NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 49th year in the gold business

JUNE 2022

“It’s as if gold has been living in an alternate universe.” – Wisdom Tree

–––––––––––––––––––––––––––––––––––––––––––––

The avalanche of history

‘It’s a very, very difficult place for us to be in.’

“[A] belated tightening of monetary policy by the world’s most important central bank, the Federal Reserve, inflicts a sort of regime change not only on US households and businesses, but on the rest of the world, too,” writes historian Niall Ferguson in a recent Bloomberg opinion piece. “All the consequences of these two shocks — one geopolitical, the other economic — are very hard indeed to predict, but I am confident that we have seen only a small proportion of them so far.”

In recent testimony before the British Parliament, Bank of England governor Andrew Bailey admitted he felt “helpless” in the face of what has become runaway inflation. In doing so, he may have framed a new conundrum for central bankers everywhere – taming what increasingly looks like an untameable course of events. Unlike the Fed, which is raising rates and unwinding its balance sheet in the face of a slowdown, Bailey says BoE will not be selling government bonds in a time of economic turmoil. “It’s a very, very difficult place for us to be in,” he says.

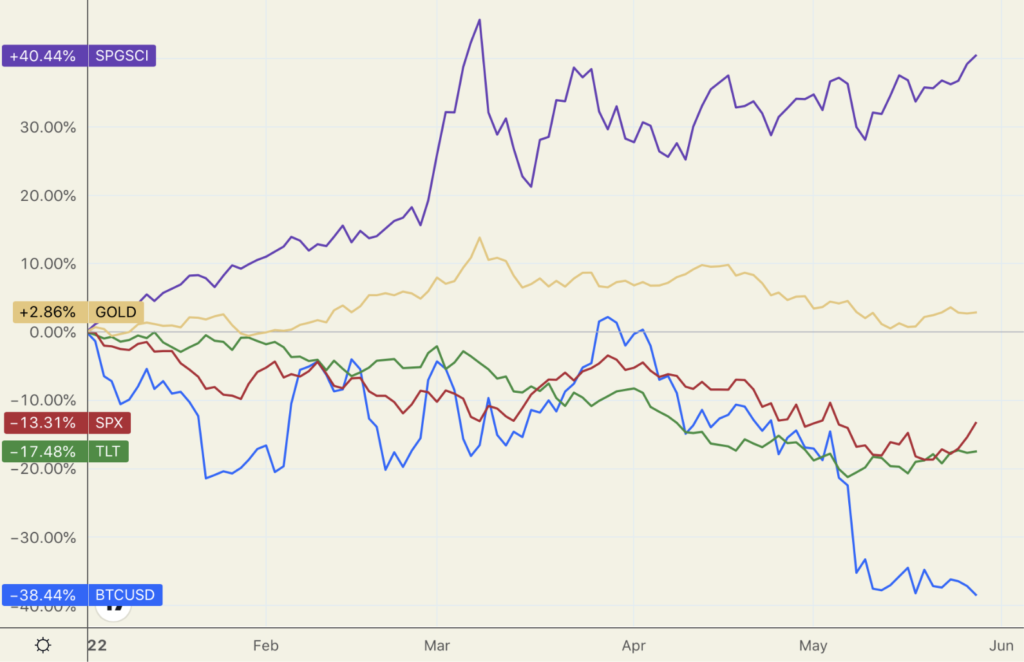

Gold, as you can see in the chart immediately below, has held up well in response to what Ferguson calls the avalanche of history, while other assets covered in his lengthy analysis – most notably stocks, bonds, and bitcoin – have declined sharply. Commodities have been the star performer by far, and under such circumstances, we might have expected more from gold. Then again, it’s early in the game. Ferguson identifies the 1970s as the closest comparison to the present period but says “the analogy is far from perfect.” Like the 1970s, though, we should not “expect a rapid return to stability, whether in macroeconomic or geopolitical terms,” he says.

“For most of the past year,” writes Wisdom Tree, the Dublin-based financial firm, “gold has been ignoring the red-hot inflation that we have been living in.… It’s as if gold has been living in an alternate universe.” Now, though, it believes gold has reached a turning point. Its consensus forecast has the metal at $2315 by the first quarter of 2023. Its bullish scenario, based on sticky near double-digit inflation and a sharp correction in the dollar index, puts it at $2680. Its bearish forecast, which would result from the Fed successfully taming inflation, puts it at $1790.

