This is a brief of our annual analysis of the gold and silver markets. In the full Outlook Report, we take an in-depth look at the market players, dynamics, fallacies, drivers, and finally give our predictions for gold and silver prices over the coming year.

Our unique analysis of precious metals, encapsulated in our Supply and Demand model, is a true signal in an otherwise very noisy market. It has achieved over 75% accuracy in predicting future price moves over the last decade.

So, how exactly do we do it?

How We Think About Gold

Gold and silver cannot be understood by conventional commodity analysis.

This is because virtually all of the gold ever mined in human history is still in human hands (to a lesser extent for silver). No other commodity comes even remotely close. The World Gold Council estimates this to be about 201,296 tons. That’s over 6 billion ounces, and just shy of $12 trillion dollars (as of this writing).

We think this number underestimates it, potentially by multiples.

Why?

For two reasons. Humans have been accumulating gold for a very, very long time.

Second, gold isn’t exactly the kind of thing people mention that they have.

The implications of this are extraordinary.

It means there’s no such thing as a glut in gold. And there’s no such thing as oversupply. People are happy to keep stacking gold today, and for all the “today’s” going back thousands of years.

All of the above ground gold that humans have been accumulating for millennia is potential supply, under the right conditions and at the right price.

Unlike with ordinary commodities, virtually everyone on the planet represents potential demand. People are happy to accept the 1,001st ounce on the same terms as the 1,000th or the 1st ounce.

What could account for this kind of behavior over millennia? There is only one conceivable answer.

It’s because these metals are money.

This leads us to conclude that a change in the desire to hoard or dishoard gold, even a small one, is the primary driver of the price.

How then does one measure the desire to hoard or dishoard gold?

The answer to this question forms the basis of our Supply and Demand model for gold and silver.

How We Analyze the Gold Market

The market is composed of 5 different primary groups: buyers of metal, sellers of metal, buyers of paper, short sellers of paper, and market makers (warehousemen).

Despite the fact that virtually all of the gold ever mined is still in someone’s possession, the market can experience seasons of relative abundance and scarcity. The spreads of the warehouseman provide a good signal to see them.

Normally, the price of a contract to deliver gold in the future is above the price of gold for immediate delivery. If this spread—future minus spot—is wide and getting wider, there is an abundance of gold to the market. And the reverse is true, if it is narrow, or even inverted, then there is scarcity in the market.

Relative abundance indicates a soft market, and likely precedes a falling price. Relative scarcity indicates a stronger market, and typically precedes a rising price. We publish more on our theory and model, in our full Outlook Report.

This analysis helps predict the price for the short-term, because the model focuses on what is happening. But for longer term trends, we need to understand why it’s happening. For that we turn to broader macroeconomic analysis on inflation, interest rates, the madness of central banks and even wildcards like Bitcoin. We’ll touch on a few of those briefly here.

For our full analysis, download our Gold Outlook 2022 Report.

Bitcoin

The following is not a prediction for bitcoin’s price. We don’t know what the price will be in the short term, and neither does anyone else. It is a look at the economics of bitcoin.

First off, bitcoin is not a Ponzi scheme. A Ponzi is a fraud, in which the sponsor promises a yield. The sponsor does not actually do anything to generate this yield. He simply reports gains to investors, while spending their money to support his lavish lifestyle. Ponzi schemes blow up sooner or later, when the sponsor’s spending and/or investor withdrawals drain the bank account dry.

Bitcoin is closer to a pyramid scheme. A pyramid is not necessarily illegal. Bitcoin does not promise any particular return, certainly not in the sense of a yield on invested capital. You pay X dollars to a seller of bitcoin based on the expectation that a future a buyer will pay you X + Y dollars. Like a Ponzi, the gains come from new investors. Unlike a Ponzi, there is no common pool into which your dollars go.

Note that one does not put dollars into bitcoin. One does not convert dollars to bitcoin. One forks over one’s savings to a former owner of bitcoin, who sells the bitcoin to you. The seller now has the dollars (your savings), which he can spend as his profits.

In other words, the seller is spending your savings.

Bitcoin is therefore like any other bull market fueled by the falling interest rate. It serves as a mechanism for the conversion of one party’s capital into another’s income, to be consumed.

