With the Dow rallying 700 points for its best surge since November 6, the day after Election Day, and with bond yields getting sharply jerked back down—all due to the CPI inflation report—you’d think it was stellar news. In the headlines, it was, at least, a little bit good, but only a little. Core inflation, which the Fed watches most, dialed back one notch. That’s not much, but it sent the Dow up 700 notches! After a few months of going the wrong way, markets breathed a huge sigh that one measure of inflation had finally reversed direction.

Dig a little deeper than the headlines that were written for markets, however, and the news was a little worse than it had been. Markets that have felt like they were being throttled by inflation for the last couple of months were ecstatic over any relief they could get, so they took the good and ignored the bad.

“Perhaps most importantly, today’s CPI number takes additional rate hikes off the table, which some market participants were beginning to prematurely price in.”

The good news was that core inflation backed down from 3.3% in last month’s annual inflation rate to 3.2%. The 10-year Treasury yield dropped significantly back about 13 basis points at about 4.65%, taking some of the competition away from stocks, and perhaps money that was taking safe haven in bonds decided to move back into stocks because greed is eager that way.

Stocks also rose because all major banks reported stellar news, shooting those bank stocks way up and pulling some up in their wake.

“We got a good start today to earnings season. The bank earnings are key because the financial sector is so tied to the general economy. So for these big banks to put up bullish numbers today, I think it does bode well,” said Larry Tentarelli, chief technical strategist at Blue Chip Daily Trend Report.

Fair enough on that. So, a great day all around for stocks.

But what lurked beneath the surface?

Step away from the YoY reading that took a notch backward, and you find that on a monthly basis, inflation is still climbing month after month. Even year-on-year, the headline number that includes all items and doesn’t subtract out food and energy, rose once again (up 2.9% YoY compared to last month’s 2.7% YoY, and we were as low as 2.4% back in September when inflation started climbing if you were looking at the right things).