Investment performances 2022

(%, year to date)

(SPGSCI = Standard & Poors Goldman Sachs Commodity Index; TLT = Bond ETF; SPX = S&P 500; BTCUSD = Bitcoin)

Chart courtesy of TradingView.com

Short and Sweet

IN A RECENT WALL STREET JOURNAL EDITORIAL, economist Judy Shelton explores two interrelated questions. First, who is responsible for a sound dollar, Congress or the Fed? And second, who is to blame if the currency crumbles? She then attacks the political process in Washington for essentially defending inflation rather than producing a sound currency. She ends by calling for a commission “to carefully consider how best to secure the integrity of the American currency.” Much could be said about Shelton’s proposal to make the dollar a sound currency via the political process. While we are waiting for Congress to make the greenback sound, the best alternative for those who share her concerns is to confront the issue by owning sound money outright in the form of gold and silver coins and bullion.

A RECENT SURVEY CONDUCTED BY THE WORLD GOLD COUNCIL found that 31% of respondents invested in cryptocurrencies (compared to 44% in gold), and 32% viewed crypto as “high risk with the potential for high returns or as a purely speculative bet.” WGC concludes that “attitudes towards gold among these investors are contrastingly different – they recognize its safe-haven, inflation hedging qualities. One-third of investors view their gold investment as either ‘a store of value (to protect my wealth)’, a way to ‘protect against inflation’, or as ‘a safe investment that I don’t have to worry about.’ Which may explain why even more investors bought gold than crypto last year. According to the research, 44% invested in gold in the first 10 months of 2021, with bars and coins among the most popular options.”

“THE FED’S STOCK OF TREASURY BONDS and mortgage-backed securities,” reports NewsMax-Reuters, “is projected to decline by roughly $2.5 trillion by mid-2025, to about $5.9 trillion, when the central bank’s run-off of assets is likely to be halted to maintain an adequate level of bank reserves, the New York Fed said on Tuesday.” However, those numbers appear to be a projection rather than an actual schedule of reductions. The great debate at the moment is whether or not the Fed can stay the course on quantitative tightening or if it will be forced to throw in the towel if and when the economy tightens and financial markets register a negative response. The most interesting revelation comes at the end of the article when Reuters reports that the Fed intends to hold its Treasuries portfolio until maturity. In other words, the Fed will reduce its balance sheet through natural attrition. If that turns out to be the case, it will temper the impact on rates from the sell-side of the equation. The most consequential impact will come from the buy-side of the equation as the Fed withdraws its bond market support as the buyer of last resort.

(Chart note: Some years ago, we constructed the interactive chart above at the St. Louis Fed’s FRED portal. You can track it at our Monetary Trends and Indicators page and several other charts of interest to precious metals owners.)

“GHANA, REPORTS REUTERS, “HAS STARTED a bulk purchase programme to buy gold locally to raise the gold component of its reserves, Central Bank Governor Ernest Addison said on Tuesday, in a bid to strengthen the cedi currency without increasing inflation.” Thereby, Ghana joins Russia and China as a top-ten global gold producer, now channeling the bulk of its production into national reserves. It is the world’s sixth-largest gold producer. China is number one, and Russia is number three.

“[GUGGENHEIM’S SCOTT MINERD SAID ATTENDEES at [a Hoover Institute] conference,” reports MarketWatch, “estimated that the Fed would need to take interest rates to 3.5% to 8% to hit neutral, which suggested to him that the central bank might need to dial-up rates until something in the economy or markets, or both, breaks. The Fed appears to have ‘very little concern about the continuation of what I think now is a bear market,’ Minerd said. If that is the case, ‘we are probably going to have a pretty severe selloff.'” Minerd believes that the Nasdaq could plunge 75% from its peak and the S&P500 45%. He says we are headed for a summer of pain. About a year ago, he predicted gold would eventually rise to between $5,000 and $10,000 per ounce and that silver would outperform it. In short, he foresees a major bear market for stocks and, on the flip side, a major bull market for gold.

