Gold, silver and the miners in relation to SPY/SPX

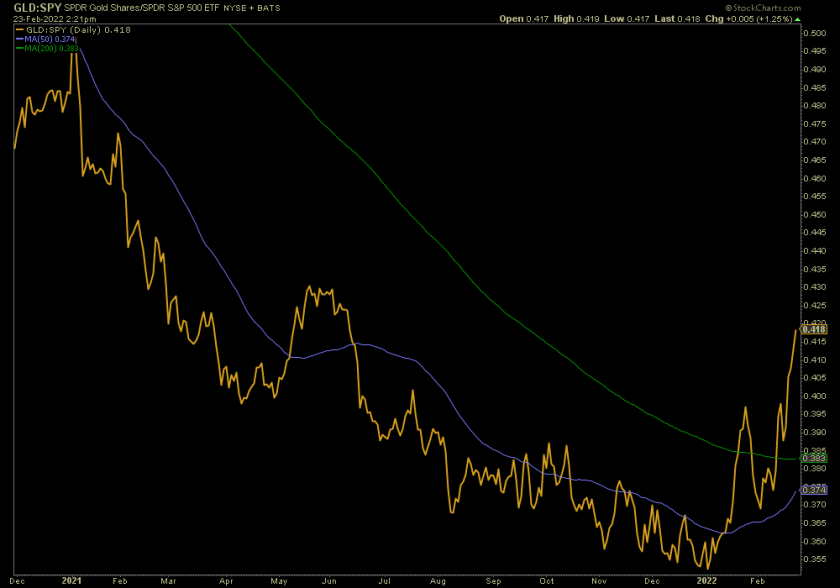

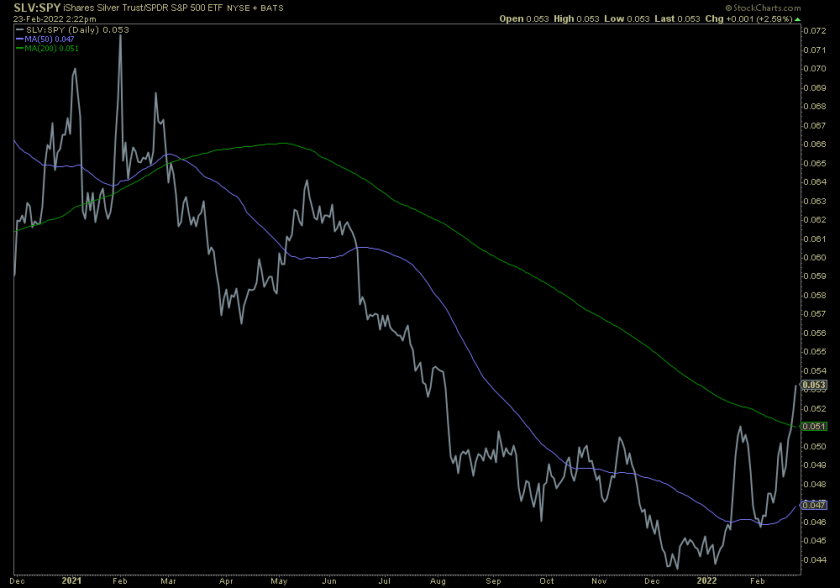

We all know that gold and its fellows have bottomed (minor or major)* vs. broad stock markets, and below is a daily chart pictorial view showing the impulsive bursts upward off the lows (relative to SPY) by gold, silver and the miners.

We all know that gold and its fellows have bottomed (minor or major)* vs. broad stock markets, and below is a daily chart pictorial view showing the impulsive bursts upward off the lows (relative to SPY) by gold, silver and the miners.

The caveat is the shirtless man on the Ukraine border, associated media ‘war drums’ and contrary market sentiment knee jerks that could cause a reaction in gold when that sentiment adjusts away from fearful as it eventually will. But the non-caveat is that this came from an outstanding risk/reward for gold and its associated complex. Ref. from December 30:

The relative (to SPY) daily charts below show impulsive spikes off the bottom, and when Russia/Ukraine sentiment relief finally comes about in the broad markets there would probably be a downward reaction in the overbought precious metals.

With the hawkish Fed jawbones having been instructed to back away from their microphones for a moment by the non-inflationary and risk ‘off’ macro signaling that came with the crisis, the ‘market relief’ play will be seen in hindsight to have been in the bag. The question is when and from what market support levels?

That would probably include pressure to some degree on the precious metals. They are earning the correction they would get when macro relief sweeps across the land. But again, before all this started there was that excellent risk/reward for gold much like was probably the case in 2001 when gold began a secular bull market during the mother of all war drum events, putting Russia/Ukraine in some perspective. A negative reaction does not need to mean ‘terminal’ in this case. A real bottom may be in.

