The bitcoin versus gold debate has gone on for over a decade now. In that time regulators have been scratching their heads wondering how far they can let the cryptocurrency machine run for. “This far,” seems to be the decision this week. Meanwhile gold and silver carry on, continuing to offer a simple and unassuming safe haven for people’s wealth.

The Cryptocurrency is “As-Good-As-Gold’ Myth has been put to rest by many over the last year, but for those still holding on to the myth that cryptocurrency is going to recover and that it is ‘outside regulation’, this week’s events by the U.S. Securities and Exchange Commission (SEC) will put those to rest too!

Investing in gold or silver through GoldCore is an investment without counterparty risk – a reassurance crypto investors do not receive. See our post on November 7, 2022 – The Bitcoin is ‘As-Good-As-Gold’ Myth is over.

The main attribute touted for cryptocurrencies is that it is a ‘currency’ that is beyond the government’s control – regulation was not stringent, and many investors did not pay taxes on their earned interest or profits from holdings.

Crypto Crackdown

However, we have warned before that it was only a matter of time until governments started major crackdowns on cryptocurrencies and cryptocurrency exchanges.

… and the day of reckoning has arrived for more crypto exchanges. The U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Crypto exchange Binance Holdings Ltd. (and its top executive Changpeng Zhao) on Monday, followed by a lawsuit against Coinbase on Tuesday this week.

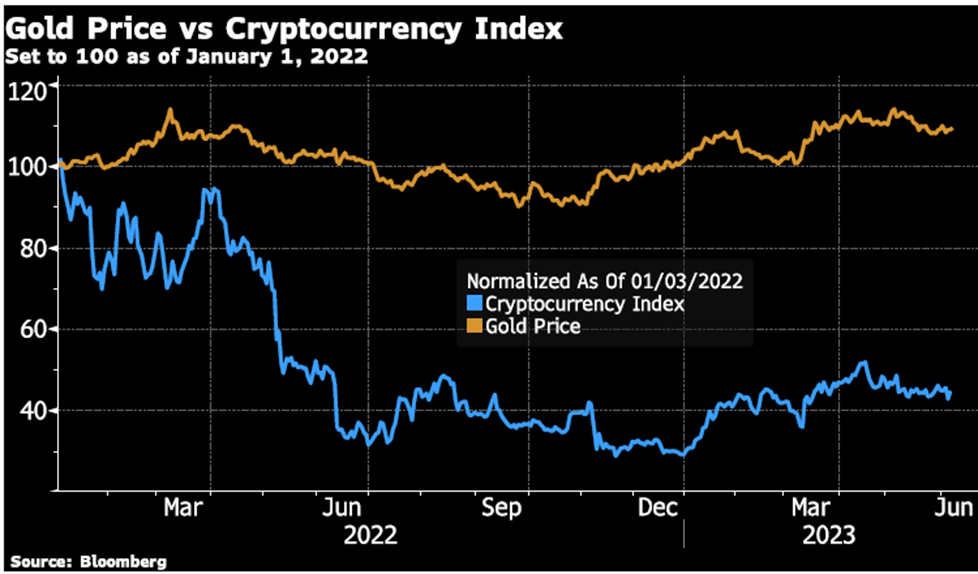

It was difficult to ignore the pandemic fueled gains in the cryptocurrency market (upwards of 1500%) but like all bubbles and fads, what surges higher; always crashes down. Gold has far outperformed the crypto market since the ‘crypto’ bubble burst.

Gold Price Vs Cryptocurrency Index Chart

Gold Price Vs Cryptocurrency Index Chart

The cryptocurrency market has been struggling since the pandemic-era ‘bubble’ burst in November 2021, when total market capitalization for the industry reached over US$3 trillion.

The market then dropped to an ‘after the bubble burst’ low in December 2022 of approximately US$825 billion, a decline of almost 73%.

Also, the market cap has improved slightly to US$1.2 trillion through May 2023. Over the last two years, the crypto market has been riddled with scandal, theft, and bankruptcy. We discuss it often to alert investors to the obvious and blatant untruth that cryptocurrencies are an alternative to gold (see our post on June 10, 2022 – Is Gold Still a Safe Haven Asset?)

Too Many Counterparties

Additionally, the SEC lawsuit against Binance includes thirteen separate charges. Among the charges, the SEC accuses the exchange of mishandling customer funds, misleading investors and regulators, and also breaking securities rules.