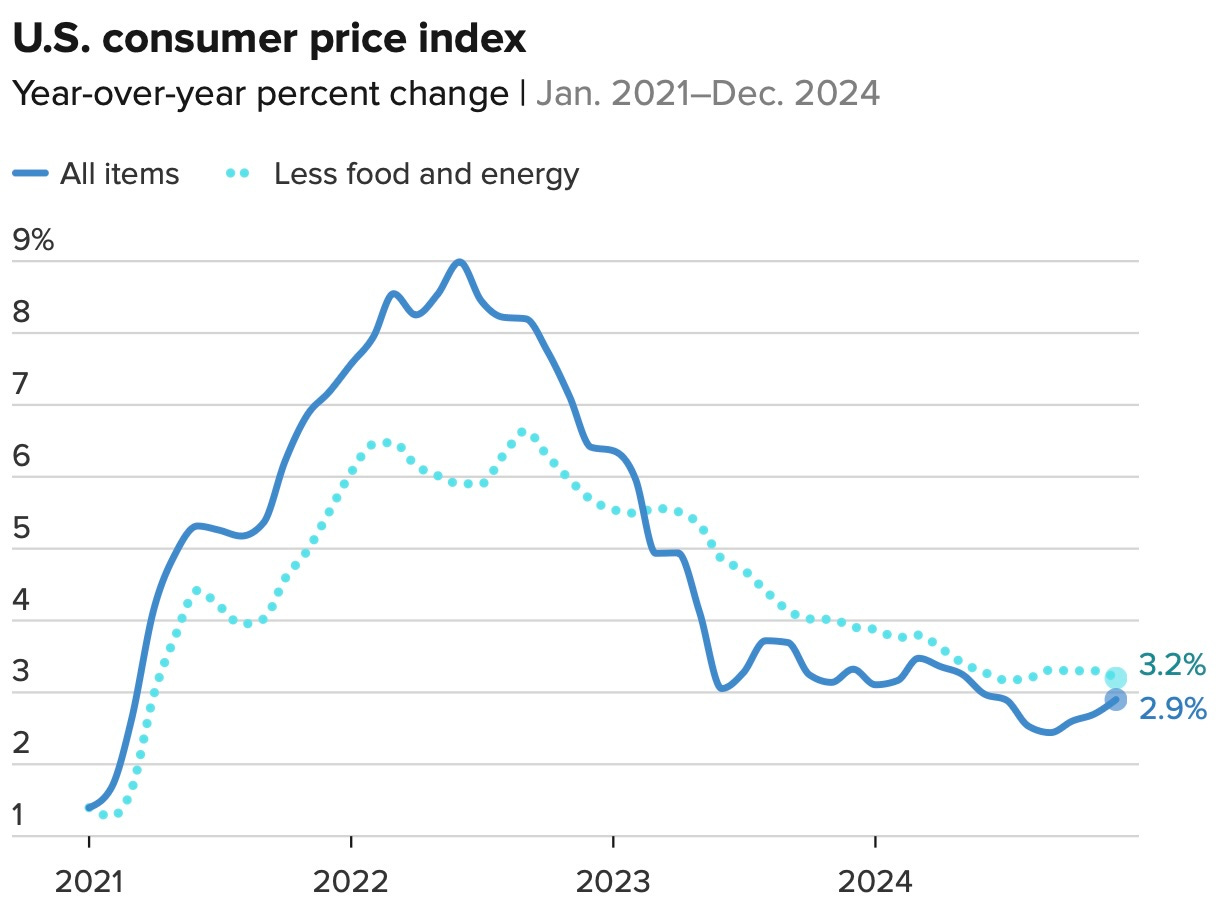

The difference between core inflation and headline or overall inflation charts out like this:

