Finally, a rally in gold that looks capable of leaving the $2000 barrier in the dust! This one is being pushed not only by the threat of escalated conflict in the Middle East, but by the dawning realization that a strong dollar and rising interest rates are about to trigger a crisis for the world’s central banks. Europe will be even more vulnerable than the U.S., since it cannot loosen credit as long as the Fed is tightening or even just vamping. The ECB will also have to deal with trillions in euroloans it made at subzero rates to give Europe’s dying economy the appearance of solvency.

Pegging the currency to gold is a logical way to keep the euro from collapsing while Frankfurt’s best and brightest cobble together a plan. But hardening their currency so that it can compete with the dollar in the meantime will be enormously costly — and deflationary, since it will increase not only the cost of borrowing, but the cost of servicing loans already on the books. Factor in the prospect of soaring oil prices and you can see what a mess the world is in. A commentary here three weeks ago featured a chart projecting a rise to $117 a barrel. This was before war broke out in the Middle East, but a surge of that magnitude or worse now seems likely if Iran joins the conflict.

The Old AAPL Trick

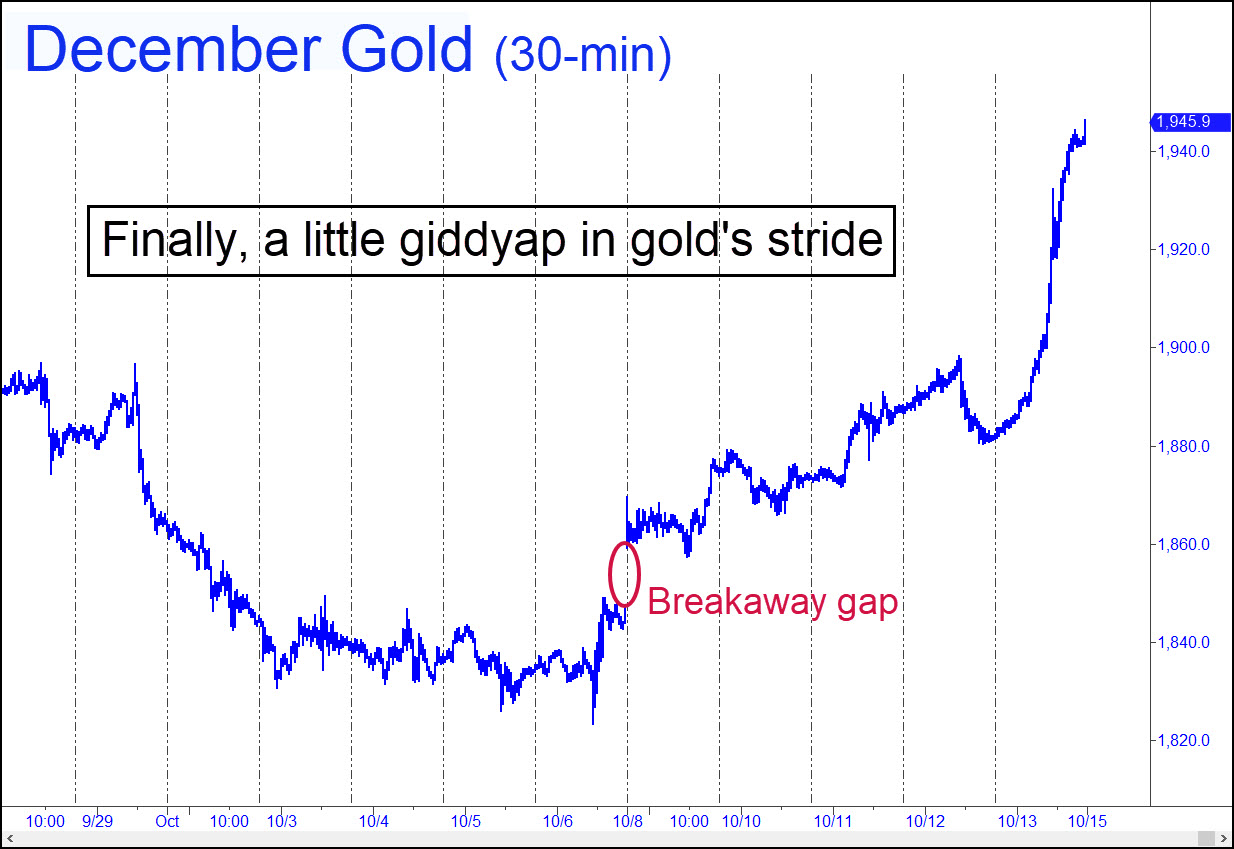

Recall that after the war erupted on Saturday, October 7, with an assault on Israel by Hamas, the markets seemed relatively subdued when trading resumed Sunday night. We can attribute this seemingly absurd behavior to the deft touch of the dirtballs who manipulate stocks, bonds and commodity prices for a living. They are very smart guys, especially in dire circumstances. And even if they weren’t able to keep a lid on bullion prices for long, they didn’t panic into Treasurys, at least not yet, and they gave stocks the temporary appearance of buoyancy.

Accomplishing this last trick was easy for reasons I’ve explained here many times: Squeeze shorts in just one stock — AAPL — and you can scare off a pitchfork mob of sellers who might otherwise incline toward burying the broad averages. In this way, the dirtballs were able to distribute stocks for just a little longer. But they will not be able to surf the avalanche that is coming this week. If index futures open quietly on Sunday night, don’t be fooled. In the investment world, as the old saying goes, he who panics first, panics best.