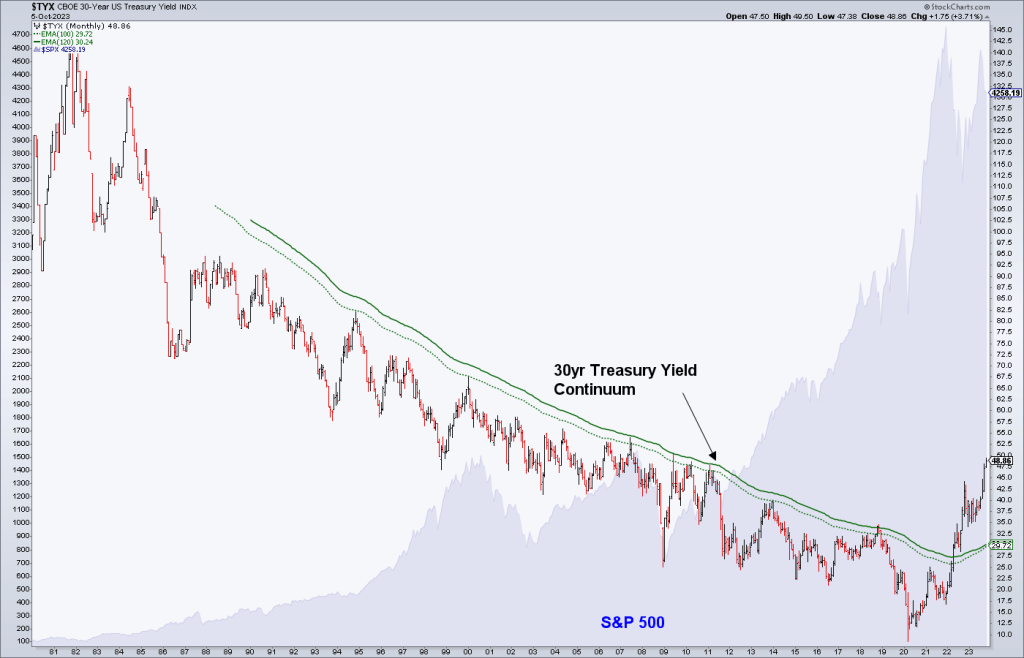

This is a financial market article that also delves into social commentary. The new macro, as exemplified by the 30 year Treasury Bond yield chart below, will bring change; both social and financial. The two are, of course, related. Here we do not come to firm conclusions, and so perhaps the article does not get picked up by some re-publishers. But in a time of change, I believe that the process of interpretation is more important than forming conclusions, just yet. Conclusions will be handled by trend followers, promoters and gurus, as they have been for decades.

As for strategically operating in the markets, we (NFTRH, its subscribers and myself) are managing them quite well, in part because we are looking into the spectacle of modern society and the markets it encompasses and seeing the lies, bromides, falsehoods, promotions and outright grift within. But mostly we observe macro trends that have been broken, in service to being among the few that adapt to the changes promptly and successfully. Because we shall not be human commodities.

When I was much younger, I was already dissatisfied with the automation and commoditization of human life (my main peeve being the relentlessness and omnipresence of the Ad man). With things of little real importance replacing sound ideals on what seemed like a mass scale, I felt very alone in my angst. Most people seemed not to mind the constant barrage and stoopidification of America.

Then I had occasion to visit the Institute of Contemporary Art in Boston to see an installation featuring the Situationist International (SI). It was not art. It was pure social commentary and it blew me away, probably because I was already going down that road at the time and it was nice to have my bias reinforced. :-)

You can get a summary of the SI at Wiki, but an important aspect of their view is summed up per SI member Guy Debord’s Society of the Spectacle (SoS):

Debord traces the development of a modern society in which authenticsocial life has been replaced with its representation: “All that once was directly lived has become mere representation.”[2] Debord argues that the history of social life can be understood as “the decline of being into having, and having into merely appearing.”[3] This condition, according to Debord, is the “historical moment at which the commodity completes its colonization of social life.”[4]

SoS was written in 1967 by a man born in 1931. Things are exponentially worse now in a culture going full cartoon commodity, as one look at what America is obsessed with, or more to the point, what the Ad man wants America to be obsessed with, will bear out.

