One article, titled “US Housing Market Is Mirroring 2008 Bubble,” claims the housing market is finally starting to follow the path of the 2008 housing bubble implosion. I’ve said for years this housing bubble crash won’t likely be as all-encompassing for the global economy as I had predicted the last housing crisis, which gave us the Great Recession, would be, except for the fact that it is already being joined by other kinds of ongoing bubble troubles that didn’t exist back then, which will likely make the entire economic crash worse in the end. The smaller housing bubble implosion this time around is part of the much bigger Everything Bubble implosion.

No ARMed time bombs

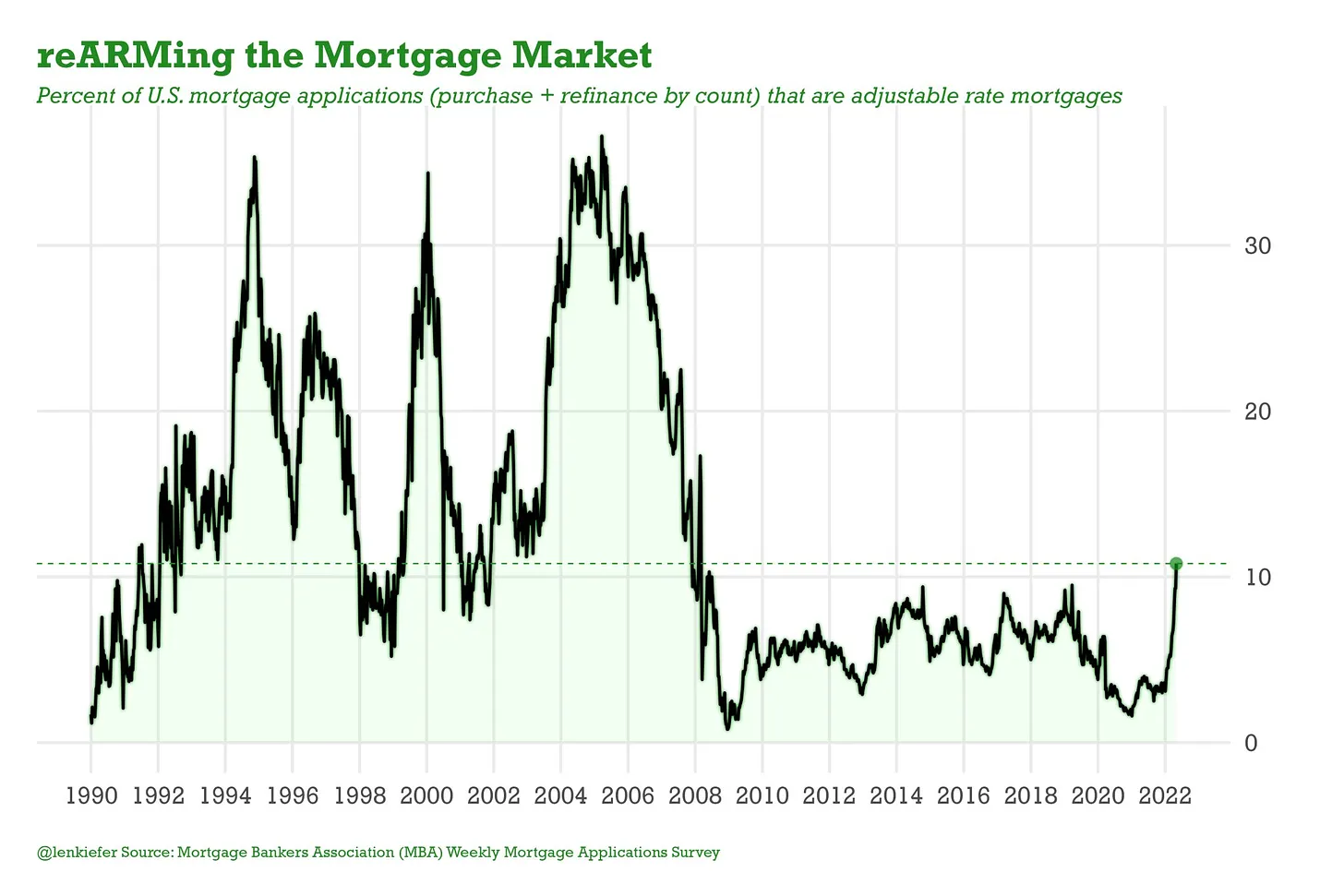

In terms of just the US housing bubble, the implosion lacks one absolutely key ingredient that the former bubble had—a massive number of adjustable-rate mortgages (ARMs) that inevitably had to reset to higher rates once people could not refinance because homes were dropping in price. These ARM time bombs were safe so long as either mortgage rates held or housing prices rose because, if you couldn’t afford higher rates when the reset date on your mortgage came with its promised higher interest and couldn’t refi, you could still easily sell for a profit and exit anyway.