Furthermore, the charges against Zhao directly accuse him of misuse of customer funds which included funneling some customer funds into a company controlled by him, along with misleading investors as to the company’s ability to detect market manipulation on the exchange.

The SEC also accuses Binance of ‘running an unregistered trading platform in the U.S. and allowing U.S. customers to trade crypto on an exchange that is supposed to be off-limits to U.S. investors.

“Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law,” said SEC Chair Gary Gensler, in a statement. “They attempted to evade U.S. securities laws by announcing sham controls that they disregarded behind the scenes so they could keep high-value U.S. customers on their platforms.”

To no one’s surprise Binance is fighting the allegations they are even subject to SEC rules or domestic laws. Moreover, pleading ignorance on this point became difficult after reportedly Binance’s chief compliance officer sent a message to a client that read “[w]e are operating a fking unlicensed securities exchange in the USA bro”.

Do They Think They’ll Beat The SEC?

The 101-page lawsuit against Coinbase alleges that the exchange has ignored “rules by letting users trade numerous crypto tokens that were actually unregistered”. SEC Chair Gensler in an interview regarding the lawsuit said that

“Why should the New York Stock Exchange or broker dealers we all know and respect be undermined by this other corner of the capital markets, which is sort of saying, thumbing their nose and saying ‘Catch us if you can’?”

Additionally, the SEC is seeking that Coinbase complies with securities law and that it be forced to surrender any gains that the agency deems as ‘ill-gotten gains’.

The lawsuits against Binance and Coinbase list more than a dozen major coins (seen as ‘securities’) deemed unregistered, totaling over US$120 billion of the crypto market.

Other cryptocurrencies have also been targeted by the SEC separate from the lawsuits against Binance and Coinbase, Ripple being the most notable. Also, today is the day of reckoning for others and likely tomorrow for the rest.

The statement released on Tuesday by the SEC supports further ‘crackdowns’ and more regulation.

“The SEC’s reliance on an enforcement-only approach in the absence of clear rules for the digital asset industry is hurting America’s economic competitiveness and companies like Coinbase that have a demonstrated commitment to compliance,”

What we can learn from crypto?

Furthermore, if gold and silver investors have anything to learn from the whole sorry Binance and Coinbase debacle, it’s to look into the organisation that you use for your financial activities.

Scrutinize them, ask all the questions, and then ask them again. For once, this is not a story about US officials screwing up, it’s a story about how to keep your hard earned savings safe and how counterparties can prove troublesome.

Moreover, the SEC’s net over the cryptocurrency marketplace is ever-widening. Soon their increased scrutiny will lead to increased regulation and no doubt a reckoning of the market.

Those who have bought and continue to own cryptocurrencies will be asking themselves if it’s all been worth it. When exchanges are shut down, payment processors closed and cryptocurrencies seized…what happens next? What will investors have to show for their money? A long code on the screen?

Gold and silver have been around long before any other currencies, whether fiat or crypto. They are currencies because they have some utility. They are currencies because they are able to operate outside of organisations and exchanges. They are currencies because they are simple. They do not require any kind of code to operate, they do not require a central bank to give it value. They just…work.

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

|

USD $ |

USD $ |

GBP £ |

GBP £ |

EUR € |

EUR € |

|

|

07-06-2023 |

1963.05 |

1967.35 |

1578.49 |

1574.08 |

1835.45 |

1832.78 |

|

06-06-2023 |

1961.90 |

1957.25 |

1581.49 |

1578.52 |

1834.97 |

1833.55 |

|

05-06-2023 |

1942.50 |

1959.65 |

1567.01 |

1576.93 |

1816.63 |

1828.55 |

|

02-06-2023 |

1981.00 |

1963.25 |

1580.64 |

1567.85 |

1840.35 |

1827.39 |

|

31-05-2023 |

1959.00 |

1964.40 |

1585.03 |

1588.41 |

1835.78 |

1841.23 |

|

30-05-2023 |

1949.50 |

1952.45 |

1570.32 |

1571.14 |

1818.88 |

1820.27 |

|

26-05-2023 |

1953.50 |

1947.90 |

1580.97 |

1577.02 |

1819.69 |

1816.22 |

|

25-05-2023 |

1962.30 |

1948.25 |

1585.15 |

1579.64 |

1828.08 |

1817.72 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here