“I’M NOT OFTEN GLAD I AM NO LONGER the young person in the room,” writes market analyst Merryn Somerset Webb at the Money Week website, “but this month I am. If you have only been knocking around in markets for, say, 15 years, you are seeing the collapse of everything that you have been told is true and have observed to be true about markets.” As the new verities fall one after the other and Somerset Webb returns to an old verity, saying that what is new to most market participants is actually old and a return to the 1970s. “With that in mind,” she says, “hold gold.”

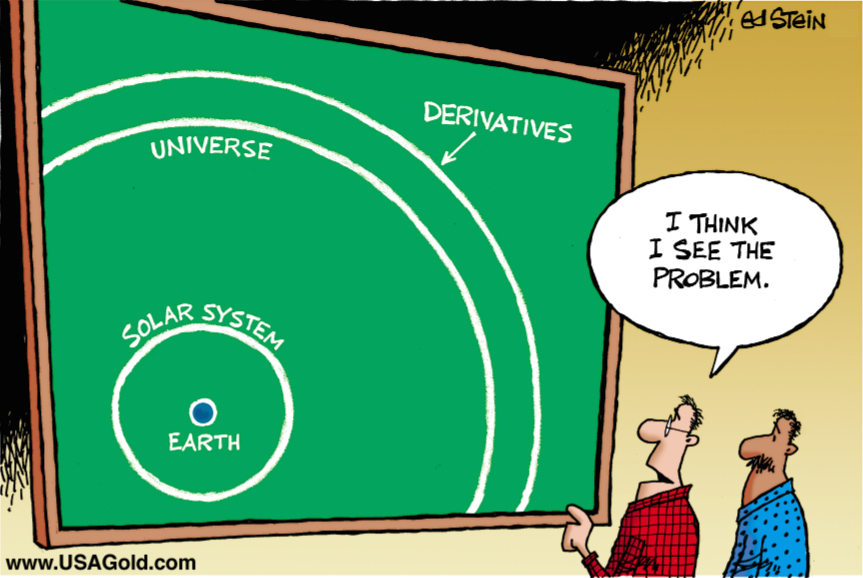

MORE AND MORE ANALYSTS ARE POINTING TO SOMETHING we have considered the real problem all along in financial markets – LEVERAGE. The Fed will find it everywhere in financial markets if it cares to look, and it will not be long, in our view, until confronting it is unavoidable. “People always say the market comes down on profit-taking,” says Cantillon Consulting’s Sean Corrigan in a CNBC interview. “it comes down on loss realization. The guy who sells at the top sells to the next two guys, who realize it’s not going to hold, who sell to the next guys, and if any of those are leveraged, we’re in trouble.”

IN A RECENT A FINANCIAL TIMES EDITORIAL, GILLIAN TETT quotes a parody on economists by Swedish economist Axel Leijonhufvud written in 1973. “The status of the adult male [of the Econ tribe],” wrote Leijonhufvud, “is determined by his skill at making the ‘modl’ of his’ field,’ The fact… that most of these ‘modls’ seem to be of little or no practical use, probably accounts for the backwardness and abject cultural poverty of the tribe.” Gold ownership makes sense for the more humble among us precisely because the Cassandras of the economic tribe can’t seem to get it right so much of the time. “These failings,” writes Tett, “were one reason why so few foresaw that 2008 crisis.” It is also why, according to Tett, the Fed stuck to its transitory inflation mantra when a quick foray into “the weeds of the financial system” might have told them otherwise.

IN AN IN-DEPTH ESSAY BY ROBIN WIGGLESWORTH PUBLISHED IN FINANCIAL TIMES, he states, “[T]he truth is that there are signs everywhere that a pretty profound market regime change is upon us and that people are only starting to grapple with the implications. The Nasdaq has now given up all of its 2021 gains, and many — like [Third Point’s Dan] Loeb — believe that this is just the beginning of an epic shakeout, rather than the end.” Wigglesworth offers a fascinating look at the degenerating “modern cycle” stock regime. He credits Goldman Sachs’ Peter Oppenheimer with coining the phrase “the post-modern cycle” – an era he says will be characterized by higher inflation, rising bond yields, increased labor costs, and surging commodity prices. “They don’t ring a bell,” Oppenheimer warns, “when the rules of the game are changing.”