When prices fell, however at the same time rates rose, the end was clear enough to become predictable as early as 2007 (though I found real-estate agents argued with me on it back in 2007 and laughed at me like I was a clown because people keep believing what the want to believe). People who were stuck in mortgages that soared above their ability to pay, as they were always designed to do, suddenly couldn’t sell for enough to get fully out of the mortgage anymore, so their homes were repossessed.

This time around, the percentage of mortgages that have adjustable rates are way down because the Fed’s money policies reduced fix rates so low for so long that anyone whose brain wasn’t as deep in denial as those real-estate agents back in 2008 refinanced to fixed rates if they had a higher rate, or they bought during the time of low fixed rates. You can see the enormous difference here:

ARMs are far fewer than they were before the last housing bubble collapse, but recently they have spiked.

ARMs are far fewer than they were before the last housing bubble collapse, but recently they have spiked.

The risk factor of ARMs could become a problem with the recent spike, thanks to people like this who advise people to get them. Nothing could be dumber or more dangerous in terms of home security at the present time. Still, at 10% of all mortgages, they are well below the time-bomb levels they were at just before the last crisis where they were absolutely devastating.

One risk factor that is still the same is the vast number of mortgage-backed securities that are still something of a mystifying box as to what you actually own when you buy into one—what garbage is piled in. Those can multiply bank troubles when the fall finally comes; but we are not there yet, though the article title implies we are.

Is the housing bubble collapsing?

The recent flood of new inventory in the U.S. housing market has brought the number of homes sitting vacant and waiting for a buyer close to levels seen only during the 2008 bubble, the real estate analyst Nick Gerli said….

For-sale … "spec," homes—new houses built under the assumption that builders will be able to sell them easily for a profit—"just hit the second highest level ever."

That is not entirely because builders have been building so fast, but more because they haven’t been able to sell them, even with huge incentives that cost builders lots of money.

The article, as is typical of financial reporting, implies the high inventory is because builders have been gunning their engines and building faster than ever:

According to Gerli, the explosion of inventory in certain markets of the country is "quite the rebound from the shortage experienced from 2012-22."

The country has long struggled with a housing shortage that has inflated prices and pushed the property ladder a little further from many Americans' reach.

While builders have been building at a fairly respectable clip, the real news for two years now has been that buyers are not buying without huge incentives because prices are way too high, especially true once mortgage rates started rising. Those rates have stayed up and even risen a little higher in some areas, in spite of the Fed’s efforts to lower short-term rates. Longer-term interest rates, which usually follow shorter-term rates, are pricing in bets of longer-term inflation; so the bond vigilantes have been fighting the Fed, and those long bonds largely determine the interest on mortgages.

The article does, at least, hint at the problem:

New inventory is good news for the housing market, but not if a slowdown of home appreciation isn't matched by a rise in demand from buyers. At the moment, with stubbornly high mortgage rates and still rising home prices, sales remain relatively low despite pent-up demand in the market.

That is not just a problem: that is the CORE problem. Housing prices are absurdly high and totally unfordable under interest rates that have become high relative to the past decade. However, the idea that “builders are doing their part to inundate the housing market with supply,” as one line in the article says, is misleading. They’re just trying to build at normal volumes; yet, the market is inundated because no one wants to buy at what are now considered “normal prices.”

The crux of the problem is not in a high volume of construction where the article largely lays it, but in this statement:

Many of the new homes for sale on the U.S. markets remain unsold because their prices are still higher than many can afford.

That is the ice dam that I laid out about a year and half ago. It is really as simple as that. Until prices crash, very few people will be willing to buy. And, though the article claims “the housing market is mirroring the 2008 bubble,” that still is not true because prices on a national average have not begun to fall year-on-year:

At the national level, according to Redfin's latest data, the median sale price of a home was $430,010 in November—up 5.4 percent compared to a year earlier.

