US stock market breadth is fading

The US stock market has bad breadth as participation thins out markedly. Below are a few examples.

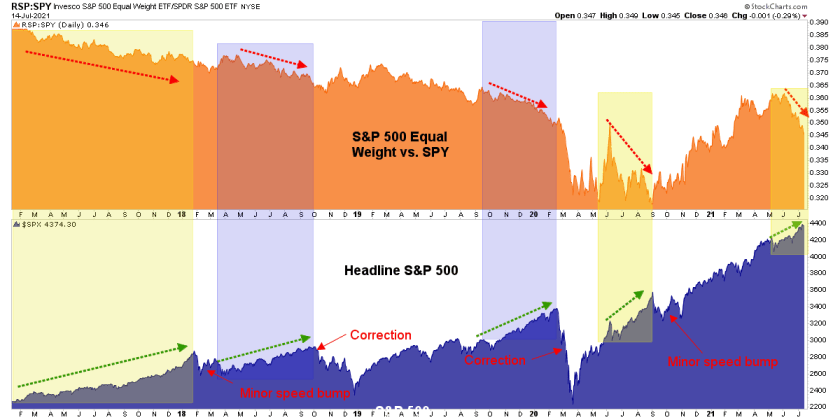

Equal weight SPX is fading headline SPX per this chart which we feature occasionally in NFTRH but update the status of most weeks.

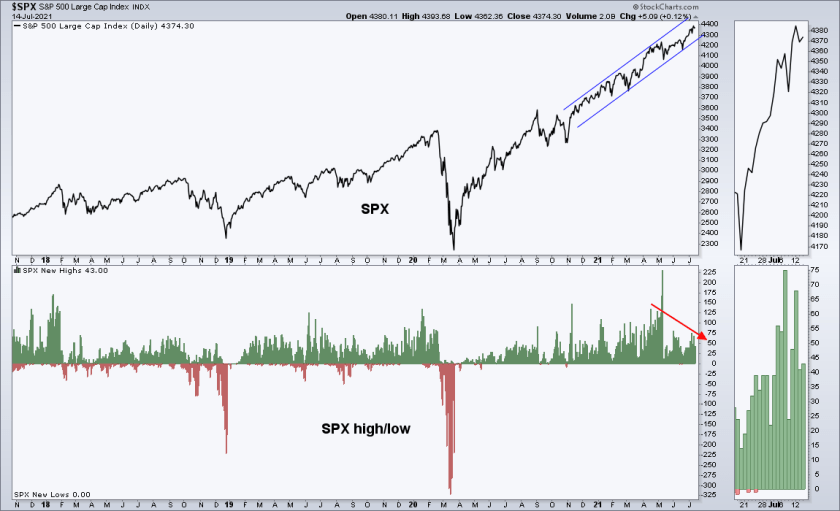

SPX new highs/lows is diverging the headline as well.

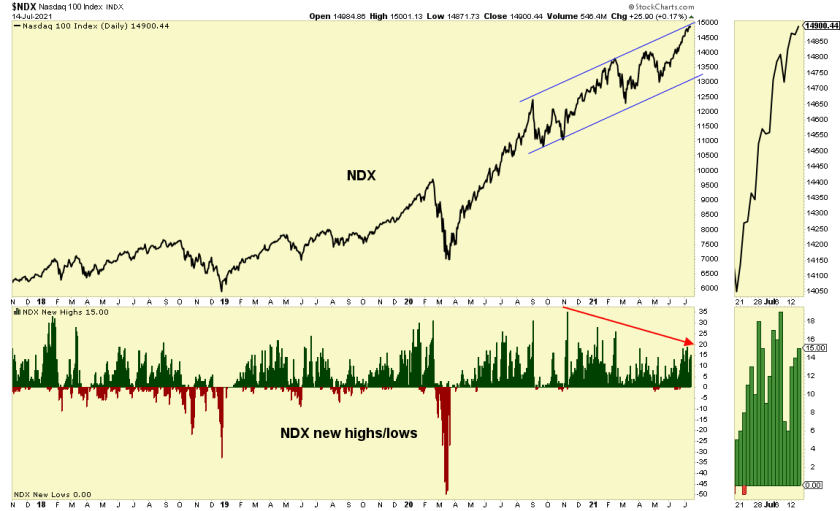

Let’s also take a look at the thinning out going on in big Tech as the headline powers higher.