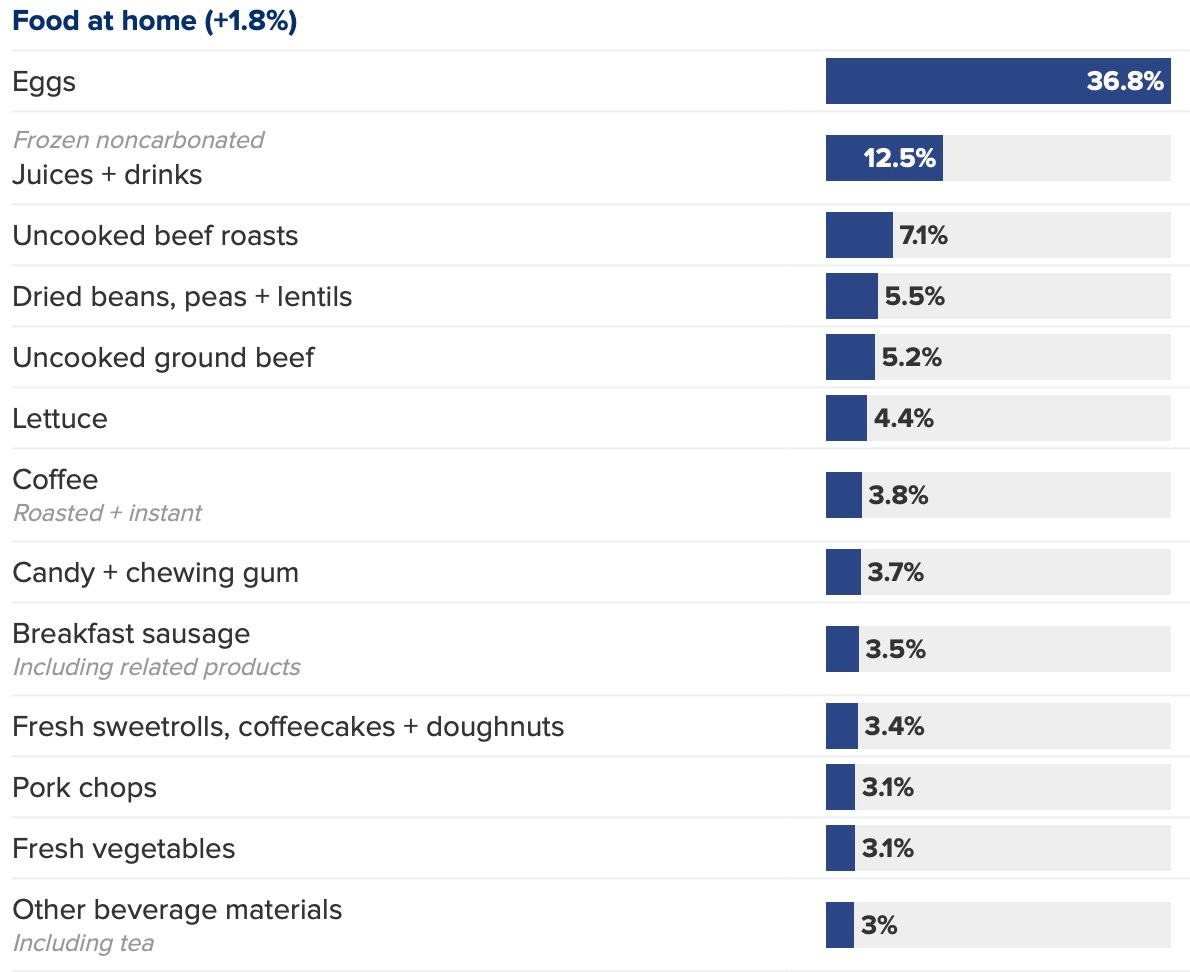

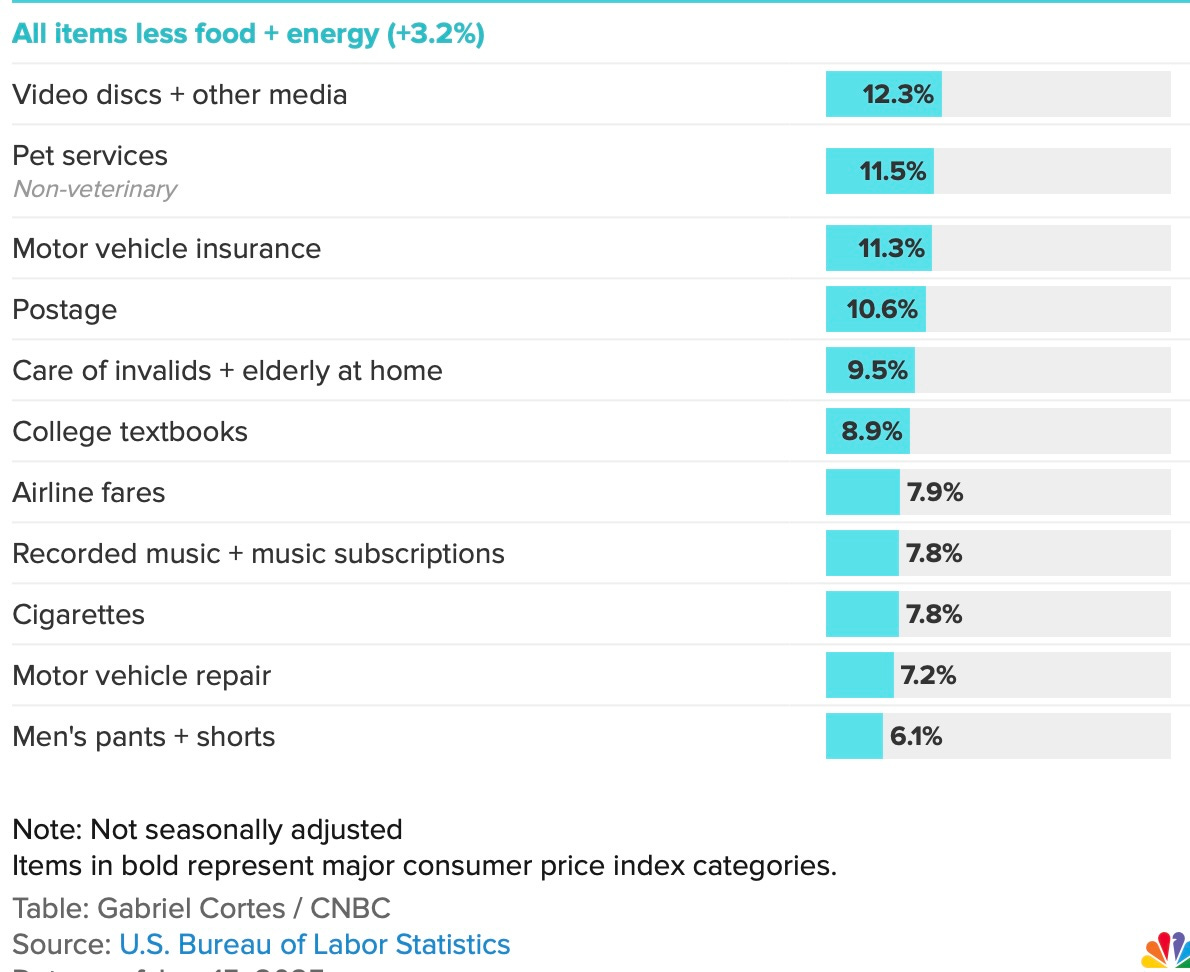

As you can see, overall inflation is continuing right along its recent flight path to creep up, up, up. Big moves in energy over the past month were the primary driver. Not too scary if those energy increases are temporary market paroxysms, but, if they stay up, energy drives up the price of everything, so energy works its way into core inflation through thousands of back doors. Food prices also rose quite a bit with eggs—due to endless wholesale slaughter of chickens—having risen an astronomical 36.8% over the past year. (There are those supply shortages acting as a driver of inflation so long as people have enough money to spend to get what they want or need.) Auto insurance is up over 11% from a year ago.

As you can see, overall inflation is continuing right along its recent flight path to creep up, up, up. Big moves in energy over the past month were the primary driver. Not too scary if those energy increases are temporary market paroxysms, but, if they stay up, energy drives up the price of everything, so energy works its way into core inflation through thousands of back doors. Food prices also rose quite a bit with eggs—due to endless wholesale slaughter of chickens—having risen an astronomical 36.8% over the past year. (There are those supply shortages acting as a driver of inflation so long as people have enough money to spend to get what they want or need.) Auto insurance is up over 11% from a year ago.

CNBC summarized with undue optimism,

