As I kind of anticipated, it didn’t take long for the delirious stock market to latch onto a new narrative and start recovering ground. Momentarily, stocks and bonds became a little more grounded in reality, but a new narrative was trotted out to restore their hopium high.

As the S&P nipped back just about 5,000 to reclaim its milestone, one of the new narratives to replace the March pivot fantasy was this:

A renewed wave of dip buying sent stocks and bonds higher on Wednesday after losses triggered by an unexpected pickup in US inflation….

“Investors should expect continued volatility as the market sorts out the continued uncertainty over how the Federal Reserve will respond to the ongoing inflation situation,” said Jeremy Straub at Coastal Wealth. “The economy remains strong and isn’t in need of lower interest rates, which is ultimately supportive of stock prices. If the Fed needed to cut interest rates, that could be a sign that the economy is softening, so investors should not completely fret elevated interest rates.”

So, there you have it: The market that maintained high sentiment based on hopes that rate hikes are over and that the Fed would start loosening in March, should now just switch to realizing that NOT lowering rates proves the economy is strong enough to handle rates where they are; and a strong economy is good for stocks. That might sound like a switch to basing stocks on fundamentals, except that it isn’t because the economy is far from fundamentally strong and far from strong enough to withstand these rates that in normal times would be considered … “normal!”

John Rubino clarifies this nicely for us:

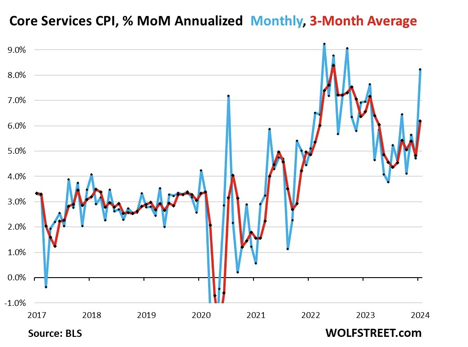

A previously obscure inflation metric called Core Services CPI shocked the world this week by rising at an annual rate of 8%. This pretty much rules out a Fed rate cut in the near term.

Indeed, as things have been going, it was a darn nasty spike in inflation that had already been slowly rising:

Rubino, in much the same camp as me in my last editorial, says the following about the economy that is supposedly now proven strong because it doesn’t need a rate cut:

The real kicker is that the economy was already headed for a serious downturn as high-yield corporate debt defaults accelerate.

Uh huh. But let’s just ignore the rickety bridge over that canyon.

Rubino also gives a nice chart for that, which you can see in his article linked to below.

Consumer loans, he notes, are also blowing up at these interest rates because, while these rates are normal in normal times, they are far from the bargain-basement days of almost free Fed funds that enticed consumers in with the lowest rates in history.

Consumer debt keeps climbing, and the strain is showing in the mounting number of car loan and credit card delinquencies, according to new data from the Federal Reserve Bank of New York.

Don’t worry about that. The worst it might cause is major bank defaults, and we are already used to those. We have normal emergency programs in place to handle them.

The last time delinquency rates were this high was in 2011.

Rubino puts some perspective on what all of this means for the economy that is now “proven strong,” according to the new narrative that is being offered, by the fact that the Fed believes the economy can withstand these interest rates. Of course, the Fed only “believes” that because it has to fight inflation so has no choice but to hope the economy will withstand these rates because it also is getting no slack from the labor market that would allow it to say, “We have to now put rate cuts over inflation fighting.” It keeps believing the increasing number of workers who have accumulated in the longterm sick pool is a sign of a healthy and strong labor market.

The idea of the US drifting gently into a mythical nirvana where already over-indebted people and businesses just keep borrowing never made sense. Now, with inflation sticky and the Fed unable to aggressively ease, it makes even less sense.

Instead, one or two of the above sectors will morph from “problem” to “crisis.”

I think so, too.

Bill Bonner also writes from the same perspective as my column recently:

Hotter-than-expected consumer inflation readings smashed market speculations of an early start to interest rate cuts this year.

It feels a bit calming to now have Zero Hedge and many others closing in on the view that rate cuts are not coming anytime soon because inflation is back to rising. I was getting weary of standing almost entirely alone on that. So, before I get further into Bonner’s perspective, let me cut away to another article that affirmed something else I’ve said repeatedly, which, until recently, I had not been able to find anyone saying. That is that the drop in longterm (YoY) inflation was due to the base effect:

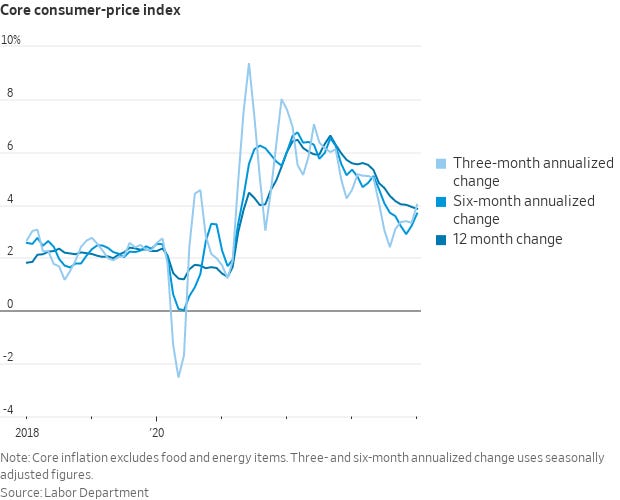

Have markets been fooled by the base effect? Have they been basing too much? One would almost think so, as the decline in the y/y rate in US CPI core inflation since the summer of 2023 seems to have largely informed market participants (alongside some weaker economic data perhaps), whereas the seasonally adjusted annual rate of monthly changes in core inflation has actually been trending up. The latter, albeit more erratic, is not subject to echoes from the past.