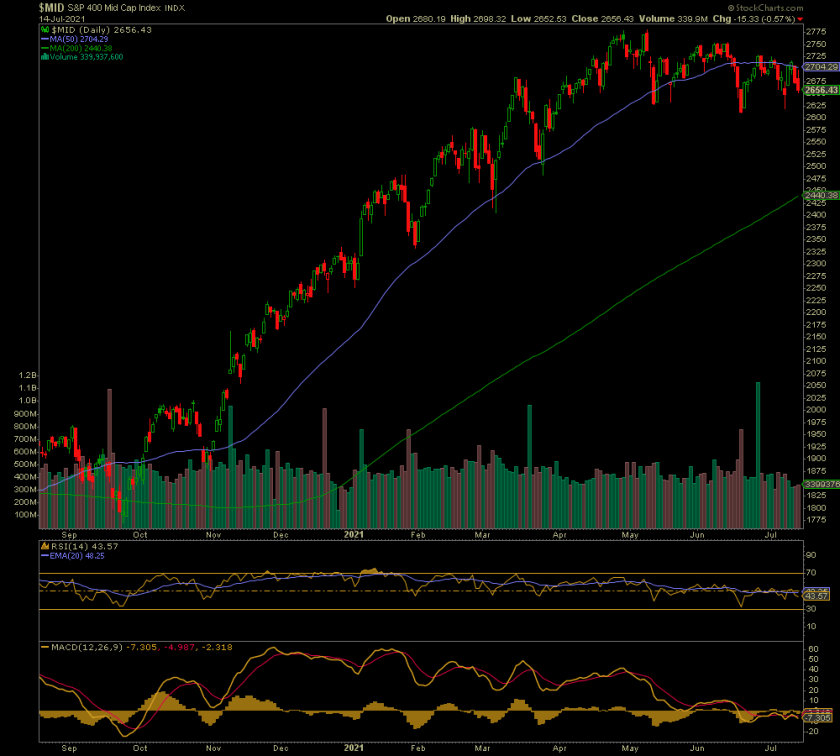

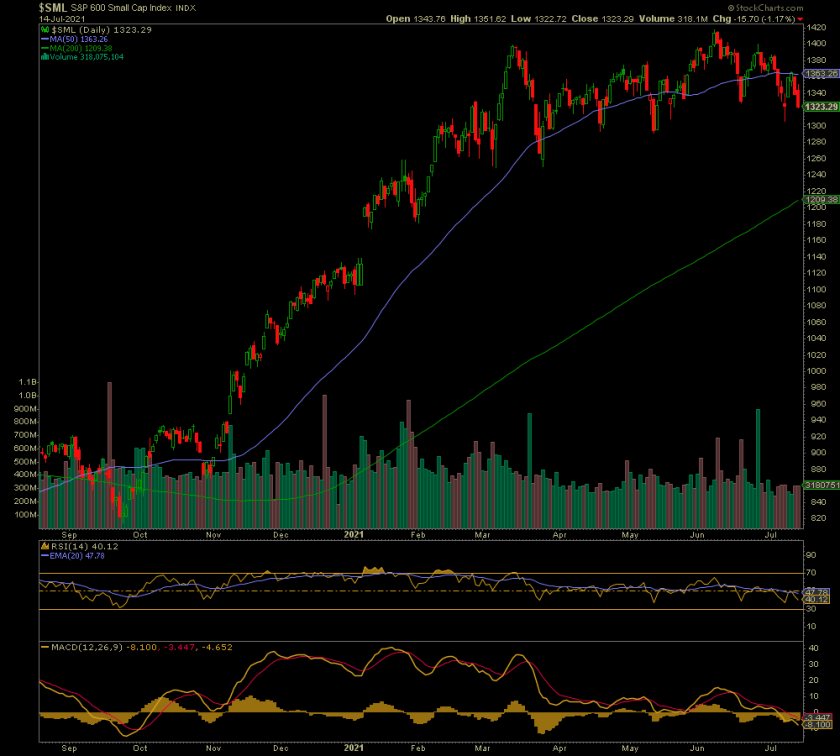

Now take a look at the disgusting charts of mid caps and small caps. They are technically in roll over mode as long as they remain below the daily SMA 50 (blue), which is also starting to roll over.

The big names that everyone knows are doing the lifting, and that is not positive. It’s man and machine rotating into the perceived safety of the biggest of big Tech. Side note: I recently sold MSFT and AAPL (while hanging on to AMZN for now) because this is late stage signaling.

Sure, the Teflon Don (AKA the US stock market) could escape unscathed as it sometimes does after painting such obvious bearish divergences. But that does not mean the divergences are not there and have not in the past foretold bearish things to come. Add to that thin summer trading and if you’re not having at least some level of caution you’re a braver person than I.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by PayPal or credit card using a button on the right sidebar (if using a mobile device you may need to scroll down). Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter @NFTRHgt.