Now we are seeing more the kinds of moves I’ve been expecting to show up in the lazy-thinking stock and bond market. Bond yields jumped on the news, and stocks tumbled just enough to show this as a day where bad news just remained bad news for once. They couldn’t figure out a way to make it a cause to celebrate.

The 10YR yield shot up almost high enough to reach its high for the year. Bets on Fed rate cuts lowered to anticipating just three for the year once again, after having climbed idiotically back up to four. Also, bond yields started reverting again, as they typically do completely before an official recession begins, though bond yields have been messed around to such extremes by the Fed’s heavy hand for so long that no one should expect them to convey their normal advance warning at this point. Bonds are still figuring out how to become a normal market again, heads still swimming in the Fed’s opiates of years past.

The recent rise did mean that bonds started pumping money out of stocks again as their yields started to move back to the level of enticement that existed before November’s big leap into insanity over fantasy Fed rate cuts. Four straight days playing Whack-a-Mole with Nvidia to keep its stock down from its last high.

And the dollar soared as people realized the Fed will, indeed, be tightening longer, while dollar gains kept knocking gold on the head.

And what caused all this ruckus?

First of all, jobs just got hotter with the number of people filing for unemployment falling in an absurd-looking manner.

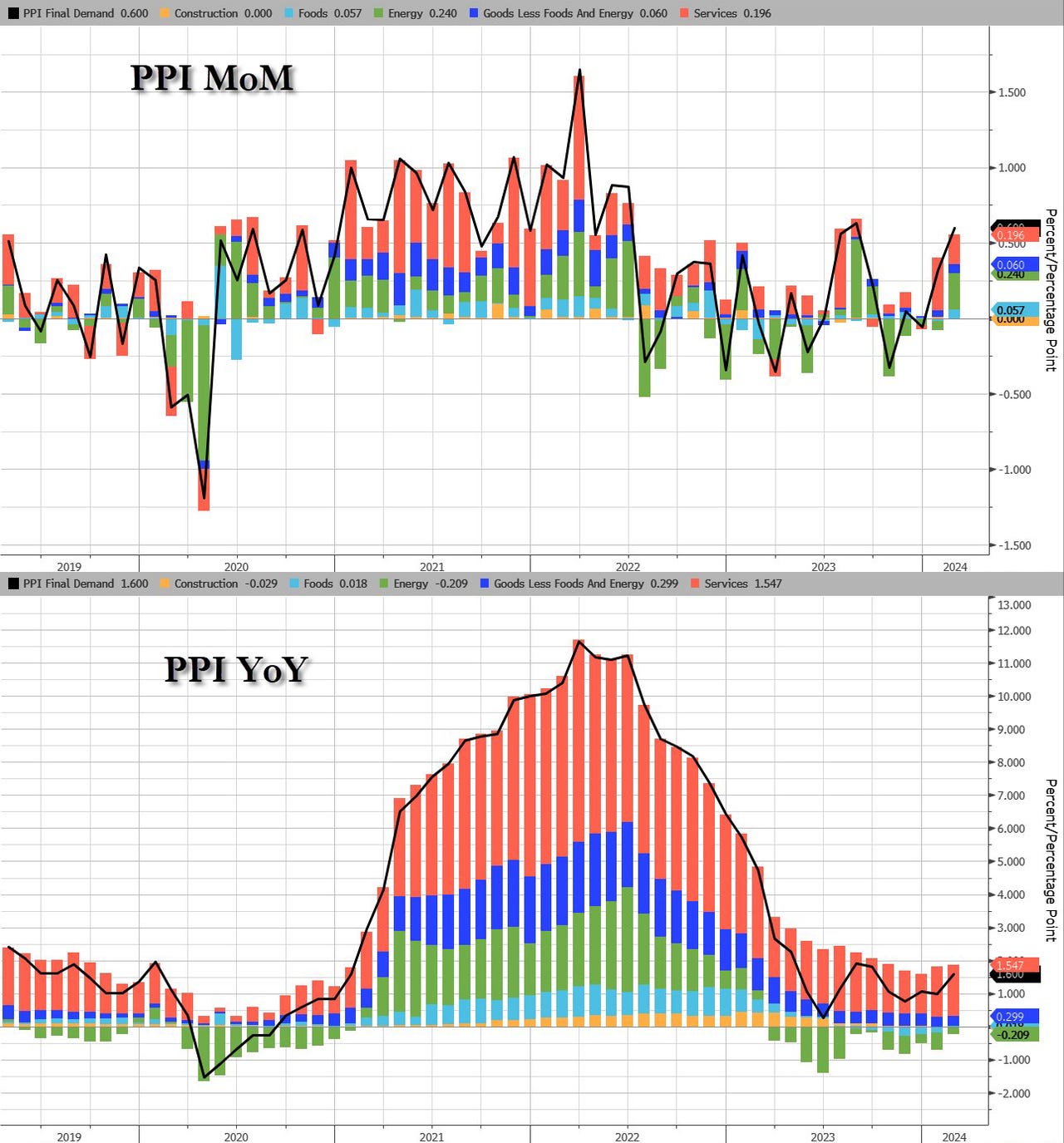

Then, most of all, the Producer Price Index, which looks a step further up the pipeline than consumer prices to see what pressures are coming, just took another predictable step up. So, those CPI price that took a step up on Tuesday are likely to take another step in the month/months ahead as these price pressures work their way down the pipe.

Startling markets, which suffer self-inflicted blindness to keep their greed alive, the overall price increase came in at double what the expected number was—a 0.6% jump in one month. Energy costs led the march uphill, and that also just became a worse pressure in future months because West Texas Intermediate crude (WTI) finally screamed above the $81/bbl, which is not priced into the PPI report yet. That’s a milestone not seen since November either, and those higher oil prices will also start showing up in all other prices as they raise the cost of production and doing business.

Look at how much of the increase in the PPI Report came from energy (the green portion of the bar) compared to the previous four months where energy prices had gone lower:

And, finally, retail sales fell month-on-month for the second month in a row in BofA and Bloomberg consensus. As with those inflation numbers I’ve pored over since last summer that we are now seeing in YoY and annualized figures, those MoM changes will also likely start stacking up over time to show up in the YoY figures.

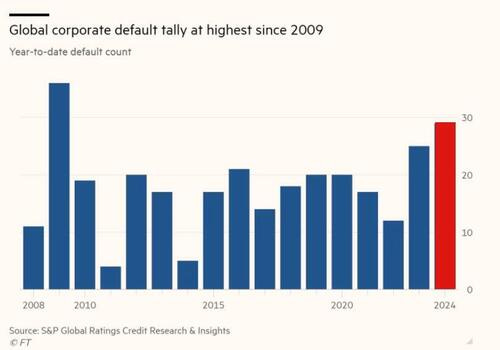

As a side note, Zero Hedge reports that more companies have defaulted around the world this year than in the first quarter of any year since the Great Financial Crisis. So, that’s a milestone, too. Tightening by central banks around the world is starting to take a real economic bite:

On the good news side, Jamie Dimon (pronounce it “demon” for proper effect) just saw his bank get fined almost $350-million for deciding not to monitor the criminal activity of its traders properly. However, I imagine, compared to the gains they made off those trades, this amounted to just an investment fee. They got Fed-spanked. They’ll never do that again until the next opportunity. After all, the trades involved “billions.” But, hey, crypto, the Demon says, is the corrupt thing to watch. I think that’s a bit like “Don’t want my left hand while my right hand flips this coin under my fingers.” But, hey again, at least Congress is overseeing this! Wasn’t JPMorgan Chase recently accuse of helping to launder money? Oh, yeah.