The big news carried in The Daily Doom today was recession after recession and inflation after inflation. They’re both back (or “back to back”), and boy are they mad! This year’s big predictions on The Great Recession Blog appear to be lining up to start tearing things up this week as a nice little gooey Valentine’s surprise that ain’t yo’ mama’s box o’ chocolates!

Suddenly recession is no longer receding from view

They have invented a new term for the recession that I said back in the summer of 2021 would begin at the start of 2022. You know: the one the NBER peculiarly refused to officially call a “recession” after two full quarters of declining GDP last year. Well, now people are grouping the big “not-recession” that happened back then … with what is happening now by calling the whole mess a “rolling recession.” I referred to this monstrosity as something that would eventually be considered a “double-dip recession” — same concept.

Back in October when Q3 2022 real GDP was reported to have finally risen again, saving us from certain proclamation of a recession, I wrote the following:

If we go up from where total GDP sits now, the recession is over, if you are inclined to call it a “recession” as we boldly would have in the old days. You could say it is over now in that it has recovered; however, if it goes right back down again (making this quarter the fluke and not a move that held) then it would typically be called “a double-dip recession,” especially since it hasn’t recovered to a new high yet, but just to even.

However, no one calls anything as it is anymore — bad news is good news if you’re an investor; men are women; cats are mice [and maybe mice are men] … you know. So, I won’t hold my breath for that truthful declaration to be made, even if total GDP does go back down. Instead, those who declare these things are likely to side with the vast majority that stands far away from me, as though I apparently stink like a pig….

“GDP Stands for One “GROSS Domestic Pig” During Election Season“

Low and behold, some mainstream financial news writers now are actually starting to side with me, as it turns out:

Here’s where the jobs will be during the rolling recessions

Recession-like conditions rolling through the U.S. economy are likely to cause more ripples through an otherwise strong jobs market.

“Rolling recessions” has become a popular term these days for what the U.S. has faced since a slowdown that started in early 2022. The term connotes that while the economy may not meet an official recession definition, there will be sectors that will feel very much like they are in contraction.…

Various dominoes already have fallen during the rolling-recession period.

Housing entered a sharp downturn last year, and the widely followed manufacturing indexes have been pointing to contraction for several months. In addition, the most recent senior loan officer survey from the Federal Reserve noted significantly tighter credit conditions, indicating a slowdown is hitting the financial sector….

For job seekers, the phrase “rolling recessions” means that it will be easier to get employment in some industries, while others will be tougher.

Uh huh. Call it a “rolling recession” or a “double dip recession;” it amounts to the same beast “that started in early 2022.”

As for the labor market, which I have repeatedly said — against the flow of all other reporting — is far from healthy but is actually “weak” and is masking the recession (causing the NBER not to officially call it a recession because “labor is tight,” there is now first evidence emerging of some cracking there in financial reporting, too:

Despite the seeming healthiness of the labor market, many economists think a broader recession is still ahead.

Yes, now it is just “seeming” healthy and we are a talking about a “broader” recession, not a second recession. They’re starting to catch up, Folks. They’re not there yet, but that’s the first glimpse that some are thinking labor may not be all it seems and may be masking the reality of a recession that is now becoming a broader recession. I’ve said misunderstanding of the tightness in the labor market will prove to be the Fed’s great blind spot this year. So, watch for this story to continue to reveal its true colors. This was the first hint I’ve seen that such realization is emerging.

The inflation equation is what needed adjustments

Oh, do you remember those inflation figures that I was questioning based on the “seasonal adjustments?” Yeah, it turns out the “seasonal adjustments” accidentally ran the wrong way so inflation was a little worse in the last few months than stated and has just been revised accordingly, which also means real GDP (the measure that factors inflation out, which we go by for determining recessions) was marginally lower than stated, too:

CPI Just Got Revised Higher for October through December. The Revisions Take a Bite out of “Disinflation” Hoopla

On Friday, the Bureau of Labor Statistics released its annual revisions to the Consumer Price Index for December, with some revisions going back to 2018….

What was actually revised were the seasonal adjustments….

Surprise, surprise.