YouTube

YouTube

Sure, it’s fine to like entertainment. I like various forms of it (and abhor many others). But it’s important to remain conscious, otherwise you are no longer Rowdy Roddy Piper (rest in peace) but instead, well, you know…

Amazon.com

Amazon.com

Buy. Consume. Marry and reproduce. Conform. Accept that the Taylor Swift and Travis Kelce hype is worth even 2 seconds of your time. Buy. Live. Reproduce…

Rowdy Roddy Piper (on the current state of things):

“Just when they think they got the answers, I change the questions.”

What, you expected “I have come here to chew bubble gum and kick ass, and I’m all out of bubble gum.”?

The subject of automated thinking by a large proportion of the citizenry is relevant to the financial markets and in particular, this moment in time in the financial markets. Why this particular moment in time instead of all those moments in time that alarmists have noted for years and decades? Because something changed in a profound manner and is no longer in place as it was over those decades. But it’s a pretty good bet that a vast majority of public market participants – when they can pull themselves away from the Swift/Kelce theatrics or our ever more cartoonish political arena (both sides of the aisle) for a moment – are still mentally riding the trend that ended in 2022.

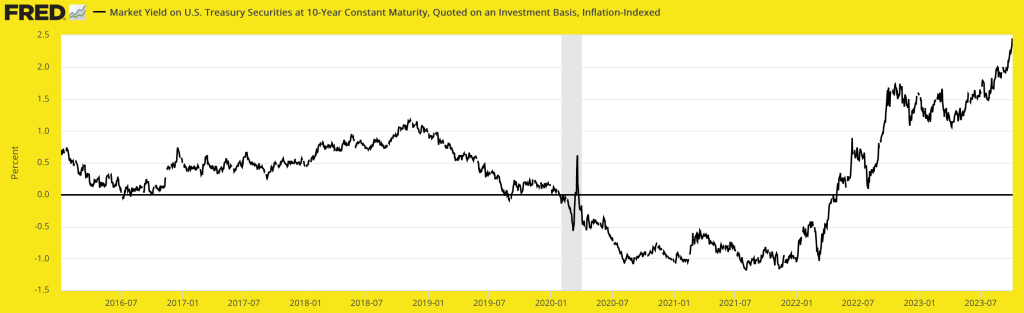

They are riding the gentle downtrend of long-term Treasury bond yields and its pleasantly disinflationary signaling over decades dating back to the 1980s. Multitudes of market participants were not even born at the start of this trend. Multitudes have been tended and bred to obey the rules. Not to question. The thing we call Wall Street is an entity that wants to keep you stupid. Stupid and satisfied. Warm froggies in a pot set to medium. It’ll eventually boil.

That said, a market bounce now can come about if the recently spiking Gold/Silver ratio and recently steepening Yield Curves ease in the near-term, as we’ve been anticipating. But they and other indicators have made their initial moves. I believe any broad rally resumption will have a shelf life. The commoditized herds will take the bait again but likely not observe the warnings beneath the surface (for my part, I am collecting interest on cash, which is my overwhelmingly largest position, after covering some shorts in precious metals and broad indexes, and am lightly playing a bounce with favored stocks, including quality gold stocks).

Back on the macro, it is super important that the bond market has signaled an end to the way business was done for decades. Said business was done by an all knowing, all controlling entity that is today going in the other direction. But is your financial advisor? Probably not. What about your Wharton educated active manager? Maybe, but probably not.

Education can equal orthodoxy, which can be another way of saying “stay in line, obey!” Many of the best and brightest were bred by decades of a trend now broken. A RE-education of sorts from the cautious yet open minded thinking abilities that many humans are born with.