So, sales are down, because prices are even worse than they were a year ago when they were already way too high. The housing bubble isn’t going to start popping or even deflating until prices start to drop precipitously as we saw with the housing bubble from 2007 through 2012. With the number of homes on the market up by 10.3% from a year ago, however, the pressure will continue to build for price cuts. Buyers should hold out for a couple of years, if they can, and wait for prices to come down a lot.

Gerli wrote on X, "The fact that spec inventory has skyrocketed so quickly in the last 6-12 months represents a big shift in the housing market."

Not yet, it doesn’t. It represents a shift in the supply side but with very little shift in the demand side because the deflation that should result from oversupply in any market hasn’t begun yet. That means the pressure needs to continue to build in order to bust through the ice dam that has held in place for nearly two years. As I’ve always said, homeowners, especially, will continue to hold out against price drops as long as they possibly can.

This part is accurate:

"This situation is mostly isolated to the South and parts of the Mountain West," Gerli told Newsweek. "Home builders in these areas permitted lots of homes during the pandemic boom and continue to permit homes in late 2024, even as buyer demand has cooled. The result is a big pileup of homes for sale," he added.

Keep the emphasis on cool-to-cold demand, and you have it right. Builders kept building, but buyers aren’t having it. The accumulating backlog in supply, however, will likely lead to the following before much longer:

How bad will the housing bubble collapse be?

"I expect prices to drop in these regions," he told Newsweek. "Reventure is forecasting home price declines in 2025 in Texas and Florida especially. Don't be surprised if price reductions cluster in suburban and rural areas, where the home builders are most active."

Not all areas share in the over-supply. The Northeast and Midwest don’t have a large over-supply of homes. So, while the supply on the market is about equal to the huge over-supply in the 2008 crisis, sellers have been slower to drop prices, and buyers are willing to wait them out.

That is exactly where we still stand, though there has started to be some decline in prices month-on-month (not year-on-year) in some areas. At the same time, housing insurance costs have been skyrocketing in some areas—especially Florida—making homeownership and financing even harder:

In a recent report investigating the effect of the insurance crisis on U.S. housing markets, the Senate Budget Committee warned that rising premiums, combined with still high home prices and mortgage rates, might lead to a housing crash worse than the one in 2008.

"In certain communities, sky-high insurance premiums and unavailable coverage will make it nearly impossible for anyone who cannot buy a house in cash to get a mortgage and buy a home," the Senate Budget Committee said in the report.

"Property values will eventually fall—just like in 2008—sending household wealth tumbling. The United States could be looking at a systemic shock to the economy similar to the financial crisis of 2008—if not greater."

It doesn’t have the same ingredients to be as extreme as the 2008 housing bubble collapse because nearly all those who already own a home will be able to keep their home, with the exception of a small number who were foolish enough (against my advice) to take out an ARM (unless they were smart enough to refi back out of it before rates rose). People cannot easily be priced out of their homes this time, as happened to millions last time, because they have locked in low interest for as long as they stay where they are. Only rising property taxes or insurance prices might price some out.

While a crisis will still build, it hasn’t so far, but the rising cost of insurance will force prices down even more if people are going to afford mortgages at these rates, since the cost of insurance gets stacked into the mortgage payments; and the eventual collapse of the housing bubble, while it shouldn’t result in nearly as many repossessions because of the much lower percentage of ARMs will contribute to the crash of the Everything Bubble.

The collapse of the housing bubble will still lead to some homebuilders going out of business because of the inventory they will be stuck with, and may lead to some trouble for banks that have made a lot of construction loans to those builders. That will also cause rising unemployment and deepen our recession; but it will be good for future home buyers and largely harmless to current homeowners who have locked in low rates for the life of their loans so long as they don’t have to move for personal reasons before the ice dam collapses. Stay content where you are, if you can, and ride it out, whether you’re a buyer, staying out, or an owner staying in with low fixed rates, and you should do fine in the long run.

I don’t try to make anything gloomy, but just call things as I believe they will be, and I don’t think this housing bubble collapse will compare to the devastation of the 2008 housing collapse, but that doesn’t make it pretty.

I don’t try to make anything gloomy, but just call things as I believe they will be, and I don’t think this housing bubble collapse will compare to the devastation of the 2008 housing collapse, but that doesn’t make it pretty.