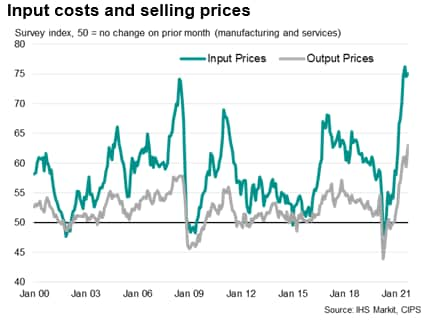

Inflation is now rising faster than anything IHS Markit has ever seen in its Purchasing Manager’s Index, but it gets worse: It is not just cost outputs to consumers that are being passed along, but the rise in new input costs has also picked up pace. That means even higher price increases are building up in the backlogs of products yet to be shipped or even in some yet to be manufactured.

On the price front, input costs rose at a sharper pace during September. The rate of cost inflation was the quickest for four months, and the second- highest on record, as supply chain disruptions and material shortages pushed prices and transportation costs up. Meanwhile, output charges continued to increase markedly, continuing to rise at a pace far outstripping anything seen in the survey’s history prior to May, as firms sought to pass on higher costs to clients where possible.…

Soaring material prices led to one of the fastest increases on record. As a result, the rate of selling price inflation accelerated to the sharpest since data collection began in May 2007 as firms passed higher costs on to their clients.

IHS then gave what is the textbook situation for stagflation:

The pace of US economic growth cooled further in September, having soared in the second quarter, reflecting a combination of peaking demand, supply chain delays and labour shortages. The slowdown was led by a cooling of demand in the service sector…. Supply chain delays show no signs of easing, with another near-record lengthening of delivery times in September. Hence factory output growth also weakened and order book backlogs rose at a record pace in September…. The upshot is yet another month of sharply rising prices charged for goods and services as demand outpaces supply, and higher costs are passed on to customers.

It’s a global phenomenon that holds as true for the UK, for example, as the US where IHS reports,

A fourth successive monthly slowing of business activity has taken the pace of expansion to its lowest since January’s lockdown … while at the same time average prices charged for goods and services are rising at the fastest rate in at least 22 years. The diverging trends of accelerating price rises and slower output growth will add to speculation as to whether the time is right for the Bank of England to start scaling back its pandemic stimulus…. The September PMI data will fuel worries that the UK economy is heading towards a bout of ‘stagflation’, with growth trending sharply lower in recent months while prices continue to leap higher.

US policy and Fed policy obviously cannot do anything to curb an inflation problem that is as true on one side of the pond as the other. Of course, the soaring inflation is fed by central banks on each side who have increased money supply as product supply tanked.

And don’t expect any abating of the coronavirus to cause any rapid improvement in the situation:

The fourth-successive monthly slowdown has occurred despite virus related restrictions being eased in the UK to the lowest since the pandemic began.

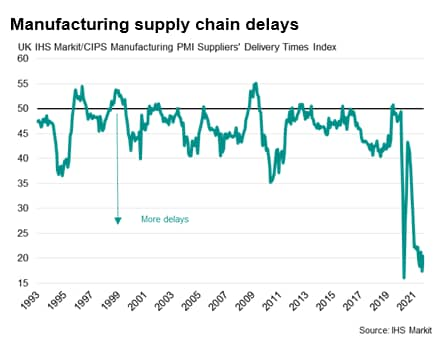

And don’t expect that those supply-chain constraints that are causing the shortage component of this stagflation are going away anytime soon, as “transitory” problems clearly have proven themselves to be solidly non-transitory:

And that is why prices, fed by central bank money creation, look like this:

Jobs growth meanwhile slowed in September, constrained by worker shortages but accompanied also by a slowdown of inflows of new business to a seven-month low. Business expectations for the year ahead have meanwhile also fallen to their lowest since January, with concerns over both supply and demand amid the ongoing pandemic casting a shadow over prospects for the economy as we move into autumn.

Not “transitory.”

So, just as central banks may start to feel the need to stimulate the economy some more, there is nothing they do can resolve the economy’s shortages, so more stimulus will only feed more inflation.

The flash PMI data come at a time when the Bank of England’s Monetary Policy Committee is split on whether the time is right to start considering tapering its emergency stimulus. The further acceleration of price growth will add to concerns that the recent bout of inflation is proving less transitory than many suspected, but the slowdown in growth is a reminder of the fragility of the recovery while the pandemic remains a disruptive force on the economy. The conclusion is likely to be one where policymakers sit on their hands, awaiting further clarity on the growth and inflation outlooks.

Rock, meet hard place.

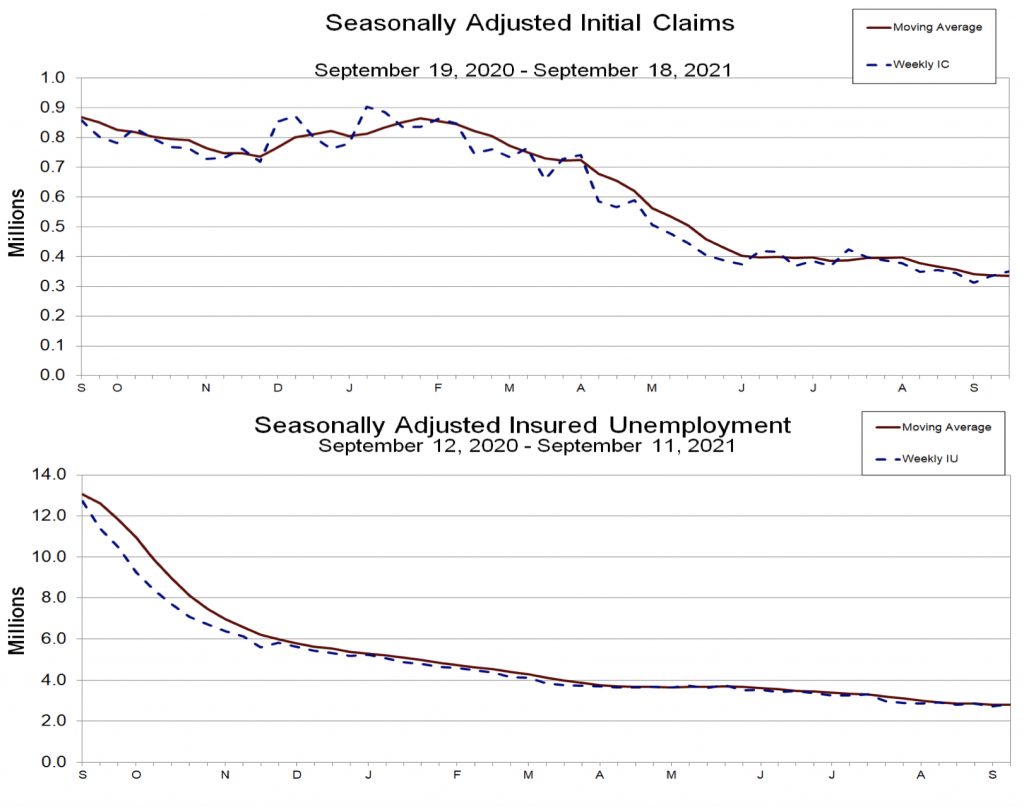

And the labor supply side of those shortages, so far, is not improving in the US, even though all the augmented unemployment benefits have expired:

Initial unemployment claims in September actually started rising in each reported week.

Not “transitory.”

Liked it? Take a second to support David Haggith on Patreon!