Like a Ponzi, a pyramid collapses when more people want to “withdraw” (i.e. sell) than who want to buy.

The above does not mean that the price of bitcoin will collapse tomorrow. Or next year. It could be a penny, a million bucks, or anywhere in between—and probably will.

Do not take our words as a moralizing admonition not to trade it. The central banks have waged a war on interest. They have deprived people of a means to earn a yield. Everyone is therefore forced to turn to speculation as a surrogate for yield.

Macroeconomic Conditions for 2022

Every year, we discuss macroeconomic conditions and how they’re likely to drive precious metals prices.

The big issue as we enter 2022 is inflation. The big news story is that the Federal Reserve says that it plans to hike interest rates.

Milton Friedman famously declared that “inflation is always and everywhere a monetary phenomenon.” So, when we see prices rising rapidly, as now, people tend to think the cause is an increase in the money supply. Then they look at a chart of the money supply, and they think it’s an open and shut case.

Not so fast.

Prices can rise due to nonmonetary forces. Today, there are three huge forces driving prices up. They are green energy restrictions, lockdown whiplash, and trade war. A good (tragic) example of the first occurs in the UK. They passed a law banning hydrofracking for natural gas, which essentially ended domestic production. Around the same time, they passed another law forcing oil- and coal-using industries such as power plants to switch to gas.

This would be bad enough, until Covid lockdown and the whiplash unleased by unlocking. Now, shipping everything from Christmas tree ornaments to natural gas is subject to long delays.

The price of energy in the UK skyrocketed. Unfortunately, it doesn’t end here. Fertilizer is produced from natural gas. A byproduct of fertilizer production is pure CO2, which used to transport frozen food. The price of food may skyrocket as well.

In the US, the tariff on Canadian lumber was recently doubled. This both increases the price of lumber and decreases it. In the US, home builders must pay more. But in Canada, sawmills must sell for less, in order to try to compete.

Another case of higher and lower prices occurs in the chicken market. Meat packing plants are challenged to keep full workforces, due to regulations that send many workers home when there is a Covid case. The net result is that they cannot produce their full output. Which means they buy fewer birds, and farmers are really struggling to stay afloat with lower volumes sold at lower prices. At the same time, supermarkets and restaurants bid up the price because there is not enough supply.

When you look past the single consumer price for US timber products or chicken wings, you see a more complex picture that shows the driver is not monetary.

This leads us to the widely-assumed fix for inflation, which is to hike the interest rate. Hiking the rate will cause damage, as cutting it has caused.

We are back to where we were in 2015. The Fed was promising rate hikes, and most people thought that it was just the medicine the economy needed. We said at the time that, if they try to hike, they will not be able to push rates up very far, nor hold them for long. That call proved to be spot on. Rates did rise a little, and hung in the air for a bit, before resuming their decades long falling trend.

Today, the downward forces on interest rates are even more powerful than they were in 2015. Have you noticed that car commercials still offer 0% for 72 months? Despite a shortage of cars, which is caused by a shortage of chips, and despite the perceived certainty of higher rates, car makers know that the only way to sell cars is with the subsidy of 0% interest. The Fed will learn that the same is true for everything else.

Our Price Call for 2022

This year, we have the toughest price call to make, of any that we have done. On the one hand, the promise of rate hikes (temporary though they will be) could cause all sorts of things to crash. We would expect the price of gold to crash less than other assets, as in 2008. And less than it did in 2008. On the other hand, plate tectonics is a force on the gold price, like pushing up a mountain range.

There is also an upward force on the gold-silver ratio (i.e. higher gold price compared to silver price). Yet on the other hand, it is around 80 now which is on the high end of its long-term range. Yet it hit well over 120 in March 2020.

For the short-term, we will look at the basis and our fundamental analysis.