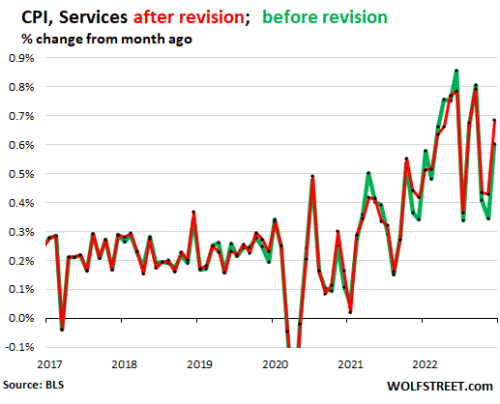

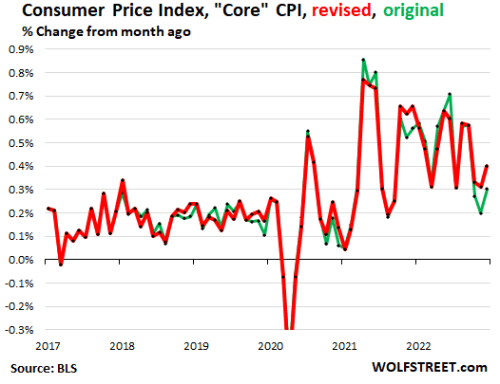

The revisions for the December month-to-month readings were all to the upside, including: Overall CPI (CPI-U), old -0.1%; new +0.1%. So there goes that. “Core CPI” (without food and energy), old +0.3%; new +0.4%. Services CPI, old: +0.6%; new +0.7%. This is where nearly two-thirds of consumer spending goes. And it is red hot.

In addition, the readings for October and November were also revised up, taking a bite out of the “disinflation” scenario….

October, November, and December … were all revised up….

The services CPI was revised to a red-hot +0.7% for December

Those revisions look like this:

In my 2023 predictions at the start of the year written for Patrons, I said,

Inflation may rise again in the first few months of the year, pressing the Fed, once again, to tighten to a higher level than either the market or Fed expects. We saw that at many of the Fed’s meetings last year. The Fed cannot control shortages, which are a major factor in our present inflation around the world, and the Fed will need to create a lot of economic damage to get inflation down by sucking money out right when scarcity is driving up prices. As a result, the Fed may even exacerbate shortages by clamping down on an economy that is already underproducing due to crippled labor. In that case, inflation may rise even more late in the year as economic wreckage worsens shortages.

In an article written for everyone, I had made the same predictions with more detail on the causes because I was convinced this is THE story for this year (along with the labor market revealing itself) that everyone needs to understand, so I gave the information away to everyone as too important not to share with all:

I think there is a strong chance we’ll see inflation rise again very soon and a reasonable chance we’ll see it rise worse in the latter part of the year than what we’ve already seen, and what follows are the indicators and reasons why that is likely.…

One major driver I reported in The Daily Doom today is that fuel prices are back on the rise.… That doesn’t mean much if crude prices do not continue to rise; however, there are reasons to think they will, and gasoline and diesel, of course, drive the price of just about everything….

“2023 Prediction: The Fed’s Inflation Fight is FAR from over!“

I went into great detail to support what I believed was coming in oil prices, and so far that is how it is playing out. News today in The Daily Doom says economists are joining me in saying inflation is likely to be reported tomorrow as back on the rise, primarily, they say, because the drop in the last couple months was based almost entirely on energy prices, which I had pointed out were a very weak basis for thinking inflation was falling, because they are likely to rebound. Most of the drop in inflation was due to the drop in energy prices, and now we know December inflation didn’t actually drop at all! Turns out it rose!

Stocks got a bond-aid that’s peeling off

Michael Wilson of Morgan Stanley along with former US Treasurer Larry Summers, plus a few bond-market gurus all say the stock and bond markets have likely been too optimistic by COMPLETELY ignoring every word the Fed has said about its battle with inflation raging on — a drum I’ve been pounding throughout this past rally. They say they have never seen markets so completely disconnected from the reality around them. Bonds started catching on first:

US stocks are ripe for a sell-off after prematurely pricing in a pause in US Federal Reserve (Fed) rate hikes, according to Morgan Stanley strategists.

“While the recent move higher in front-end [bond] rates is supportive of the notion that the Fed may remain restrictive for longer than appreciated, the equity market is refusing to accept this reality,” a team led by Michael Wilson wrote in a note.

Wilson — the top-ranked strategist in last year’s Institutional Investor survey — expects deteriorating fundamentals, along with Fed hikes that are coming at the same time as an earnings recession, to drive equities to an ultimate low this spring. “Price is about as disconnected from reality as it’s been during this bear market,” the strategists said….

US inflation data could be a catalyst to bring investors back to reality, and get stocks in line with bonds again, if prices rose more than expected, Wilson said, while noting that expectations for such a result have been growing.

Former Treasury Secretary Lawrence Summers warned that complacency is setting into financial markets about inflation, and that the Federal Reserve may need to tighten further than what investors are currently expecting.

“We’re headed into what’s likely to be a turbulent period,” Summers told Bloomberg Television’s “Wall Street Week” with David Westin. “I’m not sure we’re on a trajectory that’s going to get us to 2% inflation without more interest-rate increases than the market is now anticipating.”