TIM CONGDON, ONE TIME ADVISOR TO THE THATCHER GOVERNMENT, takes to task those who say the jump in consumer prices results from external forces like shortages, supply bottlenecks, etc., which he sees as “a symptom of inflation, not a cause.” Instead, he blames money creation and the inflation of asset prices (with long and variable lags) for consumer price inflation. “It is plainly daft,” he continues, “to attribute the remarkable increase in the price of houses – many of which were built a few decades ago – to energy prices, price movements in second-hand cars and lumber, the international shipping market and so on in 2020 and 2021.”

Notable Quotable

“I’m slightly fearful [inflation] might stick around a while as well – this won’t be come and gone in a matter of months. I think this could be years — rather than months.” – Anthony Haldane, former Bank of England chief economist, Yahoo

“Inflation is the decline in the of a currency, period,” he says in an analysis posted at Forbes, “Rising prices are a consequence of inflation, or better yet, can be a consequence. But they’re not inflation itself. To presume that rising prices cause inflation is the equivalent of asserting that wet sidewalks cause rain. Causation is reversed.…To be clear, gold doesn’t rise as a result of inflation; rather gold’s rise is the signal of inflation. When the dollar weakens, gold reflects this weakness. Gold’s rise IS the inflation.” – John Tamny, Forbes

“We saw this quite recently in the early days of the pandemic: in early March 2020, major gold ETFs actually fell by around 10%. But the price of physical gold bars and coins went through the roof. So, in my opinion, physical is always better than paper.” – Simon Black, Sovereign Man\

“Raising interest rates is not going to solve the problem of inflation. It’s not going to create more food. It’s going to make it more difficult because you aren’t going be able to make the investments.” – Joseph Stiglitz, Columbia University economist (Bloomberg interview)

“The correlation between rate hikes and S&P 500 returns indicates that it is not the number of hikes that impacts the market as it is the level of interest rates that suddenly trigger outflows from the market to other securities like bonds. With five proposed rate hikes in the remaining 9 months of the year a similar adverse market reaction could be triggered by the end of the year. However, I submit the larger concern will be the liquidity drain from the Federal Reserve’s aggressive quantitative tightening schedule.” – JD Henning, Seeking Alpha

