One needs to remain on the sidelines today, tomorrow, and Monday. There is still a lot of speculation of aggressive interest rate cuts by the Federal Reserve (0.50% 18th of September, 0.50% 7th of November, and 0.25% 18th of December). Chinese central bank could also aggressively cut interest rates to boost demand and exports. All in all global liquidity is set of see a massive rise from September for the rest of the year and in 2025.

There can be blips of one-way price moves followed by large period of consolidation. Patience plus higher trailing stop loss is needed for the next thirty days.

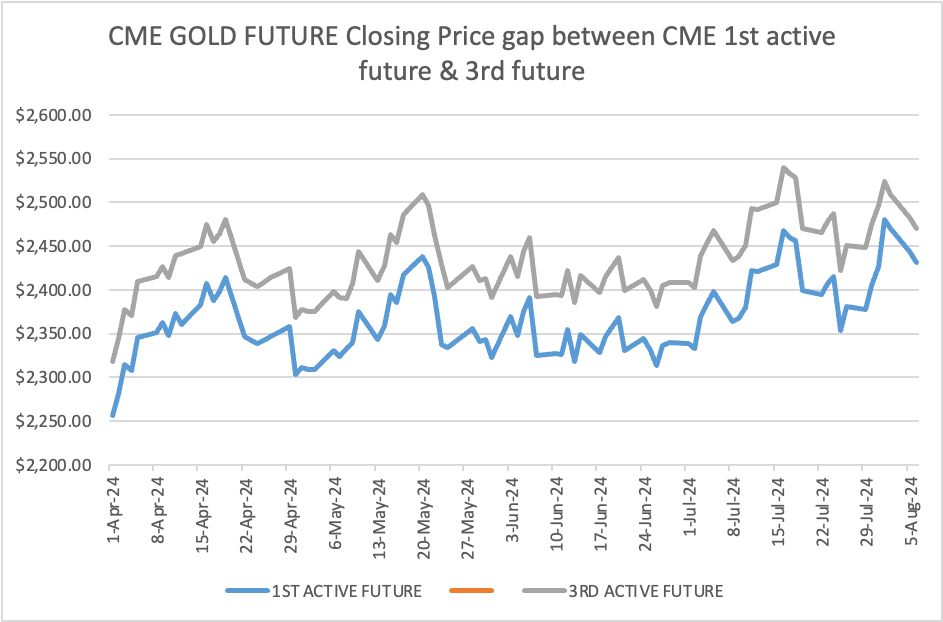

CME GOLD CLOSING PRICE GAP/SPREAD COMPARISON BETWEEN 1ST ACTIVE FUTURE AND 3RD ACTIVE FUTURE.

The whole world is speaking of Options. They trade in options. Most of us analyze price trend using technical trends of near-dated active future contracts and near-dated option.

Very few analyze spreads/badla (for Indians). Spread analysis can also tell us the trend. Old schools thought traders like me kept a close watch at spreads every hour as well. Trading decisions are made when we see some extreme moves in spreads or badla.

Let me analyze CME gold closing price gap/spread active future between 1st future contract and 3rd active future contract. Currently, the first active gold future CME contract is gold December. The third active gold future CME contract is gold in April 2025.

- Time period: 1st April 2024 closing price to 6th August 2024 closing price.

- Highest closing price gap was $92.20 on 23rd May 2024. Gold price fallen by over $100 from the high. This implies higher investment demand on dips.

- The lowest closing price gap was on 6th August at $38.80. In my view the significant reduction in closing price gap implies traders are cautious in the bullish trend in the first quarter of 2025.

- The average closing price gap was around $67.10.

Spreads and the subsequent trend is not inclusive and conclusive way to determination of price trend in gold or any investment avenue. It is just another armour to prevent losses, retain profit and sometimes gives us higher profit.

Disclaimer

- The investment ideas provided is purely independent view point and are solely for collective learning and for academic interests. There is no commercial benefit accruing or have deemed to accrue to me out of providing such investment ideas.

- The investment ideas shared here cannot be construed as investment advice or so. If any reader is acting on these advices, they are requested to apply their prudence and consult their financial advisor before acting on any of the recommendations made here. I am not responsible to anybody in the event of profits and losses (if any) upon acting on such advice.

- I hope that our reader is aware about this well aware of the risk involved in trading in commodity derivative trading.

Disclosure: I trade in India's MCX commodity exchange. I have open positions in India's MCX commodity future. I do not trade in CME future or OTC spot gold and spot silver.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow us on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.

- ALL NEWS IS TAKEN FROM REUTERS NEWSWIRES.

- TECHNICAL ANALYSIS IS DONE FROM TRADINGVIEW SOFTWARE