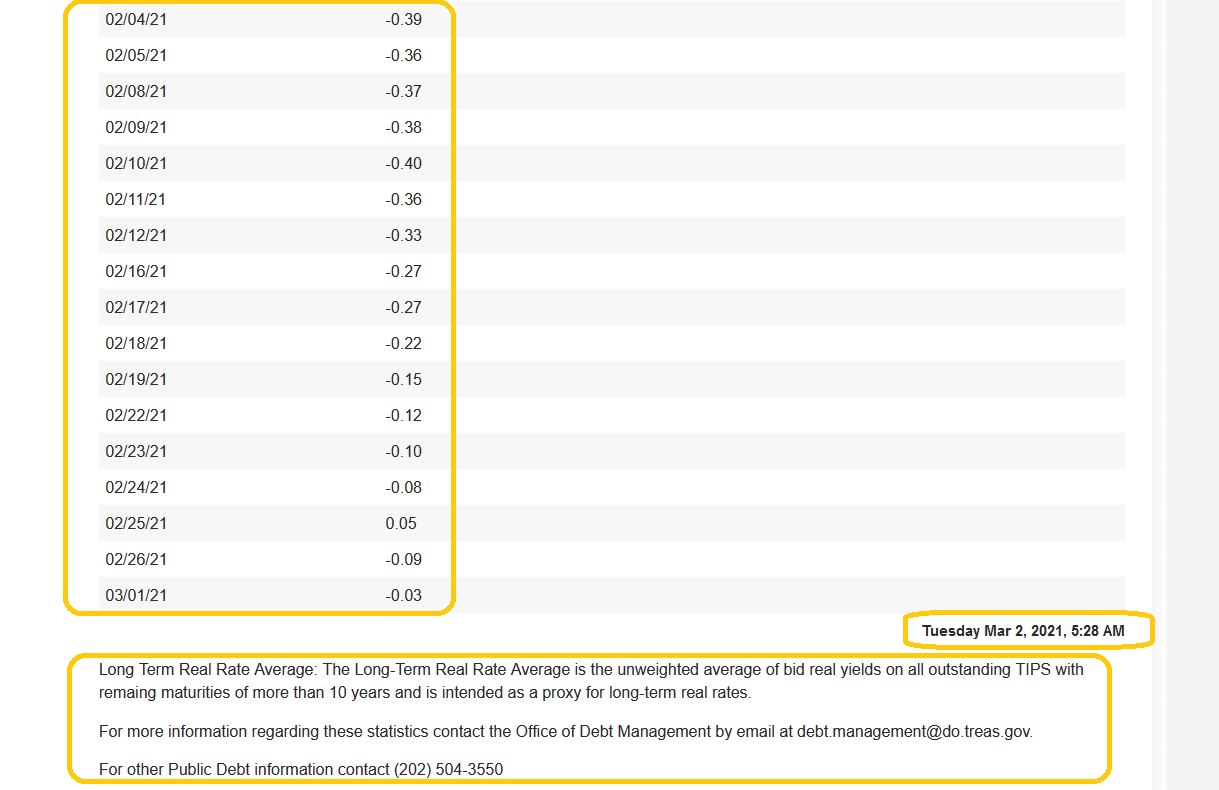

- The disappointing price action in gold (against the dollar) is mainly related to the perceived rise in real interest rates.

- Please click here now. It’s unfortunate that the US government and the Fed use indexes of inflation that the average citizen can’t relate to at all.

- For the average person with minimal savings, rising debt, questionable job security (if they have a job at all), and skyrocketing prices of the items they need for daily life…

- The 1.4% inflation rate used by the government is a very bad joke.

- It’s equally unfortunate that institutional money managers focus on these “out of touch” inflation indexes.

- If money managers used “common man” inflation gauges, they would now be buying gold maniacally rather than selling it somewhat aggressively.

- America’s inflation indexes are about as useful for the average person as a rotary phone, but because money managers move substantial funds in and out of gold based on these indexes…

- All gold bugs need to stay professional in their actions. A major focus on the weekly chart is very important.

- On that note, please click here now. Double-click to enlarge what I consider to be the most important gold chart in the world.

- There’s no point flailing away trying to call “final lows” or “big tops” in the gold market. Building sustained wealth is all about buying into weekly chart support zones and selling into weekly chart resistance zones.

- The buying and selling can be tweaked by using a couple of solid technical indicators like my 5,15 moving average series and 14,5,5 Stochastics.

- Market sentiment is also important. Market rallies in gold rarely begin before most analysts and investors are 100% sure the price is going lower.

- On significant price reactions, professional investors feel roughly the same way that amateur investors do (demoralized), but they are able to essentially “bet against themselves”; they buy even though they are sure the price is going lower.

- When the gold price arrives at a support zone defined by a previous low, like it did at $1767 last week, investors can buy with a stoploss. This strategy ensures there is no significant damage (emotional or financial) if the price continues to move lower.

- When the price breaks a low, it can fall quite quickly, creating a panic. Investors need to be prepared to manage that type of market.

- In contrast, as gold dips into a strong support zone defined by previous highs, I encourage investors to buy there with no stoploss. Core positions can be accumulated, mainly because… gold is money!

- For a big picture view of gold, please click here now. Double-click to enlarge this monthly chart. Back in 2013-2014, I told investors to prepare for a huge “head” to form in the coming years, a head of what promised to be a gargantuan inverse head and shoulders bull continuation pattern.

- That head formation played out majestically, and as gold rallied from $1045 towards $2000 I urged all gold bugs to prepare for a “right shoulder build”… a process that could and likely would take several years.

- That right shoulder building process is in play now, and it’s likely to continue for some time.

- For a short-term view of the action, please click here now. Double-click to enlarge this daily gold chart. I’m a buyer of gold and related items at $1671, but for gold to regain its positive “mojo”, the price needs to rise above $1760 (former support that may be turning into resistance now) and above the minor high at $1820.

- What about the miners? Please click here now. Double-click to enlarge this weekly GDX chart.

- The H&S toppish action is mildly negative but that’s balanced with the support at $30 (the current price) and at $26.

- Please click here now. Double-click to enlarge. While gold miners swoon during the gold bullion shoulder build process, investors who want immediate satisfaction may want to look at some crypto miners like “No Jive Hive”, which I carry in my blockchain newsletter portfolio.

- For crypto, the action is hot and heavy right now. For gold, the big picture means investors need patience, but everyone should be ready to buy bullion at $1671, for some potentially awesome upside rally time fun!

Thanks!

Cheers

St