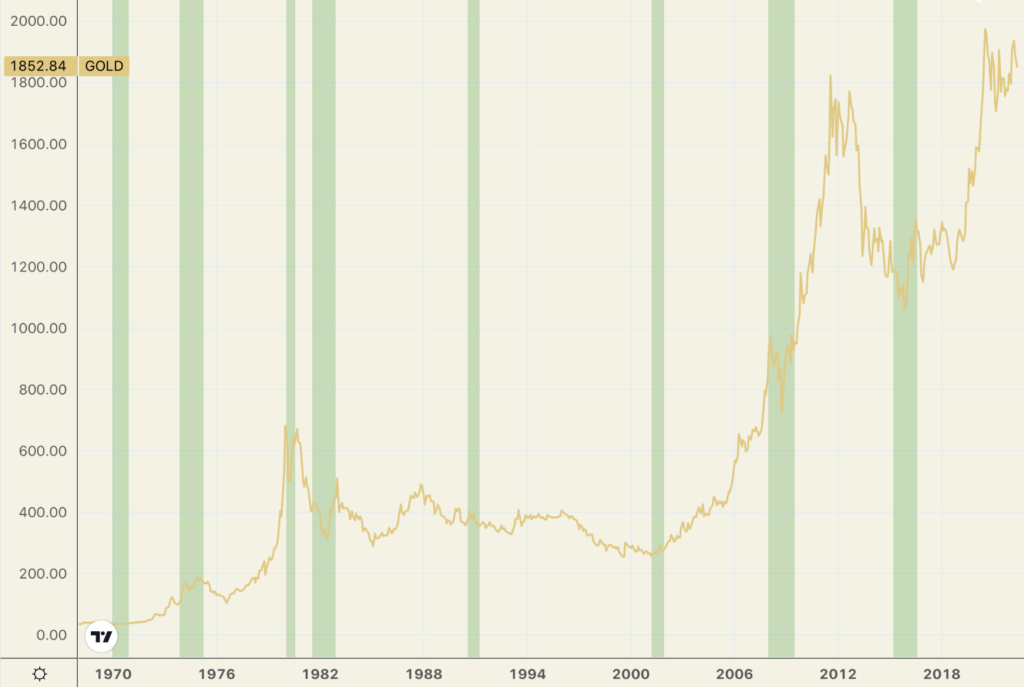

“For gold, recessions are typically a positive environment.…If we look at performance over the entire recession cycle, it is notable that in each of the four recessionary periods gold saw significant price gains on average in both US dollar and euro terms.… Moreover, it is striking that, on average, the higher the price losses of the S&P 500, the stronger gold performed. Once again, this worked well during the most recent recession in 2020.” – Ronald Stoferle, Incrementum, (In Gold We Trust)

Gold and recessions

(1971 to present, green bars = recessions)

Chart courtesy of TradingView.com • • • Click to enlarge

“There is no prospect for a material reduction in inflation unless the Fed aggressively raises rates, or the stock market crashes, catalyzing an economic collapse and demand destruction.” – Bill Ackman, Pershing Square (CNBC)

“Big shocks to the global economy, such as Russia’s invasion of Ukraine, understandably capture the most attention. But a new worldwide pattern of little fires everywhere may be equally consequential for longer-term economic well-being. Over time, these small fires can coalesce into one that is just as threatening as the initial large fire that acted as the catalyst.” – Mohamed A. El Erian, economist (Financial News)

“Most of the market stabilization liquidity injected by central banks flowed into financial assets, where price inflation was mistaken for investment genius.” – Bill Blain, Morning Porridge

“I have held that the Fed’s ability to sustain US securities market price inflation has for decades provided key unappreciated support to our currency offsetting unending massive current account deficits and general monetary inflation (currency debasement). From this perspective, I’m increasingly on guard for a consequential shift in dollar sentiment that would catch a vulnerable market by surprise. And a weakening dollar would support precious metals and commodities prices, in the process solidifying the secular transition of Hard Asset outperformance relative to financial assets.” – Doug Noland, Credit Bubble Bulletin

“[T]he time had come, as in all periods of speculation, when men sought not to be persuaded by the reality of things but to find excuses for escaping into the new world of fantasy.” – John Kenneth Galbraith, The Great Crash of 1929

“Over the last 20 years, annual inflation has averaged 3% in the UK, according to the Office for National Statistics. Over the same period, the price of gold has increased by an average of 10% per year (according to the World Gold Council). Adjusting for the inflation rate of 3%, the ‘real’ value of gold has therefore increased by an average of 7% per year.” – Jo Groves, Forbes

“A growing crescendo of commentary places the blame for the current surge in US inflation squarely on the Federal Reserve. But much of the criticism is stupefyingly naive about the political pressures that the Fed and other central banks around the world have had to navigate in recent years. In the United States, pressures on the Fed reached a peak when the Democrats, eager to put progressive ideas into practice, took control of the White House and Congress in January 2021.” – Kenneth Rogoff, Harvard (MarketWatch)