Okay, time for more imagery. My edit of the formerly all powerful, all controlling Federal Reserve. Why formerly? Well, I can guarantee you that this bond market rebellion and the most recent inflation problem that spurred it on was not anticipated by our dear leaders. Don’t take my word for it, take the word of the eggheads themselves: “TRANSITORY”… Transi friggin’ tory! They used that word until they could use it no more lest they be completely discredited and debunked, even by the mainstream.

From May, 2022: Eggheads Tardy in Doing the Right Thing

Wikipedia w/ Gary’s edits

Wikipedia w/ Gary’s edits

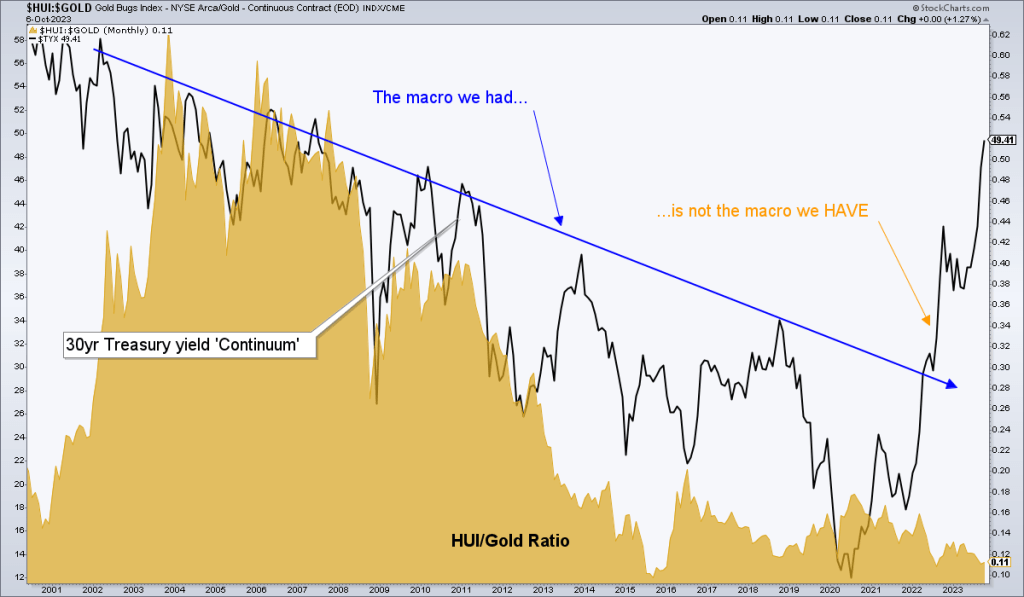

Referring back to the chart above, the Continuum’s long down slope gave the Fed permission, even license to control the markets. Today, due to the bond market rebellion the Fed is sidelined and desperately trying to put the bond genie back in its bottle. But a trend has changed and so have the rules. Our job is to effectively interpret new rules and not only abide by them, but as speculators, profit from them.

So I feel confident in having felt like a social outsider my whole life, because guess what? Being on the side of what was for decades the right side is not the right side anymore. If the bubble is not bursting it surely is taking on new shapes and dimensions. One important indicator of change is the fact that gold has not imploded on the state of ‘real’ 5 and 10 year Treasury yields. Historically, over the course of the Continuum’s decades, this condition (implying tight monetary policy) was very detrimental to the gold price. Here is the 10 year.