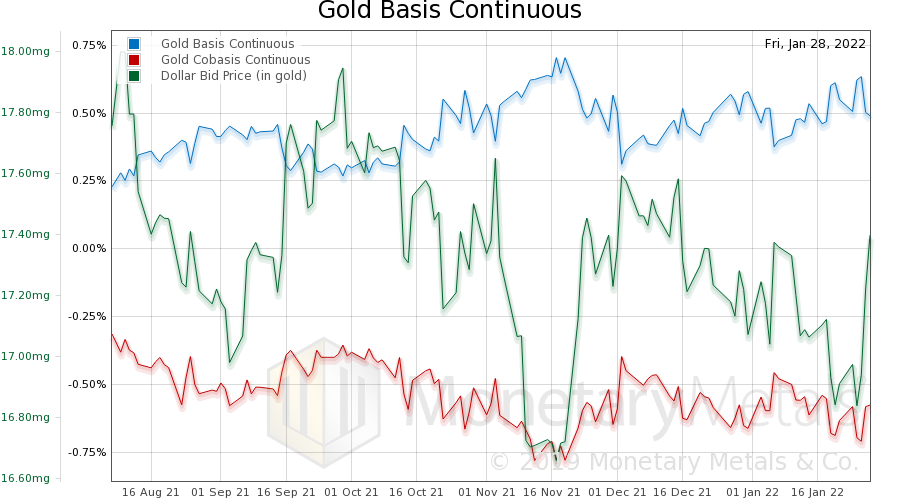

Chart of the six-month rolling gold basis, overlaid with the dollar measured in gold

Since August last year, the price of the dollar has been volatile but it is currently 0.4mg gold lower (i.e. the price of gold, measured in dollars, is $40 higher). And the cobasis (i.e. scarcity of gold to the market) is 27bps lower. Which moved greater in proportion?

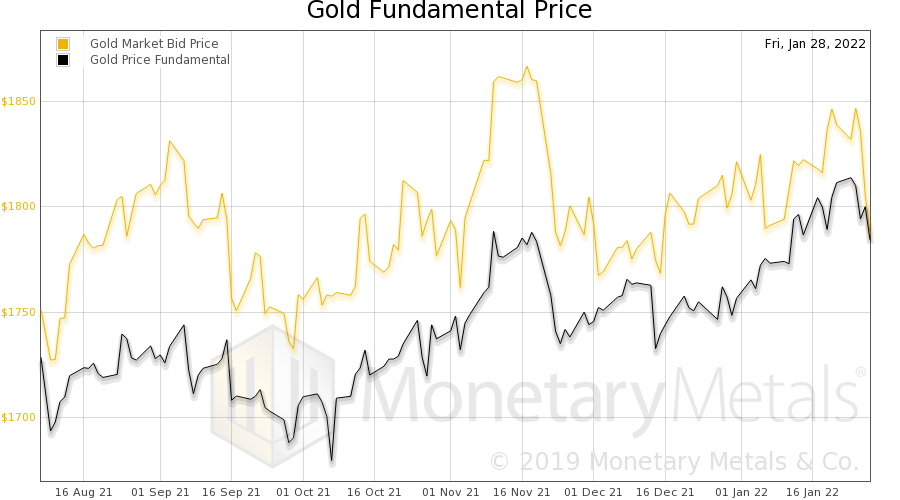

Chart of the gold market and fundamental price

The fundamental price, as calculated by our model, rose around $60 to $1,784. Also notable, the market price has converged down to meet the fundamental price. We calculate that the futures market, at this one moment in time, has no net effect on the price. That is, this is the price at which metal would be exchanged without a futures market and leveraged trading on margin. Make of this what you will.

There’s a clear uptrend, though we note a $27 drop in the fundamental in the last five days. And this coincided with increased volatility in the stock market in the last few weeks—the volatility index (VIX) hit a high not seen since March 2020.

It is logical for futures contracts to sell off, but we shall have to watch the fundamentals to see how owners of metal react to continuing volatility—assuming the Fed doesn’t change its policy stance quickly—if not weakness in other assets.

If asset prices go over the cliff as in 2008, then the price of gold will go down less. And stay down for a briefer moment. This is because there is not a lot of leverage bidding up the gold price right now, and people have many reasons to buy gold even if their reasons to buy meme stocks, real estate, and crypto currencies turn to dust in the wind.

If not, if the Fed manages to loosen credit (whether openly admitting it, or not) then we do not see drivers for a lower gold price. Quite the opposite.

And keep in mind that if there is a crash, the Fed’s means of fixing it is to lower the Fed Funds Rate and loosen credit. This would tend to spur gold buying.

We discuss our longer-term price call for gold and silver, in our full Gold Outlook Report. Free email subscription required.

© 2022 Monetary Metals