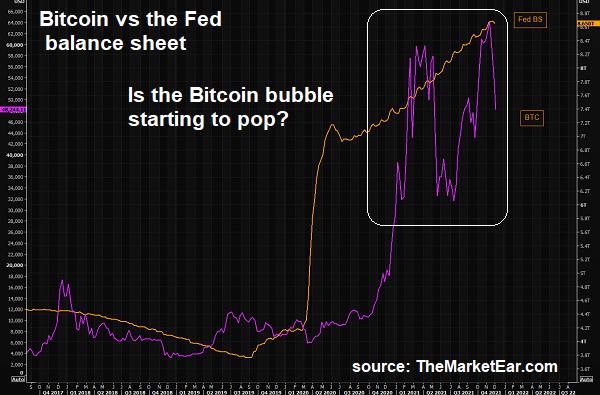

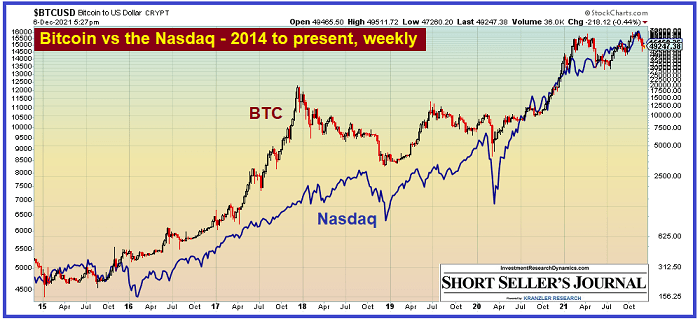

There can be no denial of the high correlation between Bitcoin and the Nasdaq. The Nasdaq stocks were the favorite gambling chips for retail daytraders and reckless fund managers in the late 1990’s tech bubble. Now that internet technology, shrouded by fairytales of a mysterious Asian creator and zero counterparty risk, has captured the imagination of the naïve or misinformed, Bitcoin joins the Nasdaq as an effigy of the biggest financial market bubble in history.

Wall Street On Parade published commentary on Bitcoin today which appropriately describes Bitcoin for the scam that it is.

“One of the most respected investors in America, Warren Buffet, summed up Bitcoin like this in May 2018: Bitcoin is “probably rat poison squared.” Also in 2018, Bill Harris, the former CEO of Intuit and PayPal, wrote a detailed critique of Bitcoin for Vox under the headline: “Bitcoin is the greatest scam in history.” Harris explained:”

“In my opinion, it’s a colossal pump-and-dump scheme, the likes of which the world has never seen. In a pump-and-dump game, promoters ‘pump’ up the price of a security creating a speculative frenzy, then ‘dump’ some of their holdings at artificially high prices. And some cryptocurrencies are pure frauds. Ernst & Young estimates that 10 percent of the money raised for initial coin offerings has been stolen.”

Here’s a link to the full article: Bitcoin Weekend Crash Provides a Hard Look at “Rat Poison Squared”