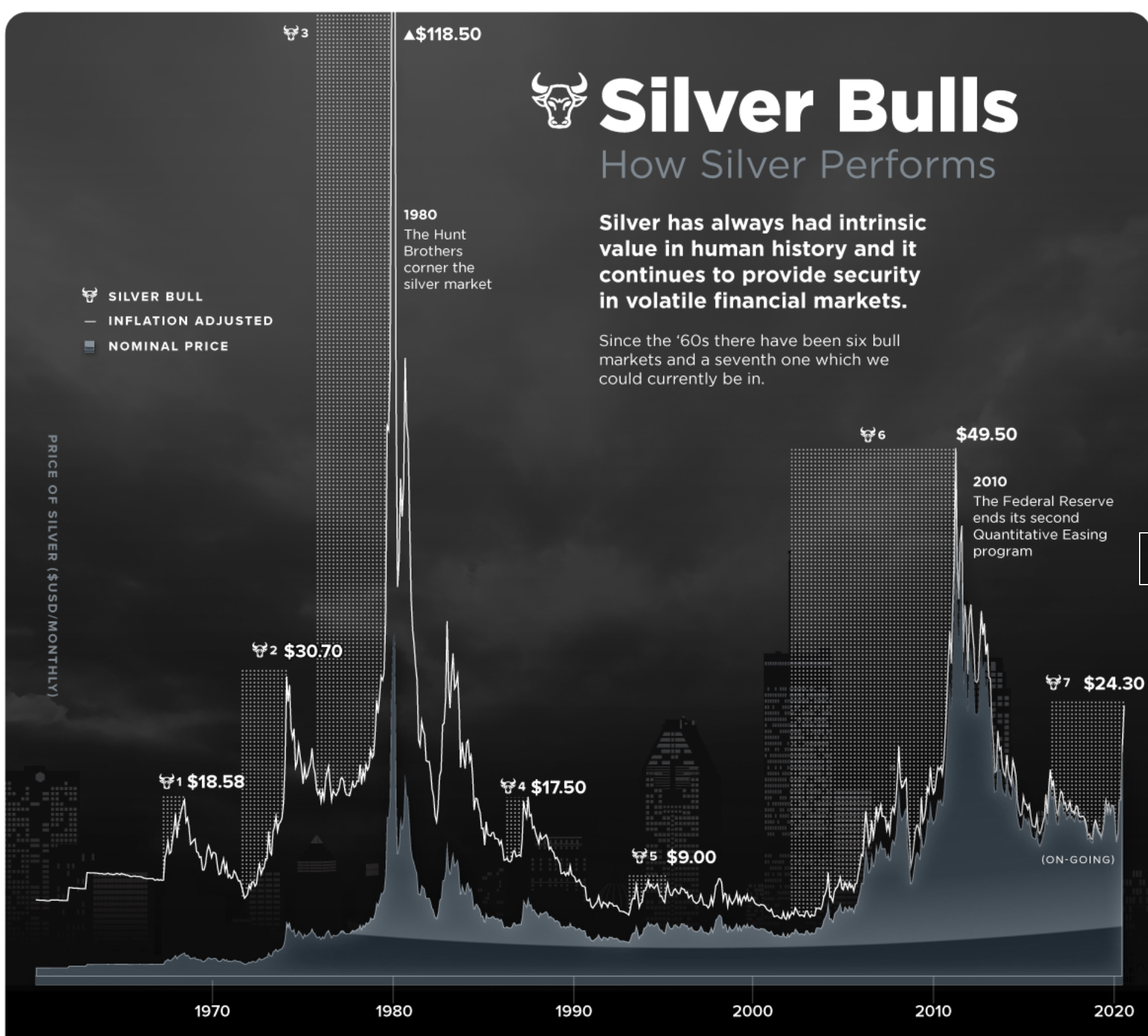

Gold is good, but silver is even better

In fact, it has been the best-performing asset in 2020

We would be remiss if we didn’t include at least a short section on silver’s outstanding performance thus far this year. At publication time, gold is up 26.25% year to date while silver is up 47.66%. Over the past twelve months, it is up 37.25% to gold’s 24.75%. Deutsche Bank’s Henry Allen recently pointed out that silver was the best-performing asset across the boards thus far in 2020 outperforming even the highly-touted NASDAQ. “The jump in [the silver] price in July reflected renewed interest by retail investors potentially priced out of gold,” reports German-based refiner Heraeus in its latest precious metals forecast. “July represented one of the best months on record for silver, recording its largest monthly price gain since 1979. Inflows to silver ETFs have been very strong, with global holdings reaching a record 1,036 moz in August. … Silver has outperformed gold for many weeks now, which has seen the gold:silver ratio fall back to 71. Industrial demand is recovering but investor demand must be sustained for this outperformance to continue. With the economic outlook still uncertain, further stimulus measures by governments or central banks could keep investors interested in silver. The price is anticipated to trade within a range of $22.5/oz and $35/oz for the remainder of the year.” [Emphasis added]

Chart courtesy of Visual Capitalist/Nicholas LePan • • • Click to enlarge

Final thought

A gilding of the rose

“A recent survey of 1,000 people,” writes Ruchir Sharma in a New York Times opinion titled Why Is Everyone Buying Gold? “found that one in six Americans bought gold or other precious metals in the last three months, and about one in four were seriously thinking about it. On Robinhood, the popular online trading platform, the number of users holding two of its largest gold funds has tripled since January. It seems we’re all gold bugs now.” That last reference is a twist of the phrase and a counterpoint to President Richard Nixon’s declaration upon departure from the standard almost fifty years ago that “we are all Keynesians now” …… We might be entering a new era for gold (and silver) if Sharma is correct – a gilding of the rose, so to speak – but very doubtful that we will be departing from Keynesian doctrine any time soon.

Image courtesy of Degussa Goldhandel AG

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. The utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

Michael J. Kosares is the founder of USAGOLD and the author of The ABCs of Gold Investing – How to Protect and Build Your Wealth With Gold. He is also editor and commentator for USAGOLD’s Live Daily Newsletter and editor of the News & Views monthly newsletter.