One of the reasons people choose to invest in gold bullion or to buy silver coins is because they are simple and they are finite; basically the opposite of fiat currency. The complexity of fiat-driven markets and infinite possibilities to create money works to the advantage of central banks.

And they particularly like to take advantage when asked by the general public a very obvious question… Central banks are on the defensive over printing too much money during the pandemic. One of the latest examples is a post from the Bank of Canada on Twitter (August 25) stating #YouAskedUs if we printed cash to finance the federal gov’t. We Didn’t.

The Twitter feed went on with an explanation that the Bank of Canada bought bonds from banks in the open market. This was to help unblock frozen markets at the start of the pandemic. This lowered the cost of borrowing to help Canadians get through the pandemic.

Then the BoC Twitter thread states We bought the bonds with settlement balances – a kind of central bank reserve – not with bank notes.

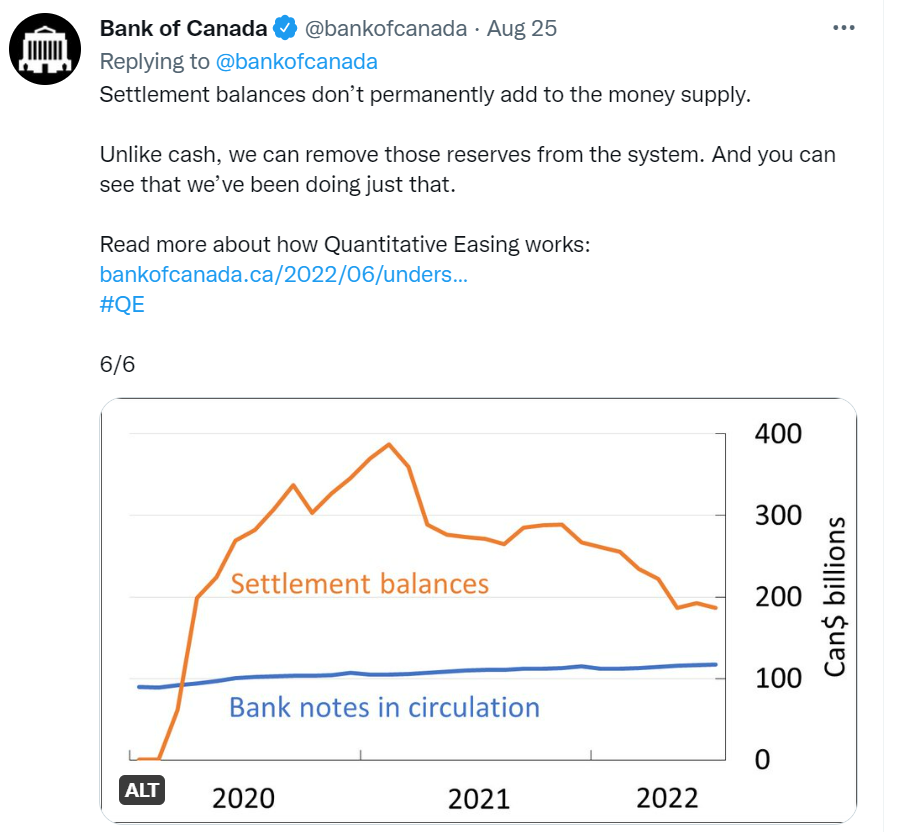

And finally, the Bank of Canada states Settlement balances don’t permanently add to the money supply. Unlike cash, we can remove those reserves from the system. And you can see that we’ve been doing just that (with the chart below as their evidence.)

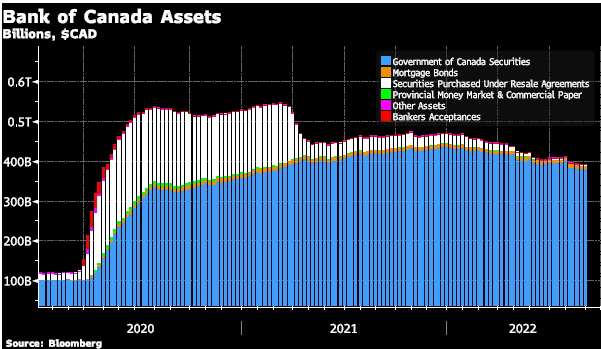

Let’s take a step back and look at the BoC’s Balance sheet. Starting with assets.

Bank of Canada Assets

The reason that the Bank of Canada started purchasing assets in 2020 was to provide liquidity to markets in the wake of covid-induced government lockdowns.

The bank provides liquidity to markets by purchasing assets from its primary dealers and from the public.

Although the main asset it purchased was Government of Canada Bonds it also purchased mortgage bonds and other assets. For very short liquidity it purchases assets Under Resale Agreements. This is an agreement between the Bank of Canada and the Primary Dealer that the Primary Dealer repurchases the assets back on a specified date.