From NFTRH 694:

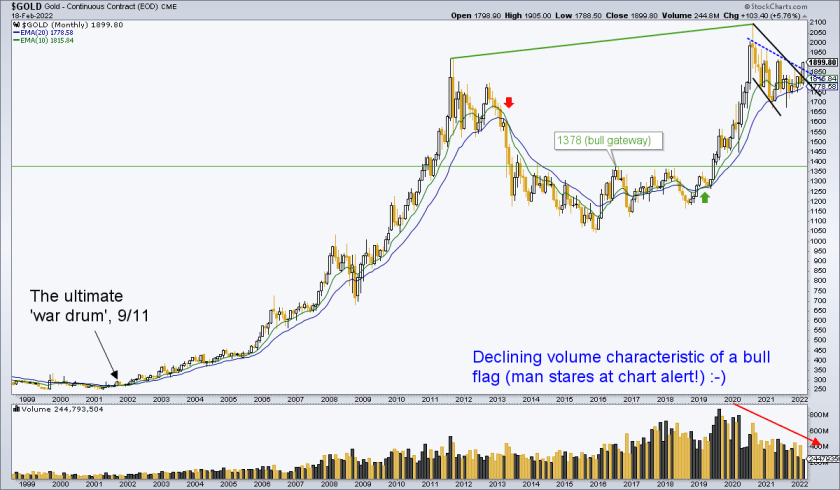

The beautiful monthly chart of gold would argue against my reservations about the war drums, however.

9/11 was a terrifying time. The terror gave way to war abroad but also a gradual resumption of normalcy here at home and eventually, an inflated bull market in stocks that became obvious in 2003. Again, whatever ‘normal’ means these days. Let’s call it ‘Normalcy onDemand’ to go along with the Fed’s ‘Inflation onDemand’.

Point being, a secular bull market in gold began as the ultimate terror/war event engaged. It continued on for many years after terror-stricken sentiment had faded. So let’s not set our views in stone. Negative hype events were met with spikes and failures by gold all through its 2011-2019 bear market. But this is a bull market; a bull market that has barely been interrupted by the last 1.5 years of relatively bearish activity.

So there’s that.

*For a strong rally at least and quite possibly a new bull market in gold relative to stock markets, and a new up phase in the ongoing bull market for gold.

Gold (GLD) vs. SPY

Silver (SLV) vs. SPY

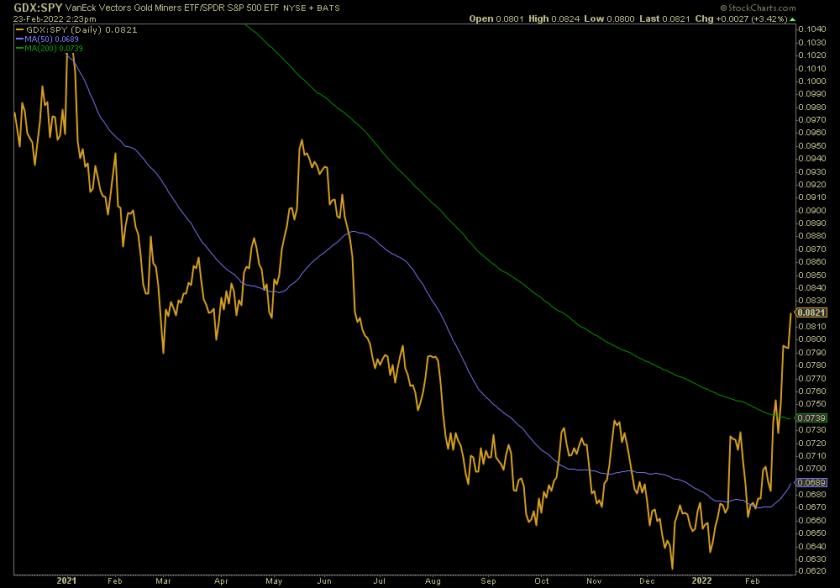

GDX vs. SPY

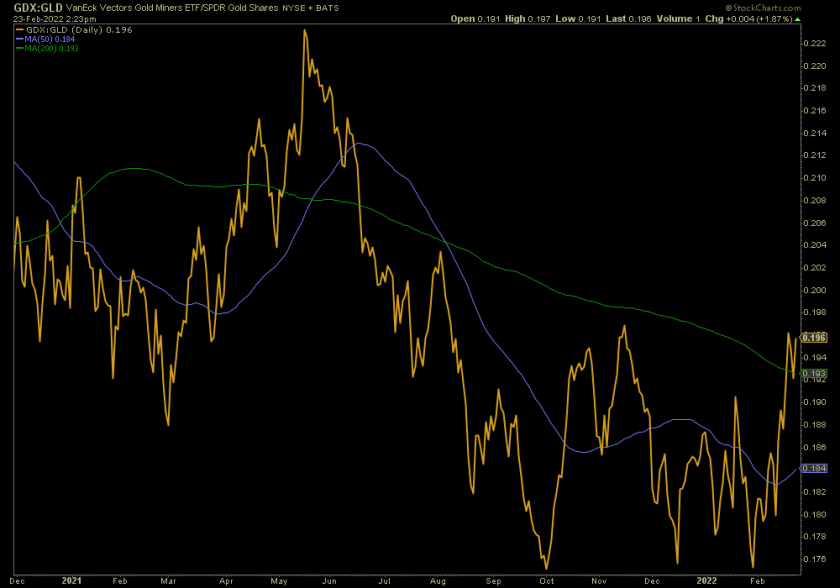

For good measure, let’s throw in this important chart with respect to the precious metals rally. When this starts to weaken (sooner or later) it would be a signal to have some caution. Right now it’s anything but weak. The miners are actually ‘impulsive up’ vs. gold on the very short-term.

Next step for this and all of these charts is to turn the daily trends up by turning the 50 and 200 day moving averages up.

GDX/GLD

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by PayPal or credit card using a button on the right sidebar (if using a mobile device you may need to scroll down) or see other options. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter @NFTRHgt.