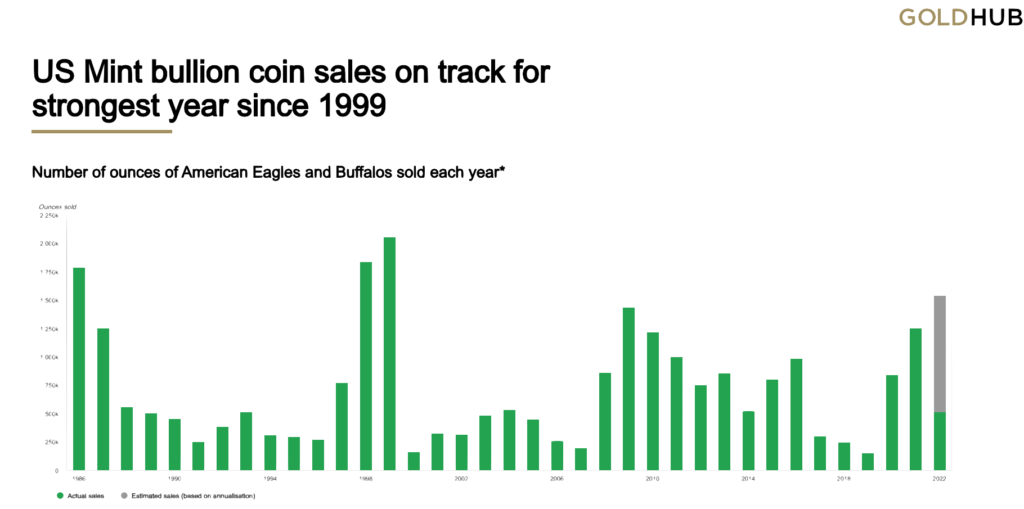

IN A RECENT MARKET UPDATE, THE WORLD GOLD COUNCIL projected US Mint would turn in its best year since 1999 for bullion gold coin sales, despite a slowdown in April. “Should this strong demand continue,” it says, “we could see the highest year on record in terms of notional sales. This performance clearly shows that last year’s strong retail interest in physical gold investment products has continued in 2022.” We will add that demand for silver bullion coins and bars is also running at very strong levels. (Editor’s note: The green bars in the chart below represent actual sales. The grey extension represents projected sales annualized for 2022.) After all is said and done, inflation remains the fundamental problem overhanging the US economy. Though the dollar might gain ground against other currencies, it continues to lose ground in terms of purchasing power, and that ultimately is what drives long-term investor interest in precious metals.

Chart courtesy of World Gold Council • • • Click to enlarge

The green bar represents the current coin sales annualized for the remaining months of the year. (Actual sales (12/4). Based on available data from 1986 to 30 April 2022. Source: US Mint, Bloomberg, World Gold Council