In other words, if you looked at the month-on-month, as I kept holding up for closer inspection, you’d see that each month was increasing the rise of inflation. By looking at one-year periods, you could see inflation continuing to decline because longer periods benefited from months way back that experienced larger drops in the inflation rate, but if you look at shorter annualized terms to see where inflation is now headed look, they were looking increasingly WORSE:

Notice how the shorter-term measures of the change in inflation from the last three months when annualized or the last six months started an upturn months back. Over a twelve-month period, however, inflation just appeared to be slowing its rate of descent; yet, the longer-term numbers were the ones everyone focused on, while the shorter-term numbers show more what is happening now.

Since that upturn is what has been happening with core inflation (which the Fed watches more than overall inflation) over the past few months, Bonner continues,

Counting on a rate cut this spring? Well, you can forget it. Inflation is not going down as fast as speculators hoped. The fix was not in, or at least not as firmly as most people thought.

Bonner believes those who are betting on the bubble mania to hold stock valuations up are betting for a big loss, but more to the point of the new rate-cut propaganda now proving the economy is strong, Bonner adds,

Meanwhile, the whole economy is headed for a Big Loss, too. Earlier this week, we looked at the “most predictable crisis ever,” the ballooning US debt.

The Fed being stuck with keeping rates up does not mean anything about the economy being strong. It is just what inflation is forcing the Fed to do…until something badly breaks.

We all know, however, that those who have bet on the national debt balloon exploding have been wrong for years. Something is critically different now, though. The balloon is being downgraded by the big agencies, and even the Fed says continuing to inflate it has become unsustainable; and all of this is because interest rates are at this higher level, while the enormous balloon was inflated at a much lower level. So, even that balloon cannot withstand these higher rates.

That doesn’t mean it will pop this year, but the problem blew up much larger just before interest rates also went up three times higher than they had been for years:

The most costly of all peace-time fixes in history took place in 2020-2021. In response to the challenge posed by a virus (which turned out to be insubstantial), the Trump administration and state governors closed down much of the economy…and then handed out trillions in newly-created money, for a total cost (lost earnings and output as well as direct federal outlays) of $14 trillion.

It leaves us with a grossly distorted economy with some metrics for measuring the economy broken because they were not designed to work during such extreme bubbles that are now all facing high interest for longer than anyone in the market was recently expecting. We are staggering under the weight of former solutions created by earlier problems that were met with the same kind of throw-more-money-into-it solutions (meaning, really, throw more debt into it).

Meanwhile, those who should be solving these problems with real solutions that create a solid economic base and that eliminate the high-risk greed that imperils the whole structure are spending their time impeaching and repeaching each other and themselves. The most recent rounds have been from the Republicans choosing to engage their limited time in rightfully impeaching and throwing out their own lying member, George Santos, and impeaching and threatening to throw out Biden’s border chief of chiefs, which will, of course, go nowhere. Impeaching a cabinet official hasn’t happened in over a century and a half, but we now live in the epoch of impeachment and counter-impeachment wars.

Both parties are fully absorbed in fighting each other with impeachments, but do any of them have actual answers or resolve to actually end problems with tough solutions? One Republican pollster warns the Republicans, who just learned that their impeachment of their own resulted in the flip of another House seat to Democrats, that the state vote to put a Democrat in Santos’ place was not a pro-Biden vote, it was an anti-Republican vote in a district that had last voted a lying Republican into office. Better watch out, the pollster warns. There is no love lost for their party.

Luntz issued a warning to Republicans following their defeat … that the results are not an "endorsement of Biden," but instead a "rejection of House Republican chaos." While he believes voters in the district don't necessarily approve of Biden's policies, Republicans "gave voters nothing to vote for," he wrote.

They start actually having plans they can pull together on. No one wants another party that cannot even get its heads together to repeal and replace Obamacare, which the former president assured us would be easy, so easy, just you wait and see; and it will be a better plan, a much better plan. They came up with no plan because both parties are obsessed with making war on each other, but they have no idea what to actually do for their nation.

"Democrats just flipped George Santos' #NY03House seat. Tonight is the final wakeup call for the @HouseGOP. If they ignore or attempt to explain away why they lost, they will lose in November as well. The issue agenda is on their side. Their congressional behavior is not," Luntz wrote.

Those who think they can do well just by proving they can squabble with the other side probably are not thinking at all. Even if they get re-elected, they won’t do any more good for the country than they are doing now or than they did when they owned all branches of government during Trump’s first two years and still couldn’t even repeal Obamacare because everyone knew they had no better alternative to replace it with. (Not that a better one couldn't be envisioned—just that they could never bring themselves to agree on it and work together.)