The general perception is that Trump can slow down the pace of interest rate cuts. Hence, the recalibration, in the form of a renewed rise in US treasury yields plus a rise in the US dollar index. The inverse correlation between bond yields and gold worked. The net result was a sell-off accompanied by a technical breakdown.

US President-elect Donald Trump will take oath on 20th January 2025. Add two weeks to 20th January 2025 which is 3rd February 2025.

Make Strategies, Think, and Worry, only till 3rd February 2025. Why?

Donald Trump has more enemies globally than anyone can visualize. These enemies will try to create all kinds of hurdles and pitfalls for his future as President of the USA. For new long-term investments in selected asset classes (other than gold, silver, and industrial metals), I will prefer to wait for the trend on or after 3rd February and then decide. (Long-term fundamentals of silver and copper and industrial metals will not change due to a change in the US President or change in any key global political leadership.)

Gold and silver are and will buy/invest (separate intraday trading from investment) in a significant crash. The current world situation and current global economic situation will ensure that bearish trends (if any) will be short-lived. The pace of rise may slow (as compared to the first ten months of 2024), but the rise will be there.

Physical demand for gold and silver will be very high in India and all over Asia starting today and for the rest of November. Winter Hindu marriage season in India will begin today and continue till 22nd December – followed by a break till 14th January and it recommences from 15th January till the end of February. There is not an iota of doubt that India’s November gold imports will be very high (as compared to the month of October).

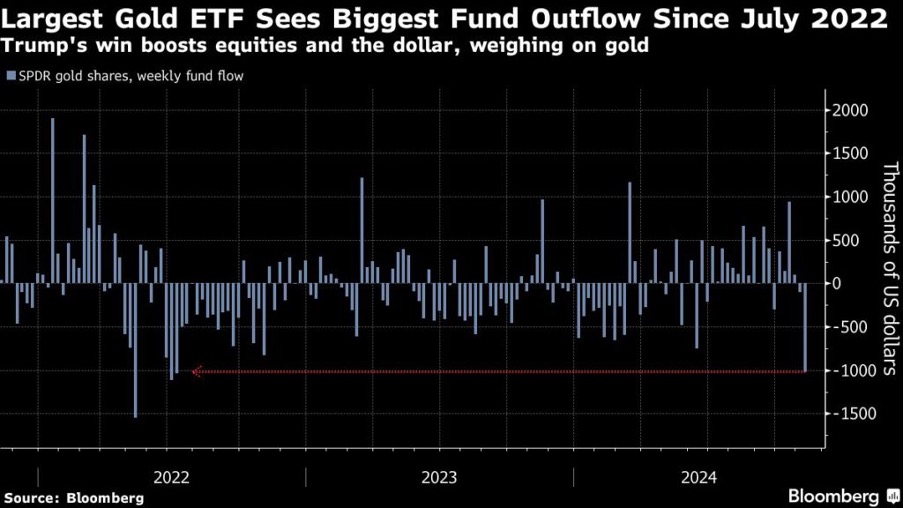

Top gold ETF sees largest weekly outflow since 2022 on Trump's win

SPDR Gold Shares (GLD) saw an outflow of over $1 billion, the largest weekly fund outflow since July 2022, according to data compiled by Bloomberg. Spot gold fell 1.9% over the same period. Total gold ETF holdings slipped 0.4%, the second straight weekly decline.

I believe that gold ETF traders will re-enter if and when the price reverses from the bottom.

I believe that gold ETF traders will re-enter if and when the price reverses from the bottom.

There is a US economic data release vacuum for the next two weeks, apart from US October inflation number, CPI, and PPI. I would prefer to trade in the technical.

COMEX SILVER DECEMBER 2024 - Intraday View

- 50 Day Simple Moving average: $3165.00

- 100 day simple moving average: $3045.00

- TODAY: Silver December has to trade over $3045.00 to rise to $3165.00 and more.

- Crash or a big sell off will be there only on a sustained fall below $3045.00.

- A daily close below one hundred day simple moving average around $3045.00 for four consecutive trading session (from today) will confirm a short term bearish trend with $2999.80 and $2854.90 as potential price target.

- TODAY: Gold December has to trade over $2627.00 today, tomorrow and next week to be in a short term bullish zone and rise to $2725.30 and more.

- Crash or knock down will be there if gold December trades below $2627.00.

Disclaimer

- The investment ideas provided is purely independent view point and are solely for collective learning and for academic interests. There is no commercial benefit accruing or have deemed to accrue to me out of providing such investment ideas.

- The investment ideas shared here cannot be construed as investment advice or so. If any reader is acting on these advices, they are requested to apply their prudence and consult their financial advisor before acting on any of the recommendations made here. I am not responsible to anybody in the event of profits and losses (if any) upon acting on such advice.

- I hope that our reader is aware about this well aware of the risk involved in trading in commodity derivative trading.

Disclosure: I trade in India's MCX commodity exchange. I have open positions in India's MCX commodity future. I do not trade in CME future or OTC spot gold and spot silver.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow us on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.

- ALL NEWS IS TAKEN FROM REUTERS NEWSWIRES.

- TECHNICAL ANALYSIS IS DONE FROM TRADINGVIEW SOFTWARE