Trend is bullish for gold and silver. But we need to focus on resistances. The ability/inability to break the immediate resistance will decide the trend this week. There is no news. Trend of US stock markets and trend of crypto currencies is dictating intraday price move. All asset classes are rising and falling at the same time.

In India people will use all the price crash to buy physical gold and physical silver in all forms. Gold and silver prices have reversed significantly from the lowest price in the last two weeks. “People are thinking, OH I have lost a chance to buy at lower price in gold and silver.” This view among people of India will be there unless there is a falling trend for two weeks to three consecutive weeks. India is a very big consumer of gold and silver.

Few things we need to understand for the reason for increased risk-taking ability in all asset class and very quick readjustment.

- Cash and Cash in Bank and Bank Fixed Deposit Certificate are giving negative real returns.

- Treasury yields and investment in treasuries also do not cover real consumer price inflation and perceived inflation.

- Before the pandemic, in India, people had very high cash in bank and had invested huge amounts in bank fixed deposit certificates. The current young working population now are getting much higher returns (in India) in selected mutual funds, gold etf, silver etf. Physical gold and physical investment among other lowest risk investment avenues available in India.

Gold and silver will continue to attract more and more investors on every major price dip in India for the rest of the year and in the next five years. Even if Indian stocks see a fomo rally, then also there will be rising investment in all forms of gold and silver.

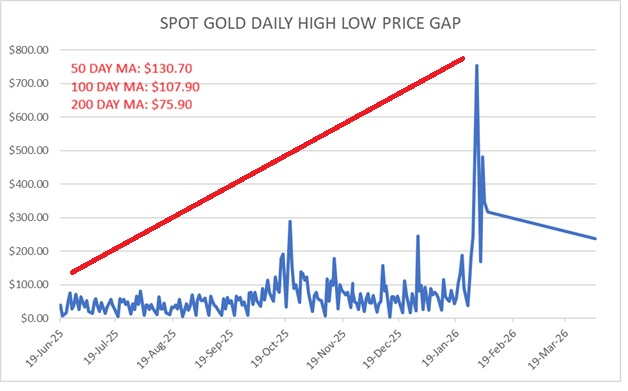

- The above is the spot gold daily high-daily low price gap from 19th June 2025 to 6th February 2026

- On an average spot gold is seeing over $100 daily high -low price gap.

- This implies very high intraday volatility.

- Short term traders are also there in spot gold.

- Speculative demand is also very high in gold.

For gold price to fall and/or move into a short term bearish trend there has to be a significant reduction in the daily high-daily low price gap. If not, then the frequency of boom-bust type price moves will significantly increase in the next eighteen months.

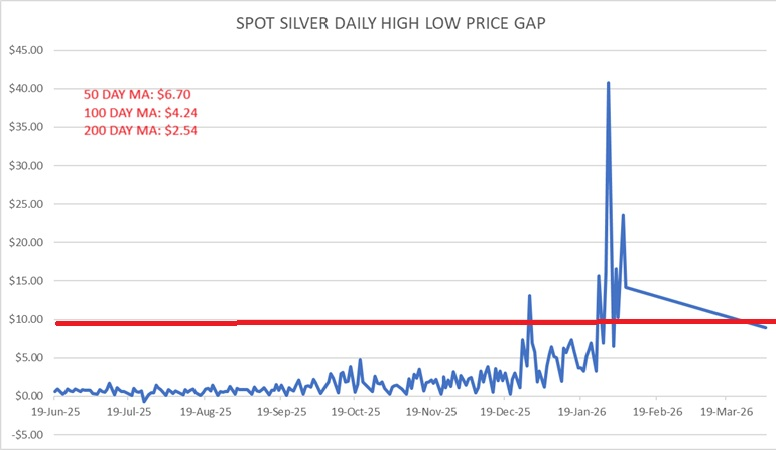

- The above is the spot silver daily high-daily low price gap from 19th June 2025 to 6th February 2026

- On an average spot silver is seeing over $9 daily high -low price gap in the past one month and over $4 in the past three months.

- Historical high intraday volatility is there in silver.

- Silver has become the punters favorite investment class.

- Speculative demand is also very high in silver.

I have tried to analyze gold and silver by doing a technical analysis on the daily high-daily low price gap to try and understand the investment price gap and exit/profit booking price point. One can use this along with standard technical analysis.

Since I trade/invest only in silver, my bias to invest in silver over gold will always be there. You can take it as a Disclosure and Disclaimer.

Gold and silver are giving very good profitable intraday trading opportunities. Global trading volumes is rising day. Gold and silver trading can be small part of one’s portfolio. The word “Cyclical” is now no more applicable to trading in gold and silver.

Chinese central bank has been increasing gold reserves since 2003 or may be even before. CBGA central bank gold sellers are now increasing gold reserves at a very high increasing rate every month. The long-term vision of Chinese policy makers is applaudable. We need to keep a close watch on moves and regulation in China on precious metals and non-ferrous metals for the rest of the year and next year. Trump trying to do a China on USA manufacturing (through trade tariff) is doubtful.

Very short term traders and intraday traders, trade very carefully this week. China is on holiday next week.

Spot Silver – Current Market Price $81.25

- TODAY VIEW: Spot silver has to trade over $79.01 today, tomorrow and Wednesday to rise to $93.02 and more.

- Crash or sell off will be there if spot silver trades below $79.01 for minimum twelve consecutive hours to $73.20 and more.

- To intraday traders mild sell off will be there if spot silver trades below $80.67 after London open and till days close.

- There can be some very sharp two way price moves today.

- Views are intraday unless otherwise specified.

DISCLAIMER: The investment ideas provided is purely independent view point and are solely for collective learning and for academic interests. There is no commercial benefit accruing or have deemed to accrue to me out of providing such investment ideas.

The investment ideas shared here cannot be construed as investment advice or so. If any reader is acting on these advices, they are requested to apply their prudence and consult their financial advisor before acting on any of the recommendations made here. I am not responsible to anybody in the event of profits and losses (if any) upon acting on such advice.

I hope that our reader is aware about this well aware of the risk involved in trading in commodity derivative trading.

Disclosure: I trade in India's MCX commodity exchange. I have open positions in India's MCX commodity future. I do not trade in CME future or OTC spot gold and spot silver.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow us on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.

- ALL NEWS IS TAKEN FROM REUTERS NEWSWIRES.

- TECHNICAL ANALYSIS IS DONE FROM TRADINGVIEW SOFTWARE