All of these purchases are added as assets to the BoC’s Balance sheet. The Bank of Canada expanded its assets from just over CAD$100 billion in assets in mid-March 2020 to CAD$550 billion by July of 2020.

The Bank held these assets until March 2021 when it started selling them back into the market. However, the assets on the BoC’s balance sheet currently still stand at almost $400 billion.

When the BoC purchases securities these become an asset on its balance sheet. However, this means that there must be an offsetting liability.

In other words, the BoC has to pay for this asset somehow. Also, the most efficient way for the BoC to do this is to ‘credit’ the primary dealer’s account electronically.

This then becomes part of the settlement balances on the liability side of the BoC’s balance sheet (settlement balances are referred to as excess reserves by other central banks).

This is how the money supply is created from the Central Banks’ monetary base.

Bank notes in circulation are also liabilities on the BoC’s balance sheet. (Note that both the Settlement balances and the Bank notes in circulation shown in the BoC’s Twitter post above are both liabilities of the Bank of Canada.)

This ‘electronic payment’ now becomes an asset on the primary dealer’s balance sheet that they either use to purchase other assets or use to make loans. This then expands the money supply.

The central bank, in this case, the BoC, creates what is known as the monetary base – or high-powered money. However, it is the banks that then use this base to create and expand the money supply.

They do this through taking in deposits and then making loans against those deposits. Canada, like the UK, does not have an ‘official required reserves’ requirement of 10% like the U.S.

Federal Reserve does, however, Canadian banks still need to have enough reserves to ensure smooth settlement at the end of each day. In general, this is around 10% of their M1 liabilities.

Using the 10% reserve requirement as an example. This means that when a bank receives a deposit that it only has to hold 10% of that deposit. It can lend out or purchase other assets with the other 90%.

An example of this is if Consumer A makes a deposit of $100, then the bank can lend $90 of that to Consumer B. Once Consumer B deposits that loan with their bank then Consumer B’s bank now can lend out $81 dollars and so on.

This is how the money supply is created and expanded by banks from the Central Banks’ monetary base.

If consumers A through F all use their new bank loans to buy homes, then we have liquidity fueled debt driven housing boom.

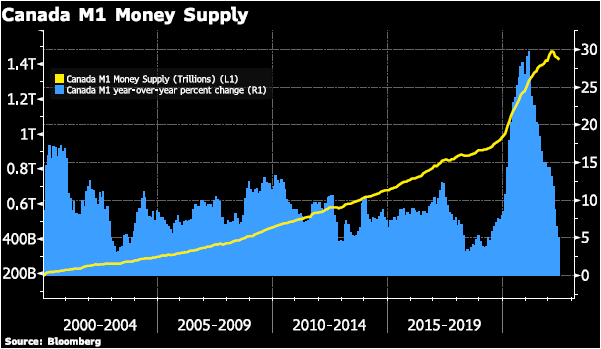

Canada’s M1 money supply, which includes all banknotes and coins in circulation plus chequable deposits held in commercial banks. This has been increased by more than 50% (CAD$500 billion) since 2020.

Bad News for Central Banks?

Bottom line is that there is CAD$500 billion more money in the Canadian economy than there was pre-covid.

The money supply also surged in other countries. The UK has 630 billion more pounds. The U.S. has added more than 3 trillion in dollars to its money supply for example.

So it seems clear that the Bank of Canada, one of the central banks, is deflecting valid criticism rather than openly and clearly answering reasonable questions put to it by the public.

Instead of saying ‘yes we added more currency to buy bonds’ they actually said ‘we did not print money’ in the hope that no one notices the semantics difference. The staff at the BoC is trying to be too clever by half.

Canada is a mediocre economy with an uninspired central bank. So, if their staff is bold enough to be super cute with words instead of forthright today… just imagine what baseless claptrap they will attempt to pedal when things really get rough.

We note that physical gold does not need to tweet. Physical silver does not need to take questions from the public!

Over time the price of metals rises precisely because the metals are entirely outside the shenanigans of the central banking system!

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

07-09-2022 1705.05 1702.65 1486.63 1492.54 1722.10 1719.34

06-09-2022 1712.50 1702.60 1477.89 1480.41 1721.23 1724.73

05-09-2022 1711.95 1710.95 1488.54 1486.13 1727.02 1723.44

02-09-2022 1706.90 1712.50 1476.30 1484.05 1709.46 1711.82

01-09-2022 1706.00 1694.30 1471.08 1469.64 1701.74 1702.26

31-08-2022 1712.40 1715.90 1472.15 1478.08 1713.60 1715.21

30-08-2022 1734.00 1730.30 1475.81 1481.31 1726.37 1727.36

26-08-2022 1752.10 1751.25 1480.52 1475.95 1751.05 1741.09

25-08-2022 1762.40 1753.55 1489.23 1485.26 1763.81 1760.04

24-08-2022 1752.00 1745.65 1483.59 1483.10 1760.41 1759.79

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here