USD:

Analysis:

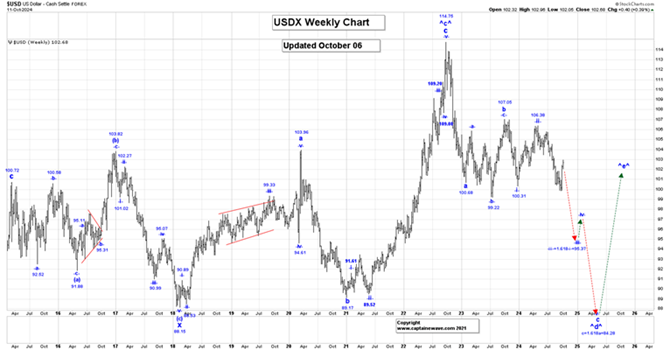

We continue to work on a very large wave B bearish triangle and within that triangle all of wave ^c^ ended at the 114.75 high.

We are now falling in wave ^d^. Wave ^d^ cannot fall below the wave ^b^ low of 71.46 for this triangle formation to remain valid. Wave ^d^ needs to consist of at least one abc pattern but can have up to 3 such patterns.

Within wave ^d^, we have now adopted our alternate count, which suggests that wave a ended at 100.68 and wave b at 107.05. We are should now be falling in a subdividing wave c.

Within wave c, we completed wave -i- at 100.31, wave -ii- at 106.38 and wave -iii- at the 99.86 low. We should be now rallying in wave -iv-, which has a 50% retracement level of 102.21. We have now reached that retracement zone, so we need to be guard for its completion and the start of another drop in wave -v-.

Our current projection for the of wave c of ^d^ is:

C = 1.618a = 84.28.

This count is incredibly supportive of our gold/GDX/gold stock and silver counts.

Trading Recommendation: Go short. Use a stop at 107.10

Active Positions: Short, risking to 107.10!

Oil:

Analysis:

Wave i ended at the 103.65 high and we are now falling in a lengthy and complex wave ii correction.

Our retracement levels for all of wave ii are:

50% = 68.50.

61.8% = 53.87.

Our minimum target for the end of wave c, is the wave a low of 63.57.

After wave ii ends, we expect a very sharp rally in wave iii~

Trading Recommendation: Go long crude with a put as a stop. Go long Suncor.

Active Positions: Long crude (from $6!) with puts as our stop! Long Suncor.

Gold:

Analysis:

If the wave counts are confusing…

Stay focused on our updated Daily Gold Chart!

We continue to rally in wave .v. of -iii-. Within wave .v., we completed wave ^i^ of *i* at the 1997.20 high and all of wave ^ii^ at the 1931.80. We continue to rally in wave ^iii^, which has a projected endpoint of:

^iii^ = 6.25^i^ = 3101.20.

Wave ^iii^ is subdividing with wave -i- ending at 2151.20 and wave -ii- at the 1973.10 low. We are now rallying in a subdividing wave -iii- with wave $i$ ending at 2088.50, wave $ii$ at 1984.30, wave $iii$ at the 2431.50 high, and our wave $iv$ bullish triangle at the 2277.60 low.

We need to be on guard for the completion of wave @iv@, perhaps at the 2604.20 low, and the start of another rally in wave @v@.

We did have a key daily reversal higher in Friday's day session!

Our current projected endpoint for wave @iii@ is:

@iii@ = 1.618@i@ = 2836.00.

We are thinking that wave @iii@ may still be subdividing and still heading higher.

Our projected target for the end of wave -iii- is:

-iii- = 6.25-i- = 3199.90!

We still expect higher prices as wave !iii! continues to develop.

To keep it simple: Stay focused on our updated Daily Gold Chart!

Trading Recommendation: Go long gold. Use puts as stops.

Active Positions: Long gold futures (in size from $1080!), with puts as our stop!

Thank-you!

Captain Ewave & Crew

Email: admin@captainewave.com

Website: www.captainewave.com