The December CPI report, coupled with a relatively soft reading Tuesday on wholesale prices, shows that while inflation is not cooling dramatically, it also isn’t indicating signs of reaccelerating.

Actually, it is. Rather than spell that out in my weekend Deeper Dive, having covered inflation a lot lately, I’ll refer you to Wolf Richter’s article and graphs via the link in the headlines below. Richter lays out how all that background pressure has been mounting and continues right on doing so without any hesitation. Financial writers these days don’t see what they don’t want to see, although CNBC did admit the following:

A separate report Wednesday from the New York Fed showed manufacturing activity softening but prices paid and received rising substantially.

Let me say it again, background prices that eventually move to the foreground in CPI and PCE were shown to be rising substantially.

At least, the present CPI report helps take pressure off markets going into the Fed’s rate-setting meeting next week. They may be able to stop worrying for a week about the possibility of an actual rate hike … this month. The Fed is loath to admit it’s losing ground, so it will likely be as ready to take the respite provided by this week’s two inflation reports as markets were.

Markets are betting that the dip in core CPI (the Consumer Price Index) and in PPI (the Producer Price Index) means that the Fed’s favorite inflation gauge—core PCE (Personal Consumption Expenditures)—will come in flat. But look to Richter’s article if you want to see what really happened in PPI this week, versus what all the financial press tried to focus on. Not good!