- The governments of most nations love to meddle in the affairs of innocent citizens and businesses, using vile fiat money and debt to do it.

- As nations grow into empires, the meddling goes out of control… to the point that the “Gmen” of the empire can be seen using surreal amounts of fiat money and debt to meddle in the affairs of citizens at home and in faraway lands.

- This, of course, is why sane citizens under attack from the evil meddlers… must own lots of gold.

- Fiat currency is, by definition, socialist currency. The silly Gmen who eagerly embrace it define themselves as socialists.

- Feeding starving citizens is not socialism. It’s sanity. Socialism is insanity. Socialism is spending trillions in fiat money debt on regime change war schemes in faraway lands. Socialism is bailing out rich stock market investor bums who cry big tears to mommy because they have a drawdown in their fiat money accounts. Socialism is using trillions of printed fiat dollars to subsidize OTC derivative gamblers whose silly bets have gone awry.

- In contrast to socialist fiat and its silly worshippers, gold is the world’s “top of the food chain” currency. It benefits the poor, middle earners, and the rich… equally.

- Simply put, gold is the currency of champions.

- To view it in glorious daily chart action,

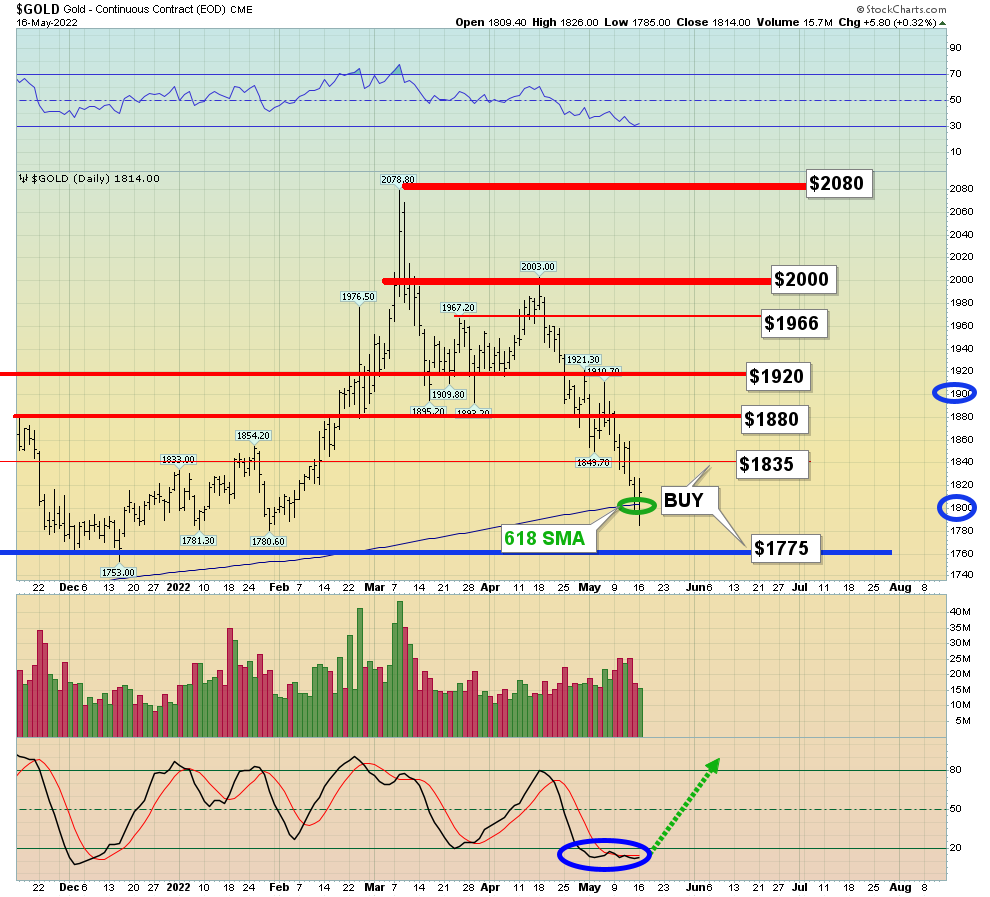

Double-click to enlarge. My $1835-$1775 buy zone that I outlined for citizens in the “gold bull era” looks stellar.

Double-click to enlarge. My $1835-$1775 buy zone that I outlined for citizens in the “gold bull era” looks stellar. - Note the position of my 14,7,7 series Stochastics oscillator and the “Fib 618” moving average. Both are in sync with the arrival of gold at the key round number of $1800. The bottom line:

- Eager gold bugs should feel compelled to buy.

- Please click here now. Double-click to enlarge this important CDNX chart.

- For a second look at it, please click here now. Double-click to enlarge what is best termed… my junior mines ATM chart.

- It appears that junior mining stocks are poised to decouple from the US stock market, anchor to gold, blast up from an immense H&S bottom pattern… and stage the biggest rally in the history of junior mining!

- I cover the CDNX and key junior miners in my Galactic Juniors newsletter, and at $199/yr it offers great value. Given the potential for a “Golden Geyser”, I’m doing a special offer this week of just $169/14mths. Click this link or send me an Email if you want the offer. Thanks!

- All inflation-oriented “cylinders” are firing, and to view them as a group, please click here now. Double-click to enlarge this GSG-NYSE general commodities chart.

- As lockdowns are fading in China, oil demand is set to surge. At the same time, India has banned wheat exports and key commodity sugar is rallying.

- Stock market investors see the re-opening in China as great news for the global economy, but that celebration could be cut short by the appearance of food, shelter, and fuel protests… protests that I’ve predicted morph into riots, and most ominously for America… outright civil war.

- Key numbers? An oil price of $200 and higher could bring shootouts at US gas stations. “I’ll pay $100 or even $150 to fill my small car’s gas tank, but I’m not paying $500. I brought my handgun, and you can take my $100 or take a bullet. ” – Joe Blow American auto owner at the gas station, in August 2023?

- There could be grocery store worker walkouts, as the clerks demand extra pay to deal with enraged shoppers. It’s not a good situation, unless you own gold, silver, and general commodities too!

- Please click here now. Double-click to enlarge this Finviz.com snapshot of meat prices in the futures market.

- Americans are voracious meat eaters and very soon they will need to decide whether they want to be eating lots of high-priced meat paid for with “maxed-out” credit cards, or whether they want to join the rest of the world’s “useless eaters” and engage in serious street protest against their fiat-obsessed governments.

- Please click here now. Double-click to enlarge this spectacular GDX chart. In terms of price, the bull cycle reaction from the 2011 highs ended in late 2015/early 2016 at about $12. In terms of time…it just ended now!

- As GDX traded near $41 as gold touched $2000, I urged investors to prepare for a pullback to $30 for GDX, and that’s precisely what occurred. Now that the pullback is done, investors should be ready for the meat and potatoes period of the “exciting” 2021-2025 war and inflation cycle.

- The bottom line: For the world’s gold bugs, what lies ahead is going to be mostly a golden street party rather than an inflation protest or riot, one that will feature a marching mining stocks band!

Thanks!

Cheers

St