Summers cautioned that a number of factors that had been helping pull inflation down may reverse. One sign of that dynamic came from used-car prices, which climbed 2.5% last month — the most since the end of 2021, according to an industry report on Tuesday. Gasoline prices have also risen this year.

“There are a variety of bounce-back factors that we’re going to have,” said Summers…. “The gains in terms of further reduction are going to come hard” going forward, he said….

The risk is “this tightening cycle is not just about one more, two more, three more 25 basis-point increases, but something more fundamental,” Summers warned.

In other words, this inflation fight may take a lot more than just three 25-basis-point hikes, including the last one. This monster may have deeper roots — may be more sticky than many have wanted to believe. So, more turbulence ahead, these prognosticators say, when markets are forced to square with reality that says things are not going as the dreamers and schemers wish. If not in this CPI report, then in the next one.

You can only ignore reality until it stops ignoring you and simply runs right over the top of your dreams, and it appears the present rally, while it got the bulls quite excited, has only (once again) inched toward a perfectly normal retracement for bear-market rallies by fibonacci standards — just like the others.

The buying binge that has propelled US equities almost without interruption for four months is nearing a point where past rebounds caved in.

It’s in the charts, with the S&P 500’s recovery reaching the same half-way-point threshold that spelled doom for bulls in August….

Central bankers say their inflation-fighting campaign may have years to go and data on earnings and the economy continue to crater. Buying stocks now means taking a flier on valuations that are high by most historical standards and betting against a pundit class that is united as it ever has been in the view that stocks are due for a reckoning….

And warnings are blaring from bonds, whose bullish thrust had given cover to equity faithful convinced they’d weathered the worst the Federal Reserve had to give…. The two-year Treasury yield jumped more than 20 basis points to above 4.50%, the biggest weekly increase since November….

Consider the renowned 50% retracement indicator that is often touted as a nearly foolproof signal that a rally has legs. At a closing high of 4,180 on Feb. 2, the S&P 500 erased half of its peak-to-trough decline incurred during the last year. Then it fell in four of the following six sessions.

If the pullback continues, it’d mark the second time in a year when the indicator failed to live up to its billing. A similar signal was flashed in mid-August, spurring hope the worst was over. Then the selloff renewed and stocks spiraled to fresh lows two months later.

In many ways, the rally that lifted the S&P 500 as much as 17% from its October trough has been at odds with a worsening fundamental story. Outside the labor market, the economy has weakened, as evidenced by data on retail sales and manufacturing. The recession warning in the bond market is growing louder, with the yield gap between two-year and 10-year Treasuries reaching the deepest inversion in four decades.

Moreover, analysts’ estimates on how much corporate America will earn in 2023 have kept falling…. Souring earnings sentiment can be trouble in a market when stocks are already expensive….

“I don’t think valuations support a further run here,” said Jake Schurmeier, portfolio manager at Harbor Capital Advisors.

How often have you heard me say now that the labor market is the anomaly here that should not be trusted for what it appears to be showing? Everything else screams “recession” again and again. Which all means the utterly lunatic stock market is poised to fall upon the first bad news about inflation if that news materializes strong enough on Tuesday.

Investors are bracing for key inflation data next week that could worsen the bond-market rout.

January consumer prices are seen accelerating for the first time in three months, even as the annual inflation rate declines further, a Labor Department report Tuesday is expected to show.

The reversal would come on the heels of blowout January jobs data that sent bonds tumbling since then. Afterward, Federal Reserve officials conveyed that the inflation battle is not over and it may take a lot longer for the central bank to achieve price stability. It would also dash hopes that inflation would remain in a downward trend, a view that sparked a rally in Treasuries last month.

“There is a near-term risk that inflation does not fall as rapidly as the market is expecting,” said Jimmy Chang, chief investment officer of Rockefeller Global Family Office.

The fantasy-focused markets (both stocks and bonds) have been paying no attention at all when the Fed has given such warnings about this prospect as follows:

Fed Chair Jerome Powell also struck a wary tone, telling an audience in Washington this week: “If we continue to get, for example, strong labor market reports or higher inflation reports, it may well be the case that we have do more and raise rates more than is priced in.” During another speech, Governor Christopher Waller said: “I am prepared for a longer fight to get inflation down to our target….”

“CPI still does matter. And we have gasoline ticking up, used cars ticking up and technical adjustments.”

Says, Bloomberg:

Prices of US goods and services probably climbed last month at a pace that remains discomforting for consumers as well as for Federal Reserve policy makers seeking greater progress in their battle to beat back inflation.