Final Thought

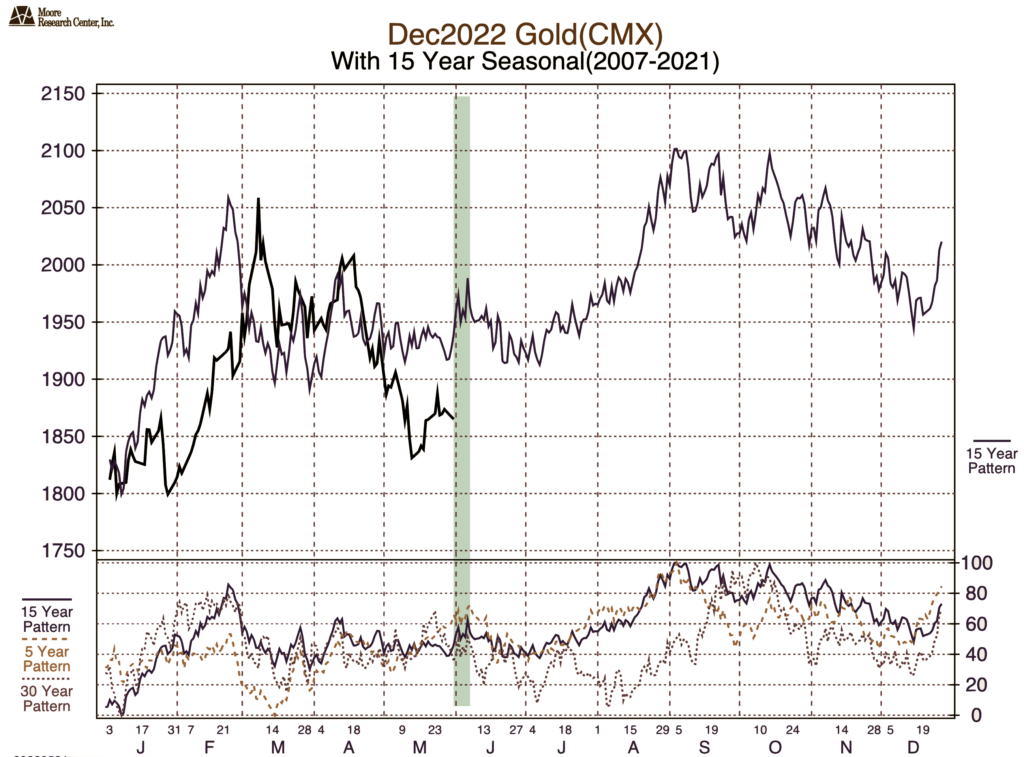

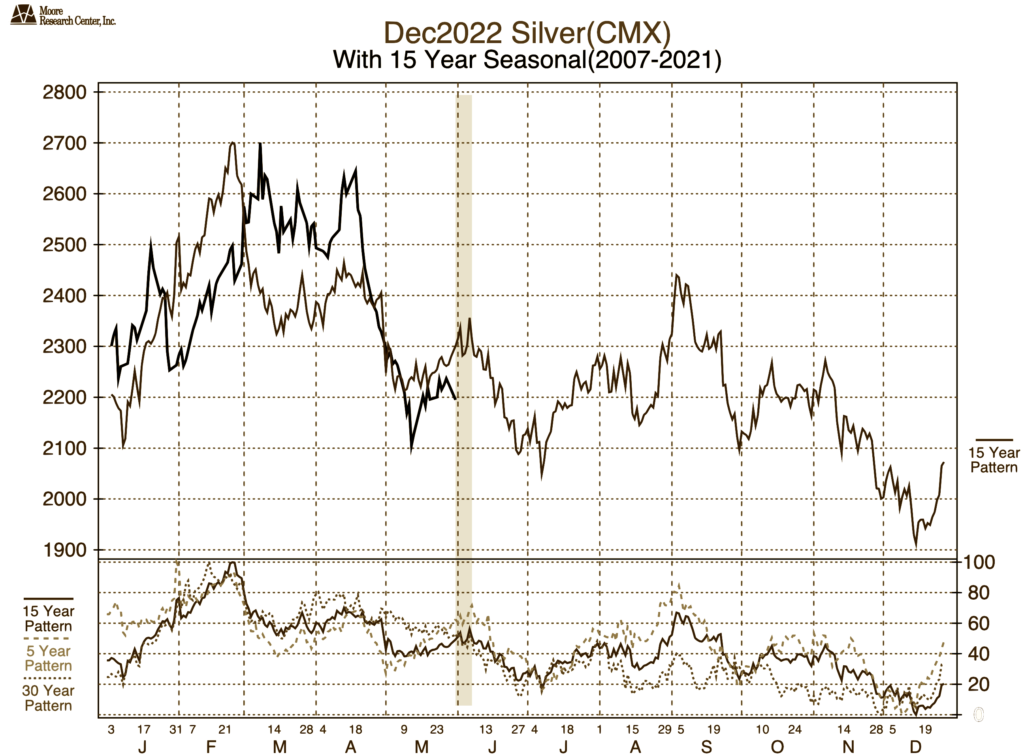

The gold and silver summer doldrums are upon us.

For the most part, our clientele owns precious metals for long-term asset preservation purposes – as portfolio insurance rather than speculative trading items. As a result, the most important advantage seasonal charts offer the bulk of our clientele is identifying potential buying opportunities. Traditionally, as the charts below illustrate, gold and silver experience low points in their seasonal pricing pattern during the summer months. However, with the amount of angst and volatility on the loose in financial markets of late, this summer could be an exception. Furthermore, as Moore Research Center points out, “analyzing correlation studies is subjective, and one must use them as a tool rather than as a trading system. You must realize that even high correlation studies can follow a market pattern for an extended period of time and then suddenly deviate from this expected pattern. We like to look at correlation studies as giving us roadmaps as to where the price might go.” [Emphasis added.] With that in mind, and without further elaboration, we offer the following charts for your consideration with the kind permission of Moore Research Center.

Charts courtesy of the Moore Research Center (541-639-5340) • • • Click to enlarge

Chart[s] note: “Seasonal patterns,” explains Moore Research Center, “are displayed against a numerical index from 0 to 100 (the right-hand vertical scale). The graph reaching 0 represents the seasonal low (the time of the year when prices are most consistently low); the graph at 100 represents the seasonal high (when prices are most consistently high). The graph at 20 represents when prices have tended to be in the lower 20% of the year’s eventual price range.”

Do you think now is the time to prepare your portfolio for whatever shocks might lie ahead?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ORDER GOLD & SILVER ONLINE 24-7

If you appreciate NEWS & VIEWS, you might also take

an interest in our Daily Top Gold News and Opinion page.

–

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.