St. Louis Fed

St. Louis Fed

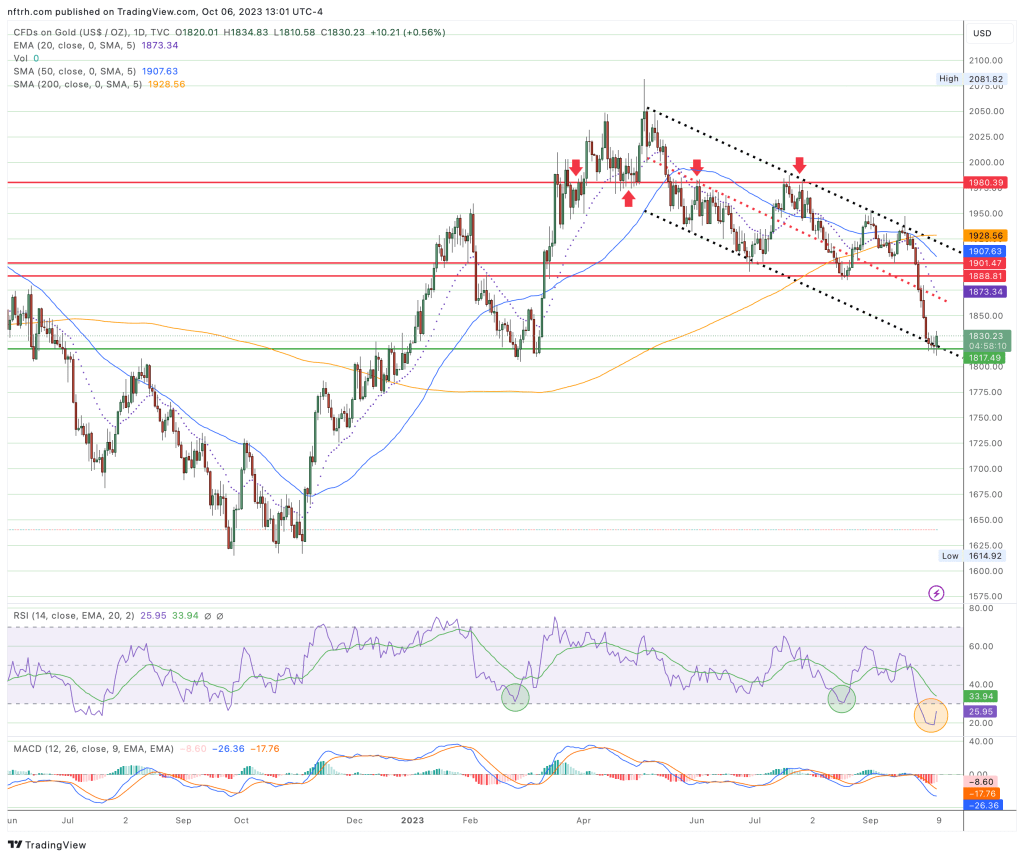

If all were as it was, no way should gold (daily chart) be holding support and the channel bottom today, especially on a blow out payrolls number. A deeply oversold condition and a logical support area could well be the final act of a gold-negative macro environment. It likely would not be the final act if the macro we had for decades were the macro we have today. But dear commoditized trend extrapolaters, it’s a whole new ball game.

There is much question as to whether the precious metals correction has ended. Don’t let the touts likely to emerge on this broad market relief bounce convince you otherwise. But I expect the proof to come out in the pudding, perhaps before year-end. I expect gold stocks to shine after broad markets top out and gold stocks potentially (an important word, not a prediction) take one more leg down. Today the precious metals are rallying with everything else and that means they are not yet unique.

One signal about when they will be unique? When gold stocks stop under-performing gold. That will come about when most of the macro stops out-performing to gold. Then the miners will leverage gold’s standing within the macro and quite possibly put on a laser show not unlike the one that the 30 year yield has put on. For 20 years now the miners have under-performed with the declining yield as a guide. But the macro we had is not the macro we have.

It’s been a satisfying market to manage in the interim simply because at the start of something new the answers are not ready-made and information is no longer a commodity.* It is a new thing altogether. We are called to the task of thinking for ourselves in order to succeed. The macro is churning out signals galore lately, including both new fundamental macro signals and interim plays in the other direction (like this week’s broad bounce, which we anticipated due to index support levels and secondarily, depressed but not extreme sentiment). Meanwhile, the commoditization of financial market analysis will follow its trends that no longer are. Perfect.

* As a former manufacturing person I am well aware that commodities are what the name implies, readily available materials and building blocks. They are not precious and they are generally abundant and not special (like for example, a great new break through in cancer therapy or even, in the vein of the opening theme of this article, surveillance technologies that can spot a mosquito on your head while documenting and categorizing your every move. Just kidding (but not really).