The January consumer price index on Tuesday is expected to increase 0.5% from a month earlier, spurred in part by higher gasoline costs. That would mark the biggest gain in three months. Excluding fuels and foods, so-called core prices — which better reflect underlying inflation — are seen rising 0.4% for a second month.

Such gains are consistent with the Fed’s view that, while inflation is moderating from a four-decade high last year, further interest-rate increases will be needed to ensure price pressures are extinguished.

Bloomberg via Yahoo!

So, Tuesday may not deliver chocolate-covered valentines to the besotted stock market:

The upcoming February 14 Consumer Price Index (CPI) report is poised to deliver a significant blow to the equity market. The market has been on a meteoric rise since the start of 2023, fueled by dreams of falling inflation and the possibility of interest rate cuts from the Federal Reserve. However, if the report reveals the expected change in trend from the previous couple of months of disinflation, it could shatter market hopes and cause a significant market reversal. The report could mark a turning point in the equity market’s expectations for inflation and interest rates, with far-reaching implications.

Analysts predict that the headline CPI will increase by 0.5% month-over-month and by 6.2% year-over-year. Meanwhile, core CPI is expected to rise by 0.4% month-over-month and 5.7% year-over-year.

Tuesday will tell, but this is just what I had in mind. If not this month, then next — a return to rising inflation in the early part of the year was the centerpiece of my predictions for 2023.

Oh, but the rigorous riggery never ends

With that said and with the notes above about how the Bureau of Lying Statistics’ seasonal adjustments in recent months were predictably too optimistic to where they had to be readjusted, let me also point out how the government is now readjusting the way it measures inflation this year to try to take some of the inflation out of the inflation this year. That, in fact, is why the are willing to now allow some of the numbers from last year to rise (when no one cares any longer about those old numbers) … because it softens the rise for this year by giving a higher benchmark from previous months. But there is trickier sleight of hand than that involved:

The recent revision of the CPI has also reweighted the various components, leading to changes in their relative importance. For example, energy, which had provided a meaningful deflation impulse in the second half of 2022, will see its weight drop to 6.92% from 7.86%.

Ahh, do you see how that works? One of the reasons for the readjustments that just happened was to also change the weighting of energy prices now that they are rising again so they have less impact in CPI going forward. They won’t have any less impact on YOUR actual experience with inflation because presumably you are still heating your home as much, bathing as much, driving your car as much; so energy occupies the same throne in your budget it always did, but the geniuses who are in charge of measuring CPI at the Bureau of Lying Statistics are deciding, now that energy is back to rising, energy prices should not have as much impact on CPI as they did when energy prices were falling.

No one will call them out on this or even question their methodology. It will be assumed, since they are the government experts, they know what they are doing.

Likewise, used cars and trucks have dropped in weighting to 2.66% from 3.62%. That’s a pretty big drop. Well, that only makes sense, now that their price is back to rising quite sharply again. We should expect, of course, the government would want to reduce the weight they carry in affecting CPI. Let’s cut the weight of the two things that have just returned the most to rising again. Give them a smaller percentage along the slices of CPI pie. By such approaches, the US government makes sure that your Social Security, which has to rise, by law, to match with CPI, doesn’t go up as much as your actual experience of inflation. (Joe Biden, of course, was quick to claim the glory for how your Social Security benefits were rising, but didn’t mention it was because the only thing that really rose was inflation, and law requires SS to match up, though the government uses inflation figures that rarely match up to your reality.)

We can likely be sure that, if food prices were to go back to rising, they would have been reweighted lower in this annual reweighting, too. In fact, I have noticed in past years, how it is always the very thing that has just started rising that gets weighted lower for the year ahead. Odd how that works, isn’t it?

For example,

January saw significant gains in some factors declining in the year’s [2022’s] second half, such as used autos and gasoline. [But now rising significantly:] The Manheim used auto index rose by 2.5% in January, which could indicate that the actual CPI used vehicle index will also rise in the coming months. The Manheim used auto value typically leads the actual CPI used vehicle index by 1 to 2 months. However, the positive impact of these gains is likely to be limited due to their lower weighting in the revised CPI.… The January CPI report will be tricky to interpret due to weight changes and recent gains in some inflationary factors.

How convenient.

So, the question that remains for Tuesday, is was the BLS able to reweight things enough to keep price inflation from becoming too turbulent in its impact on markets? Only Tuesday will tell.

In appreciation of those who support the straight-forward truth telling you get here and the hard-nosed predictions, I have been creating The Daily Doom each weekday morning to track the news stories I research that go into these reports. Those who support my writing at the $10/mo. level are given a password each month to unlock those articles.

Liked it? Take a second to support David Haggith on Patreon!